This article on commodity futures is the opinion of Optimus Futures.

- Many analysts are forecasting a multi-decade bull market–also called a “supercycle”–in commodities.

- Monetary and fiscal policies due to Covid-19 have begun shaping the recovery across multiple commodity classes.

- Commodity class “rotation” can vary, but overall, their performances can be unpredictable–so choose wisely or diversify broadly.

Commodity Futures Maybe The Next Big Thing This Year

Have you ever heard of a supercycle? A supercycle is a trend that lasts for several decades. If you’ve never seen one, here’s a perfect example.

The bullish trend in the S&P GSCI Commodity Index from 1971 – 2008 is one massive supercycle, and the downtrend from 2008 – 2020 (April) is another.

There are many factors affecting supply and demand in each commodity class–from corn to crude, or pork to platinum–on a regular cyclical basis, but 2020 saw something unprecedented in the form of a global pandemic. And it’s the global response to Covid-19’s economic ravages that, according to many analysts, may lay the groundwork for the next commodities supercycle, starting in 2021.

Papering-Over the Covid-19 Crisis

There’s not one person who hasn’t been economically affected by the Covid-19 crisis. If you haven’t lost your job, you likely know someone who has. To date, around 10 million Americans remain unemployed, and throughout 2020, food banks began re-emerging as the poverty and bankruptcy rate began to surge.

The $2 trillion stimulus package in March 2020 is now being followed up by a proposal for another $1.9 trillion. Meanwhile, the US national debt stands at more than $27 trillion, which in itself seems unsustainable, despite expectations that it will only grow more, and rapidly.

The Federal Reserve is holding rates near zero until it is able to see an “averaging” of 2% inflation, meaning that the Fed is willing to overshoot inflation up to 5% for a period of time until it reaches its target average. And for all of the fiscal stimulus spending, the Fed is willing to load up its balance sheet–essentially printing money to purchase fiscal debt.

All of these actions point to the likelihood of high inflation. High inflation means a severe reduction in the dollar’s purchasing power.

The international community–investors and central banks–have already begun diversifying against the US dollar by purchasing foreign currencies and gold, replacing their dollar reserves. Basically, there is a massive de-dollarization effort taking place.

De-dollarization results in US Treasuries being sold and interest rates moving higher, which can be disastrous for the US economy. So, the Federal Reserve has to step in and purchase these treasuries. But with what money? They need to issue more currency. More currency means a greater risk of even higher inflation.

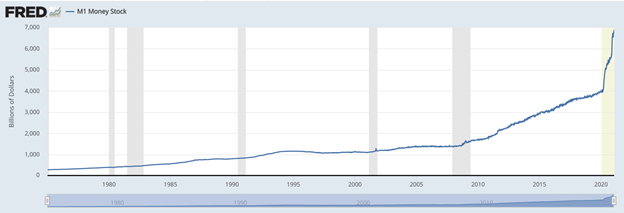

Here’s the current money supply:

It is estimated that 20% of all dollars in existence was created in 2020.

In the end, the American taxpayer will end up paying for this, as the creation of new dollars to support fiscal spending is nothing more than a claim on Americans’ future income, if not through taxes, than through the hidden tax called currency debasement–IN SHORT, INFLATION.

Now, let’s talk about commodities.

Futures Outlook: A Commodities Supercycle Starting with Base Metals (Goldman Sachs)

Last year, we saw commodities rebound alongside the equities market. But according to Goldman Sachs’ 2021 Commodities Outlook: REVing up a structural bull market”, Nov. 18, 2020, this rebound was only the first leg of a prolonged structural bull market.

Goldman argues, “Looking at the 2020s, we believe that similar structural forces to those which drove commodities in the 2000s could be at play.” The investment bank believes the coming supercycle is predicated on Covid-19 economic recovery with special emphasis on the “green industrial revolution.” This points directly to base metals.

While capital spending on commodities has been low since before the pandemic, certain nations undergoing rapid recovery, like China, have been absorbing much of the global metal supply, particularly copper, aluminum, and iron ore. This demand will invariably have a direct impact on commodity-producing countries and labor markets.

