A good trading method is much more than a set of entry rules. Whereas most traders would agree to this statement, only very few really internalize the true meaning while always blaming “bad entry signals” for their lack of success. In this article we show you which other aspects of a trading method need to be defined and how the individual components can help your trading become more robust.

What is a good signal?

There are dozens, maybe hundreds, different ways to come up with entry criteria for a trading method. Often, it’s not about whether certain parameters are “better or worse”, but how they are combines and applied to the charts. Here are a few principles that help traders create better trading signals:

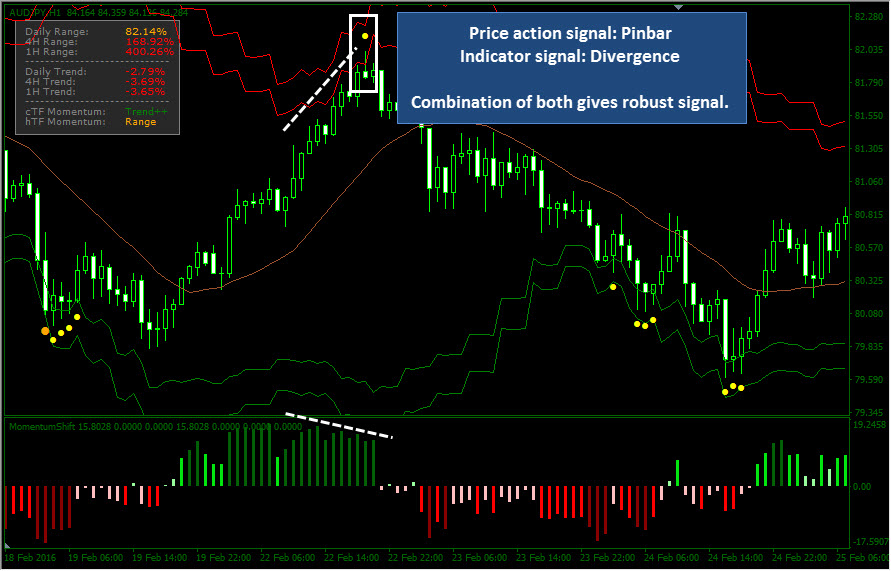

- Price action and indicators

Most traders think that they have to choose between indicators and price action trading. However, the best traders know that they can combine the two and so benefit from the advantages that each approach has to offer. Indicators definitely have their place and together with price action information, the trader can create confluence and build a robust method.

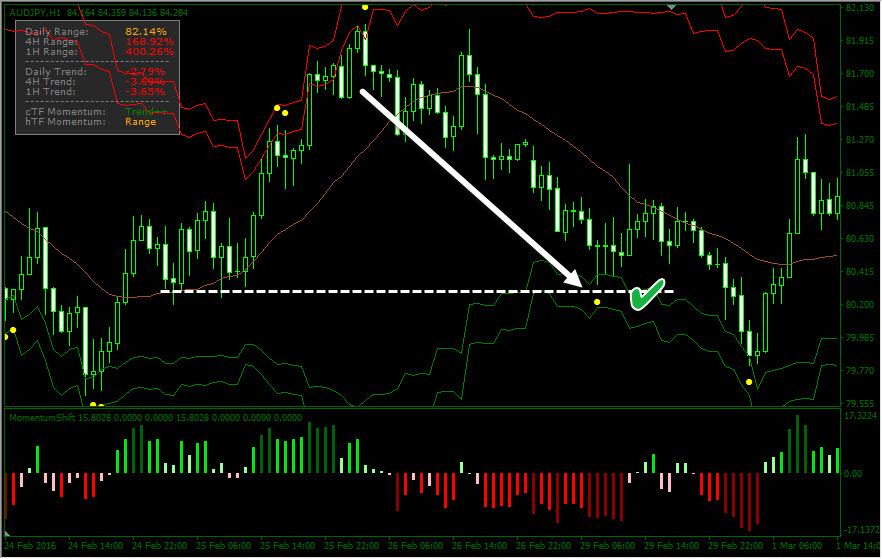

Charts by MT4

Charts by MT4

- Use dynamic indicators instead of static ones

Most indicators are “either-or” indicators which means that they either work in range markets or during trending markets. Market conditions, momentum and volatility are always changing, whereas most indicators are static. We recommend adding one dynamic indicator to your method that adjusts based on price behavior and market conditions.

- Know when to use your tools

Traders who choose the wrong indicators or use their indicators in the wrong context, often experience inconsistent results. It’s important to understand the tools and indicators you are using and in which context to use them. Momentum indicators should only be used during trends and oscillators during ranges.

Targets that are non-subjective and easily identifiable

Ineffective profit taking is often a huge problem because traders don’t maximize their profits and so leave money on the table potentially. At the same time, only very few traders have clear and specific rules for their profit taking. Be sure to know exactly how you define your exits and also what signals a manual exit ahead of your actual target. Such an approach eliminates a lot of guessing and by creating a repeatable approach you can often minimize unnecessary mistakes.

Charts by MT4

Charts by MT4

Stops that are set at reasonable prices

Your stops should always be set at price levels that show that your initial trade idea is no longer valid. Unfortunately, the general approach to stops is very different. Here are two common problems of stop placement and how to change them:

- Don’t choose a stop to achieve a certain reward to risk ratio

- Never use a stop loss method that uses fixed distances

Your stop loss should vary based on the chart context and always take price action into consideration.

Charts by MT4

Charts by MT4

Clear rules for risk management

It’s very common to see traders have a decent trading method at their hands, but they still end up losing money; flawed risk and money management principles can ruin the best trading method.

Your position sizing has to follow rules that make sure that you give equal weight to all your trades. Varying position size creates a lot of account volatility and increases risk. Furthermore, you should know how to deal with winning and losing streaks. Don’t increase your risk during losing streaks to make up for losses faster and don’t get over-confident during winning streaks.

The bigger picture perspective

A problem many traders have is that their view is too narrow. Often, traders don’t even leave their execution time frame and completely forget the higher time frame situation. Trading in the context of you higher time frame is important to eliminate noise and trades that go against the bigger picture.

There are a few tips that can help you with that. First, you start your day with a multi time frame analysis. Second, you use higher time frame indicators on your lower time frames. Finally, you create a method that displays higher time frame information directly on your lower execution time frame.

Conclusion

Creating a more robust trading method is often not that hard and by following the steps and tips in this article you can probably improve the robustness of your trading methodology already. We suggest auditing your method with the points provided in this article and see where your method still has room for improvement.

Futures and Forex trading involve a substantial risk of loss. Past performance is not indicative of future results.

The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders