Master futures trading from contract basics to advanced strategies—completely free.

Estimated reading time: 9 minutes

This article on Learn to Trade Futures is the opinion of Optimus Futures.

Futures trading offers unmatched opportunities—24/5 market access, capital-efficient leverage, and exposure to indices, commodities, currencies, and crypto. But to learn to trade futures successfully, you need structured education covering contract mechanics, risk management, and execution strategies.

That’s why Optimus Futures built the Futures Trading Learn Center—a free resource with 50+ lessons to help you learn to trade futures confidently.

Whether you’re a beginner learning what futures are or an active trader improving your execution, this guide covers everything you need to learn to trade futures step-by-step.

Quick Start: Your First Trade

Want to learn to trade futures TODAY? Here’s the fastest path:

Step 1: Understand the Basics

What are Futures Contracts? – Futures are agreements to buy/sell assets at future dates. Start with E-mini S&P (/ES), Nasdaq (/NQ), or Micro contracts.

Step 2: Master Core Order Types

- Market Orders – Execute immediately

- Limit Orders – Control your price

- Stop Orders – Protect against losses

- Bracket Orders – Automate profit targets

See also: Futures Order Entry Guide

Step 3: Practice Risk-Free

Practice with real market data. Test all order types. Build confidence before risking capital.

Step 4: Start Small with Micros

Begin with Micro E-mini S&P (/MES) – just $50 day trading margin. At current levels (6,870), you control $34,000 exposure. Each point = $5, so a 10-point move = $50 profit or loss.

Real market experience with minimal capital risk.

Ready for deeper knowledge? Continue with the comprehensive courses below.

Why Learn to Trade Futures?

Understanding why traders choose futures helps you learn to trade futures more effectively.

Capital Efficiency Through Leverage

Start small with Micro E-mini S&P 500 (/MES). At current levels around 6,870, one /MES contract controls about $34,000 in market exposure with just $50 day trading margin.

Each point move = $5 profit or loss. A 10-point move (6,870 to 6,880) = $50. That’s meaningful returns on minimal capital—impossible with stocks without massive account sizes.

True 24-Hour Global Markets

Trade nearly around the clock across CME, ICE, and CBOE exchanges. Capture opportunities during Asian, European, and U.S. sessions.

Markets open Sunday 6pm ET through Friday 5pm ET. No waiting for 9:30am opens like stocks.

Equal Long and Short Capability

Go short as easily as long. No uptick rules, no borrow fees, no restrictions—essential for hedging and tactical trading.

Stocks require locating shares and paying fees. Futures treat long and short identically.

Tax Advantages for Active Traders

Futures enjoy 60/40 tax treatment (60% long-term, 40% short-term) under Section 1256, regardless of holding period. Active traders save significantly compared to all short-term rates on stocks.

Diverse Market Access

Trade equity indices, treasuries, energies, metals, commodities, currencies, and crypto—all from one account. No need for separate forex brokers or crypto exchanges.

Single margin calculation across all products. Easier risk management when everything’s in one place.

Comprehensive Courses to Learn to Trade Futures

The Learn Center provides structured education from beginner to professional level.

Futures Trading Fundamentals (8 Core Lessons)

Essential foundation for anyone wanting to learn to trade futures:

What are Futures Contracts?

Learn how futures work, why they exist, and their role in global markets. Understand mechanics, participants, and purpose.

Contract Specifications

Master tick sizes, multipliers, and notional values. Discover why /ES, /NQ, /CL, and /GC are most actively traded.

Futures Symbols

Understand standardized naming conventions across exchanges—essential for accurate orders.

Major Exchanges

Explore CME Group, ICE, and CBOE. Learn which exchanges host specific assets and trading hours.

Benefits of Futures

Key advantages compared to stocks, forex, and options—from tax treatment to leverage efficiency.

Plus lessons on expiration, liquidity, and settlement.

Risk Management Essentials (10 Critical Lessons)

Principles that separate successful traders from blown accounts:

Leverage Explained

How leverage amplifies gains and losses. The critical difference between margin as collateral versus borrowing cost.

Margin Requirements

Intraday versus overnight margins, maintenance thresholds, and how exchange margins change during volatility.

Risk Management Fundamentals

The 1-2% rule, daily loss limits, and position sizing based on account volatility.

Stop Loss Strategies

Technical stops, volatility-based stops (ATR), and percentage-based risk management.

Plus position sizing, margin calls, and advanced techniques.

Order Execution Mastery (8 Essential Lessons)

ACTION-FOCUSED: Start here if you learn by doing, then return to theory.

Market Orders

When immediate execution matters and when market orders are dangerous.

Limit Orders

Price-controlled execution for managing slippage and protecting profits.

Stop Orders

How stop orders trigger, slippage risks, and when stop-limits are superior.

Bracket Orders

Simultaneously place profit targets and stop-losses that auto-cancel—professional trade management.

