The Trendspider Review below is the opinion of Optimus Futures, LLC.

As traders, we’re constantly searching for reliable trading software. The top charting platforms not only allow us to perform basic technical analysis, they help us explore financial markets and our trading interests. The tools help us take a trade idea and turn it into a full-fledged trading strategy.

It’s about a great learning tool for new traders that also allows advanced traders to test their trading strategies and professional traders who need reliable analysis software.

Today’s article features TrendSpider, a holistic platform that combines automated analysis tools with basic chart patterns; an ability to view multiple timeframes and analyze them from different angles.

The TrendSpider platform delivers a robust system incorporating automated charting and tools, backtesting, and much more.

This Trendspider review aims to deliver a broad overview of all that Trendspider has to offer from automated alerts to in-depth technical analysis.

Trendspider provides users with an array of tools they won’t find anywhere else, combining a user-friendly interface, automation, and broad market intelligence.

TrendSpider Review Summary

Today’s TrendSpider review includes the following:

- What is TrendSpider

- TrendSpider Review: Key Features

- What Is Automated Charting Software?

- TrendSpider Multi-Time Frame Analysis

- Trendspider Alerts

- TrendSpider Raindrop Charts

- TrendSpider Strategy Tester

- TrendSpider Market Scanner

- Trendspider Pricing

What is TrendSpider

Trendspider is more than just charting software. It’s a platform and network of data and automated tools that caters to everyone from those learning the markets to experienced traders; fundamental researchers to active traders and technical analysts.

The TrendSpider platform includes an intuitive interface with rich features from simple candlestick charts to Trendspider’s proprietary ‘raindrop charts.’ Users gain access to any charting tool they can imagine. Yet, it’s the integration of unique features that sets Trendspider apart from its peers making it one of the top charting platforms on the market.

Additionally, Trendspider’s web-based platform connects with brokers through Signal Stack, allowing traders to take their automated strategies and turn them into live orders.

And for those on the go, TrendSpider offers a mobile app available at the Apple Store or on Google Play.

Who is TrendSpider For?

TrendSpider can work for every trader, from novices to the most experienced among us.

The tools and data sets cover a wide array of markets, from equities to indexes, futures data to cryptocurrencies. TrendSpider has something for everyone.

TrendSpider Review: Key Features

Charting software must be easy to use, intuitive, and have a short learning curve. It’s not just about how many technical indicators you can drop on a chart but how the charting software gives you different viewpoints.

Nearly every one of the TrendSpider alternatives includes multiple ways to view a stock chart, and basic technical indicators.

Trendspider takes this to another level by creating an analysis platform that allows users to take trade ideas from conception to execution.

Like most robust charting platforms, TrendSpider starts off with classic technical analysis tools, from support and resistance lines to multi-timeframe analysis, moving averages to drawing trendlines. Of course, you can choose from a classic candlestick or bar chart based on your preference.

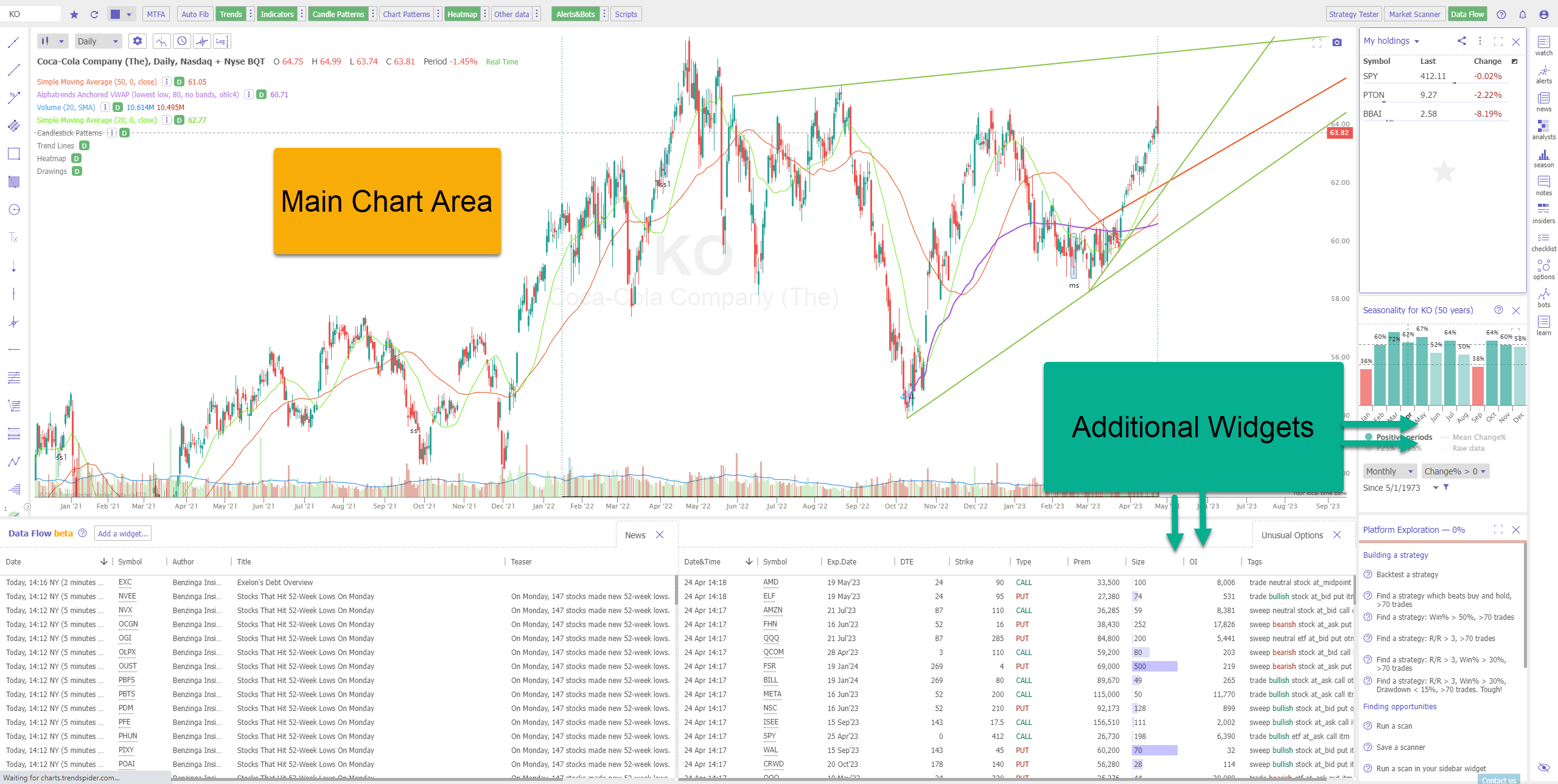

The main charting area offers dynamic views that allow users to conduct multi-timeframe analysis, viewing technical indicators from one timeframe on another.

As an example, the daily chart for Coca-Cola below includes a 20-period simple moving average for the daily timeframe as a solid line, and overlays the weekly as a dashed line.

For those wanting to get off-chart market intelligence, widgets offer a wealth of information from seasonality to fundamental data. Professional traders can view unusual options activity, short volume, and much more.

What Is Automated Charting Software?

What sets TrendSpider apart from others is one word – automation.

Imagine a charting platform that delivers automated trendlines with the click of a button.

TrendSpider delivers a powerful platform with automated charting software that saves traders and delivers more consistent analysis.

Think of it this way. Suppose you’ve built a trading strategy that relies heavily on support and resistance and drawing trendlines. Typically, you look at stocks with larger market caps, such as the components of the S&P 500.

Every week, you pop through the daily timeframe of each stock chart, performing your technical analysis and drawing important price levels.

How long do you think it would take to do this across 20 charts? What about all 500 tickers in the S&P 500? How about across multiple timeframes?

You could spend hours and not make it through a fraction of the possible stock charts…

…or you could let TrendSpider do the heavy lifting with automated trendline detection, part of its automated charting package.

Automated Trendlines

TrendSpider charts automatically perform trendline analysis and draw objects as quickly as you can pull up the chart, allowing users to move through stocks in a fraction of the time.

In the snapshot below, the automated trendline analysis picked up and drew several important trendlines.

Users can adjust the trendlines to draw off the highs and lows or the bodies of the candlesticks, choose between original, standard, and enhanced analysis, determine how many trendlines it should draw, as well as whether to respect or ignore gaps.

Once you’ve chosen the parameters, TrendSpider will automatically redraw trendlines on whichever stock chart or timeframe you choose.

Automated Chart Pattern Recognition

In addition to trendlines, TrendSpider’s platform can automatically recognize chart patterns. This includes popular items such as a rising wedge, ascending triangle, or, as shown below, a double bottom.

Documentation is available for each chart pattern for traders unfamiliar with the concept.

If you don’t find the chart pattern you were looking for, users can request a new feature from the TrendSpider team directly in the platform.

Automated Candlestick Pattern Recognition

Candlestick patterns are another automation feature available in the TrendSpider platform. This can be particularly useful, especially when combined with multi timeframe analysis.

Chart and candlestick patterns go hand in hand, with many traders using candlestick patterns to confirm chart patterns.

As an example, the image below combines the double bottom chart pattern along with a six green candlestick pattern recognition.

This automatic candlestick pattern recognition works on any timeframe and is an excellent automated tool to help traders quickly identify price movements.

Automated Technical Analysis

What’s really impressive are the prepopulated options that make technical analysis easier for traders, such as anchoring VWAP to important highs, lows, or important dates.

Once you’ve got your chart set up the way you want it, those automated trendlines, important technical indicators, and drawings all carry over from symbol to symbol.

This automated charting software not only saves time but creates consistent technical analysis.

It’s also a great way to hone your skills, especially for beginners. Draw your own trendlines and then compare them to the automated trendline detection output and see how close you were.

Automated Fibonacci Retracements

One particularly unique feature of the TrendSpider platform is the one-click Fibonacci retracement calculated.

Let’s take a look at an example using automated Fibonacci retracements.

The chart below shows a 15-minute timeframe for Apple.

With the touch of a button, the charting platform automatically draws support and resistance lines based on Fibonacci mathematics.

Once saved, TrendsSpider carries these automatic Fibonacci retracements from chart to chart, letting you rapidly and consistently perform technical analysis across multiple symbols.

TrendSpider Multi TimeFrame Analysis

Anyone who’s performed technical analysis knows the challenges of managing multiple timeframes.

