This article on Micro Gold Futures is the opinion of Optimus Futures.

Nearly 50 years ago, Nixon upended global gold markets.

Facing inflation, high unemployment, and risk to US gold reserves, in 1971, President Nixon instituted several measures dubbed the “Nixon shock.”

The most important of the resulting actions was the suspension of the direct international convertibility of the US dollar into gold.

Effectively, the gold standard, which directly linked a country’s currency to a fixed exchange rate for gold, was over.

Following this divorce, gold and currency have generally held an inverse relationship, leading some traders to use gold to hedge against currency and other risks during times of uncertainty.

While standard gold contracts are a staple amongst large asset managers, the size and leverage of these specific contracts don’t work as well for smaller portfolios.

Consequently, the CME created the E-Micro Gold Futures contract.

In this article, we’ll cover what you need to know about Micro Gold Futures, including what they are, how they differ from standard contracts, their benefits, as well as a few trading strategies to get you started.

What are Micro Gold Futures contracts?

At one-tenth the size of a standard gold contract, the E-micro Gold Futures contract is tailored to meet the demands of the active individual investor looking for the opportunity to trade physical gold in smaller increments with the same capital efficiency.

But before we explore the micro gold contract in more detail, let’s start with a brief discussion about futures contracts in general.

Futures contracts are leveraged derivative contracts tied to a specific physical or cash product such as gold or a market index.

Unlike options contracts, the holder of a futures contract is obligated to buy or sell the underlying asset at expiration.

Gold futures contracts come in three flavors: standard, mini, and micro. The only difference between them is the underlying notional value.

- A standard gold contract controls 100 troy ounces.

- A mini gold contract controls 50 troy ounces.

- A micro gold contract controls 10 troy ounces.

Micro Gold Futures Contract Specifications.

Each futures product and the contract can be a bit different. Here are the important points you need to know about E-micro Gold Futures.

- Exchange Symbol: MGC

- Exchange: CME COMEX

- Tick Size: $0.10

- Tick Value: $1.00 per tick

- Margin/Maintenance: $825/750 (varies by clearing firm and subject to exchange changes).

- Daily Limit: 10% above or below the previous settlement

- Contract Size: 10 troy ounces

- Months: Feb, Apr, Jun, Aug, Oct, Dec (G, J, M, Q, V, Z)

- Trading Hours: 5:00p.m. – 4:00p.m. (Sun-Fri) (Settles 12:30p.m.) CST

- Last Trading Day: Third last business day of the month preceding the maturing delivery month

Micro Gold vs. E-Mini Gold vs. Standard Gold Futures

In the simplest terms, a standard gold futures contract is a legally binding agreement between an investor and seller that stipulates the sale and delivery of a 100-ounce bar of gold at an agreed-upon price at a certain predetermined future date

Designed to replicate this contract, a micro gold futures contract controls 1/10th of the notional values of a standard gold futures contract.

While sized at one-tenth of a standard gold futures contract, a single E-micro gold futures contract does not allow for the delivery of a 10-ounce gold bar.

However, through an accumulation and conversion process, an investor can take delivery of a 100-ounce COMEX gold warrant (representing an actual bar of gold).

For each micro gold futures contract, an investor receives one Accumulated Certificate of Exchange (ACE), representing a ten percent ownership stake in a 100-ounce gold bar. Upon accumulating 10 ACEs, they may be converted into one COMEX gold warrant.

Why Should You Trade Micro Gold Futures Contracts?

Anyone looking to trade, speculate, or hedge using gold should consider futures products.

Futures contracts combine high liquidity with leverage, allowing for more capital efficiency. Additionally, you get nearly round-the-clock trading and zero storage costs. These benefits aren’t available with most traditional ETFs.

In particular, micro gold futures offer smaller contract sizes with the same capital efficiency, giving retail and institutional traders more flexibility.

Some additional benefits specific to the CME you may not be aware of include:

- Convertible, with 10 ACEs equivalent to one, 100-oz. COMEX gold warrant

- Backed by the security of CME Clearing

- Cross-margining opportunities as part of the CME’s micro suite of products,

- Fair pricing above cash prices as opposed to independent dealers that quote different prices

What is the Settlement Process?

The settlements in the Micro Gold Futures are drawn directly from the settlements of the standard sized Gold Futures

Example: If the GCZ21 settles $1772.0, then the MGCZ21 would settle at the same price regardless of where the final tick landed in the micro futures contract.

Futures contracts are either physically or cash-settled.

Gold, like many commodities, is physically settled. That means at expiration the owner is required to take delivery of the product.

