The article below on Trading Psychology below is the opinion of Optimus Futures, LLC.

- The emotional aspects of trading are as critical as the strategic aspects of trading.

- Discipline is effective but it’s reliable only when you have a good trading methodology—having the right mindset (trading psychology) can help you assess whether you’re on the right path or not.

- Markets are constantly evolving, and, therefore, so should you.

Successful trading is not just about deploying the right strategies for profit, nor is it just about fundamental numbers, or technical charts. At the heart of it all lies an often-misunderstood and underestimated factor: trading psychology.

What is trading psychology?

Trading psychology is the mental and emotional aspect that drives a trader’s decisions and actions in the market.

It includes all of the feelings, perceptions, and reactions (conscious and subconscious) that surround a trader’s decision-to-action process before, during and after trading.

It affects how you enter and exit the markets, how you manage risk; and how you deal with the inevitable losses and gains.

Trading psychology as a discipline

Understanding the nuances of your emotional responses, biases, and behavioral patterns are critical to mastering your craft as a trader.

Without this understanding, it would be like operating within a fog of your own mental characteristics.

Instead of enhancing your ability to trade, it can limit your capacity in a way that you may be completely unaware of.

Trading psychology vs discipline

Many traders read books, attend webinars, and take seminars on mastering trading psychology, only to find that their results do not improve.

Discipline, which is often touted as the solution, is blamed when things go wrong. Some argue that the problem is not a lack of discipline, but the absence of a reliable system for anticipating future price movements.

Indeed, discipline is closely linked to one’s confidence in their trading methodology. And both are only as good as your trading methodology.

Mastering your trading psychology can keep you from blindly following a bad methodology and finding improvements or a better methodology altogether.

Discipline can be blind.

Impulsivity can accelerate your ruin.

A good trading psychology mindset, however, can keep you on the right track of thinking, learning, and patience. There is no progress in trading without effective thinking, learning, or patience.

Navigating the emotional roller-coaster of losses

For many new traders, the reality of facing losses is an expected part of the journey.

Yet, the intense emotions that surface after a day of significant losses are not only unexpected but can be catastrophic.

These intense reactions often stem not from major market shifts, but from excessive trading, trade reversals, and an impulsive need to erase prior losses.

A common narrative among beginners, this pattern is something many consider a rite of passage in the trading journey.

Revenge trading – a dangerous shift from discipline to impulsivity

The allure of revenge trading—a day where trading rules are discarded and impulsiveness takes over—often takes root after a series of losses.

The emotional difference between a profitable trade and a losing one can pivot a trader’s mental state drastically.

A disciplined trader can easily devolve into an impulsive one, pushing trades just to recoup losses. This spiral is often due to the draining effects of losses, both emotionally and physically. So, simply don’t do it.

Maintain awareness throughout every step of the trading process

Awareness is key to successful trading. Recognizing that this is a frequent pitfall can prepare one mentally. Monitoring trading volume and ensuring it aligns with market conditions or strategy adjustments is crucial.

Over-trading rarely produces positive outcomes. Secondly, periods of self-reflection and analysis can be beneficial, especially when certain patterns don’t align with one’s trading strategy.

Lastly, having clear targets for profits and losses can enforce discipline. A daily loss limit can provide a safety net, allowing traders to step back, recalibrate, and avoid impulsive decisions.

Three areas where traders stumble

It may sound simple, but these three areas can be psychologically intense:

- Entry

- Exit

- Target

Understanding these areas comprehensively is essential. A well-rounded trading strategy encompasses concepts like risk management, position sizing, and when to deviate from the norm.

WATCH | How to Determine Stop Loss Levels That Work for Your Trading Style and Psychology

Traditional technical analysis might not account for institutional actions, which can significantly influence market direction.

Just as critical as entries are exits. Without a structured exit plan, traders are likely to waver, influenced by emotions rather than logic.

