This article on The Pros and Cons of Touch Trading is the opinion of Optimus Futures.

In last week’s article we explained in detail what blind touch trading refers to and a few strategies to make the method potentially work for you as a technical trader. In this article, we take a look at the pros and cons of touch trading.

As a quick refresher, we begin by briefly explaining what touch trading is. More in-depth understanding of the concept and the trading method itself can be found in our earlier article HERE.

As the name suggests, touch trading refers to a method where the trade enters the market at the point of impact of live price with a location of interest – most commonly a horizontal support and resistance level, that is within ‘touch’ of the level, without waiting for added price action confirmations. As you will now see, there are multiple merits and demerits to using this strategy.

Pros of Touch Trading

Getting in at the source

Possibly the most standout benefit of using the aggressive touch trading approach is to be able to get in at the source of market action, thereby allowing for an earlier entry and potentially a greater profit potential.

Let’s quickly elaborate what we mean by this:

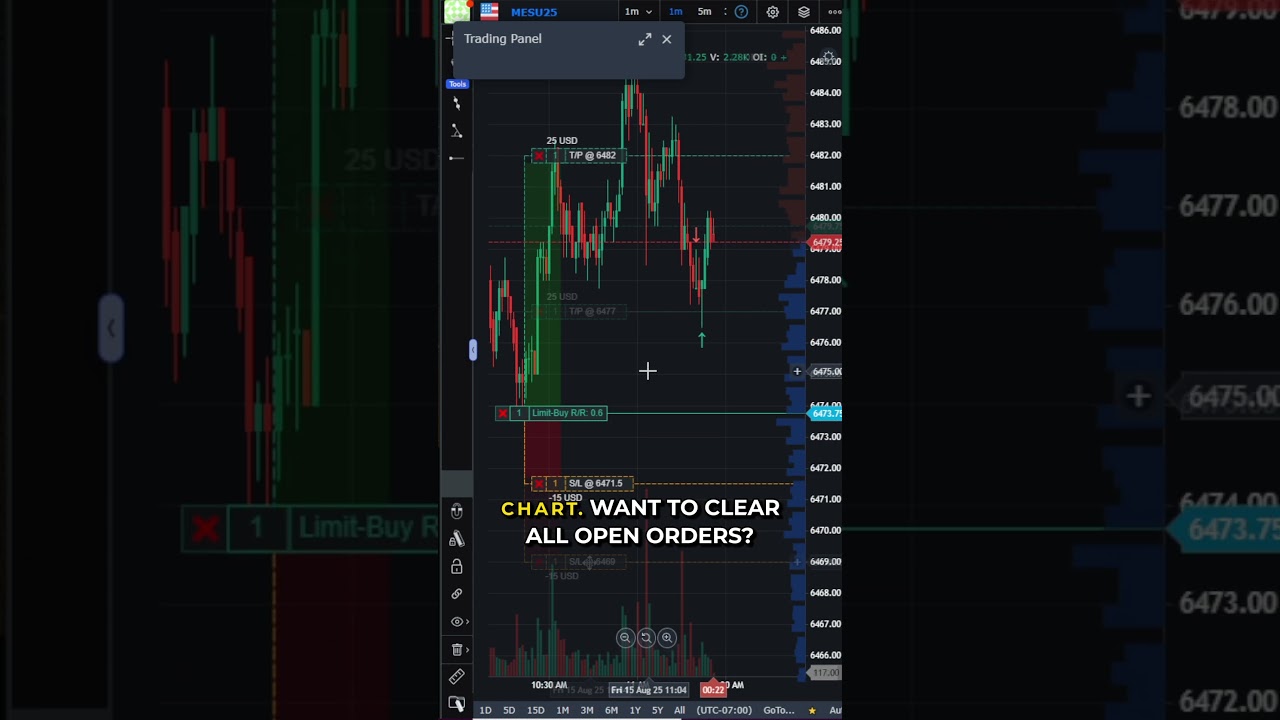

Waiting for price action confirmation can give you the added assurance of the market’s predictability, but as you may notice in the chart above it may not always provide you with an early entry point.

The blue line in the chart above shows a possible entry point for a bullish trade at the support area, while the red line shows a potential long trade for a price action trader who would have waited for the bullish engulfing candlestick to print for that added bit of assurance. As you may notice, sometimes waiting for price action at key locations can lead to late entry points into the predicted move or worse, still no entry at all – in case you do not get an authoritative price action confirmation. And that brings us to the next key benefit of taking touch trades.

Additional Trade Setups

It should come as a no-brainer that an aggressive strategy should yield more trading opportunities than a conservative risk-averse strategy. And it is no different with touch trading. Not having to use price action confirmations can eliminate the extra filters that conservative trading opportunities require and hence what remains is a more flexible and adaptive trading style that will yield more trading opportunities.

