The post below on Micro Bitcoin Futures is the opinion of Optimus Futures. Please note that price movements on Micro Bitcoins are driven primarily by the news and prevailing sentiment of retail speculators. These sometimes dramatic shifts can lead to massive intraday price swings, making Bitcoin Futures a product for aggressive and experienced day traders. The price we have used below may change due to the volatility of the underlying contract.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

How to Trade Micro Bitcoin Futures

Under the CME, Bitcoin Futures is categorized under the Equities Group and falls into the CME’s Base Guaranty Fund for futures and options on futures, similar to any newly listed futures. This does not guarantee your profits or losses but ensures that the exchange guarantees against counter-party risk.

Bitcoins: Trading vs Investing

The first thing you need to decide is whether you are interested in holding Bitcoins as a long-term investment or do you want to intraday trade Bitcoins and take advantage of its daily price fluctuations? In our opinion, the idea of Micro Bitcoin Futures is a neat proposition because it allows traders to take advantage of small or large fluctuations on both the upside and the downside by utilizing the leverage of a futures contract. If you believe that Bitcoin has reached a temporary peak, or is in the early stages of a downtrend, you can short it. Or go long when you think it is resuming its uptrend. Again, you can simply take advantage of the daily price swings and close your positions at the end of the day. Your account is affected by the commissions and the gains and losses that occur as a result of your trading activity.

Bitcoin Futures Contracts allow traders to go long or short without actually holding the Cryptocurrency. This means traders can get exposure to the price of Bitcoins without worrying about the security risks associated with storing them. This is similar to trading Energy Futures such as oil where you speculate on its price rather than physically owing oil. Trading in Micro Bitcoin Futures does not require you to own any Bitcoins.

Advantages of trading Micro Bitcoin Futures on the CME

The CME is the largest and one of the most liquid futures exchanges in the world and operates the Standard & Poor’s 500 (S&P 500) Index and the Dow Jones Industrial Average (DJIA), the two most widely known stock indexes.

The exchange is regulated by the CFTC to avoid price manipulation, fair dealing, and price transparency. It oversees some of the most sophisticated risk management practices in the financial world and provides services that substantially mitigate the risk of clearing member failure.

As the world of cryptocurrency gained popularity, many institutions have been formed to trade and invest in the digital currency space. As such, many of these institutions labeled themselves as an exchange. It is not our job to decide what constitutes a “proper exchange”. However, very few, if any, of the new players in the markets, have the safeguards that long-standing exchanges such as the CME have established in place in order to ensure fair price dealing. When you trade on the CME exchange your funds are not being held by the exchange, high supervision of spoofing to create fake volumes, and do they take opposing positions in the marketplace. The gains and losses of your account do not affect the P&L of the exchange.

Your funds will be held by the clearing firm (FCM) you choose. The FCM’s are regulated by the CFTC and the NFA to ensure that your funds are fully separated from their operating expenses, ensuring proper segregation of client money. We highly recommend staying away from corporations that may be adding liquidity by spoofing, markets where players take the other side of the trade, or are regulated in countries that have proven to have a very loose grip on unethical players.

We truly believe that the introduction of Bitcoin Futures by the CME will not only attract professional traders to reallocate their funds from those so-called exchanges but also open the asset to institutional investors.

Micro Bitcoin Futures Contract Specifications

| CONTRACT SIZE | 0.10 bitcoin |

| TRADING HOURS | CME Globex: Sunday – Friday 6:00 p.m. – 5:00 p.m. ET (5:00 p.m. – 4:00 p.m. CT) with a 60-minute break each day beginning at 5:00 p.m. ET (4:00 p.m. CT)

CME ClearPort: 6:00 p.m. Sunday to 6:45 p.m. Friday ET (5:00 p.m. – 5:45 p.m. CT) with a 15-minute maintenance window between 6:45 p.m. – 7:00 p.m. ET (5:45 p.m. – 6:00 p.m. CT) Monday – Thursday. |

| MINIMUM PRICE FLUCTUATION | Outrights: $5 per bitcoin = $0.50 per contract

Spreads: $1 per bitcoin = $0.10 per contract |

| PRODUCT CODE | MBT |

| LISTING CYCLE | Six consecutive monthly contracts inclusive of the nearest two December contracts. |

How are Bitcoin Futures Contracts Priced?

