This article on Gap Trading Strategies is the opinion of Optimus Futures.

Key Points:

- Market gaps can occur periodically, and you must be very specific in your day trading entries when developing market strategies for gaps.

- Gaps create setups, but they aren’t entries in and of themselves. Several different price gaps can occur, and knowing the risks and rewards behind each setup could help you understand how to day-trade gaps.

- How other factors, such as average volume, general price trend, etc., affect gaps can help you develop a simple day trading strategy.

What is a Trading Gap

Gaps are an important part of day trading and investing. A gap is a break in the price action on a chart, occurring when the open of a trading session moves up or down relative to the previous day’s close.

This creates an empty region between two periods of market movements which may continue for multiple days or weeks.

Gaps can occur to the upside, downside, same trading day, or the previous day’s close.

Some markets are more prone to having gaps, such as futures, commodities, stock markets, and spot FX.

Why Do Gaps occur?

A gap occurs for various reasons in different markets. In stocks, news announcements or non-market-related events can cause gaps due to sudden changes in sentiment.

In futures contracts, for example, price imbalances between buy and sell orders may cause gaps when one side overwhelms the other. Periodically, this would be associated with high trading volume.

Below we list the type of gaps that may occur and how they can be a source of trade ideas as you scan your daily charts.

Gaps and Day Trading

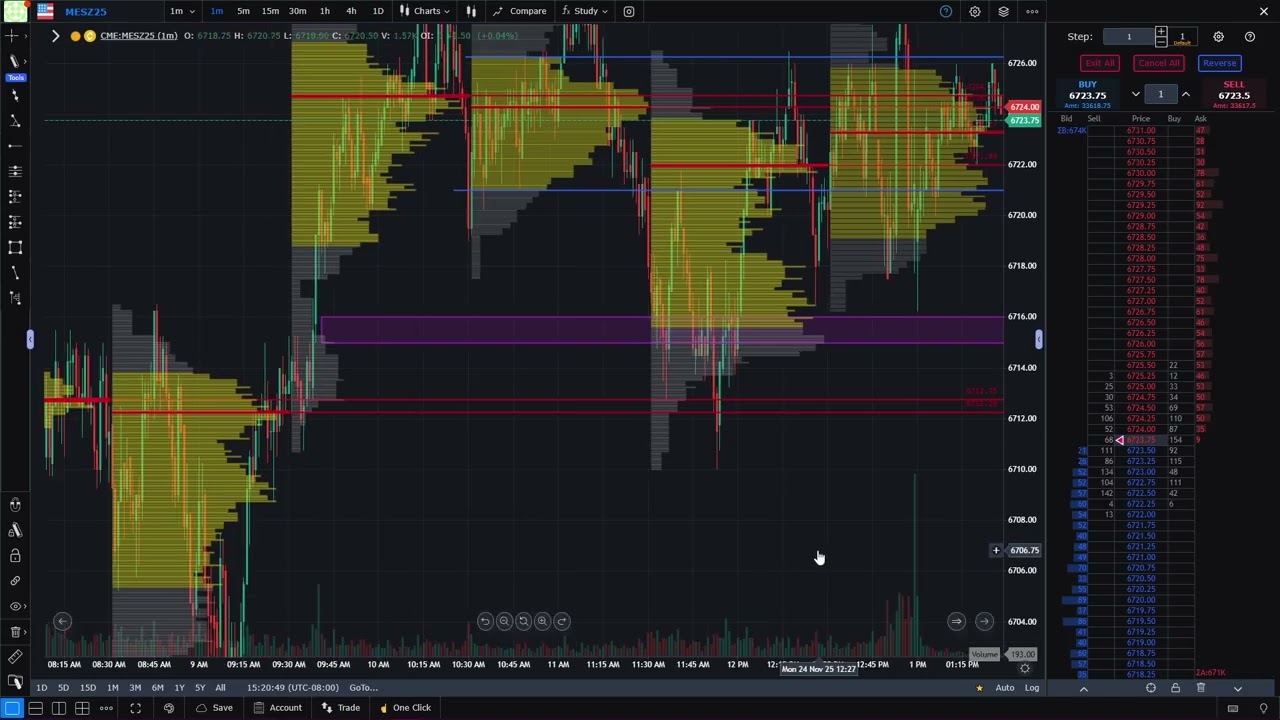

Day traders often utilize the price gap as part of their trading strategy. Gaps provide quick opportunities for traders to enter or exit positions, depending on their assessment of the current market sentiment.

Day traders often employ various charting techniques, such as trend lines and momentum indicators, to predict support and resistance levels created by gaps to identify potential entry points into trades.

With proper analysis, day traders can benefit from gaps to maximize their position sizes and control their risk per trade.

Types Of Gaps

When looking at price charts, traders need to be aware of the different price gaps that can occur. Each kind of gap can signify something about the asset class you are trading. Not understanding how and why market gaps occur can result in substantial losses so it’s important to be very careful when considering a trade.

For example, a market open with a gap up could indicate an increase in demand or positive news about the asset.

At the same time, a gap down can show a decrease in demand or negative news surrounding the asset. Get familiarized with the different types of price gaps so you can effectively analyze price charts with gaps and make informed decisions.

Common Gap

The common gap, as the name implies, is a common price pattern, and it usually does not provide meaningful information about the market where the gap occurs.

The common gap is the type that tends to see a gap fill the most often. However, common gaps are usually small.

Breakaway Gap

The breakaway gap is a type that usually does not get filled initially, and the price trades away from the breakaway gap immediately.

A breakaway gap occurs when price gaps are over a support or resistance level. It is like a regular breakout pattern, except that the actual breakout happens in the form of a gap.

A breakaway gap signals strong momentum, and the price usually keeps on trending after a breakaway gap.

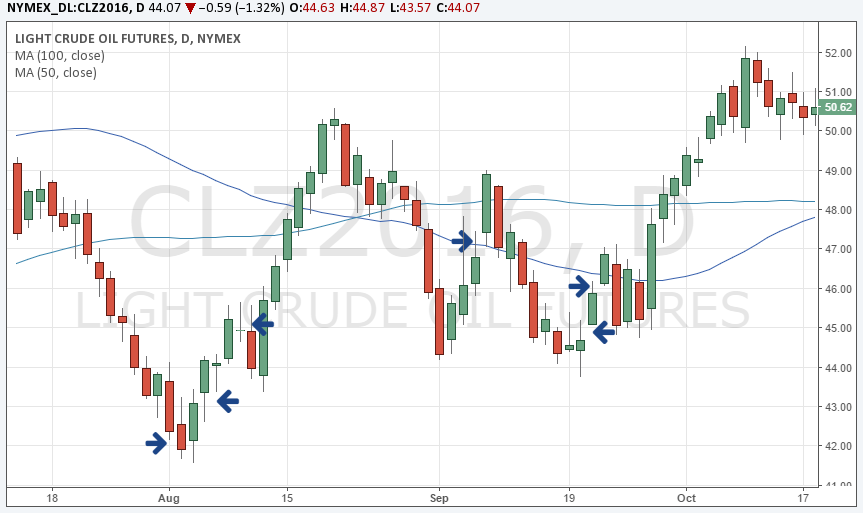

Furthermore, the larger the breakaway gap and the stronger the subsequent candle after the gap, the stronger the prevailing trend. The crude oil chart shows how the price gapped over the support level, leaving a large gap and continuing its downtrend.

Exhaustion Gap

Exhaustion gaps usually get filled, but potentially, the best way to trade an exhaustion gap is not to speculate on the relatively small gap fill but use the information to time exits and entries around the pattern.

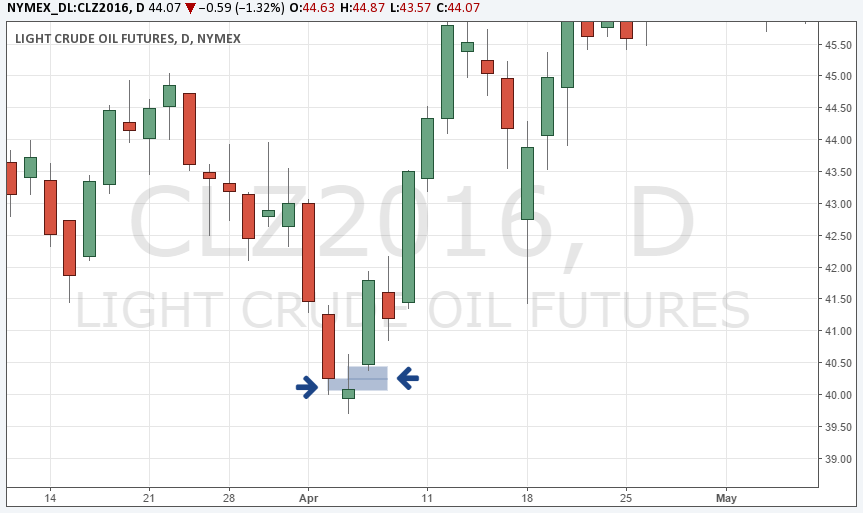

An exhaustion gap occurs at the end of a trend or at important support and resistance levels. The first gap in the direction of the trend can look like a runaway gap. Still, the following candle is usually either a Doji pattern or a pinbar, showing the indecision or rejection of a price level.

