This article on Trading Screen Setup is the opinion of Optimus Futures.

An efficient trading screen (aka workspace) with the least visual noise is integral to developing any successful trading approach. Each individual/trading style will have a unique workspace depending on their goals and preferences.

Check out our ideas for different trading styles below to give you a head start on customizing your own workspace. All the work-spaces you see here are available on Optimus Flow as customizable templates.

To access the pre-built screen setups below, Download Optimus Flow, navigate to the Workspace Manager > Create New > Template > And select your preferred trading style’s workspace from the available list of templates.

If you need help navigating your trading screen on Optimus Flow, click here.

What is an efficient trading screen setup?

An efficient trading screen setup provides traders with quick access to market data, trading tools and trade references, allowing for faster trade execution tailored to their own style.

Why it matters

- An efficient workspace reduces distractability, allowing traders to focus only on the information that is pertinent.

- Reduces unwanted or conflicting information so as to reduce decision fatigue

- Creating a workspace that is visually appealing can increase feelings of ease in an already high-stress environment.

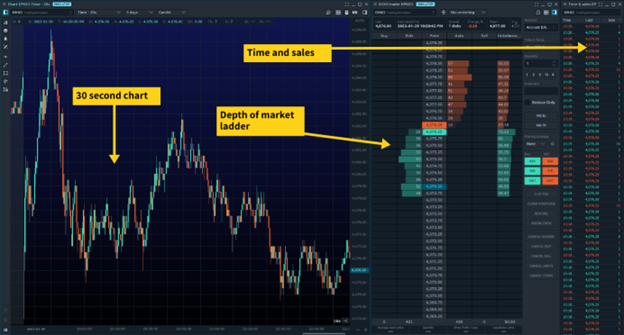

Trading Screen Setup for Scalping

Scalping is a high-frequency trading strategy that typically involves making numerous trades in a short period, often in an attempt to try and make a small profit from each trade.

Scalpers aim to take advantage of small price movements in the market and typically hold positions for just a few seconds or minutes.

- 30 second chart offers quick price action information

- The depth of the market (DOM) can give entry signals and a place for execution

- Time and sales show the velocity of orders

Trading Screen Setup for Swing Trading

Swing trading is a strategy that involves holding positions for a few days to a few weeks to try and profit from market price swings.

Unlike scalping, swing traders aim to capture larger price movements and are willing to hold positions for a longer period of time in order to achieve their goals.

- 30 minute chart offers trend confirmation and order entry

- The daily chart shows a higher time frame bias

- Market heat-map keeps an eye on other key market performance

- The positions window shows active positions/exposure

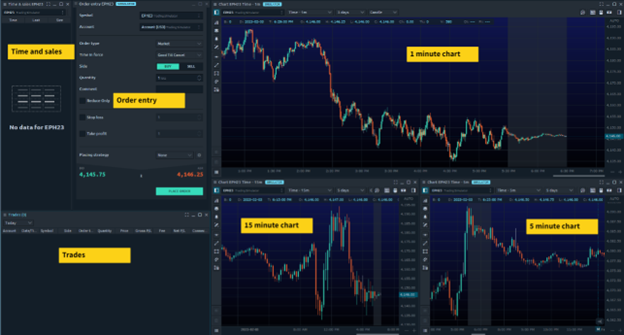

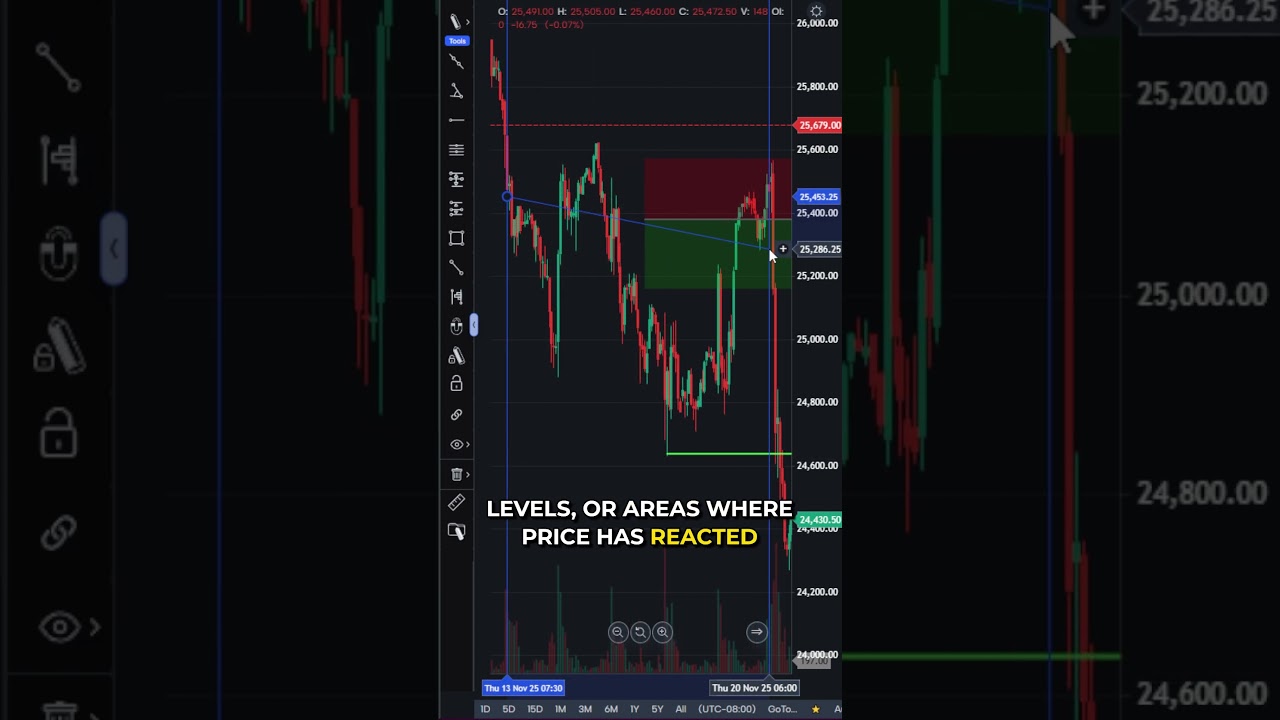

Trading Screen Setup for Price Action

Price action is a type of technical analysis that involves examining price movements in the market in order to make trading decisions.

Price action traders look for patterns in the market that can indicate future price movements, such as trends, support and resistance levels, and chart patterns.

- 1, 5, and 15-minute charts to expose candle/price action patterns

- Time and sales show the speed of tape/velocity of orders

- Order entry window to switch between order types quickly

- Trades window to show a live profit, loss, and other outstanding orders

Trading Screen Setup Order Flow Trading

Order flow trading is a type of trading that involves using information about market orders and liquidity to make trading decisions.

Order flow traders pay attention to the flow of orders in the market, including the types of orders (e.g., market orders, limit orders), and the volume of orders, in order to make predictions about future price movements.

- TPO/Volume profile charts illustrate larger time frame bias

- Cluster/Footprint chart shows “historical tape” where buys and sells have taken place at specific price levels

- Depth of market is used for order entry and reading liquidity

- Time and sales show speed of tape/velocity of orders

- Trades window to show active profit, loss, and open orders

The Bottom Line

Having a well thought out trading workspace can improve a day trader’s efficiency, accuracy, and may even improve overall trade strategy approach and outcomes.

Whether you’re setting up your own workspace from scratch or using one of our templates on Optimus Flow, remember to use it as a way to reduce distractions/impulsivity and increase emotional/psychological discipline.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.