Think of a person looking at a stock chart trying to measure several moving averages, such as the 200-period moving average.

Typical charts only allow you to see technical indicators on the current timeframe. If you want to see it on a higher or lower timeframe, you either need to add more charts or switch timeframes.

TrendSpider upends the norm by delivering multi timeframe analysis.

Users can take technical analysis from a different time frame and plot on the current chart.

The screenshot below looks at the 200-period simple moving average on the 15-minute chart (solid black) and overlays the same indicator e from the daily chart (dashed line).

If you look closely, you’ll notice two points where the stock’s price aligns with both moving averages creating a support or resistance.

TrendSpider multi timeframe analysis makes Trenspider unique compared to any other analysis platform.

Plus, with multiple chart windows, traders can perform a multi time frame analysis on different tickers at the same time.

For those who like to look at market ETFs for cross signals, this can be an invaluable instrument at their disposal.

TrendSpider Dynamic Price Alerts

Imagine you identify a fabulous swing trading idea. All you need is a price alert to let you know when the setup is ready.

That’s easy enough when you have a specific price. But what about when you have an indicator from your technical analysis as your trigger?

TrendSpider technical analysis software makes this possible with its dynamic price alerts, combining its technical analysis tools with custom signals.

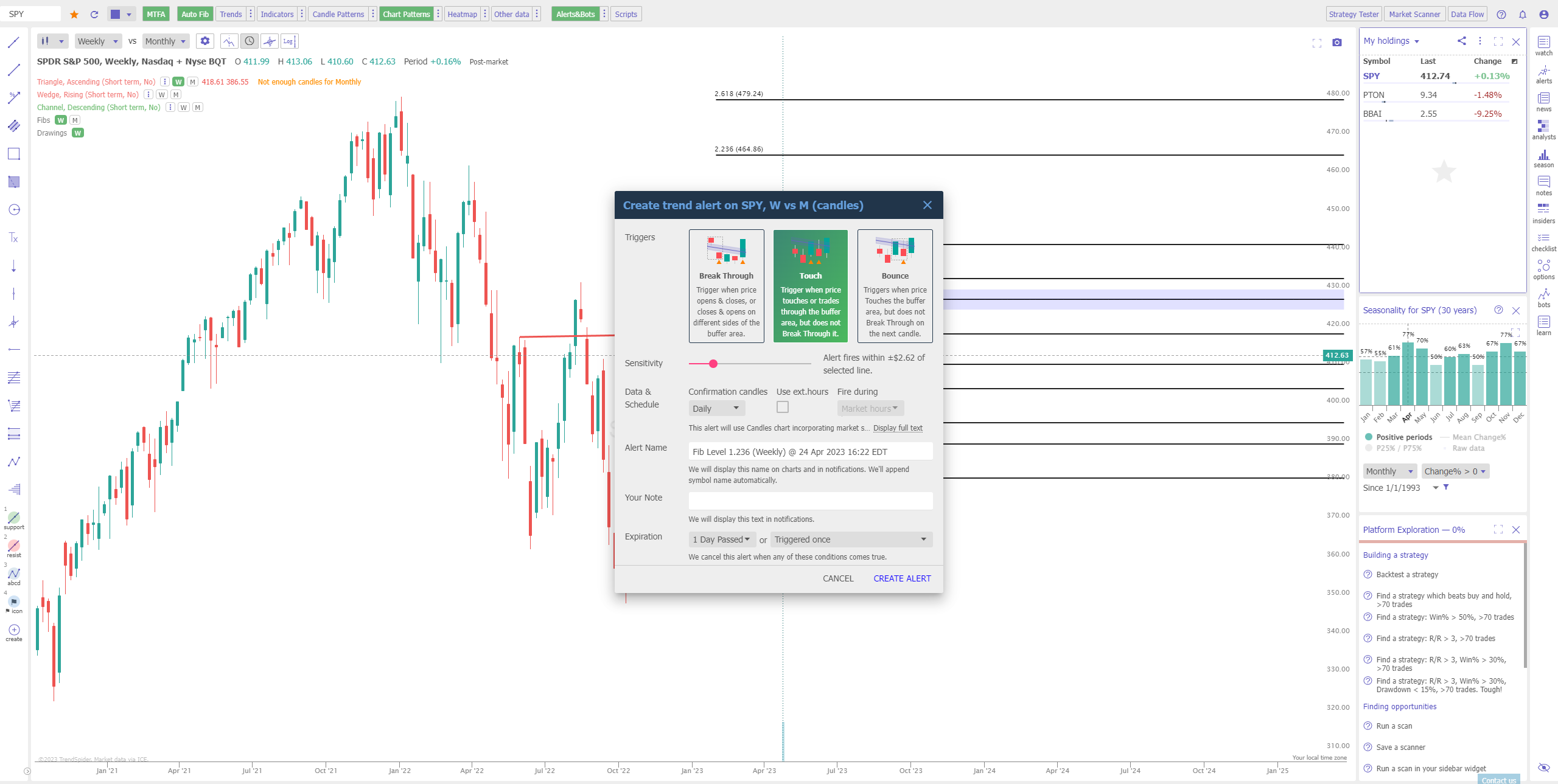

For example. Let’s say you perform an automated technical analysis that creates a Fibonacci retracement. You want the platform to deliver an automated alert you if the stock hits that price movements touch that level.