It is common to see a second gap in the opposite direction on an exhaustion gap pattern, confirming the reversal. In the example below, the exhaustion gap pattern looks like an “abandoned baby” reversal pattern.

Runaway Gaps

Runaway gaps often see the gap close, but trading the gap fill on a runway gap has to be avoided at all costs because it’s a high-risk trade. A runaway gaps occurs during a strong trend where the price keeps gapping in the direction of the trend.

Typically, you will see multiple runaway gaps during a strong trend.

Instead of speculating in a countertrend gap fill during a runaway gap, traders can use this information to enter trend-following trades or remain in their existing trades as a runaway gap signals strength.

Island Reversal Gap

The Island Reversal Gap is a chart pattern showing up as a single candle on the chart with gaps between two other candles. It usually signals the potential reversal of an existing trend, either bullishly or bearishly.

The Island Reversal Gap can be a good opportunity for day traders to identify potential trend reversals. They should be alert to any changes in price direction and be prepared to adjust their positions accordingly.

Gap and go

Gap and go is a strategy used by day traders in an attempt to take advantage of price disparities that can arise before market openings. When a gap arises, traders buy or sell a security to benefit from it.

These trades must be completed on time by the end of the day to try and capitalize on short-term fluctuations in demand.

Do Gaps Always Get Filled?

The most common trading strategy around gaps is trying to trade the gap fill – which means traders speculate that the space between the two candles will fill and the price will move to cover up the space.

Yes, gaps are sometimes closed, but speculating on a gap close is usually not a good trading strategy.

As we will see later when we move on to the chart studies, there are certain gap types where price does not close the gap. Traders who rely on a gap close can easily run into losses if they can’t let go of a position where the price doesn’t eventually close the gap.

Risk management around these price levels is critical. Instead of trading the gap fill, gaps can be used to better interpret and understand price movements in a bigger trading context.

Do Gaps Act as Support and Resistance?

Gaps in trading have been used as powerful indicators of support and resistance for a long time in technical analysis.

A gap occurs when the price of an asset moves significantly higher or lower from one period to the next, with no trades taking place between those periods.

Traders see gaps as important signals due to their ability to indicate that sentiment has changed in the market or that the trend is reversing.

Gaps act strongly as support and resistance levels because they stand out on a chart and show traders where there may be lasting movements in price.

Gaps can also be useful for gauging longer-term trends. In an uptrend, gaps down in price can signal buyers stepping back into the market, while more frequent gaps up could mean that prices may continue to increase over time.

On the other hand, gaps up during a downtrend could mean that buyers are trying to push prices further away from support levels, while more frequent gaps down could mean prices are likely to stay low for a while.

Traders should note that not all gaps need to be acted upon immediately. Some may be just short-term pullbacks, and waiting for confirmation of a new trend is wise before acting on any gap signals one receives.

Understanding how gaps work and recognizing them properly is key to successful trading strategies. Keeping an eye on these patterns may give you an edge in predicting future price movements and trading accordingly with confidence!

Technical traders use a gap trading strategy to take advantage of the natural support and resistance formed by gaps in price action. Traders use this strategy to identify possible points of entry or exit from the market based on their analysis of these gaps.

A trader may enter when the price moves above an identified gap or exit when the price drops below it.

The goal of gap trading strategies is to capitalize on quick movements within markets that often result from significant news events, fundamental events, or changes in market sentiment.

We have tried to cover the main points of developing a strategy around the price gaps above, but there are other gap trading strategies, so do not treat this as an exhaustive list.

How to Execute a Gap Trading Strategy in Futures Contracts

Here is an example of a gap trading strategy that may be commonly used within the futures markets::

- Choose your gap definition – Traders must determine their definition and what constitutes a significant change in price levels. This is why it’s so important to define the gap size, as some traders use the strategy of the gap being closed or the market moving away from it. Both strategies can be successful, but it’s essential to consider the history of the futures contracts you trade and your unique risk tolerance.

- Identify a futures contract that has gapped up or down significantly in price on high volume.

- Set a target price for the futures contract based on the size and direction of the gap. Many traders consider the gap size for risk management, choosing targets, and stopping accordingly. For example, the target price could be the price at which the gap was filled for a gap-up scenario.

- Set a stop-loss order at a price that limits the potential loss on the trade based on the size of the gap and other factors, such as the futures contract’s historical volatility. This you can customize to your liking and individual tolerances.

- Execute a buy or sell order for the futures contract at the market price.

- Hold the position until the target price is reached or the stop loss is triggered, then close the trade.

Gap Closure and Gap Extension: Which Strategy to Choose

Selecting between the gap closure or gap extension method becomes important when executing a gap trading strategy in futures contracts. A “gap closure” strategy attempts to reduce the gap by using the market’s tendency to return to previous price levels.

