This article on Best Order Flow Indicators is the opinion of Optimus Futures.

- What Indicators should you consider when reading Order Flow?

- How do you identify the big player’s trades?

- How to add VWAP to your market analysis

When trading financial assets, it’s crucial to utilize the best order flow indicators available. We often rely on charts to identify market opportunities, which help us detect patterns that might indicate future price movements.

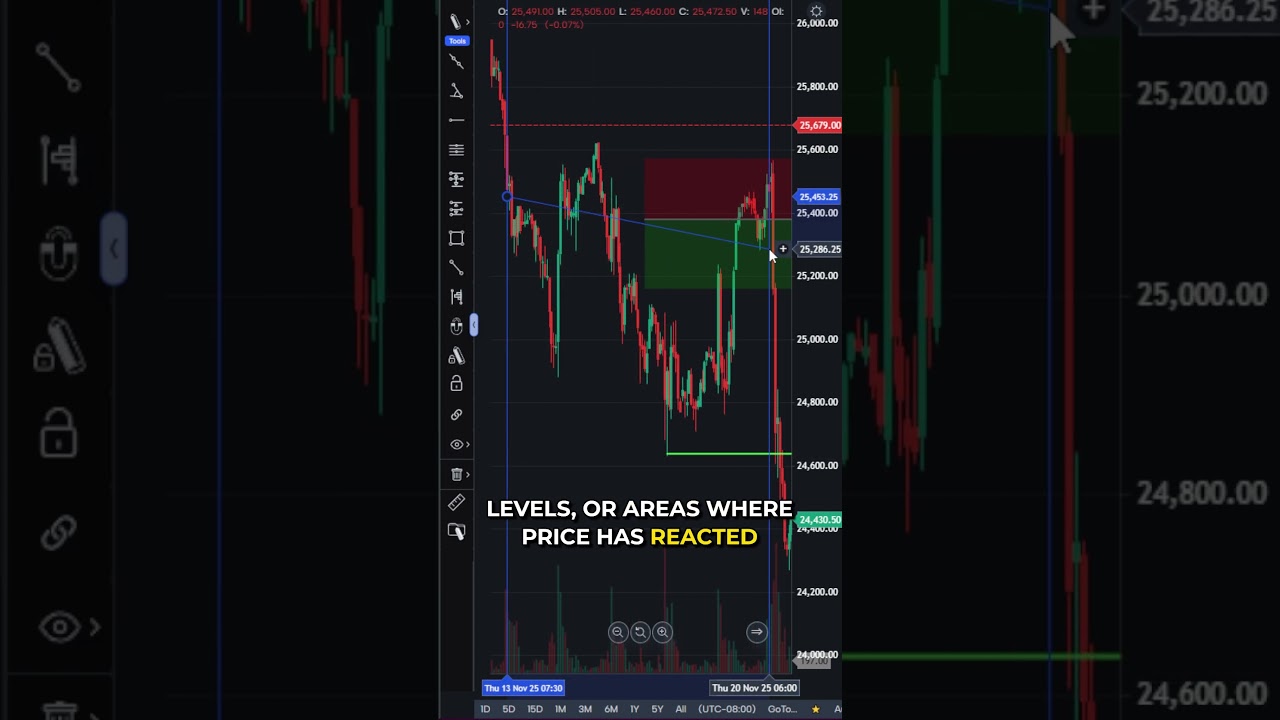

These charts serve as essential ‘maps,’ highlighting potential headwinds, tailwinds, critical levels, and turning points in the market.

On every chart, price and time are typically the dominant features. However, while indicators are variable and supplemental, they play a critical role in successful trading strategies.

Although ‘volume’ is sometimes overlooked and treated merely as another indicator, savvy traders understand that the combination of price, time, and volume, when analyzed through top order flow indicators, can reveal the true driving forces behind market movements—far more significantly than any single factor alone.

Understanding Order Flow Indicators for Market Analysis

Here’s a key concept: Price, time, and volume drive order flow.

Price movements within a given period are often misleading unless you analyze the volume driving them. Understanding the volume of trades is crucial, but it only becomes meaningful when considered in the context of price and time. Indeed, the intertwined relationship of time, price, and volume defines the dynamics of trading.

By integrating these three elements—price, time, and volume—you gain a more comprehensive view of buying and selling pressures. These are the critical factors that drive the order flow behind price movements, offering insights into market direction and momentum.