CME Bitcoin Futures Prices

The CME will use a daily price from the CME CF Bitcoin Reference Rate, which is also supported by digital exchanges Bitstamp, GDAX, itBit, and Kraken. The CME CF Bitcoin Reference Rate (“BRR”) is a daily reference rate of the U.S. Dollar price of one bitcoin as of 4:00 p.m. London time. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. It assures that the pricing of the Futures market is accurate and fluctuations in price reflect the reality of the Bitcoin fundamentals. In laymen’s terms, the CME is using what is considered a credible source of information so you can just focus on trading futures. We believe that as the Micro Bitcoin Futures on the CME exchange gains popularity and liquidity amongst traders, it will also be a major force in determining the price of Bitcoin. CLICK HERE to learn more about the methodology.

What is the Total Cost of Trading Micro Bitcoin Futures?

In order to participate in any futures market, traders have to pay for several transaction costs that make up your total commissions. There are four basic types of fees incurred every time you trade a single bitcoin futures contract, assessed on a per-contract basis. For every contract traded, the following fees are passed on to the trader.

1: CME Exchange/Clearing Fees (FCM + Exchange)

2: National Futures Association (NFA) Regulatory Fees

3: Execution Fees (Technology / Order Routing)

4: Brokerage Commissions

5: Market Data: $10 from the CME

You pay on a per-contract basis versus a percentage of your investment as in OTC exchanges. With Optimus Futures, you pay as little as $0.50 / side in commissions no matter how much you trade. Clients who meet our daily trading volume thresholds qualify for even more savings with deeply discounted commissions as low as $0.10 / Side on Bitcoin Futures. Aggressive Intraday lower exchange margins or overnight exposure could be substantially higher depending on your choice of FCM. Please discuss with us prior to trading Micro Bitcoin Futures.

Since Optimus Futures has clearing relationships with multiple Futures Commission Merchants (FCM’s), Data Vendors and Trading Platforms, we have a lot of flexibility to find you the right combination of order routing, execution, and clearing costs to trade Bitcoin Futures based on your level of funding, margin, and platform requirements.

Will there be any Price Limits on Bitcoin?

Price Limits for the CME Bitcoin Futures:

From the CME: Yes, Micro Bitcoin futures are subject to price limits on a dynamic basis. At the commencement of each trading day, Micro Bitcoin futures are assigned a price limit variant which equals a percentage of the prior day’s Exchange determined settlement price, or a price deemed appropriate by CME Group. During the trading day, the dynamic variant is applied in rolling 60-minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:

• The dynamic variant is subtracted from the highest trade and/or bid price during a look-back period to establish the lower price fluctuation limit

• The dynamic variant is added to the lowest trade and/or offer price during a look-back period to establish the upper price fluctuation limit

What are the Margins on Bitcoin Futures?

Day Trading Margin Requirements for the Bitcoin Futures Contract

Day trading margins are determined by our clearing firms and are typically provided as a percentage of the initial margin or a dollar amount. CLICK HERE to view the day trading margin requirements futures contract available from each of our clearing firms. This is the amount of money you need to daytrade the Bitcoin contract i.e. getting in and out of the market before the trading session ends. Day Trading Margins are based on many factors, including market volatility, open interest, customer credit profile, and the level of funding in the specific customer’s account.

Update 9/6/2021: Due to the changing nature of the market as it concerns Crypto and the Micro Bitcoin Futures, not all the current FCMs allow Micro Bitcoin Futures. Please contact us for more details to find the appropriate clearing arrangement for you.

