R Trader Pro includes a charting package with built-in studies, drawing tools, annotation tools, and configurable options for bar types, timeframes, and the amount of data to view on a single chart.

Rithmic's Proprietary Trading Platform

R | Trader Pro™ is Rithmic’s own front end trading and real-time risk management screen.

R | Trader Pro™ is Rithmic’s own front end trading and real-time risk management screen. With R | Trader Pro™ you can view quotes, trades, market depth and option strikes in real-time. You can place, modify and cancel orders, and view order history, performance, positions and risk limits. R | Trader Pro™ supports trailing stops, brackets, OCOs, group orders, charting and uses a real-time interface to and from Microsoft Office Excel.

R | Trader Pro Feature Highlights

- One-click trading from Chart and DOM

- Real-time quotes, market depth, and option strikes

- Advanced order types, including stop, limit, stop-limit, spreads, and OCOs.

- Server-side trailing stops, OCOs, and brackets on R | Trader Pro.

- Excel integration

- Mobile trading on the Rithmic Trader Pro App

- Server-side position and order management on the app or browser

Desktop. Web. Mobile.

Trade on the Web, iOS and Android devices on the all-new Rithmic Trader Pro™ App.

- Provides real-time streaming quotes, charting order entry and position management.

- Anyone using the Rithmic datafeed can manage their server-side positions and working orders directly from their smart phone or mobile browser.

- Simply login and connect using the same username and password you use for any trading platform powered by Rithmic.

- Organize workspaces to display your favorite futures contracts from the top down.

- Each tile displays a different contract and allows traders to swipe through three different panels within each tile.

Manage and monitor your Optimus Futures account from anywhere when you trade on platforms powered by Rithmic

How Do I Get Started?

After you open an account, we will give you a username and password that you can use to login to R | Trader Pro and Rithmic Trader Pro™ Mobile App with live market data.

If you would like to place trades on your live Rithmic account, simply login using your existing live credentials provided by Optimus Futures during your account application.

One-click trading from Chart and DOM

Server Side Trailing Stops, OCO Orders, & Brackets

Don't be scared to lose your internet connection in a position - Let your orders reside on Rithmic’s servers with 24/7 connectivity to the exchanges.

- Buy/Sell order executed at the Market

- Profit Target order (cancelled if Stop is hit)

- Stop Loss order (cancelled if Target is hit)

Real-time interface to and from Microsoft Office Excel:

R Trader Pro has introduced streaming quotes and trade signal compatibility with Microsoft Excel. This allows traders to use simple Excel formulas and spreadsheets to manipulate data, create trading signals, or even real-time fully automated trading systems. View about 100 studies and stream them in real-time into Microsoft Office Excel spreadsheets. With the power of Excel, you may develop your own indicators and, using Rithmic’s two way real-time interface, you may configure trades to be sent back into R | Trade Execution Platform™ through R | Trader Pro™, automatically or with the click of a button.

Automated Excel Exports

R Trader allows traders to have executions or any other transaction automatically saved as an Excel or CSV file for record keeping and trade logging.

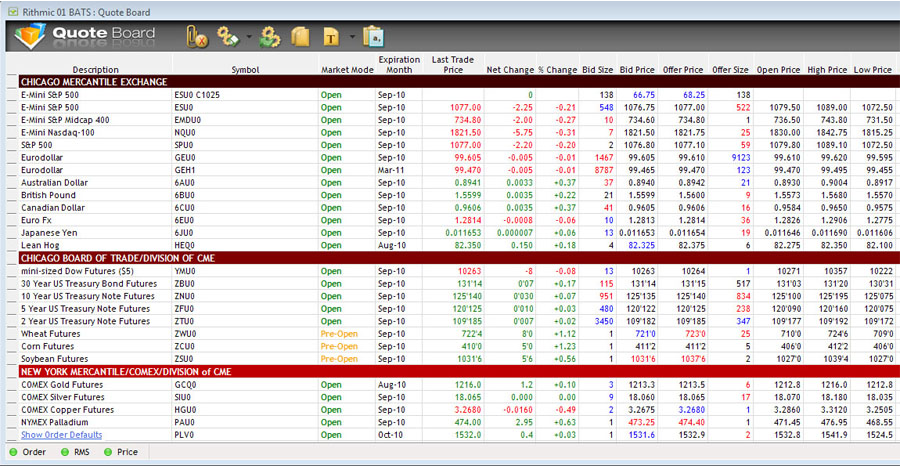

Quote Board

R Trader includes efficient, flexible, and customizable quote board options for traders who wish to keep an eye on multiple asset classes, correlating or divergent markets, and other market statistics that can be derived from this data.