Now, you might wonder, ‘What are the best tools to detect and interpret buying and selling pressure?’ We will explore the seven best order flow indicators, which are especially valuable for short-term trading scenarios.

Essential Order Flow Indicators for Spotting Market Trends

Here, we will provide a concise overview of each indicator. If you’re eager to experiment with these indicators yourself, you can easily access them all on the Optimus Flow platform.

1 – Power Trade Scanner: Uncover Market Momentum with Real-Time Data

Imagine a scenario where there are more buyers than sellers for a particular product. Typically, this imbalance means the price of the product will likely increase as buyers outbid each other, and sellers raise their prices to maximize profits.

Conversely, when sellers outnumber buyers, prices tend to decrease. This dynamic is a fundamental concept in understanding market forces.

Such market behavior often generates momentum, a crucial indicator of which direction the market might move next. Whether this momentum suggests an upward or downward price movement, it provides valuable insights for traders.

Detecting whether buyers or sellers dominate the market within a short period can be a clear indicator of this momentum.

However, how can you detect these large transactions quickly and accurately? Most conventional volume analysis tools fall short in this area.

This is precisely why tools like the Power Trade Scanner are invaluable. Designed to detect order flow imbalances swiftly, the Power Trade Scanner can help you capitalize on these quick shifts in market dynamics.

As shown in the image above, the yellow highlighted sections pinpoint large order executions that take place within a very short time span (like 3 seconds, or however you might want to customize it). By allowing you to see these short moments of high-volume trading, you are able to gain insight into probable near-term price directionality.

2 – VWAP Indicator: Align Your Trades with Institutional Activity

Have you ever wanted to trade alongside large financial institutions such as mutual funds, hedge funds, and other large investors?

Well, the VWAP indicator is one tool that can potentially get you on the same side as the bigger players on Wall Street.

VWAP stands for Volume Weighted Average Price. It’s a mouthful, but this indicator shows you the “average price” of a security based on both volume and price.

Now, why is this so important to institutional traders? When large funds need to buy or sell assets, they often do so in huge amounts.

The last thing most of them want to do is move the markets in the process of buying or selling, as that would obscure prices, making it difficult for them to complete their transaction.

To help prevent this from happening, they will often buy when the asset price is below the average price and sell when the asset price is above the average price.

And to determine where asset prices are relative to average prices, many of these funds use the VWAP indicator as a tactical tool to assist them in their transaction.

As a trader, you can also use it to increase the odds that you might end up trading with and not against the larger funds.

As shown in the image above, you can overlay different VWAP levels to get a picture of different average price levels based on time frame.

If you’re using VWAP levels as price targets, you can use support and resistance as entry levels, or you can use any standard deviation-based indicator (as shown below) to help determine entry based on when you think price may revert back to its average price.

Caveat: VWAP can be applied to different time periods. So, if you’re trying to increase your chances of not trading against larger institutions, note that some firms may be using shorter-term time periods while others may be using longer-term periods.

In short, VWAP is no guarantee that you’ll be avoiding a “whale”, but it does give you some insight as to where these whales might be spotted.

Customizing Your VWAP Strategy

You can customize your VWAP indicator to a specific time period.

In the example above, I narrowed my time frame to just a few hours of trading. As I demonstrated, you can use the customized VWAP as a tactical tool to analyze average prices within a preferred time frame. However, if you are trying to analyze average prices alongside institutional players, bear in mind that they may not be using the same time frame as you.

So although traders use VWAP to increase their odds of trading with the bigger players, just remember that customizing your VWAP will set the context strictly within your own preferences, which can be useful when personalizing your strategy.

3 – Volume Profiles: Decipher Market Structure and Trading Activity

Let’s take a step back for a moment and think of a familiar non-market scenario. Let’s think about our local geographical areas. There are certain places people frequent. Grocery stores, restaurants, and other social areas.

This volume of traffic tells you something. People frequent these areas for a reason. These high-traffic areas hold a degree of importance that either attracts people or makes them come back (for one reason or another). When it comes to price levels, a similar principle applies.

Pioneered by J. Peter Steidlmayer, the Market Profile chart aimed to analyze price activity as it evolved throughout the trading day.

There’s a lot to market profile charts, and we can’t even begin to discuss it here. But one simple way to look at it is to note areas with the largest horizontal lines. Those lines represent the amount of trading activity at a given price level.

As traders collectively go through the motions of “price discovery,” there are certain price levels at which buyers and sellers might agree on, in terms of a temporary “equilibrium” in value. These are called “value areas,” and they are often the most frequented levels.

