This article on Price Action Trading is the opinion of Optimus Futures.

- Price action trading approaches allow you to go directly to the source of market action (the price itself).

- Price action trading can potentially help you respond to markets with greater clarity, speed, and efficiency.

- This approach does require experience and skill, and it’s not for every trader.

Confusing the “map” with the “territory”…It’s easy to do. Maybe technical indicators are overrated (or not). Some traders seem to think so.

What’s wrong with indicators?

They’re useful for analyzing (read “shaping”) specific data. They’re not designed to give you a full 360-degree view. But when you combine them, they sometimes produce conflicting signals, slowing down your decision speed when evaluating markets for potential trade opportunities. They also tend to create a visual mess. In the worst-case scenario, it’s easy to confuse the map with the territory. But here’s the point:

- Indicators derive their info from “price action”

- Price action can sometimes be just as vague as indicator data

- But price action keeps you attuned to what’s happening “now”

If you can keep your eyes on the road while still paying attention to the broader market context, you might not need a map. After all, that’s what indicators are: dynamic maps of market activity.

Seeing what’s right in front of you…If you trade based solely on the movement of prices, then you’re pretty much taking a Price Action Trading approach.

What is price action trading?

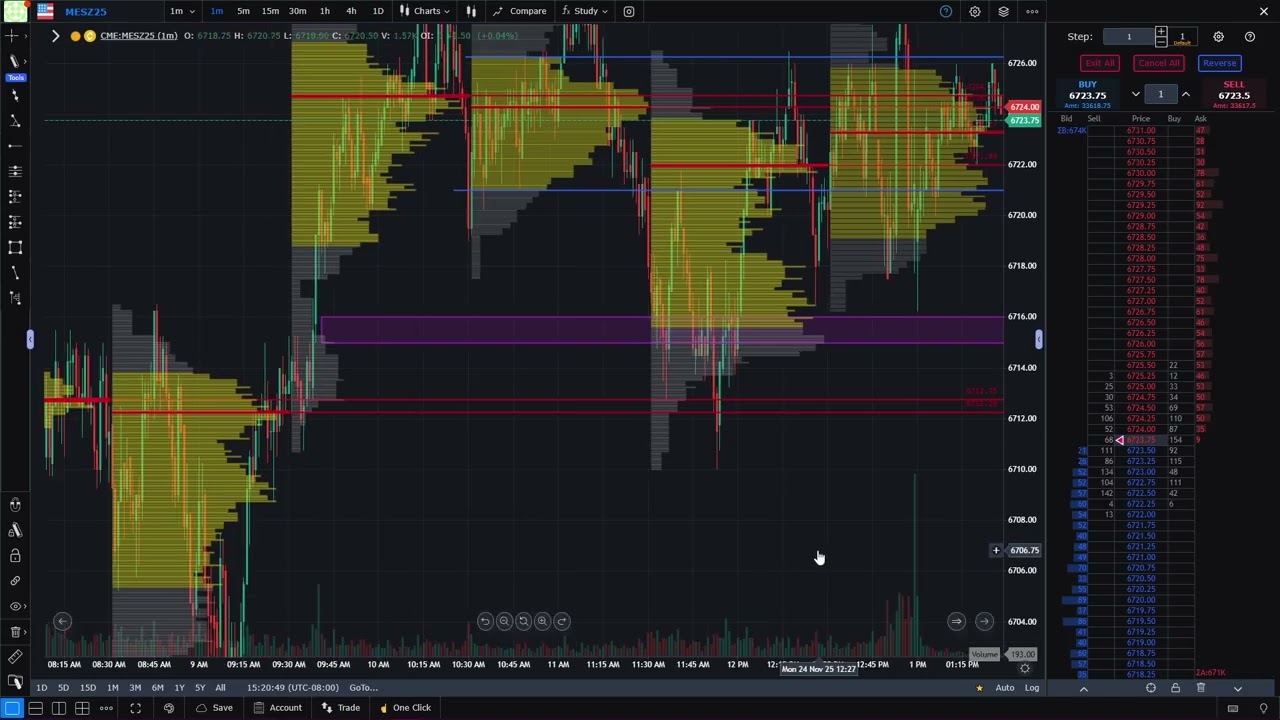

Let’s take a step back. Price action refers to the characteristics of price movements over time. So, price action trading is a method of trading that’s based solely on the movement of prices (meaning, no indicators, though traders might use one or a few, like volume bars).

What’s the value of using only price action?

Clarity and immediacy. When someone gives you a message, it sometimes helps to have another person interpret it (that’s like being an indicator). But then, it’s also like playing the “telephone game,” especially when too many interpreters give their own versions of the message.

As far as immediacy goes, sometimes you want the original message. Also, it helps to get that message now versus later (that’s what lagging indicators based on moving averages do).

What’s the risk of using only price action?

Indicators help you see the broader context. You can easily miss the big picture if you’re too fixated on the price. Plus, interpreting price action can be just as subjective as interpreting and “interpretation” price action via indicators. So, to use price action requires skill. And that takes time to develop.

Are there any price action trading “secrets”?

Yes, but it’s all in a trader’s uniquely developed approach to analyzing and trading price behavior. Here’s a thought experiment that legendary trader Joe Ross often mentioned in his books (paraphrased): Take a look at a naked chart and try to figure out new setups that might have been successful.

This way of thinking about charts may have led him to develop his “Law of Charts” method of trend assessment (one that didn’t rely on indicators). It might also have helped him develop his Ross Hook pattern, another price action technique he developed.

There are plenty more to discover and develop. The main point is that there’s more to a naked chart than meets the eye.

READ ALSO | 10 Price Action Trading Secrets to Level-Up Your Trading Game

How can I begin reading charts in this way?

We’ll present a few strategies in the coming sections/posts. For now, here’s what you need to become familiar with:

- How to identify price trends without indicators

- How to read basic chart patterns

- How to read basic candlestick patterns

- Developing a system of market entries and exits based on the three above

The bottom line

Price action can be an effective overall approach to trading markets using immediate and direct data. By working solely with price, you’re essentially using price as an indicator rather than using indicators to interpret the story that price alone might tell. You’re working directly with the source.

With that said, interpreting prices requires skill, patience, and experience. What you end up seeing is not one potential outcome but several.

Instead of being caged into a particular market bias (which indicators can do), you know plenty of more angles; the risk is that you might see too much.

But with enough practice, you may find an approach that resonates with your own trading style, allowing you to see with greater clarity and efficiency.

Next…There’s a lot of unnecessary confusion and contention between price action and indicator-based approaches.

It doesn’t have to be that way. Let’s look at both and how a trader might benefit from seeing the market both ways before deciding on an approach for a given trade.

Plus, it helps to get a more advanced grasp of candlestick patterns. For instance, here’s one we wrote on the Pin Bar.

Another thing to consider is how price action might change the way you view even the most rudimentary technical analysis principles, such as support and resistance or moving averages (which can work in conjunction with price action if you know how to use it).

For more on How to Analyze Price Action, read our Ultimate Guide to Price Action.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.