Cryptocurrency technology is new technology and it is evolving rapidly with new and influential players entering the space every day. As such, rumors, whether substantiated or not, can affect the pricing in very extreme ways. Unlike other asset classes (FX, Equities, Commodities, etc.), the Bitcoin market is dominated by retail speculators. As such, we believe that you should not extend your trading beyond day trading and NOT leave positions overnight or on the weekend. Our main concern is the price gaps that can occur and affect your account adversely.

We do not encourage anyone to trade with a higher number of contracts due to a higher level of risk-reward. However, qualified clients are eligible to receive reduced Day Trading Margins on Bitcoin Futures. Please call us today at (800) 771-6748 / Local (561) 367-8686 or send an email to general@optimusfutures.com to discuss further. (Put bitcoin futures on the subject).

Micro Bitcoin Futures are Cash-Settled

There is no delivery when trading Bitcoin Futures. A settlement will be determined at the end of the trading month’s trading period and your positions will just expire. The expiration price will determine your P&L (profit and loss). We suggest that you always trade in the liquid month. This means that once the liquidity of the Futures contract has started going down, you should trade the next month. Again, as we mentioned above, the advantage of trading with Bitcoin Futures is that you can benefit from speculating in them without actually owning them.

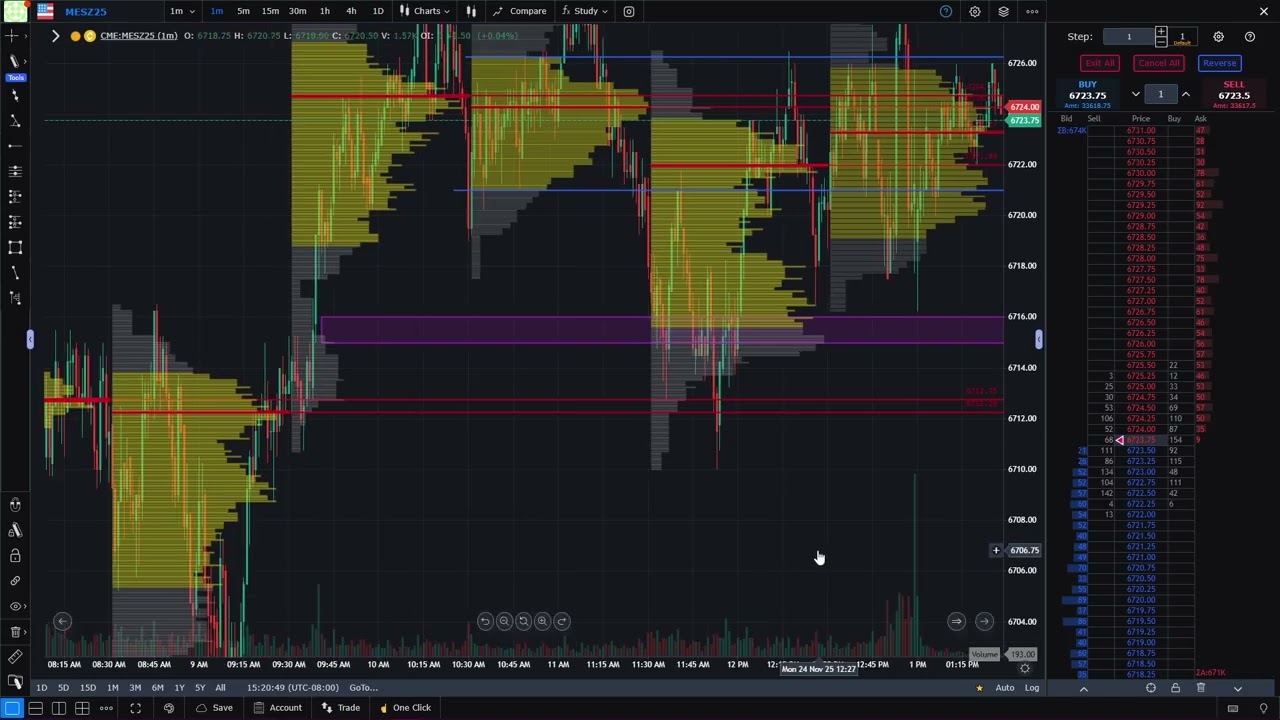

Micro Bitcoin Futures Trading Platform

With the introduction of Bitcoin Futures, you can now take advantage of the massive selection of futures trading platforms that connects to the CME, opening the technology that was previously only available to Commodity Futures traders. Experience fast order routing through industry-leading trading platforms powered by multiple data feeds from some of the biggest names in the trading technology field. See your orders working on the CME exchange in real-time and execute your trades on the charts, DOM, or an easy order entry module. You can use limit orders, stop orders to minimize risk, and trailing stops as the market goes in your favor. Set up strategy orders that allow taking advantage of volatility whether it is on the downside or upside.

Trade on desktop, mobile, or web. The futures industry is a mature industry and as such has evolved to execute and create strategies for very sophisticated traders. Whether you need trailing stops, get out at different levels while reducing your positions, and/or create time-based orders, you will find that the Futures trading platforms are very adaptable to it. Disclaimer: The placement of contingent orders by you such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

Stop-loss Disclaimer: The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

Trading IRA Funds with Bitcoin Futures