You could set up automated dynamic price alerts as follows:

This example shows how you can select between a break through, touch, or bounce off one of the price level with adjustments on sensitivity and even conformation candles that even include extended hours selections.

Automatic dynamic price alerts let you mix and match conditions across various chart and candlestick patterns in a simple-to-use format. You can have TrendSpider alert you through email or SMS text, even setting quiet hours when you’re away at a meeting.

TrendSpider Raindrop Charts

Raindrop Charts™ are designed to provide traders with significant price and volume information in a single chart by combining multiple data points (OHLC, Volume) into one integrated visual.

Additionally, Raindrop Charts™ feature an advanced ‘time-release’ mechanism that gives an accurate snapshot of the recent and long-term trends without sacrificing historical context or true granularity.

This blend of features gives traders a unique opportunity to identify key turning points in the market before they occur, giving them an edge over their trading peers. Moreover, Raindrop Charts™ help reduce decision fatigue by simplifying what would otherwise be a complex task of managing multiple indicators.

So, how do these charts work?

Each bar (raindrop) is composed of the following per chosen time interval:

- Body – Represents the Volume by Price for each half of the period, represented as the left and right sides of that period.

- High – High price for the period

- Low – Low price for the period

- Left Mean – Volume-weighted-average-price (VWAP) for the first half of the period

- Right Mean – Volume-weighted-average-price (VWAP) for the second half of the period.

Here is an example using the SMH ETF Daily Chart.

Raindrops are color coded with red when the left mean is greater than the right mean, green when the reverse is true, and blue when they are equal.

You can think of these raindrops as a combination of a typical bar chart and volume profile combined.

TrendSpider Strategy Tester

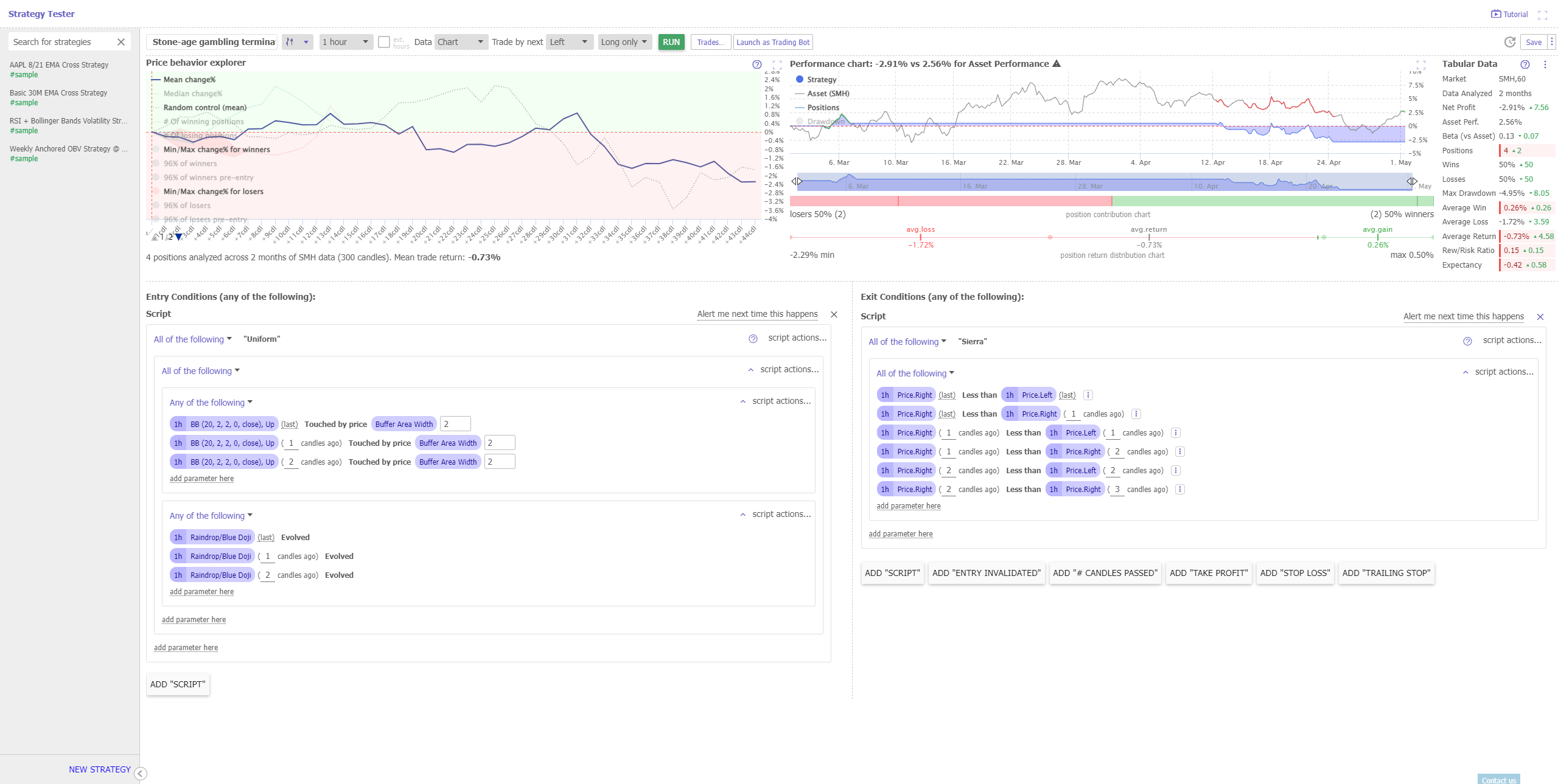

Have you ever had an idea for one or more trading strategies but wanted to vet it before putting it into action?