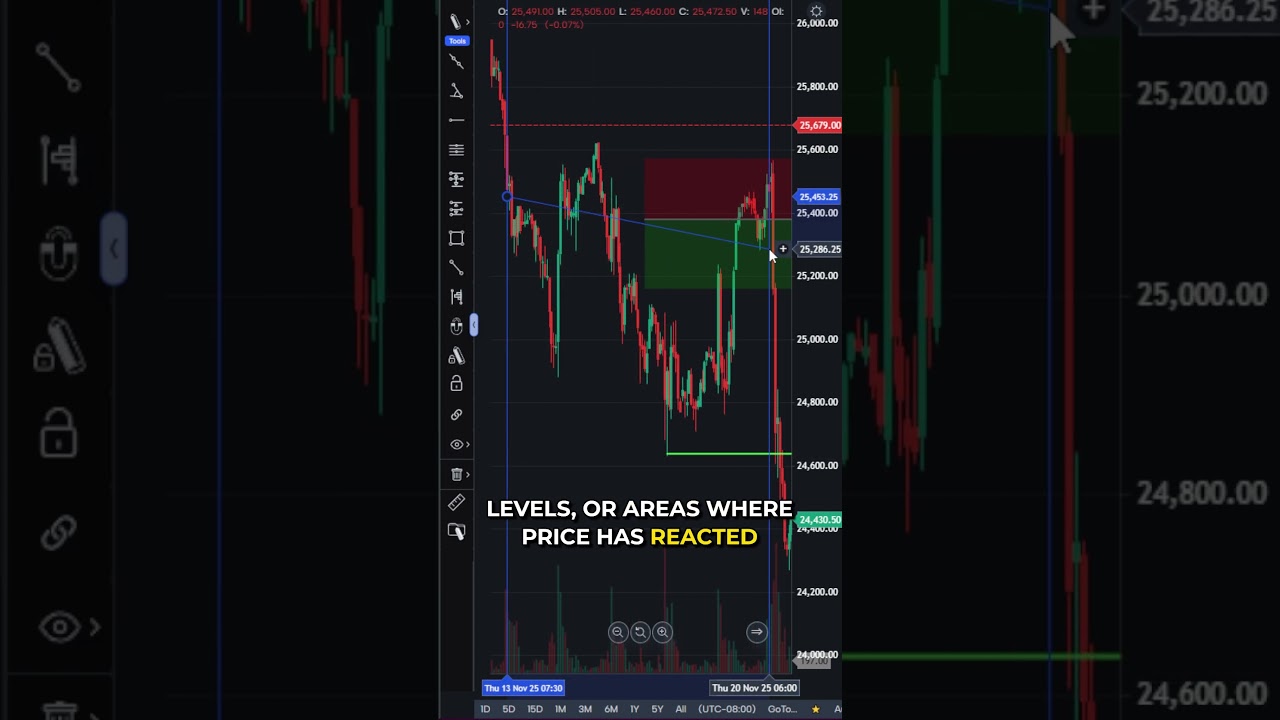

Relying on personal tolerance for setting stops is akin to embracing randomness. Instead, utilizing logical price levels can aid better decision-making.

So, how can we simplify this in a way that you might be able to isolate each aspect of trading psychology in order to buffer any weak areas you may identify?

Mastering the art of trading psychology: Enhancing your skills in six key areas:

1. Work on managing your emotions while trading

Every trade involves a myriad of emotions, from the excitement of a profitable position to the anxiety of a bad losing streak. Trading psychology emphasizes the importance of emotional regulation.

Being overpowered by emotions like fear and greed can result in making rash decisions that deviate from one’s trading plan.

Although you don’t want to get addicted to relying on a trading simulator (aka trading demo), using a simulator is one way to help get rid of emotionally-driven bad habits or to form new habits and responses.

Key Takeaway: Work on your emotional stability. Remember that emotional stability doesn’t mean being emotionless. It means “managing” your emotions so that they don’t cloud your judgment and work against you.

2. Overcoming any cognitive biases that are getting in your way

Trading psychology also addresses various cognitive biases that can influence trading decisions. For instance:

- Confirmation Bias: This occurs when traders seek out information that supports their existing belief or trade while ignoring contradicting evidence.

- Overconfidence Bias: Some traders might think they have a unique ability to predict market movements, leading to over trading or risking more than they should.

Key Takeaway: Know the various cognitive biases that affect most market participants. Being aware of the ones affecting you is the first step towards overcoming them.

3. Develop a growth mindset

In the realm of trading psychology, a growth mindset stands out as a valuable asset. It enables you to view losses as learning opportunities and avenues for growth.

With a growth mindset, you can learn to be more adaptable and resilient to an ever-changing market landscape. At the least, you can learn when and how to change your approach if it’s proving unprofitable or inefficient.

Key Takeaway: Cultivate a growth mindset! Embrace challenges, learn from your mistakes, and continuously improve and adapt.

4. Stay disciplined and consistent

At its core, trading psychology enhances your capacity to remain disciplined. This can mean sticking to a trading plan, setting realistic goals, and maintaining consistency.

It can also mean having the patience to decide whether or when to change your system.

Most importantly, it keeps you from making impulsive decisions that are misguided by emotions. Impulsivity will get you nowhere except for the realm of luck, good or bad.

Luck without skill is dangerous. But having solid skills can help you manage bad luck while generating better luck in your trading.

Key Takeaway: Discipline and consistency are the bedrocks of successful trading. Developing a structured trading routine and adhering to it, no matter the short-term outcome, will eventually foster long-term success.

5. Manage your stress

Trading is often a high-stakes endeavor. It can also be highly unpredictable. Trading psychology offers techniques such as meditation, deep breathing exercises, and regular breaks to manage and alleviate stress.

Managing stress is a serious matter over time. Everybody knows this. That means, you do too, whether or not you’re actively doing something about it.

So, take the time to find methods and approaches that you can work into your trading day.

Like a good trade, the potential returns from managing your stress can be infinitely greater than any downside.

But like a naked options trade, not managing your stress can expose you to unlimited risk. Think about that for a moment.

Key Takeaway: Mental health is integral to trading success. Incorporate stress-relieving activities to attain peak mental performance, not just in trading but in life.

6. Markets require continuous learning

You can’t navigate the markets with equation-like or formulaic simplicity. The only equation-like formula is to “buy low and sell high.” Markets aren’t static.

So, it follows that trading psychology isn’t a static field either.

As markets evolve, so do the psychological challenges faced by traders. Continuous learning, attending workshops, reading about new research in trading psychology, and seeking mentorship can help traders stay ahead.

That’s how some of the most brilliant technicians developed their indicators. That’s how brilliant traders continue to be successful. Just assume that if you’re not learning, you’re falling behind.

Key Takeaway: Market’s are evolving. Stay ahead of the curve. Today’s edge may be tomorrow’s straight road.

The bottom line

The heart of successful trading is not just about having analytical prowess or deploying a solid trading strategy. It’s an intricate blend of both combined with a steady and reliable mindset, or trading psychology.

Trading is a realm wherein emotional whirlwinds blow, from the excitement of big profits to the despair of crushing losses. You need to be able to handle both, from market preparations to entry to exit.

Embracing a growth mindset, being conscious of cognitive biases, managing emotions, and prioritizing mental health are the linchpins that hold the foundation of effective trading.

In essence, trading is not a mere game of numbers, but a profound journey of self-awareness. Good luck!

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.