However, E-mini Micro Gold Futures are cash-settled. That means at expiration, you don’t need to worry about taking delivery of physical gold.

What are the margin requirements for Micro Gold Futures?

Gold futures traders are subject to three types of margin requirements: initial, day trading, and maintenance.

- Initial margins are the amount of money necessary to initiate the trade.

- Maintenance margins are the amount of money necessary to hold the trade overnight.

- Day trading margins are the amount of money necessary to trade in and out of a product during one day’s session.

Initial margins can be as low as $825, with maintenance margins as low as $750, and day trading margins as low as $228.75. Optimus Futures offers low day-trading margins to accommodate futures traders that require flexible leverage to trade their accounts. Learn More about margins here.

What Market Factors Affect Gold Futures Price

Some of the main factors affecting gold futures prices include:

- Monetary policy rates – Interest rates can have a significant impact on the price of gold futures. As previously mentioned, gold generally has an inverse relationship to currency. So, when interest rates are low, gold prices tend to rise because Treasury instruments tend to become less attractive to investors. Conversely, when interest rates rise, gold prices will typically decline.

- Supply and Demand – As with any tradable commodity, the demand and supply of gold plays a large role in determining its price. Relative to the amount already accessible, the amount of gold being mined is not very high. As a result, when demand for gold increases, so does the price because the supply remains relatively scarce.

- Inflation – As previously noted, gold generally enjoys an inverse relationship to currency. As the price of good and services rise, so does the price of gold. In essence, rising inflation rates devalue currency. This devaluation tends to drive more people to invest in gold, ramping up demand and the price for gold.

- Uncertainty – Generally viewed as a relatively stable investment, gold often enjoys price increases during times of uncertainty.

Trading Strategies for Micro Gold Futures

Traders and investors use micro gold futures in a variety of different ways from hedging to outright speculation.

Here are a few ideas to get you started.

News Event Catalysts

Important economic events like jobs reports can move nearly every market.

As we noted before, monetary policy and inflation are key components that drive the price of gold.

In many cases, traders look at jobs data to forecast central bank interest rate policy.

This creates tradeable times when data is released.

Let’s take a quick look at a recent jobs report and the trading opportunity that arose.

