This article on Price Limits on Futures Trading is the opinion of Optimus Futures.

One of the most frightful scenarios for futures traders is getting caught in a position when markets move against them, limit up or limit down.

If this has never happened to you imagine the following scenario: You enter a short soybean futures position, shortly thereafter the market spikes limit up unexpectedly. Price limits are hit. The market stops trading. There now is no way you can get out of your losing position and it is unknown when trading may resume and at what price. When the market reopens, it immediately goes limit up again! The first day you may have lost your shirt so to speak. The second day this happens you might have lost your entire farm depending on the risk you had in the market (hopefully not!). Now what? How do you manage this situation?

The first step in trying to avoid this nightmarish scenario is understanding what price limits are, how to avoid the ones that are not in your favor, and what happens once a limit is reached. When participating in any market, but especially the commodity interest markets, it is critical that market participants have an understanding of fundamental market and exchange mechanics.

What is a Price Limit?

A price limit is the maximum range, up or down, a futures contract can move in a given trading session.

Limit Up: If a contract reaches the top of the range, it’s said to be “limit up.” If you happen to have a long position on a contract, this situation is exceedingly favorable. If you happen to be short, you’re at a severe disadvantage.

Limit Down: If a contract reaches the bottom of the range, it’s said to be “limit down.” Similar to the situation above but in reverse, a limit-down scenario favors traders holding short positions. However, those holding a long position may be at a significant disadvantage.

Limit prices are calculated for every trading session. These price limits are established by the respective exchanges where a futures contract is trading and offered, and different exchanges may have different rules for similar products.

You should also be advised that exchanges can adjust or alter the rules at any time. As a trader, it’s important for you to be aware of these rules and to adapt to any changes should you be in a position where such changes may impact you.

Why Are There Price Limits?

Exchanges impose daily price limits to protect traders from extreme price movements that may be caused by factors disrupting the natural flow of transactions.

This can range from market manipulation to technology disruptions, fake news, and even meme-driven events.

What Happens When a Limit Price is Reached?

Generally speaking, when a limit price is reached, one of two things can happen: trading can be stopped for the day (meaning the trading session is over), or a temporary halt can be implemented to give the exchange enough time to impose a new set of price limits by which to re-establish trading.

Here is where you need to know the market and exchange you’re participating in well, as different futures products will have different limits and different actions once those limits are reached.

For instance, agricultural futures products typically have an upper and lower limit, while stock index futures (like the ES) will have a downside limit but no upper limit.

Also, some futures contracts, like agricultural futures, hit their limit more often than other contracts, like stock index futures.

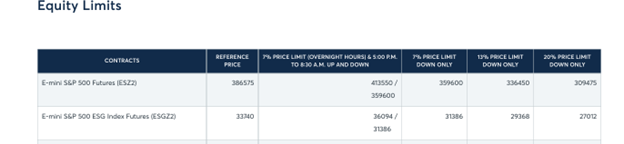

Also, different instruments may have different price limits during the day trading sessions and overnight sessions. Take the E-mini S&P Futures, for example (screen shot below representative as of 11/15/22 but is subject to change):

Notice how there are three limit-down price limits—one at 7%, 13%, and 20%—and a different price band for upper and lower limits for the overnight trading hours of 5 PM to 8:30 am ET.

Since S&P 500 futures are priced relative to the underlying S&P 500 stock index, the three consecutive downside limits are conditional to coincide with NYSE rules. To learn more, you can view the rules on the CME’s S&P price limit Q&A page.

So, as a trader, you have lots of homework to do to fully understand how price limits work in your market of choice.

The Advantage of Price Limits

Market manipulation: In the decades before digital media and price limits, market manipulation was a relatively common disruption that exchanges faced and worked hard to regulate.

For instance, schemes to “corner the market,” literally buying nearly all available supply of a given commodity, go back millennia, from Thales of Miletus cornering olive oil presses in the 6th century BC to Armajaro Asset Management cornering the cocoa market in 2010.

Although cornering the market these days is still theoretically possible even with price limits, it was much easier to do when no price limit existed to stop the sudden inflow or outflow of capital and accompanying buying or selling volume.

