This article on trading success is the opinion of Optimus Futures.

Some people believe that you need to study finance or have a lot of money to find trading success.

The truth is, education doesn’t play as big a role as you’d think. Neither does how much money you start off with.

There are plenty of incredible traders who lack any type of formal education.

Some of the most intelligent people make for bad traders.

So, why is it that intelligence doesn’t equate to trading success?

As you’ll soon find out, it’s far less about intelligence than you might think.

When Genius Fails

The main reason why many smart people don’t succeed in trading is simple.

Markets are irrational at times.

An intelligent person often looks for answers to why certain things happen, but the futures market is often driven by emotions like fear and greed.

Try putting a math genius into a behavioral field like psychology, and you’ll see what this in action.

It’s not like school, where you can study hard and know you’ll do well on the test.

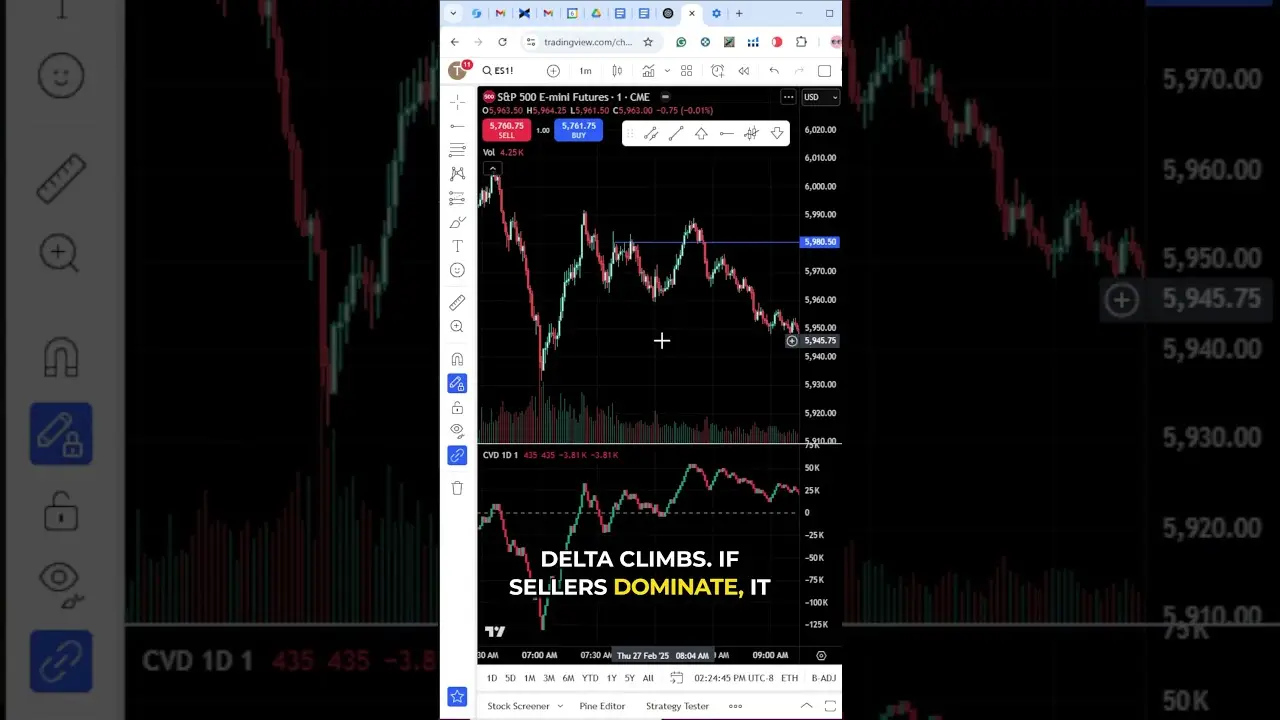

Volatility in the futures market is often driven by catalysts.

When news catalysts hit the wire, there’s something called “price discovery.” That’s when traders, in real-time, are trying to decipher the impact of the news and how it will affect the price of the futures contract.

You can’t know the outcome of the events before they happen. Only the probabilities. And even then, much of the skill lies in reacting, not anticipating.

For example, if OPEC+ has a meeting where they announce they’ll be cutting oil supply, we can assume that the news is bullish for crude oil prices. After all, a lower supply should drive prices up.

However, how bullish is it for the price of oil? That’s where “price discovery” takes place.

On the other hand, what if traders were expecting OPEC+ to cut oil supply ahead of the announcement?

In this case, the price of crude oil futures may have already risen well ahead of the announcement. When the announcement is made official, it does little to the price of crude oil.

When an event is priced in, traders often say, it’s “baked in” already.

