Ahead of an important news event, the expected outcome will usually be priced in by the time the news is released. This means that traders and financial speculators estimate the likely outcome well in advance and then position themselves accordingly. Thus, when the news is being announced, you will rarely see a large move or a complete change in direction because “the smart money” will have already taken their position. However, if an unexpected news item hits the markets and surprises traders and financial players, it can lead to disproportionately large price movements. This is because, first, traders didn’t have the time to position themselves beforehand and second, everyone is trying to figure out what the implications for the market will be.

The term used in this context is ‘overreaction’ and they occur from time to time – just often enough that it is worth explaining this phenomenon and how traders can use it to make better trading decisions – and how to avoid running into dangerous trading scenarios.

This year alone saw two major events that surprised the markets, BREXIT and last week’s US election. Let’s start with last week’s US election and explore how this was a classic overreaction pattern.

Once it has became clearer that Trump would win, markets panicked and the stock market sold off because of the uncertainty such an outcome could bring. However, this sell-off could have been premature since fiscal, monetary policies and Wall Street’s attitude had not yet been determined.

Within a few hours, price completely recovered the massive drop and then went on to make new highs.

The danger of such a market move lies in a move called ‘catching a falling knife’ where futures traders see the massive drop as it happens and then try to buy into it, hoping that price must turn eventually. This is a dangerous and high risk approach and it has to be avoided because markets don’t always recover as we will see and such a drop can last for hundreds of points, resulting in major losses.

Instead, a potentially safer approach is it to wait until price has indeed recovered the whole initial kneejerk move and then trade in the direction of the recovery. In the context of the US election move and the S&P Emini drop, you can see how price first sold off just to completely snap back to the origin of the move and it then even kept on going afterwards. Past performance is not indicative of future results.

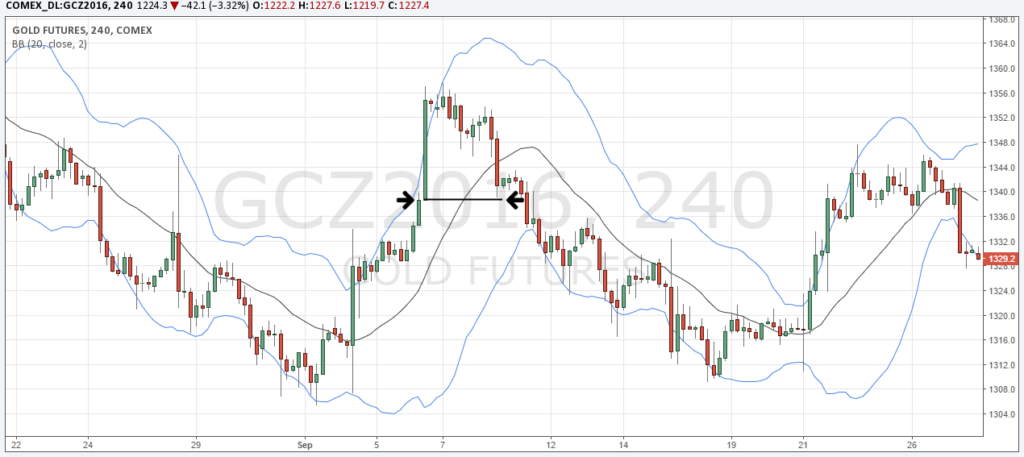

Gold Overreaction

Below we see the Gold chart’s reaction to the US election. Initially Gold rallied because of the uncertainty the Trump victory could bring. However, price immediately dropped back into the origin and then continued its sell-off. This is another classic example of a knee-jerk overreaction to an unexpected high-risk event. Again, it is not advisable to short into the rally just because you believe that ‘what goes up has to come down’ – it does not always happen. Instead, wait for the confirmation and once you see the recovery of the overreaction, you can enter with the momentum and benefit from the potentially trapped traders.

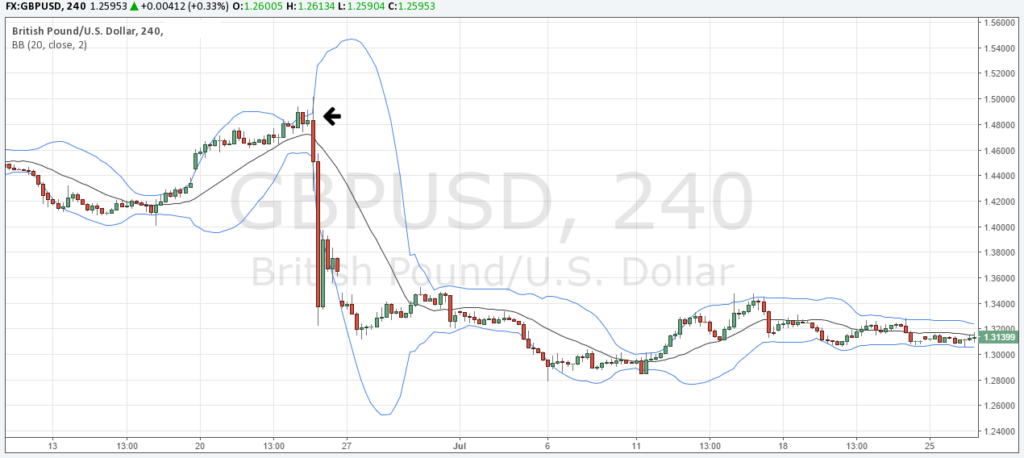

The BREXIT

The BREXIT was a classic example of a surprising, or shocking, news event that did not lead to an overreaction move. The GBP sold off across the board and although it tried to recover its losses, it didn’t, and it kept selling off even afterwards. Traders who kept buying during the drop had to face major drawdowns. The previously discussed rule that the overreaction is only confirmed once price has completely recovered the whole move at the origin of the drop could have, potentially, saved traders here from a high risk trade.

The Dangers of ‘Catching a Falling Knife’

Here is another example of why the ‘catching a falling knife’ trade is not a good trading strategy. Below, we see the EUR/CHF on the day that the SNB lifted the peg. The CHF rallied and the EUR/CHF sold off. The overraction wasn’t there and price did not recover the loss.

During those Black Swan events, the number one priority of a trader must be to protect his account and not try to outsmart the markets.

Regular Overreaction Pattern

The overreaction pattern happens intraday from time to time as well. And it does not always take a Black Swan event to cause a significant price move, but if you see a strong spike like the one below that abruptly stops and then recovers almost immediately, it can provide meaningful information to the trader.

The initial bullish momentum was unsustainable and price sold-off with strong bearish momentum. Those clues signaled that a sell-off was likely to continue – which did happen.

Conclusion: The most important aspect about Black Swan events and major market moves is that you should not let yourself get sucked into the initial hysteria. Instead, step back and wait for the panic to ease off. Once the dust has settled it usually becomes much more clear how traders really positioned themselves.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.