Backtesting is a powerful tool in a trader’s repertoire, allowing them to explore a possible method without committing capital.

TrendSpider’s strategy tester allows you to create and backtest robust strategies in nearly every way you can imagine.

What separates TrenSpider from other backtesting platforms is the straightforward navigation that cuts the learning curve, allowing those with little trading experience or programming skills to quickly set up and test their ideas.

While it can take some getting used to, TrendSpider provides prepopulated templates that can help you start by using their examples.

Most strategies can be tested in less than a minute once set up.

Each run provides the user with a comprehensive output, allowing them to test trade ideas against multiple symbols from various markets quickly,

TrendSpider Market Scanner

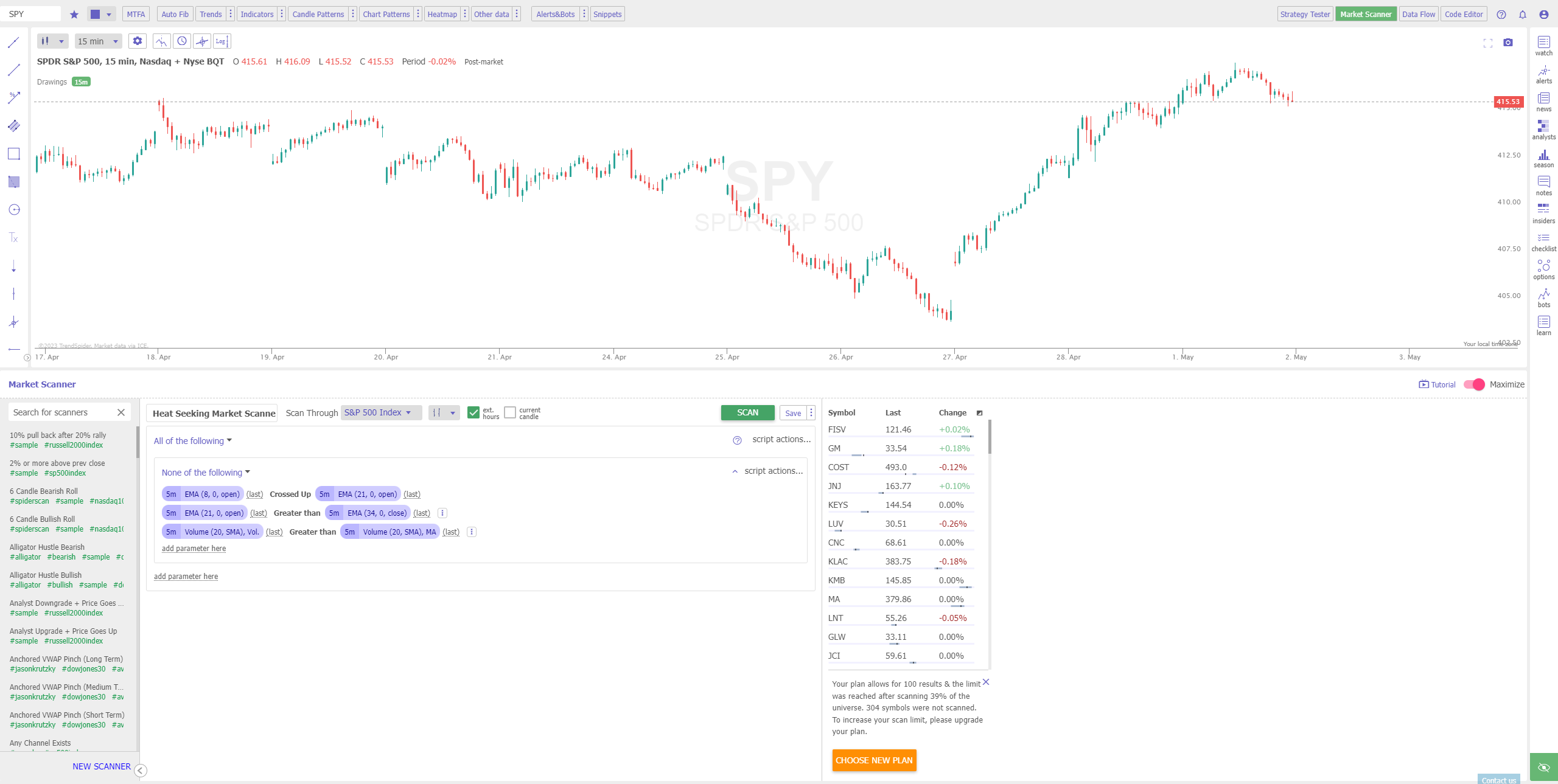

TrendSpider’s scanner is an automated tool that scans the market and identifies potential trading opportunities based on customized technical criteria, specific patterns, and indicators that traders can use to make informed decisions.

