This article on Moving Averages is the opinion of Optimus Futures LLC.

Moving averages are commonly used technical indicators often used in trend trading strategies. We specifically say ‘trend trading’ strategies because they lose some of their utility in a sideways market when prices closing within tight ranges causes it to be in close proximity of price itself, leading to an increased number of fake signals due to the price repeatedly touching the moving average.

It is also fairly common for traders to be using more than one moving average, often a combination of slow and fast moving averages. In this article, we take that approach and spin it in a slightly different way to give you a fresh perspective relating to the use of moving averages in your trading.

Moving Averages and Price Action – The Constriction Principle

The basic purpose behind using a shorter period moving average with a longer one is simple. The trader is looking for both perspectives in making a more informed decision. While a shorter term moving average will be pegged more closely to price resulting in more touches (and perhaps trading signals), the long-term moving average gets touched less frequently during a normal trending market, and is frequently used as a target in trading systems – or in some cases even a signal for trend reversal when the long and short-term moving averages cross over.

There exists, however, a different perspective to following the simultaneous patterns of slow and fast moving averages in relation to price action and we call it the constriction principle. This principle would generally apply to most combinations of slow and fast moving averages, but in this article, we attempt to find the critical point for the 21 and the 50 exponential moving averages (EMA) interaction where traders can determine a price direction.

The constriction principle is a derivation of the much popular Bollinger bands indicator. This principle emphasizes not on the moving averages crossing over, but rather the distance between the two moving averages as an indication of the strength of the trend.

When in a strong trend, the price will pull the 21 EMA with it which in turn will diverge further away from the 50 EMA, causing a larger gap between the two moving averages. As price pulls back, or transitions into a sideways pattern, the moving averages will close in together, often creating a ‘constriction’ that usually works like the tightening of a spring and its eventual release. That is, the price will often bounce right off the constriction zone, or breakout into a trend – as the case maybe.

If you recall, we said the constriction principle is a derivation of the Bollinger Bands indicator. Note that Bollinger Bands also measure market volatility and will expand or contract given the tick activity in the market.

Past performance is not indicative of future results.

The chart above illustrates how the two EMAs behave when the market is strongly trending. We have above a dominant downtrend displaying frequent but short pullbacks. Notice how the distance between the two EMAs is fairly consistent to reflect the smoothness and consistency of the trend itself.

When the market does pull back, it bounces fairly accurately off the 21 EMA – a phenomenon we notice is very common during strongly trending conditions.

You should also notice that towards the bottom right we have an extended pullback. Notice the behavior of the moving averages. We have here what we call the ‘constriction’ of the EMAs caused by an extended pullback into the downtrend. Essentially, the 21 EMA gets pulled back up with the price to close in on the 50 EMA tightening or constricting the gap between the EMAs. If the trend is strong enough, and other factors permit for the trend to continue (for example the lack of any clear and evident support areas underneath for this case), we can expect this coiling up of the EMAs to swiftly release price back in the direction of the trend.

Note, however, that like all technical indicators, moving averages too are lagging in nature, which means that they react to price rather than price reacting to them. That also means that the constriction of the EMAs itself isn’t the cause of the resumption of the downtrend, but is rather an effect of price resuming the trend. Like with all technical indicators, eyeing the constriction phenomena will help you read price action because of the visual cues.

We’ll illustrate with an example to clarify the above point.

Past performance is not indicative of future results.

We’re looking at an uptrend that slowly transitions into sideways market action. Each of the pullbacks into the uptrend cause a slight constriction of the EMAs, resulting in price shooting back up sharply. But as we approach potential key resistance around the 1.200 crucial round numbers, an extended pullback does NOT result in price shooting back up sharply. You should note that as price tried to resume the trend after the last pullback, it stalled at the crossover point of the two EMAs and actually reversed back down. This is usually a very strong indication that we are either entering a period of elongated sideways action, preparing for a deeper pullback into the dominant trend, or entirely reversing the trend.

A major criticism of a lot of moving average based trading systems is that they often fare poorly in trying to predict upcoming broader market sentiment. In other words, moving average traders often find they do well in trending markets but will need to absorb a few losses before they eventually come to realize the market has transitioned into a range rather than a steep dominant trend.

This refined approach, however, can potentially better clarify price action. By watching how price behaves as it pulls back to a constriction zone can give you deep insights into the momentum present in the current move. Remember that upon a pullback to the constriction zone, we are actually looking for a sharp move back in the direction of the trend.

It also helps to be able to add other aspects of technical indications into your analysis. As stated above, when looking for a resumption of the trend at the constriction zone, it helps to analyze if the trend has room to proceed. Does the constriction zone also line up with a round number or a horizontal support and resistance zone? Is the trend headed into a key swing high /low? Answering these questions will help you build an overall understanding of the market while following the patterns can help give shorter term cues to fine tune your entries and exits.

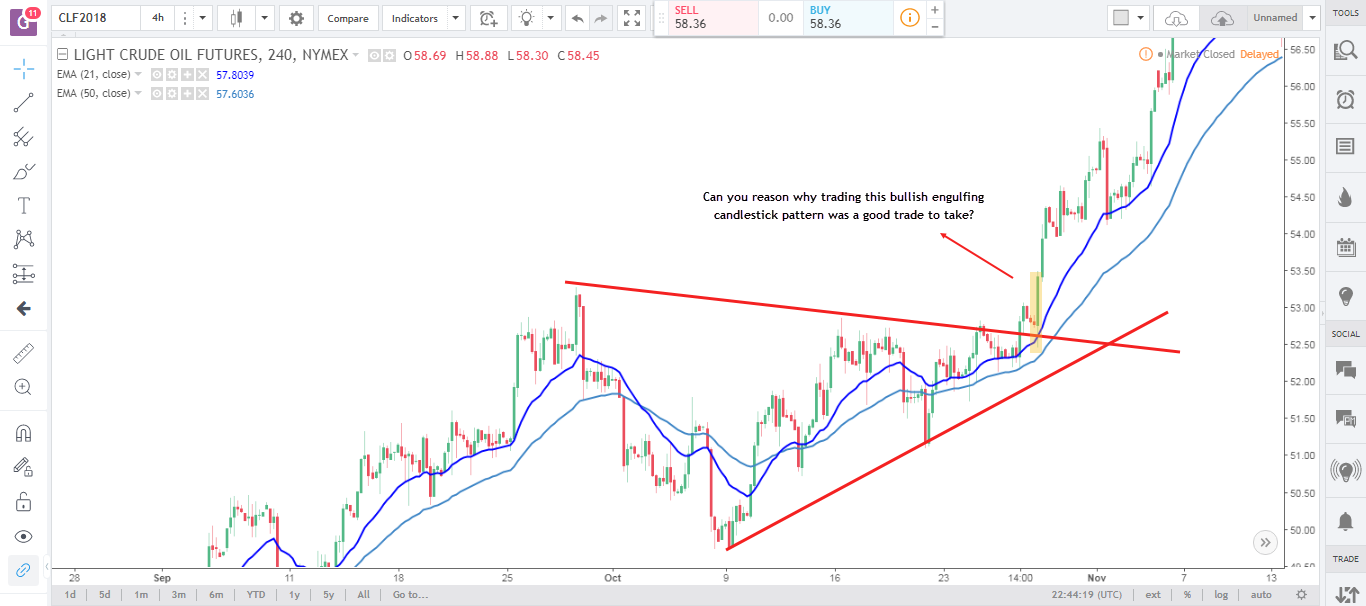

On the chart above we highlighted a bullish engulfing candlestick pattern. Can you see why this could have been a very good trade? Not only do we have the constriction of the MAs and the candlestick pattern form right off the constriction zone itself, we also have a breakout play here out of the wedge pattern indicated by the two angular red lines.

As is with any profound trading methodology, your trigger should come from a singular source. Some trade setups, however, have multiple factors lining up in favor of them. Watching for constriction zones on these two EMAs is just one of those factors.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.