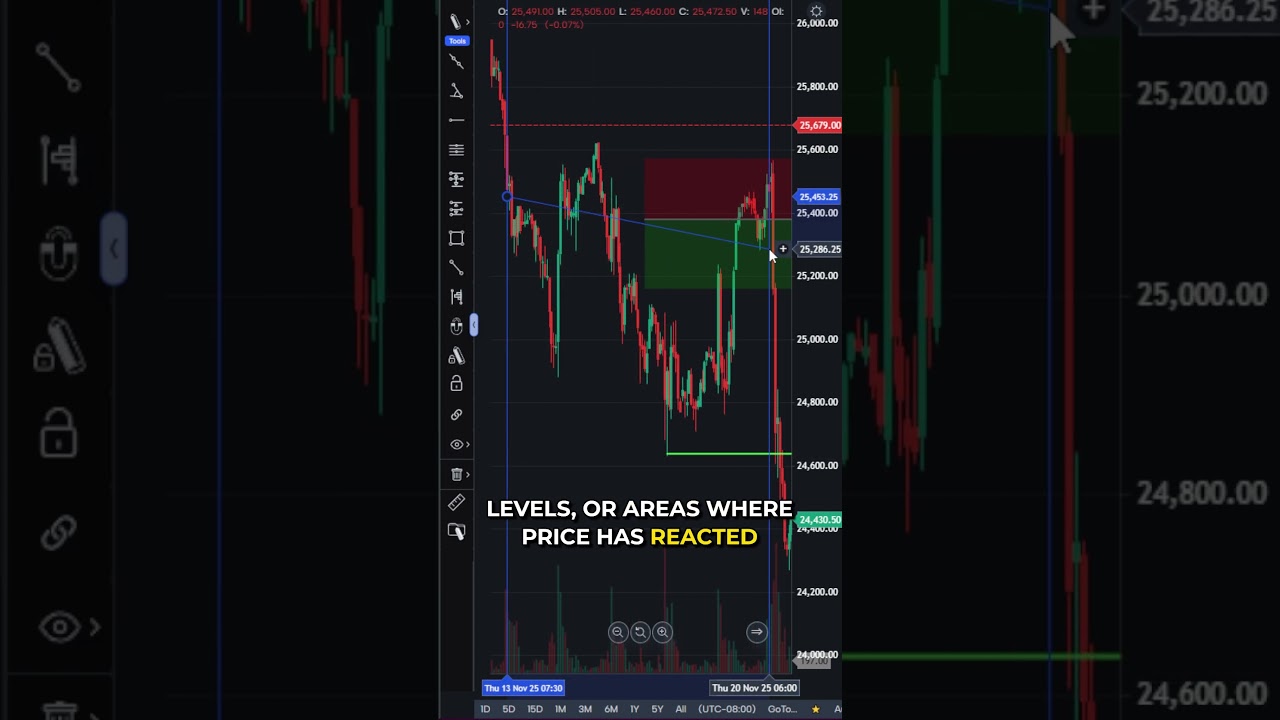

In this gold futures chart, you can see where the jobs data release sent gold prices up quickly.

A trader can use important support or resistance levels to create a trade in the opposite direction.

In this case, gold stopped and reversed right at a key swing point that created a resistance level noted on the chart.

Micro gold traders could short futures at this level, playing for either a scalp or complete mean reversion towards the recent trading range.

One solution that we at Optimus Futures are offering clients is Optimus News, designed to provide a comprehensive scan of the market environment so you can trade futures contracts that are susceptible to news-driven events.

Breakout Trades

One common tactic for trading is known as a ‘breakout’ strategy.

This strategy looks for gold prices to expand out of a previous range, creating significant price movement.

The tough part is identifying when these occur and not get faked out.

In the chart below, we employ Bollinger Bands (blue) and a swing point price level (yellow) to help frame the trade.

In this example, gold broke below the recent low while it also expanded below the lower Bollinger Band (a statistical trading window).

That would indicate price should continue to move lower in the coming periods.

A conservative trader could wait for this to occur, then use a retracement back to that same yellow line to initiate a short position.

Dollar Divergence Trades

As we noted before, the US dollar and gold tend to have an inverse relationship.

At different times, this can and does break down.

So, to work this trade, you need to assume (or measure) a negative correlation between the US dollar and gold.

The idea is a simple mean-reversion. We look for areas where one index extends too far or moves in the same direction as the other.

In the chart below, we’ve plotted gold spot prices using candlesticks (red and green) and dollar futures using OHLC bars (black).

At the first set of callout boxes, we noted how gold climbed briefly when the dollar also climbed.

Assuming a negative correlation, either the dollar should drop or gold should.

So, a trader could place a bet by going short gold in that spot and taken a potential profit shortly thereafter.

Similarly, the 3rd callout box highlights a point where the dollar didn’t move, but gold quickly climbed.

Again, we could assume a mean-reversion trade and bet against gold at that point.

For more Micro Gold futures strategies, check out Optimus Futures’ weekly trading ideas on TradingView. This idea uses a simple 200-period moving average on the hourly chart, a support level , along with a continuation trading pattern to identify consolidation points prior to breakouts.

How To Get Started Trading Micro Gold Futures

Like most other futures, you can trade Micro Gold Futures through Optimus Futures on our proprietary Optimus Flow platform or through our 3rd party apps.

Our trading platform is unique in that you immediately gain access to all the tools and indicators we have to offer from the get-go, for FREE.

To get started, you simply enter the symbol you want in any of our tools.

In this example, we’ll do this in the order entry form.

Here, we’ve selected the gold futures contract along with a market order to buy 5 contracts (lots).

You can also place orders through hotkeys, in the depth of market (DOM) ladder, or directly into the chart.

Optimus Futures specializes in products for futures and futures options, including the CME Group’s Micro Suite of products from Micro gold to Micro Euros.

This particular suite of products offers a wide away of tradeable assets that include benefits such as cross-margining we noted above.

Open your free account with Optimus Futures today and start trading.

Trading futures and options involve substantial risk of loss and are not suitable for all investors. Past performance is not necessarily indicative of future results. You should use ONLY risk capital when trading Futures. Please consider if Futures trading is suitable for your financial situation.

There is a substantial risk of loss in futures trading. CME Micro contracts generally have a value and margin requirement that is one-tenth (10%) of the corresponding regular contract. The cost of trading Micro contracts is higher than regular contracts when measured as a percentage. Commission rates are not always one-tenth of the rate for regular contracts. Exchange and NFA fees are not proportionately reduced. Frequent trading of Micro contracts further compounds the cost disparity. Futures transactions are leveraged, and a relatively small market movement will have a proportionately larger impact on deposited funds. This may result in frequent and substantial margin calls or account deficits that the owner is required to cover by depositing additional funds. If you fail to meet any margin requirement, your position may be liquidated, and you will be responsible for any resulting loss.