Silver is in a unique position, mainly because it is an industrial metal that is a key component in the production of solar panels (alternative energy) and also a monetary metal that is sought after to hedge inflation and other forms of general market volatility.

Both the “greening agenda” and the Fed’s “inflationary agenda” are at play.

Futures Outlook: Precious Metals to Shine Above All Commodity Classes

According to a recent London Bullion Market Association (LBMA) forecast report, precious metals are poised for double-digit gains in 2021.

But what’s remarkable about this forecast is that silver is expected to have the strongest bull run.

Again, silver is both an industrial metal and a monetary metal. Despite being the more volatile among the four precious metals, it has attributes that make it a potential beneficiary to periods of economic recovery as well as periods of high inflation.

Again, silver is both an industrial metal and a monetary metal. Despite being the more volatile among the four precious metals, it has attributes that make it a potential beneficiary to periods of economic recovery as well as periods of high inflation.

Since 2020, silver has outperformed all precious metals–and for reference, almost all metals have outperformed the S&P 500 index.

“Silver is undoubtedly the star of the show,” says the LBMA report. “Silver is forecast to be the best-performing metal in 2021, but with a trading range of $38.5, nearly five times its range forecast last year, it looks as if it’s in for a real rollercoaster ride in 2021.”

We know that silver has a large number of shorts according to the most recent COT report (week of 2/01.2021). We also know that the Reddit traders attempted to short-squeeze what turns out to be four major financial institutions looking to prevent prices from going over the $30 an ounce mark.

But over time, the effect of a loose monetary policy–the Fed’s 2% averaging framework–in combination with fiscal stimulus, not counting the possibility of yet further lockdowns due to new Covid strains, will likely catapult silver and gold to higher price levels.

Energy Commodities Are Expected to Rise, But for How Long?

RBOB Gasoline and Crude Oil futures are rising again on hopes that demand will increase as vaccination rollouts accelerate and expand. On the equities side, most analysts also expect the energy sector to outperform this year. But what happens if the new strains of Covid cause economies to enter the third lockdown? Think about it, and tread carefully.

Also, legacy energy (petroleum products) is under threat from alternative energy developments. Although the green agenda may entail higher costs than legacy energy sources, at least for now, we can assume that green energy is in our future.

So you might want to look into commodities that might be beneficiaries to this new movement. Silver is a perfect example, as it’s needed for solar panel production.

But Which Commodity Classes Will Outperform in the Next Supercycle?

Have you heard of “sector rotation” in the stock market? The S&P 500 is made up of around eleven sectors–tech, financials, utilities, consumer discretionary, and more. Some sectors perform better throughout the business cycle than others. The same can be said for commodity classes.

Check out the chart below. It shows you how commodity class returns tend to rotate each year. Do you see the pattern? If not, then you’re probably right. Like sector rotations in the stock market, the results are more random than most would expect.

The big idea here is twofold:

- If you’re planning on focusing on a few different commodity futures, then get to know their technical and fundamental characteristics well.

- If not, then spread your “bets” across multiple commodity classes; this way you can participate in any commodity that may rise when others fall.

Commodity Trading Across a Wide Palette

There are a lot of other commodities which I haven’t discussed. The important thing to note here is that if you want to participate in a larger commodity cycle, you might want to separate your short-term trading from your longer-term holds.

Also, think “big picture” and don’t fall for newbie mistakes that can take down even more experienced traders. It would be sad to make small gains from day trading or swing trading when you could have also captured larger returns from riding the bigger bull run.

If you don’t have the capital to open up longer-term positions in the futures market, then consider trading options for your longer-term holds.

Of course, there’s no guarantee that this supercycle will transpire. But if it does, be prepared to take advantage of it.

Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

These links are being provided as convenience and for informational purposes only; they do not constitute an endorsement or an approval by Optimus Futures, LLC of any of the products, services, or opinions of the corporation, organization, or individual. Optimus Futures, LLC bears no responsibility for the accuracy, legality, or content of the external site or for that of subsequent links.