Risk and money management is an underrated trading element because, it seems at first glance, that looking for yet another entry methodology will be more beneficial for a trader. Nevertheless, many professional traders do not necessarily see themselves as traders, but at as risk managers.

“At the end of the day, the most important thing is how good you are at risk control.” – Paul Tudor Jones

The 6 following elements can help traders not only make better trading decisions, but also improve their outlook on trading in general and adopt a professional risk and money management approach.

All graphs and performance figures are for illustration only. There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The use of stop-loss may or may not protect profits or limit losses to the amount intended. Certain market conditions may make it difficult or impossible to execute such orders.

[bctt tweet=”6 elements of professional risk and money management #trading #futures #ES_F #market”]- What are arbitrary stop loss orders?

A mistake many traders make is that they use arbitrary stop loss orders in their trading. As we have mentioned in an earlier article, markets are constantly changing and it is therefore necessary to also adjust your stop loss approach. It might be necessary to use wider stop loss orders in high volatility market environments or smaller stop loss orders during low volatility times. Furthermore, different financial instruments behave differently and, thus, your stop loss order also has to account for that. Using arbitrary, or even the same stop loss order approach across different markets, time-frames or periods indicates a misunderstanding of how financial markets behave.

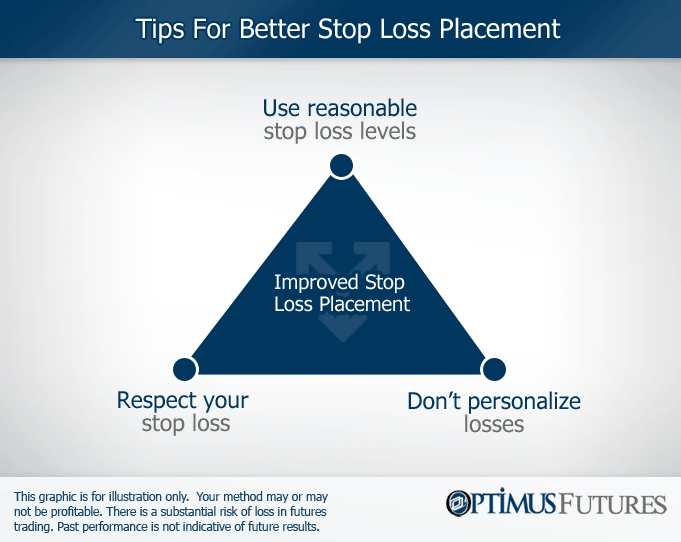

- The process of placing stop loss orders

A stop loss order is the price level at which your trade idea is proven invalid. Therefore, it is important that you identify your stop loss level before you start calculating your position size. Most traders approach it the opposite way which leads to problems as we will see in the next point.

First, after identifying a potential trade entry, look for a reasonable stop loss level at which you do not want to be in the trade anymore. Then, determine the position size and how many contracts you have to buy. Most traders first determine the position size and then look for where they can place their stop loss.

- Respect your stop loss and don’t personalize losses

If you understand and accept that a stop loss order should be the price where your trade idea is wrong, you can approach trading from a new angle. Amateur traders regularly re-enter losing trades or engage in revenge trading. This is often caused by setting stops loss orders at unreasonable locations. Additionally, they personalize losses much too often. Everyone will know that trading with a 100% winrate is impossible, but when it comes to realizing losses, traders are particularly bad. Keep in mind, losing a trade is not necessarily a sign that you are a bad trader, but just that your trade idea was wrong.

- Process-oriented thinking

The cause for re-entering losing trades and revenge trading is often caused by the fact that traders personalize losses. Amateur traders often have a results-oriented mindset which means that they exclusively judge their abilities by the outcome of their trades. The professionals, on the other hand, understand that they cannot win every single trade and that they have no control over the outcome. Furthermore, professional traders have often adopted the process-oriented mindset which allows them to look beyond measuring their abilities by the outcome of their trades alone, but by how they formed their opinion and how well they executed their trades. The process-oriented trader focuses on how well he is following his trade plan, whether or not he has obeyed his trading rules and how he executed his trades; even the best setup can, and will, fail and it is important to you unlearn the results-oriented thinking.

- Reward:Risk ratio – keeping the odds in your favor

The reward:risk ratio, the ratio between the potential loss and the potential profit of a trade, is among the most important concepts of trading. A good reward:risk ratio makes sure that your winning trades are able to offset your losses. For example, a trade with a reward:risk ratio of 1:1 (the potential profit and gain are the same) requires a winrate of 50%. A trade with a reward:risk ratio of 2:1 (the potential gain is twice the size of the potential loss) only requires a winrate of 33% or higher. It is important to engage in trading situations where your reward:risk ratio is favoring a positive outcome.

“Frankly, I don’t see markets. I see risks, rewards, and money.” – Larry Hite

There is a risk of loss in futures trading. Past performance is not indicative of future results. The use of stop-loss may or may not protect profits or limit losses to the amount intended. Certain market conditions may make it difficult or impossible to execute such orders.

- The influencing factor of position size

The position size of your trades can have a big impact on how you approach trading and how you manage your trades.

If your position size is too big, and by this we mean that a potential loss could have significant impacts on your overall trading account, you are more likely to make impulsive and emotionally caused trading mistakes. For example, a relatively big position can lead to closing winning trades too early to avoid giving back profits or closing a losing trade too late because you want to give it the chance to turn around.

On the other hand, potentials winning and losing trades for positions that are relatively small, which is often the case when traders have a relatively small trading account, do not amount to meaningful results. Over time, these traders often adopt an undisciplined trading approach because their trading decisions do not have a noticeable impact.

Risk and money management is multi-dimensional

It becomes quite clear that money and risk management is more than just choosing how many contracts you have to buy, but that many concepts and elements of trading are interconnected. By being conscious about how different trading decisions and concepts relate to each other, a trader can adopt a more professional approach and understand how to effectively manage and control risk better.

Please be advised that trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. This matter is intended as a solicitation to trade. The use of stop-loss may or may not protect profits or limit losses to the amount intended. Certain market conditions may make it difficult or impossible to execute such orders.