An IRA (Individual Retirement Account) is a trust or custodial account set up in the United States for the exclusive benefit of you or your beneficiaries. All IRAs are held for investors by custodians or trustees. We work with a number of IRA custodians that work directly with the Futures industry. Once you select a custodian, simply Open an Account with us with the clearing firm of your choice and we will work with the custodian to complete all the necessary paperwork to establish your new IRA. If you need help determining the right custodian and clearing firm, please contact us and one of our licensed brokers will help you choose the combination best suited to your goals. Offering multiple FCM’s and custodians gives us a lot of flexibility to match you with your trading needs. However, since these are IRA funds, you MUST exercise caution in the allocation of such funds. Speculation in Futures carries high risk.

Trade Micro Bitcoin Futures with Optimus Futures

- Go long or short on Bitcoin with a single click and get lightning-fast order execution.

- No need for a Cryptocurrency wallet, just log in or open a live or demo account in minutes.

- All our clients’ funds are kept in segregated trust accounts

- Fully Regulated – Optimus Futures is licensed and regulated by the NFA. Please read NFA and CFTC disclaimer below how virtual currency could affect your Futures trading holding and trading. The NFA does not endorse trading in any financial instrument including Bitcoin Futures.

Simply Open an Account to start trading Bitcoin Futures today!

Disclaimer: Virtual currencies including Bitcoin experienced significant price volatility, and fluctuations in the underlying virtual currency’s value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Be very cautious and monitor any investment that you make. There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

Please be aware, however, that just because futures on virtual currencies, including Bitcoin, must be traded on regulated futures exchanges does not mean that the underlying virtual currency markets are regulated in any manner and what occurs in a virtual currency’s underlying market will impact the price of a virtual currency’s futures contract.

OPTIMUS FUTURES LLC IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

See the link below from the National Futures Association for more information.

https://www.nfa.futures.org/investors/investor-advisory.html

Additionally, the Commodity Futures Trading Commission (“CFTC”) has made available a Virtual Currency Resource Web Page designed to educate and inform the public about this topic and its risks. See the link below for further information from the CFTC.

http://www.cftc.gov/bitcoin/index.htm

CME Micro contracts generally have a value and margin requirement that is one-tenth (10%) of the corresponding regular contract. The cost of trading Micro contracts is higher than regular contracts when measured as a percentage. Commission rates are not always one-tenth of the rate for regular contracts. Exchange and NFA fees are not proportionately reduced. Frequent trading of Micro contracts further compounds the cost disparity. Futures transactions are leveraged, and a relatively small market movement will have a proportionately larger impact on deposited funds. This may result in frequent and substantial margin calls or account deficits that the owner is required to cover by depositing additional funds. If you fail to meet any margin requirement, your position may be liquidated, and you will be responsible for any resulting loss.