Complete Order Entry Guide with platform tutorials.

Trading Strategies & Advanced Concepts (12 Proven Approaches)

Progress from fundamentals to institutional strategies:

Day Trading Futures

Opening range breakouts, momentum scalping, mean reversion. Entry signals, exit rules, position management.

Swing Trading Basics

Multi-day positions using technical analysis and fundamentals. Managing gap risk through overnight sessions.

Order Flow Analysis

Institutional-level analysis. Read bid/ask imbalances, absorption patterns, large orders using footprint charts.

Level 2 Market Depth

Read full order book, identify support/resistance, spot institutional activity before price moves.

Order Book Techniques

Analyze depth, detect spoofing, identify genuine liquidity versus fake walls.

See also: 10 Best Futures Trading Strategies with detailed charts.

Product Specialization (12+ Market Lessons)

Deep dives into specific asset classes:

Stock Index Futures

Master /ES, /NQ, /YM, /RTY—world’s most liquid contracts. Specifications, trading hours, strategies.

Cryptocurrency Futures

CME Bitcoin (/BTC) and Ether (/ETH). Cash settlement, regulatory advantages, lower margins.

Plus commodity futures, currencies, interest rates, and specialized strategies.

Learn to Trade Futures on Any Platform You Choose

Platform-Agnostic Education

We teach universal futures concepts, not specific software:

✅ Universal principles – Apply to any professional platform

✅ 6+ platform options – TradingView, Sierra Chart, Optimus Flow, and more

✅ Single account, multiple platforms – Try different tools, find your fit

✅ No vendor lock-in – Choose what works for your style

Professional traders need professional tools. We give you choice.

Validate Your Strategy with Simulation

Test Before You Trade

Before placing a live trade, validate your approach in simulation:

✅ Unlimited simulated trading for all funded accounts

✅ Real-time market data – actual price action

✅ Test execution mechanics – understand order types and fills

✅ Validate strategy logic – does your approach have edge?

Key validation milestones before placing a trade:

- Execute 20+ simulated trades to understand mechanics

- Test all order types (market, limit, stop, bracket)

- Confirm you understand margin requirements

- Experience how stop-losses trigger in real market conditions

Once you understand execution mechanics and have a validated strategy, you’re ready to begin live trading with real capital.

