Trades rarely work out as planned. First, you have to choose your entry and find reasonable levels for your stop loss and profit order, which allows you to trade with a decent reward-risk ratio. Then your trade is exposed to market volatility, the uncertainty of financial markets and your own emotional responses and impulses. Even if a trade starts out with a positive outlook and good conditions, things usually change; stops get hit, orders are moved around, profits are taken too early or too late, or volatility picks up your orders. There are four trading metrics which can help traders evaluate their trades in a better way.

The beginning vs. the ending of your trade

The starting reward-risk ratio

Most traders measure their reward-risk ratio; you get the reward-risk ratio by comparing the distance of your entry and stop price, to the distance of your entry to your target. Thus, the ratio compares the potential risk and the profit potential of your trade.

The reward-risk ratio is an important measure because it analyzes if a trade is worth taking in the first place. However, many traders chose large reward-risk ratio by using stops that are too tight or profit target which are overly optimistic. Or they justify taking mediocre trades by randomly choosing a large reward-risk ratio.

The final outcome and R-multiple

By comparing your initial reward-risk ratio to the final outcome of your trade, you can get new insights into your trading and if your order placement was correct or not. The concept of R-multiple (R stands for risk) measures the outcome of your trade in terms of the risk.

For example, a long trade from $100, with a stop at $90 and a final exit price level at $120 has the outcome of +2R – the outcome was twice the size of the risk. Had he trader closed his trade for a loss at $90, the outcome would be -1R.

Putting the two together

Even though many traders are aware of those two metrics, they don’t compare them in a meaningful way. A trader who can see that his final R-multiple is usually much smaller than his initial reward-risk ratio might see that he is having problems with letting winners run or that his profit targets are too optimistic.

Numbers don’t lie and once a trader can quantify that his trade management and/or order placement does not work well with the market he is trading, he can make specific and targeted adjustments.

Optimizing order placement

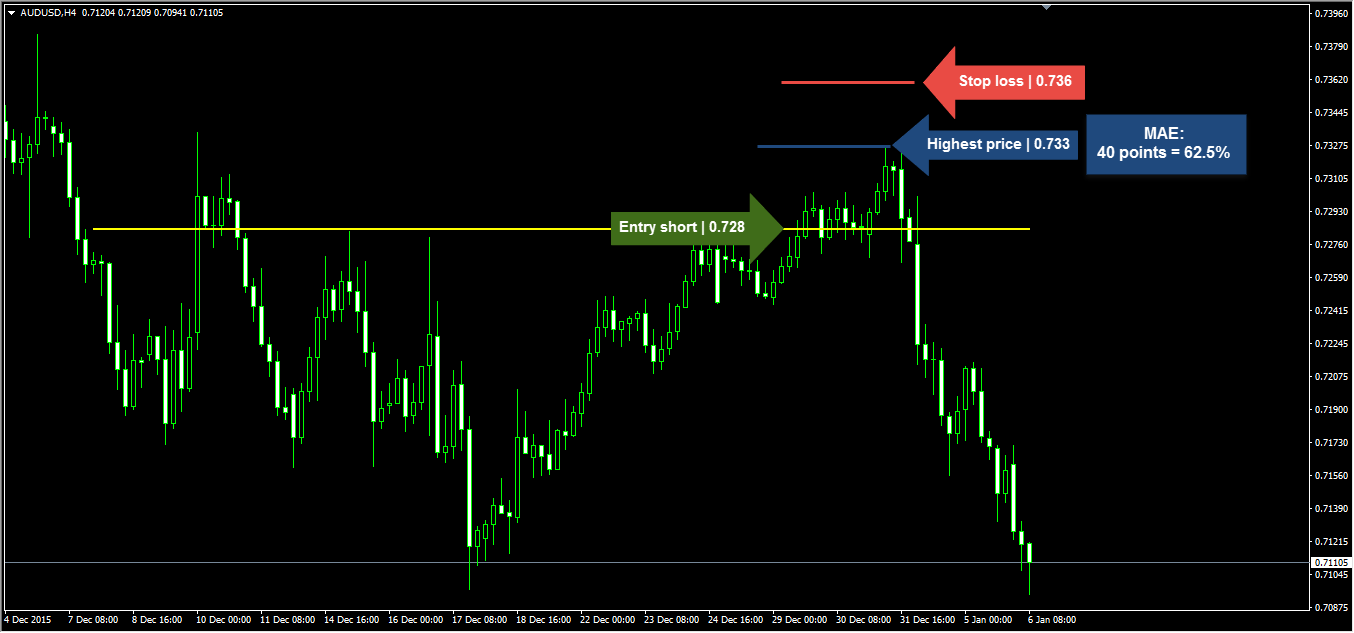

Maximum Adverse Excursion (MAE)

The MAE is the largest experienced loss during a trade; it measures how far price went against you. For example, for a long trade with an entry at $100 and a lowest price of $94 during the duration of that trade, you had a $10 MAE – with a stop at $90, the MAE could be expressed as 60%.

The MAE measurement can be used to analyze the effectiveness of stop placement. A trader with a very low overall MAE could potentially increase his expectancy and the size of his winners by using a tighter stop. However, adjusting stop size has to be done with care since a tighter stop usually leads to a higher loss rate.

Maximum Favorable Excursion (MFE)

The MFE is the opposite of the MAE and it measures the largest observed profit during a trade.

A high MFE on losing trades shows that price went close to the profit taking level, before turning and running into the stop loss. A trader could then, potentially, improve his approach by using profit targets that are a little more conservative.

Again, adjusting order placement has to be done with care. A tighter profit taking approach leads to a reduced expectancy. A trader, thus, has to find the right balance between using a smaller take profit level to avoid giving back profits and not reducing his overall expectancy at the same time.

Conclusion – professionals look beyond entries

Whereas most traders exclusively focus on finding “better” entry systems, the professional traders understand that it is not their entry that makes or breaks their trading method. Traders typically lose because of incorrect stop loss and take profit placement or because of bad trade management.

The combination of reward-risk and R-multiple, and the live-trade metrics – MAE and MAF – provide news insights into a trader’s approach that can help him improve his trading even further.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts since market conditions may make it impossible to execute such orders.