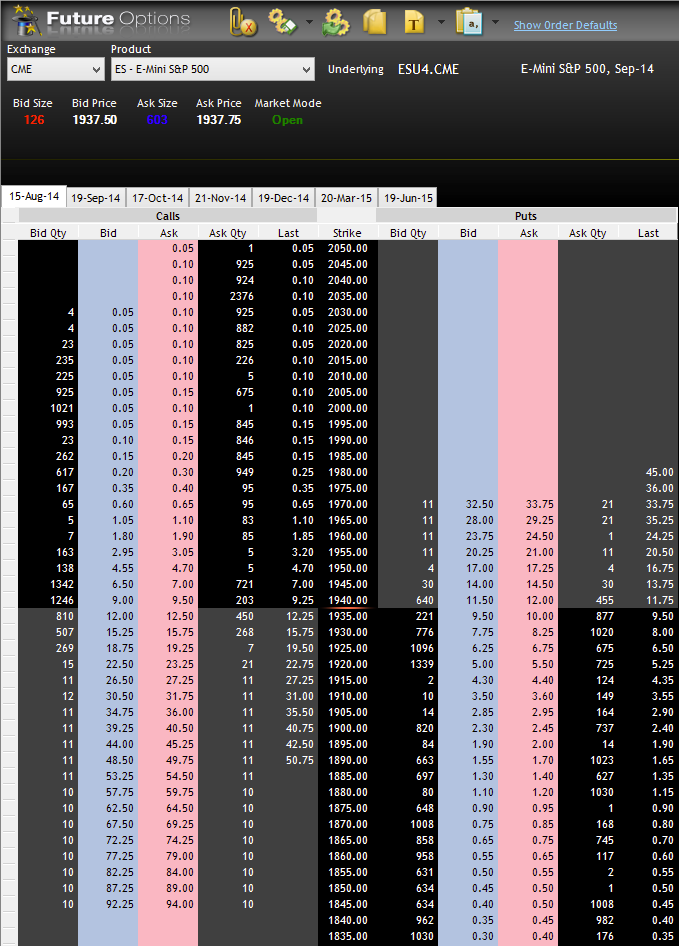

Options Board

Options on Futures are available through the R Trader platform, and can be viewed and traded through the Options Board within R Trader. This allows trades not only the opportunity to look at the standard Futures markets but the Options on Futures markets as well.

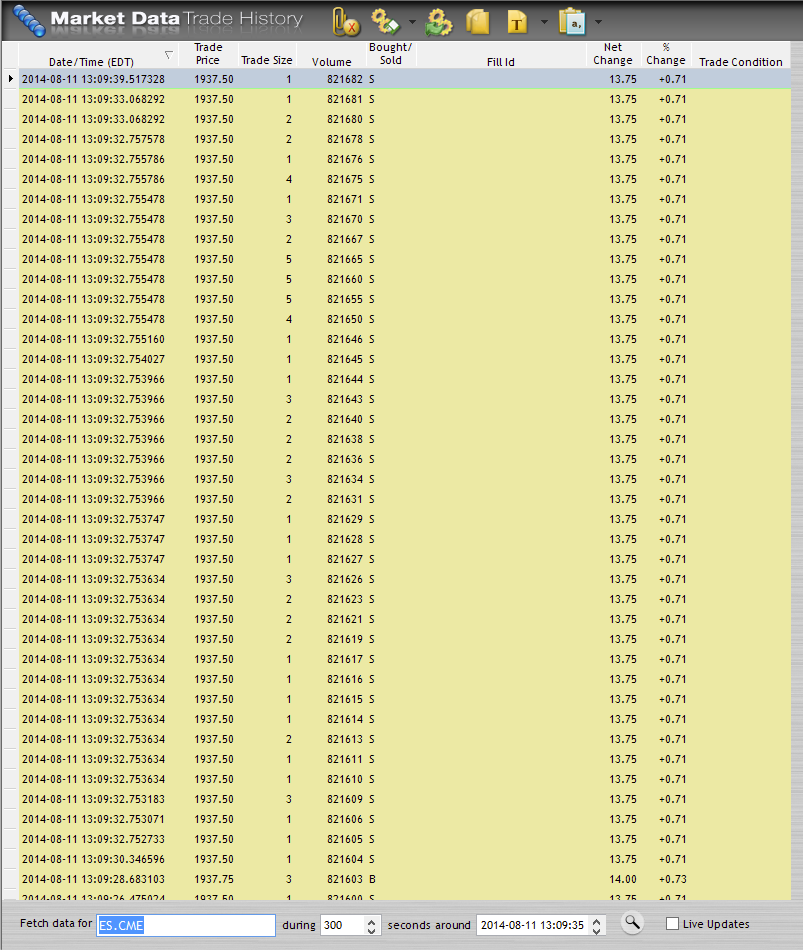

Order History

Order history can be viewed, searched, and analyzed within R Trader directly from the Rithmic infrastructure.

Micro Send Timestamps

R Trader publishes all order transmission timestamps so that traders can see at what speeds they are interfacing with the exchanges.

Order Book

Market depth, price action, and simple order entry are all available through the Order Book. Bracket order templates, OCO orders, and other exit and entry strategies are also configurable via the Order Book window.

Rithmic API | Programmatic Trading Interfaces - Build and Deploy

R | API is a collection of C++ and/or .NET software libraries and interface definitions distributed under license to our professional customers. R | API provides un-throttled real-time market data, historical tick data, historical one-minute bars, as well as order execution and order management capabilities. For execution-only capabilities, a Financial Information eXchange (“FIX”) 4.2 compliant interface is also available.