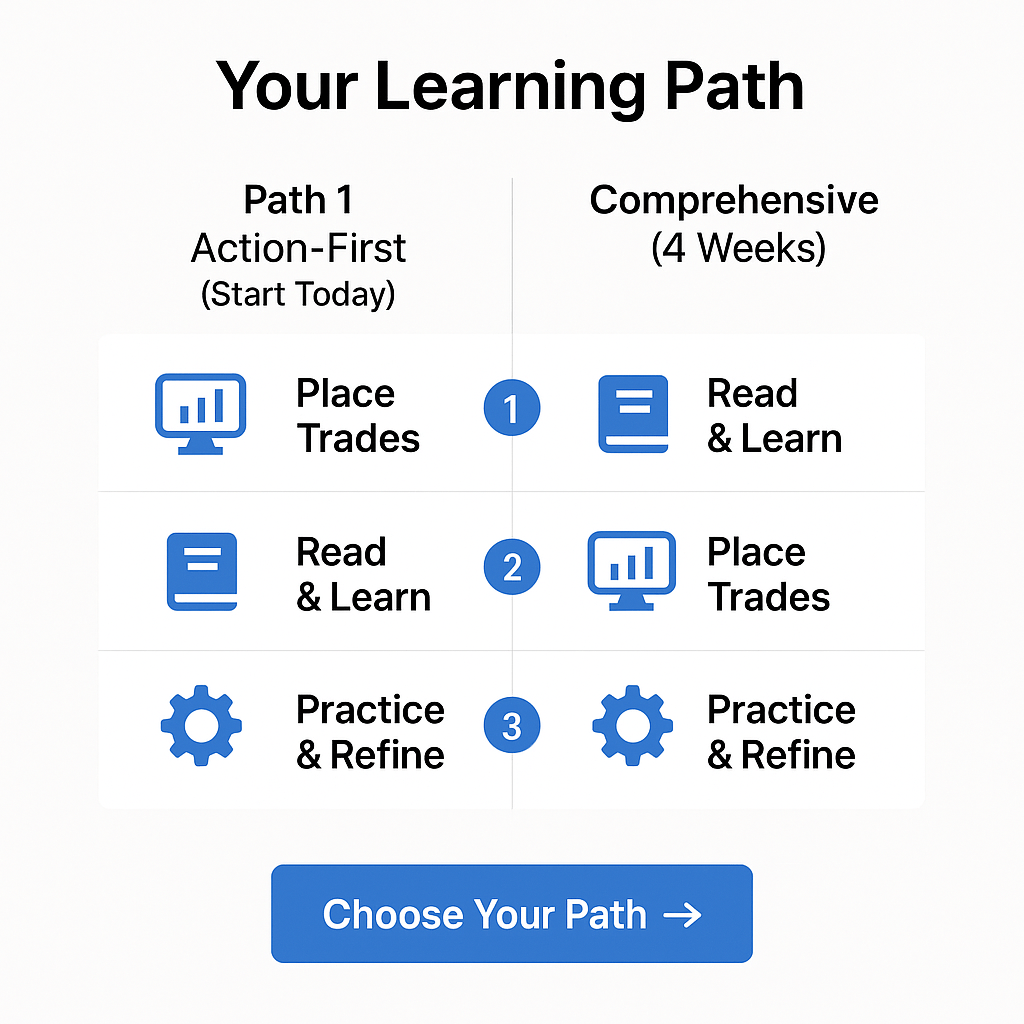

Your Learning Path

Choose your approach to learn to trade futures:

Path 1: Action-First (Start Today)

For traders who learn by doing:

Today:

- What are Futures?

- Market Orders

- Limit Orders

- Stop Orders

- Open Demo – Place 5 practice trades

Build Skills: Practice with placing orders, test multiple trades, read Risk Management, refine your strategy.

Fill Knowledge Gaps: When ready, transition to live trading with Micro contracts while completing the remaining courses.

Path 2: Comprehensive Foundation

For systematic learning before action:

Phase 1 – Fundamentals

Phase 2 – Risk Management

Phase 3 – Order Execution

Phase 4 – Strategy and Practice

- Stop Loss

- Day Trading

- Product focus: Index / Crypto

- Open live account and start practicing on sim mode

Experienced Trader Fast Track

Jump to advanced content:

- Order Flow – Read institutional activity

- Order Book Analysis – Market microstructure

- Level 2 Depth – Professional DOM

- Volatility Strategies

Ongoing Education & Community

Weekly Learning Resources

Podcast: Futures Trading Tips & Strategies

20+ years of experience in lessons covering technical analysis, technology, and risk management.

Videos: Educational Video Library

Hundreds of tutorials from basic to advanced topics covering platforms and strategies.

Community: Join Discussion

Learn from experienced traders, get expert answers, discuss strategies and technology.

Resource Hub: Tutorials & Guides

Comprehensive guides and tutorials to test strategies in live market conditions.

Additional Resources

Comprehensive Futures Guide

Long-form tutorial covering complete journey from understanding contracts to first trade.

Best Platforms 2025

Detailed comparison of TradingView, Sierra Chart, Optimus Flow, and other professional platforms.

10 Best Strategies

Strategy deep-dives with charts, entry signals, risk management.

Futures vs. Stocks

| Feature | Futures | Stocks |

|---|---|---|

| Hours | Nearly 24/5 | 9:30am-4pm ET |

| Leverage | 10-20x | 2x max |

| Short Selling | No restrictions | Uptick rules, fees |

| Taxes | 60/40 favorable | Short-term for day traders |

| PDT Rule | No restrictions | $25k minimum |

| Starting Capital | $500-$1,000 | $2,000 minimum |

Learn more: Benefits of Futures Trading

Start Learning Now

Visit learn.optimusfutures.com to access all courses and 50+ lessons—completely free.

Ready to Trade?

Open Optimus Account for:

Low Commissions:

- $0.25/side Micros

- $0.75/side E-minis

- Volume discounts to $0.05

Low Day Trading Margins:

- $50 on Micros

- $500 on E-minis

Platform Choice: TradingView, Sierra Chart, Optimus Flow, CQG, Rithmic, MultiCharts, ATAS

Direct Access: CME, CBOT, NYMEX, COMEX, ICE, CBOE – all major U.S. exchanges

Questions?

Contact Us or visit our Support Portal.

FAQ

Yes—all 50+ lessons across 5 courses, no account needed, no credit card. Just free education to help you learn to trade futures.

No. The Learn Center is open to all traders regardless of brokerage. Better-educated traders benefit the entire industry.

Absolutely. Topic 1 starts with What are Futures? assuming zero knowledge. Follow the structured learning pathway at your own pace, with each lesson building on previous material.

The Learn Center is a comprehensive reference library you’ll use throughout your trading career. Start with foundational concepts, then progress to advanced topics at your own pace. Even experienced professionals reference specific lessons when exploring new strategies or markets.

Only live trading prepares you for live trading. The Learn Center provides the knowledge foundation—contract mechanics, order types, risk principles, and strategy frameworks—but nothing replaces the experience of trading with real capital. Use the Learn Center to build your knowledge base, then start small with Micro contracts to gain real market experience.

Risk Disclosure: Futures trading involves substantial risk of loss and is not suitable for all investors. Leverage amplifies both gains and losses. Only trade with capital you can afford to lose. Read our complete risk disclosure.