Extending the oil example, if traders expected OPEC+ to cut oil by 400,000 a day and OPEC+ decides to go with 200,000, oil prices might plummet even though supply is being removed.

Being too logical in an irrational market can be a detriment in trading.

Another issue intelligent people have is that they’re used to being right. Some strategies in trading can be profitable, even if the win rate is 40%.

How?

If those 40% winning trades post larger profits than the 60% losers, that’s how.

You have to be able to accept that you’ll be wrong in futures trading. And that’s a hard pill to swallow for some folks who are used to always being right.

Lastly, patterns can take time to develop and aren’t always present in every market.

Imagine if you started trading in 2008 and learned how to become successful based entirely on your tenure in a bear market. How well would that serve you in the following decade?

Risk Tolerance

If you want to succeed at trading futures, you must have a high tolerance for risk. Some successful people just don’t have it. The idea of losing money just doesn’t sit well with them.

This is common with highly skilled professionals where there is little margin for error.

The idea of risking $1 to make $3 might not appeal to you when you can just work and make a steady income.

And as mentioned earlier, it can be a real bruise to the ego if you’re used to being right in your other profession.

The most successful traders are humble and understand that drawdowns are part of the game.

Personality

A poker player is likely to make a better trader than someone who is a doctor.

A business owner is likely to make a better trader than a lawyer.

Why?

Because they understand the concept of risk vs. reward.

There are no guarantees in the business world, the same is true in trading.

Hard work alone is not enough. You can work hard, but if you are trading the wrong strategies, and don’t have a trading plan, then you’re likely not going to find trading success.

The highly skilled professional is used to getting results from hard work alone.

Unfortunately, in trading, you’ll need more than just hard work. That’s why it generally makes sense to work with an experienced professional who can guide you along the journey.

Be Like Water

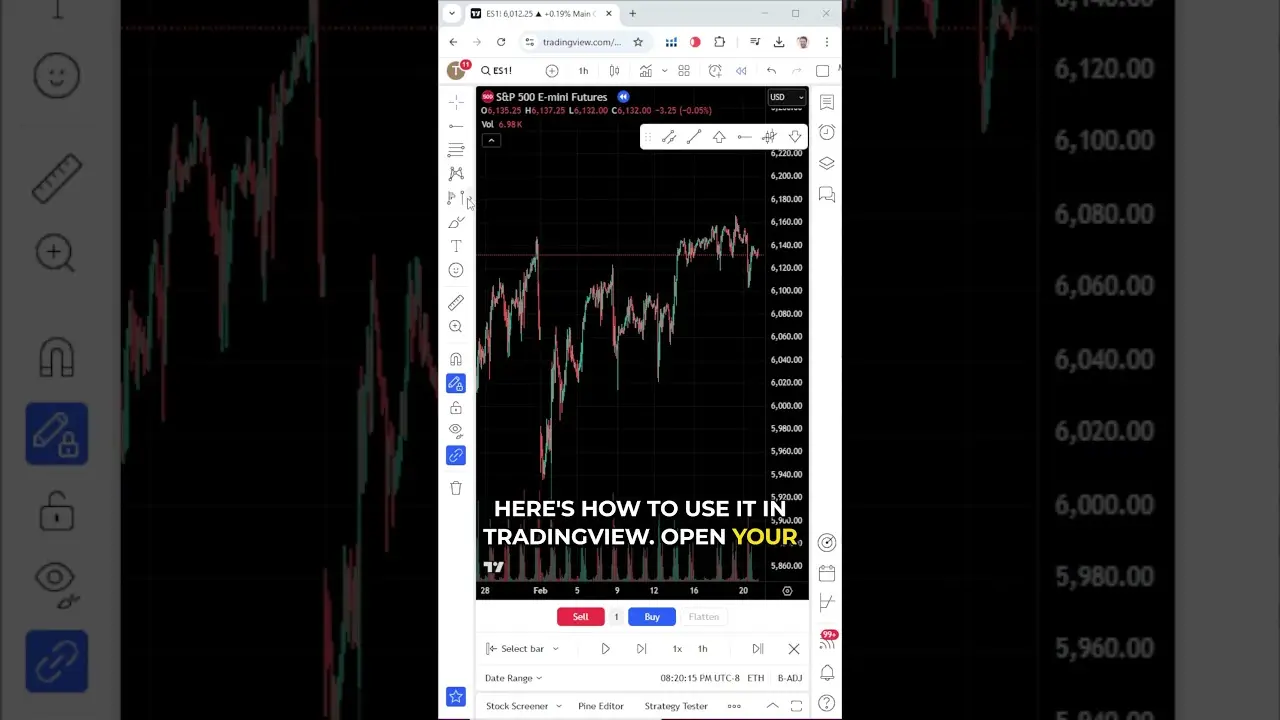

Successful futures traders are flexible. They pick up on trends and take advantage of them. However, they know that the trend can change, and adjustments will need to happen.

