Your All-in-One

Futures Trading

Low Day Trading Margins

- $.0.25 Commissions / Side on Micros

- Free Platform with Order Flow

- Unlimited Simulated Trading

- Free Trading Journal

- Streaming Real-Time Data

- TradingView Integration

Trusted by futures traders around the world

Read ReviewsWHY OPTIMUS FUTURES

A Futures Broker To Help You Unlock Your Potential.

Free Platform

Become a potentially better trader with professional grade trading tools and take on the futures markets with speed, precision, and purpose.

Low Margins

Get day trading margins as low as $50 margins on micros and $500 margins on E-minis and enjoy more leverage to increase your buying power.

White-Glove Support

Start your trading journey with a completely personalized onboarding experience and on-demand support from highly experienced futures trading professionals.

Trade Futures With Low Commissions

- Free CME Market Data (Level 1)

- Free Routing

- Free Trading Journal

- Free Real-Time News Alerts

Increase Buying Power with Low Margins

- Micro E-Mini S&P 500 (MES)

- Micro E-Mini Dow Jones (MYM)

- Micro E-Mini Russell 2000 (M2K)

- Micro E-Mini Nasdaq (MNQ)

The Futures Trading Platform With The Tools You Need

A professional-grade trading platform designed for traders of any level of experience.

Chart

The chart panel is one of the most important panel for an active trader. Accurate market data, graphical and analytical tools are integral components of the panel, which allow you to make the right trading decisions.

DOM Trader

DOM panel shows the number of buy and sell orders placed at various price levels around the current price for a particular instrument

Market Replay

Backtest your trading instrument of choice over any period, study your errors, and seek out adjustments to develop robust strategies.

DOM Surface

DOM Surface panel shows all past and current changes in the order book — placing, modifying orders, and executing trades.

TPO Chart

See the price distribution during the specified time via the TPO Profile (known as Market Profile®) & understand at which levels the price has spent the most time

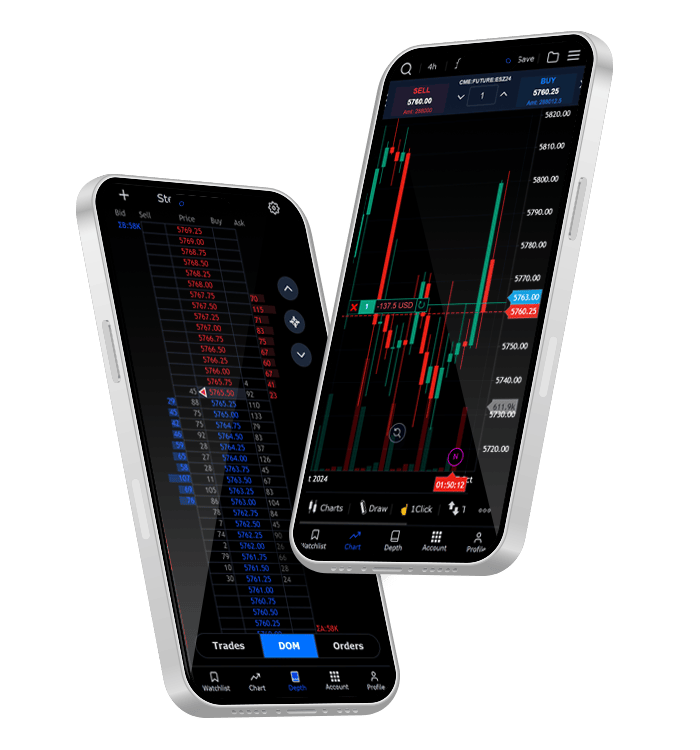

Trade Futures Across All Your Devices

Optimus Futures Mobile - Get access to our mobile app and web-based platforms so you can trade from any device and take your trading experience with you – at home, at work, or on the go.

TradingView Mobile - Leverage our trading knowledge to trade futures directly on the TradingView Mobile app. Access real-time data, view charts, and place orders effortlessly, all from the convenience of TradingView's world-class mobile platform.

Trade with Peace of Mind

Trust

Our company is licensed and regulated by the NFA and CFTC

Privacy

We will never share your private data without your permission

Resources & Education

Discover a wealth of resources, including in-depth tutorial guides, detailed walkthrough videos and regular product updates to empower you as a trader and enhance your skills and knowledge.

Futures Trading Video Library

View AllLoading Videos...

COMMUNITY

Futures Trading CommunityFutures Trading Blog

View AllLoading Posts...