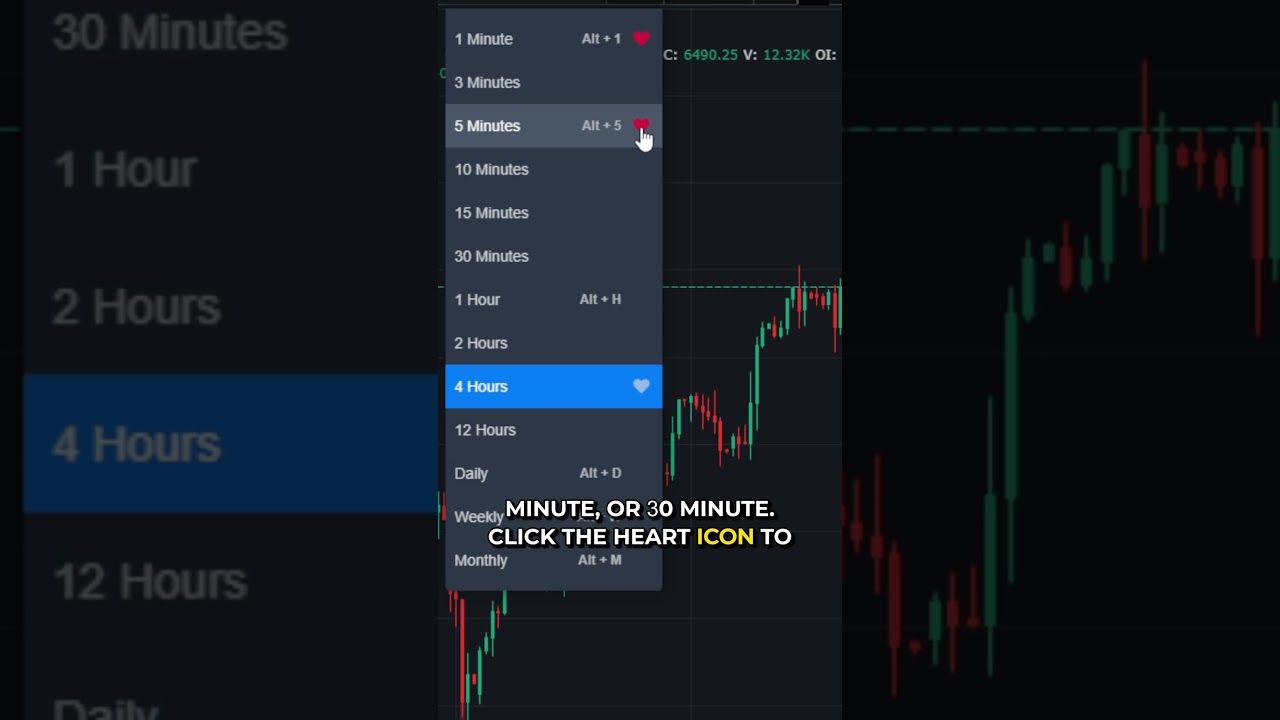

As you can see in the chart above, we have price accelerating into a well-defined resistance area which is what touch traders would potentially be looking out for as trade-able opportunities. Price hits the resistance level and bounces off hard making for a textbook touch trade win. However on the same time frame, we do not have any price action confirmations in terms of specific candlestick pattern breakouts that would have attracted a conservative price action trader.