The scanner offers numerous benefits, including:

- Saving time and effort: With over 70 automated scans that update in real time, traders can save hours of market research time.

- Identifying opportunities: By customizing technical criteria, traders can create unique and personalized trading strategies that identify potential trading opportunities.

- Informed decisions based on customized technical criteria: Traders are empowered to make informed trading decisions based on personalized technical criteria.

- Can be used for multiple asset classes: The Market Scanner can be used for stocks, cryptocurrencies, and other asset classes, making it a versatile tool for traders.

TrendSpider give traders the option to choose from multiple stock selection lists that include everything from trading halts to the S&P 500.

Advanced Features

While this TrendSpider review covered many of the most common topics and ideas, we wanted to give you a taste of some more dynamic items available.

TrendSpider Widgets

TrendSpider widgets provide traders with additional tools to augment their typical analysis.

For example, traders can include Data Flow, a feature that includes:

- Analyst estimates

- Dividends

- Earnings

- Insider trading

- News

- Splits

- Unusual options

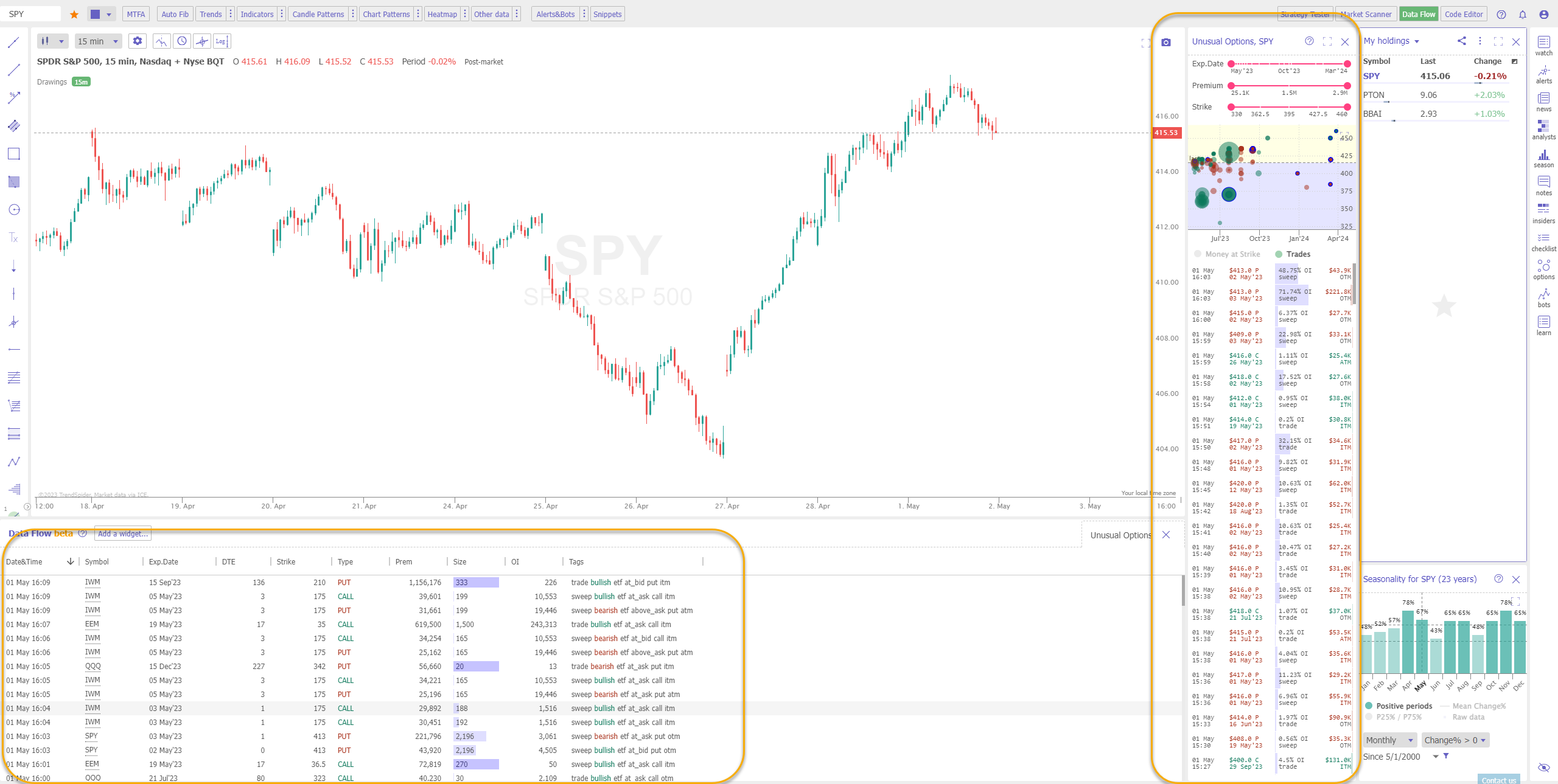

The image below shows gives you a sense of the rich information provided by the ‘Unusual options’ widget:

The bottom widget shows overall unusual options data flow, while the right side widget delivers information tailored to the selected symbol in list and graphic form.

Trading bots

TrendSpider allows traders to take their automated strategies and turn them into live trades with trading bots without any coding required.

Once a trader has developed and tested a strategy, trading bots automate trade executions to a user’s broker or via webhooks.