Some people love math because, typically, there is just one right answer. The answer in trading always changes.

Short-term trading is often driven by emotions, more so than fundamentals.

So many times, people want a formula…If I do X, can I expect Y result?

But the futures market is too dynamic for that.

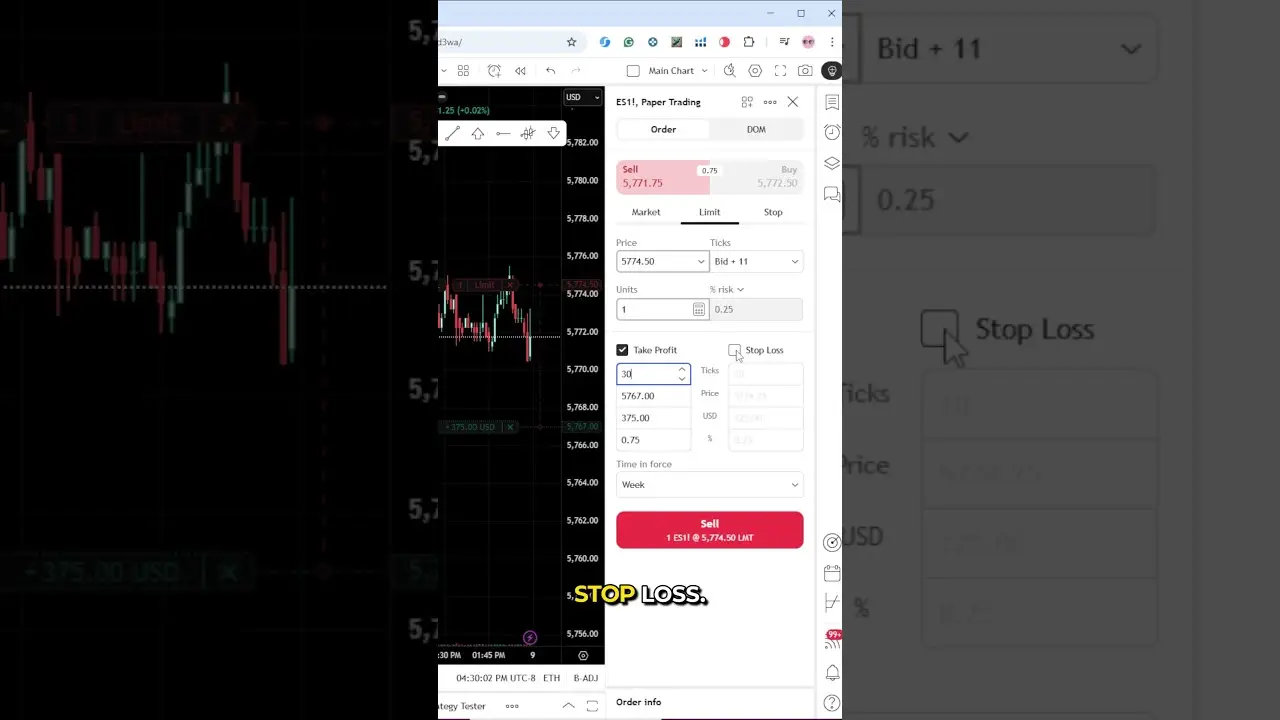

And here’s the thing. You can have a great idea in trading, but if you fumble your execution, you can end up losing money.

Or you can have the right idea, but you decide to trade something that isn’t liquid, which ends up robbing you of your gains.

The key is to be flexible and open-minded.

What It Takes To Succeed

We’ve spent a great deal of time discussing why being intelligent doesn’t always mean you’ll succeed at trading.

The point isn’t to knock smart people or say you have to be of average intelligence to succeed. It’s that intelligence doesn’t play as big a role as some might think.

So what does matter?

- Having no ego. You need the ability to understand that you’ll be wrong often as a trader, and be willing to accept it.

- Being flexible. There is no magic formula for success. Trading is dynamic. Successful traders can pick up on trends and patterns but are also aware that they can change.

- Have risk tolerance. If you are not willing to lose money, then futures trading isn’t for you.

Final Thoughts

If there is one phrase to remember, it’s this – KISS – Keep it simple stupid.

Intelligent traders love to overanalyze and overcomplicate things.

Start with something simple and slowly add from there.

That might sound easy enough, but people can get overwhelmed by the number of choices out there.

Click here to open a live trading account.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.