Technology and human error: As trading has moved more and more electronic and algorithms have been introduced to the mix, there have been several instances in which a major crash was triggered by a massive onslaught of simultaneous sell orders by computerized trading programs across the globe.

Without price limits, the effect of such a sell-off would be much more severe. Computers can trade much more quickly than human beings in a pit were previously capable of – with electronic trading limits can be hit in a matter of seconds with little to no warning.

You may also be familiar with term “fat finger” error. This is an error in which a human trader (or a coder who incorrect programs a trading strategy) accidentally adds additional digits to a trading order, exponentially increasing the size of a buy or sell beyond what was intended. This type of error varies in magnitude but in the most extreme cases can push orders into lock limit conditions almost immediately as well.

Fake news and meme attacks: Although fake news and meme swarms typically affect individual stocks, they can impact single commodities or single stock futures as well. In either case, an event or a social media meme can prompt a large number of traders to buy or sell a given financial instrument in a short period of time, causing an exaggerated rise or fall in price driven almost entirely by sentiment or in some cases micro participant collusion.

An example of fake news, in the case of stock trading, would be a report that a prominent CEO of a prominent company has died or has a terminal illness. This news causes share prices to react – most likely fall only to find out later the report was false. The same could happen due to a viral video of a car spontaneously combusting, sending the stock of the cars manufacture into a tailspin. Later the news could change that the car combusted due to some external force that had nothing to do with the manufacturer.

In the case of memes, 2020 saw the Wall Street Bets phenomenon, where shares of companies with poor fundamentals, like Gamestop, saw a tremendous rise in share price simply because traders decided to jump in for reasons solely connected to meme forums. This would be an instance of micro participant collusion to move price violently up or down. In the case of Gamestop, shares rose as high as 1,700% almost entirely due to internet forum banter and sentiment!

While it may be more difficult to pull such tactics off in commodity based futures, there is not necessarily a guarantee that it won’t or can’t happen. This is why price limits can be advantageous. They can slow a runaway market down if price movement is unfounded and allow pricing equilibrium to be re-established in a rationale and controlled way.

The Disadvantage of Price Limits

As helpful as price limits can be in protecting traders and investors, they can also be harmful, especially if you’re on the wrong side of the market.

The biggest disadvantage and risk is that you’re caught in a position that you can’t exit per the example above. When price limits kick in price discovery ends and you’re stuck in the position you own until trading resumes.

For example, let’s suppose you’re short soybeans. Suddenly, news of a severe supply chain disruption causes buyers to jump in, anticipating the ensuing rise in soybean prices.

The market goes limit up, trading halts, and the session closes. The next day, buy orders are stacked up and outnumber sell orders. The market stays locked and prices gap higher with no ability for you to trade out of your position.

The risk here is that your order can get filled at an unbearably high price toward the next limit-up level, or, if you’re unlucky, you may not get filled at all should the market, once again, go limit up for the second session, third session, fourth session etc. in a row.

If this happens to you, the losses you could sustain can be devastating. Often losses of this type may even exceed the amount you hold in your trading account forcing you into a debit position where you owe money to close out of your losing position.

On the long side, the situation (limit down) would be similar but in reverse. Price limits stop price discovery and damage liquidity. This can mean that in the most extreme cases there is no price at which a commodity or other financial product can be traded during the halt period.

The Bottom Line

Most price limits are triggered during sessions of extreme volatility. In most markets, they’re rare events. And despite the inconveniences or risks they pose, depending on which side of the market you’re on, they do serve an important purpose toward upholding the integrity and efficiency of the market. On the one hand they can stop market manipulation, irrational exuberance, and unfounded speculation. On the other hand they can halt the price discovery mechanism the markets are intended to be and damage those caught on the wrong side of the move by locking them into a position.

It is critical that all market participants become familiar with the limit moves of the futures markets they trade or intend to trade. If possible, exit before such limit moves occur, and in our opinion, you should exit even if they are favorable to your account. As a final tale of caution it is not impossible for a limit-up market to turn into a limit-down market and vice versa. Remember price limits come into play during periods of extreme volatility, market stress, or manipulation. With no orderly price discovery mechanism available trading this type of market, especially without understanding the rules of the game, can be devastating.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. You are responsible for the losses you sustain during limit up or down moves and may be required to deposit additional funds. Losses can exceed your initial deposit.