Bots come with notifications via SMS, email, and webhook. Traders can choose from different behavior settings, telling it what to do when it misses a check or what to do when it starts a new position.

TrendSpider designed its bots to be both position-aware and fault tolerant. That means the system will automatically check for bot integrity before triggering any signals, avoiding any conflicting triggers.

While trading automation can be a great way to free up time and create more consistency, it requires more initial involvement and training. That’s why TrendSpider recommends anyone interested in creating a bot review all relevant material and thoroughly test your bot before going live.

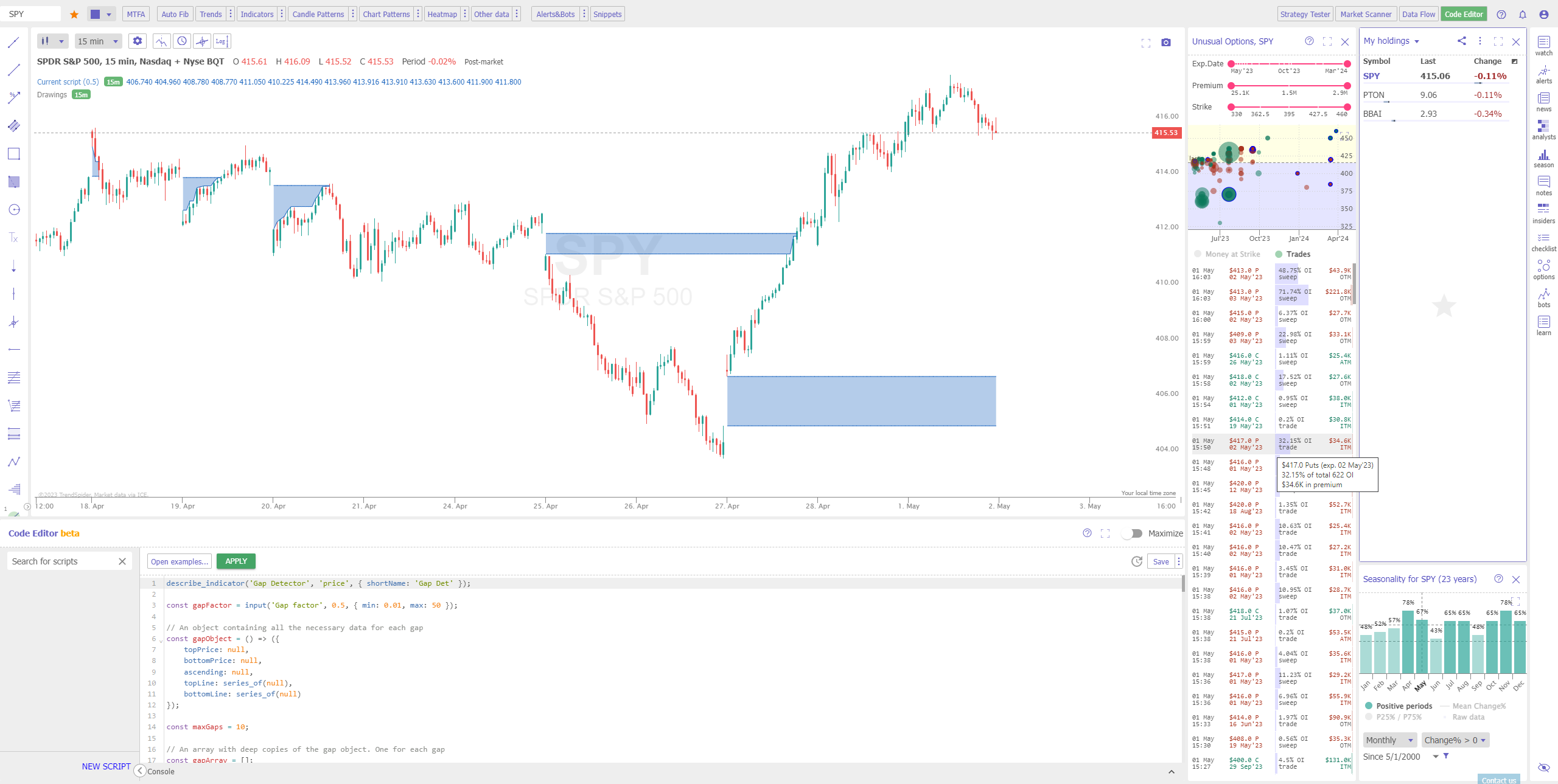

Scripts and Codes

TrendSpider lets users create, write, edit, save, and share their own code.

With a straightforward programming language, advanced users can adjust or create technical indicators or complex calculations on the fly.

TrendSpider’s code editor comes with examples that give programmers a foundation to build their own scripts and ideas.

The image below shows an example of an ‘open gap’ detection script:

As you’ll learn below, TrendSpider’s customer service includes an option for 1 on 1 sessions that can include discussions and help with scripts and codes.

TrendSpider Education & Resources

Yes, TrendSpider has an extensive library of articles and information to help users navigate the platform.

However, they take it a step further with YouTube content, TrendSpider TV, a TrendSpider blog, a market data library, and so much more.

Plus, as well as joining their Discord channel. Here, users can discuss strategies, trade ideas, tips, technical analysis, financial analysis, and more. TrendSpider doesn’t just provide support, it creates a community for folks to grow and learn.