Value areas will change from day to day as the market digests new information. Value areas will also take different shapes and forms depending on the price discovery process.

As you trade with a given Profile, you have to interpret what these trading areas mean, and whether they might indicate support and resistance, breakout levels, or price targets.

And with Optimus Flow, you can customize your Volume Profiles by analyzing different time frames, or even place multiple profiles at once–setting one at the center, left, and right of your chart. We will cover the details of this fascinating indicator in a later post.

4 – Time and Sales Window: Classic Tool for Historical Trade Analysis

Ever wondered what old fashioned ticker tape reading was like? Well, the Time and Sales window is probably the closest you will get to it.

Not so much an indicator as a historical record of trades, time and sales displays all trades for a given instrument, detailing price, quantity, date, and time.

Unlike the past, where trades were dispensed in a seamless row of tape printouts, today’s digitally powered trades hold much more volume and speed, especially in real-time, where the data flows like a ticker tape on steroids.

Nevertheless, time and sales data can be a treasure trove for those who know what to look out for.

So, what’s the point of reading Time and Sales? Similar to the Power Trades scanner, you are looking for aggressive trades that might indicate stronger buying or selling pressure.

Except, unlike Power Trades, you are sifting through all of the trade data by sight.

Tape reading is no easy task, and it is a skill that takes practice. But if you can master it, you might have an edge over other traders who are unfamiliar with this long-forgotten practice. You have to admit, it’s pretty “old school”.

5 – Time Statistics: Detailed Insights into Market Behavior Per Candle

The Time Statistics window provides comprehensive volume data for each bar or candle. Key insights include the volume in the last bar and the count of buy and sell trades.

These statistics help traders understand how volume influences market price movements.

These are all questions that the stats data can answer. It is like another way of monitoring the Time and Sales. But instead of following a running history of trades, you can see the data evolve as each bar forms.

6 – Time Histogram: Comprehensive Volume and Trade Analysis

The most common histogram that we are used to seeing, possibly because every chart has it, is a volume histogram.

Volume histograms are quite useful as they provide a relatively clear picture of volume trends (or lack of) and buying/selling pressure. But what if you wanted more information?

For instance, what if you wanted to know the total volume, buy or sell volume, buy and sell volume, average buy or sell side, or what if you wanted to filter your volume information?

Getting this level of detailed information is what makes Optimus Flow’s Time Histogram very useful, as you have a list of data choices you can display on your screen.

For instance, here is a Time Histogram displaying buying/selling volume. Again, this is just one set of data that can be displayed in a histogram format.

Depending on the kind of data you choose to see, you can customize the histogram’s settings to analyze historical trading activity or to forecast potential turning points in the market.

7 – Cluster Chart: Advanced Visualization of Intraday Market Depth

Also known as a “footprints” chart, the Cluster Chart allows you to get an in-depth view into what is going on inside a candle. What is the order flow like in terms of total trades, buy or sell trades only, trading volume, etc.? There are several different settings you can use to filter the candle information.

Why use the Cluster Chart? So, you can get insight into zones of maximum buying or selling, zones of high trading interest, or indications of aggressive buying and selling activity.

These bursts of short-term momentum can often determine the coming price direction. Aggressive buying pressure may indicate that there are more buyers than sellers in the room; aggressive selling pressure may indicate the opposite scenario.

If you can identify areas of high trading interest, you may be able to pinpoint zones of support and resistance, both of which also can serve as breakout points when buyers outnumber sellers or vice versa.

What you are viewing is the dynamics of the order flow for each individual candle, the “footprints” that have caused the price to move in a given direction, and the current footprints that may cause a similar reaction moving forward.

Further Reading: How to Identify Imbalance in the Markets with Order Flow Trading

The Bottom Line

Order flow drives the inner dynamics of price movement. And the essential information contained in order flow is the amount of buying pressure or selling pressure within a given window of time.

With specialized indicators designed to observe buying and selling pressure, you can get a unique view toward price action that many other traders may not be able to see. You can see order flow–a dynamic that most traditional technical indicators are incapable of representing.

Ultimately, this can provide you with a potential trading advantage, particularly if you develop your own unique approach toward integrating this analysis and set of tools into your trading style.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. When considering technical analysis, please remember educational charts are presented with the benefit of hindsight. Market conditions are always evolving, and technical trading theories and approaches may not always work as intended. .