Build your own trading programs with R | API™ or R | API+™, or build them over FIX. Deploy them on your machines co-located with Rithmic’s equipment.

R | API™ is a collection of C++ and .NET software libraries and interface definitions. Developers and screen designers incorporate R | API™ into their proprietary software to gain access to R | Trade Execution Platform™. R | API™ provides its callers with a normalized view of market data and reference data and of order and execution reports across all supported exchanges. Additionally, R | API™ exposes R | Trade Execution Platform’s™ timestamps which have µsecond granularity, enabling a proprietary algorithmic trading program incorporating R | API™ to make its own latency calculations on which it may take appropriate action.

R | API+™ is R | API™ but with access to advanced features of R | Trade Execution Platform™. A program that incorporates R | API+ gains access to R | Trade Execution Platform’s™ custom time, tick, volume and range bars, symbol look-ups and server side trailing stops, OCOs and brackets.

For developers who prefer a protocol interface Rithmic provides R | FIX API™ – a protocol interface that supports FIX. R | FIX API™ handles orders, modifications and cancellations only. For access to real-time market data developers use R | FIX API™ in conjunction with R | API™.

R | Diamond API™ is R | API™ but with access to R | Trade Execution Platform’s™ ultra-low latency and high frequency trading capabilities. R | Diamond API™ contains R | API™ but also enables its caller to connect directly to Rithmic’s exchange facing gateways and to connect to Rithmic’s market data handlers.

Contact Us to learn more about how to integrate these Application Programming Interfaces (“APIs”) to achieve fast execution, stable trading environment and superior automation.

Rithmic Pricing:

Rithmic Connection Fee - $25 per Monthly Minimum per User ID

Rithmic Trade Routing Fee - $0.10 per contract

Rithmic API Connection Fee - $100 monthly minimum per User ID

Rithmic Colocation & Hosting

Colocation is ideal for traders seeking the fastest access to Rithmic's CME exchange matching gateway. Rithmic Colocation can greatly benefit traders who are running automated trading systems, customers trading the US Markets from overseas or those living in rural area that does not have access to fast internet. Taking advantage of Colocation brings your strategy as close to Rithmic's CME matching engine as possible, significantly reducing execution times, as well as the risks of multiple points of failure without having to have a major investment in hardware and infrastructure.

Virtual Private Servers are located in the CME Aurora data center (Data Center 04). These servers are connected directly to Rithmic’s trading network, allowing you to trade using any of the available trading platforms.

Open an Account to take advantage of low latency direct market access to all major U.S. markets.

Rithmic Data: Trade Better, Trade Faster - Low Latency Trading

The trading platform you use must be able to withstand large volumes of market data with the lowest possible latency. Having access to the right data – quickly, constantly and consistently – is the key to trading successfully!

Why trade futures with Rithmic data?

Rithmic provides traders access to the ultimate routing and connectivity solution for the fastest and most reliable market data and order routing solution.

Is slow execution ruining your method?

Rithmic’s trade execution software delivers to you the low latency and high throughput performance used by large trading houses and boutique hedge funds. Level the playing field and place your trades via high paced dedicated servers co-located on the CME exchange - Tick-to-Trade in less than 250µs with Rithmic – That’s a Quarter of a Millisecond!

Do you trade on short term intervals and seek to get a few points or ticks?

Most data feeds are unable to keep up with market volatility and are only able to provide the “average prices” or "aggregate data", often referred to as “filtering”. Rithmic's streaming real time quotes provides fast, unfiltered data to your trading platform and order routing to and from the exchange, giving you a true tick-by-tick view of the market - Clear and Instantaneous picture of price activity!

Do you often see your price get hit again and again but your order does not get filled?

Trading execution is based on first in, first out; the faster you are in the more likely your orders will get filled ahead of others in the queue. Execution must occur in the shortest time span possible (low latency) to minimize slippage. Success in trading requires that you react faster than everyone else to changing conditions in the market. Stay ahead of the curve – Platforms connected via Rithmic are able to withstand large volumes of market data with low latency!

For example, client programs built on R | API (as depicted by the green box in the lower right hand part of the diagram) connect to the infrastructure from inside the firewall (above the red rectangle), avoiding any of its latency.

We hope that this technology combined with our customer service will yield a long-term relationship that will benefit all our clients. We never underestimate the difficulties of trading, the challenge of finding a profitable methodology and the discipline required by traders to trade the futures markets. Therefore, we value our customers by providing them with what we believe to be the leading technology.

Optimus Flow + Rithmic | Solid Trading Solutions Driven by Low Latency Data.

Connect Optimus Flow to Rithmic and start trading faster with unfiltered data!

Optimus Futures trading integration with Rithmic includes a native integration with our flagship platform Optimus Flow as well as a huge selection of 3rd party platforms. Rithmic provides reliable exchange connectivity and fast order routing through these industry-leading trading platforms, giving futures traders multiple options to execute their plan more efficiently. Traders receive access to real-time level 1 and level 2 market data and can take advantage of direct market access to all major U.S. markets.

Open an Account to get universal access to all of these trading platforms that route over Rithmic’s API