Trendspider Pricing

To keep things simple, TrendSpider offers three different pricing packages: Essential, Elite, and Elite Plus.

Please note: TrendSpider is a third-party platform, and Optimus Futures does not cover the cost of its license. Customers must purchase a license directly from TrendSpider to use the platform.

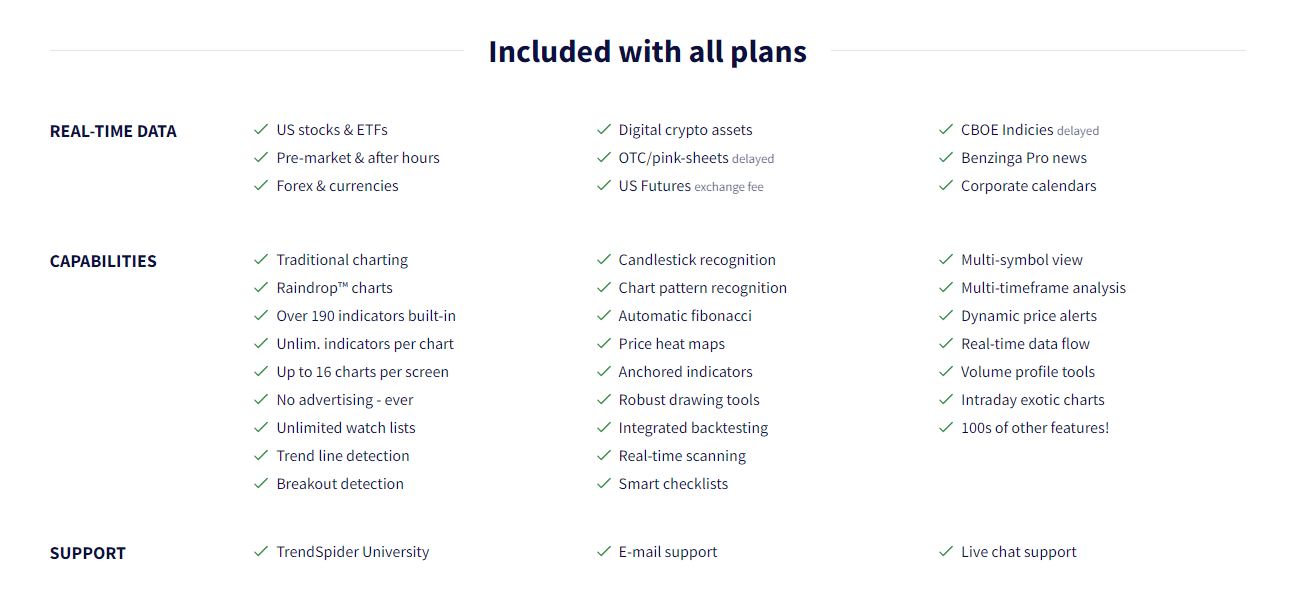

Every TrendSpider pricing plan includes all of the following:

Essential Package

The Essential package runs $39.00 per month or $384 if you pay for the full year in advance. This option includes basic access to most data, tools, and capabilities. Beginners and those exploring the platform will get plenty of use from the Essential package, including backtesting, advanced charting software, and real-time data alerts. Traders can scan through daily timeframes with up to 25 results per scan. When help is needed, subscribers can access chat and email support. 1-on-1 training sessions are available for $49 per session.

Elite Package

Next is the Elite package, which starts at $79.00 per month or $780 for an entire year. This package, geared towards more experienced stock traders, expands on real-time data to include dark pools, retail trading analytics, insider trading, analyst ratings, market seasonality, and much more. Plus, the number of available alerts are expanded and now includes multi-factor alerts. Additionally, traders can introduce up to six trading bots. Scanner use is expanded to allow for 1-minute backtesting and up to 100 results. Elite members can access support through phone and receive priority.

Elite Plus Package

The flagship Elite Plus package is geared towards advanced traders runs $179.00 per month or $1,620 for a full year. This enhanced package allows up to eight workspaces, 300 active alerts, 50 trading bots, unlimited market scanner results, 7,000 candle backtest depth, and more. All 1-on-1 sessions are now free.

TrendSpider Support and Service

Like most traditional services, TrendSpider provides traders with typical phone and email support.

However, TrendSpider prides itself on taking good customer support and making it excellent with the addition of two unique features you won’t find in most other places.

First, as noted in the pricing section, TrendSpider offers 1 on 1 training that’s either free or fee based depending on your plan. Each session lasts for 60 minutes and can be broken up into two 30-minute sessions.

This unique white glove service is both interactive and curated to the individual trader. It’s a great option for anyone looking for a guided tour or interested in exploring advanced features in more detail.

Additionally, users also have the option of following the company on social media and asking questions in the Discord channel.

Ready to Open Your Trendspider Account?

This TrendSpider review covers only a fraction of what’s available on the TrendSpider platform.

You can find a wealth of information about the platform, including additional tutorials and ideas on the YouTube channel.

Sign up today to get started with TrendSpider.

Please note: TrendSpider is a third-party platform, and Optimus Futures does not cover the cost of its license. Customers must purchase a license directly from TrendSpider to use the platform.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.