The goal of gap extension, on the other hand, is to benefit from the market’s momentum by predicting that the gap will continue to move in the same direction.

Both methods have benefits and drawbacks.

For example, some gaps might never be filled, while others might be filled quickly. You can choose which method to apply by thoroughly examining the futures contract you’re trading and considering its latest price changes.

Considerations for Gap Trading in Futures Contracts

It is important to remember that there are various trading strategies, and gap trading is just one of them.

It is essential to conduct thorough research on the futures contract being traded and to consider the risks and potential gains of any trading strategy before executing any trades.

Price gap trading in futures contracts can be a useful strategy for traders who are prepared to research their futures contracts and carefully manage their risk thoroughly.

How to Trade Partially Gap Up?

Partially gap-up is a type of day trading in which traders try to benefit from an asset’s price fluctuations after it opened significantly higher than its last day’s closing price.

When trading partially gaps up, it’s essential to consider other factors affecting the security, including news or fundamental data influencing the market’s sentiment.

When monitoring the price chart, identifying risks and timing entry and exit can be aided by being cognizant of significant support and resistance levels.

Gaps and Swing Trading

Swing trading is another popular strategy that involves taking advantage of short-term changes in trend direction or market sentiment by entering positions with a somewhat longer time frame than day trades.

Gaps can offer several potential advantages to swing traders.

They can act as significant resistance or support when prices move quickly within markets after important news events or fundamental data releases.

Swing traders can take advantage of quick movements within markets for profitable trades by keeping an eye on movements around these gaps.

FAQ:

What is a trading gap?

A trading gap is defined as when the opening of a trading session swings up or down in relation to the previous day’s closing; a gap is formed in the price action on the chart, separating two periods of market movement.

What results in a gap?

There may be a gap for a number of causes, such as news releases or unrelated events that produce abrupt changes in opinion. Price disparities between buy and sell orders can also result in future contract gaps.

Can gaps present trading opportunities?

Yes, there are times when trading gaps can result in profits. To reduce losses, it’s crucial to comprehend the risks involved with each gap trading pattern.

How do gaps aid day traders?

Day traders can incorporate gaps into their trading strategies and utilize various charting tools to forecast the support and resistance levels gaps will produce. Day traders can maximize their position sizes, take advantage of gaps, and manage their risk in each transaction with the help of proper analysis.

What varieties of trading gaps are there?

Common gaps, breakaway gaps, exhaustion gaps, runaway gaps, island reversal gaps, and measurement gaps are just a few of the several sorts of gaps that can occur in trading. Every type of gap may indicate anything specific about the traded asset class.

What does a typical trading gap entail?

Common gaps are frequent price patterns and typically don’t offer useful insights about the market where they occur. Common gaps typically don’t give a good reward-to-risk return since they are so modest.

What does a trading breakaway gap mean?

When price gaps are above a support or resistance level, it indicates strong momentum and is known as a breakaway gap. After a breakout gap, the price typically continues to trend; the bigger the gap and the more powerful the subsequent candle, the stronger the trend.

What does a trading exhaustion gap mean?

An exhaustion gap, which appears towards the end of a trend or at significant support and resistance levels, can indicate that an existing trend may be about to reverse. A second gap typically appears in the opposite direction, indicating a reversal.

What does a runaway trading gap mean?

During a strong trend, when the price keeps gapping in the trend’s direction, is known as a runaway gap. Traders can use this information to enter trend-following trades or keep their current transactions open because a runaway gap suggests strength rather than gambling in a countertrend gap.

What does a trading island reversal gap mean?

The Island Reversal Gap attempts to show the potential reversal of an existing trend. Traders should be on the lookout for any shifts in the price’s trajectory and be ready to modify their positions as necessary.

Summary

Gap trading strategies can be powerful for day traders looking to capitalize on certain uptrends and downtrends. Understanding the risks associated with each type of gap and its reward potential is important.

Common gaps are usually small and don’t offer a reasonable reward-to-risk payout, while breakaway gaps tend to provide larger rewards and risks.

When it comes to gap fills, it is important to analyze the volume of trades occurring in relation to the gap and the overall price movement that follows it.

A high volume often signals an upcoming gap fill followed by price retracement.

In contrast, a low volume could indicate a lack of momentum behind any price movement, resulting in an incomplete or no fill.

Technical analysis can also help us determine which market environment we may find ourselves in: whether it is suitable for entering trades when gaps occur or exiting trades when gaps fill.

For example, chart patterns such as head & shoulders or double tops/bottoms can help traders identify entry points when trading gaps and potential exits from the trade once a gap has been filled.

Understanding how different markets behave and responding accordingly will help traders make more informed decisions about their trading strategies for day trading gaps.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.