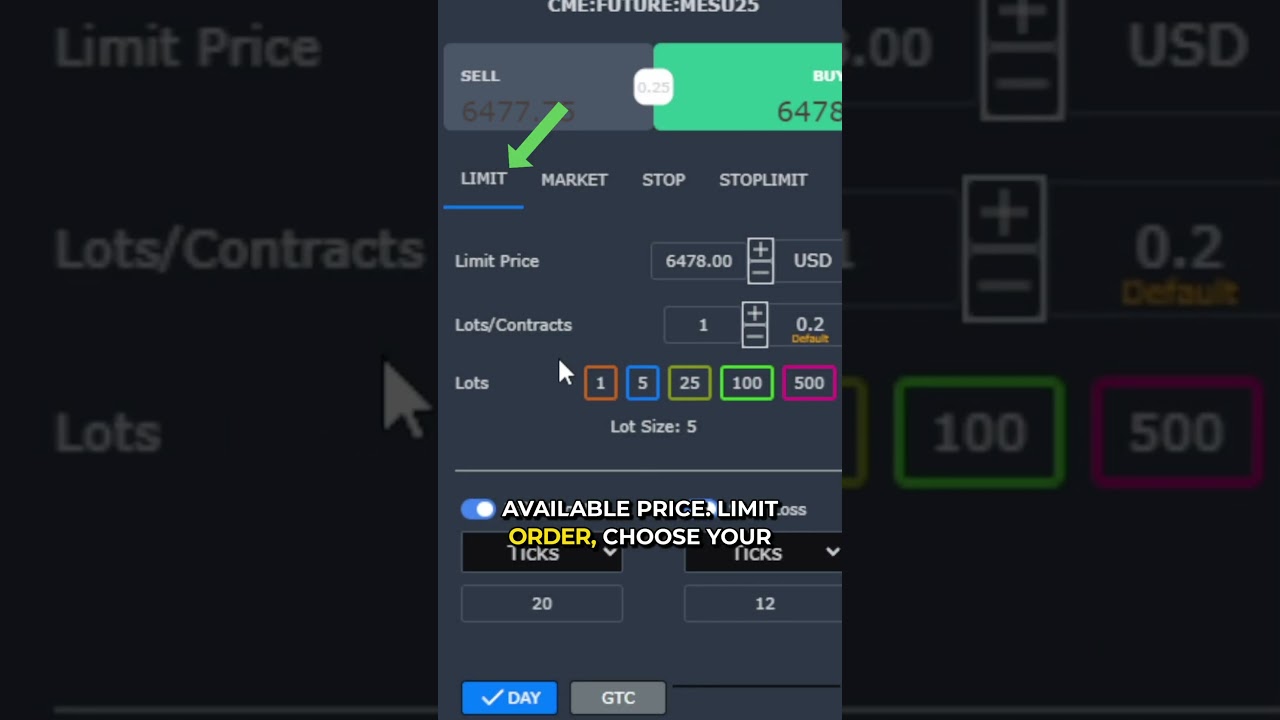

Tighter Trade Management – Higher Risk to Reward

A key concept with touch trading is being able to quickly adjust if the market seems to be going against you. This is understandable because being able to trade at the source allows a trader to have a reasonable expectation of the market reacting at the interest point. Hence, in times when the market does not react as per expectations, the trader can possibly quickly bail out to limit the damage.

In terms of trade management strategy, this often translates into tight fixed or floating stop loss placements that seem to be banking on the market’s sharp reversal off the key support or resistance area. A tighter stop can potentially lead to an increased risk to reward ratio, not to mention being able to get in early at the source already provides the added benefit of increased potential profit.

On the contrary, more conservative price action trading styles often call for wider stop loss placements because an entry farther away from the source needs to incorporate the possibility of a non-threatening pullback against the presumed market direction.

More trading opportunities and more profit potential intuitively sounds like a win-win, until you consider the flipside. Here are three negative elements that you also MUST consider before adopting a touch trading style.

Cons of Touch Trading

Lower Hit Rate

This demerit is perhaps the most important to consider as part of your thought process of adopting the touch trading style. Increased trading opportunities hardly ever come with the assurance of a very high hit rate as well. While a touch trading approach will yield more trading opportunities, the rather aggressive nature of the style calls for higher trade-to-trade risk meaning your hit rate for profitable trades will likely be lower than that of a conservative technical trader who prefers waiting for obvious price action confirmations.

In theory, you would think that a higher hit rate combined with lower trading frequency should roughly equal a method that uses a lower hit rate but higher trading frequency. However, in reality, it is often not that simple. The reason of course has to do with individual trading personalities that can differ vastly from trader to trader.

Most traders cannot seamlessly switch between a conservative and an aggressive trading style. In this context, it means that touch trading is likely not going to be for every trader even if you were to successfully master it. Some traders simply prefer to stack as many odds in favor of a trading opportunity as they can, and can never rely on hit-or-miss styles that rely on large enough sample sizes to prove their worth.

Not for Beginners

It is not uncommon for trading coaches to often pull new traders away from highly subjective and aggressive trading styles like touch trading. At its core, touch trading obviously requires for the trader to be very well versed with the market rhythm, general price action and order flow dynamics and just the general understanding of why price normally does what it does. The understanding often goes much deeper than highlighting some key support and resistance areas in the market and placing stop or limit orders on them and fishing for trading opportunities.

Even though this method is frequently dubbed ‘blind’, there is truly nothing that a trader can do with closed eyes that will bring him success with this method. Potential trades often require deep concentration and following of live price action as price approaches the key interest point, as well as a lot of ‘babysitting’ through the initial phase while price is still in the vicinity of the key area. Recall, that touch trading involves a high degree of adaptability and adjustment to live market conditions. Most beginner traders are often too emotional to think and act impartially, and swift ad hoc decision making is what success for this method hinges on. Unfortunately, that means the method is often out of bounds for most beginner traders that are still learning about the basic nuances of the business.

Subjective Trade Management

As much as having an aggressive trade management style for this method is a benefit, it is also perhaps a demerit to the method.

Emotional stability when managing a trade is a top priority and often a quest for most beginner and intermediate traders, and is perhaps on-going educational aspect for most seasoned traders as well. A subjective trade management strategy that relies on quick reactions to how the market behaves in the moment at a key area of support or resistance can be a bit too much on some traders’ plates.

It is very common for traders to lean towards a more set-and-forget or a more objective trade management style that unfortunately does not bode well with an aggressive trading method like touch trading.

As you may have concluded by now, touch trading in itself is probably neither a holy grail nor a ticket to disaster. A lot depends on the individual trader’s trading personality, level of experience and comfort zones. That is exactly why we chose to draft the article as a balanced approach between the positives and the negatives of touch trading, leaving the ultimate decision to adopt it or not to your own sense of reasonable judgment.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.