Financial markets are complex constructs and highly interwoven. These characteristics offer some unique and interesting opportunities for traders. By understanding what to look for and how to use market correlations to your advantage it may be possible to benefit from it and increase the chances for trading success.

[bctt tweet=”Market Correlations. Should you look at other markets when you trade only one market? https://www.optimusfutures.com/blog/market-correlations-should-you-look-at-other-markets/ #trading #daytrading #futures “]Market Correlations 101

Before we get started, let’s revisit the basics about understanding correlations.

When two markets are correlated it means that they move somewhat similar. A perfect correlation (of +1) means that if one market moves up 1 point, the other one moves the same point in the same direction. Two perfectly negatively correlated markets move in opposite ways. In between you find different degrees of correlation.

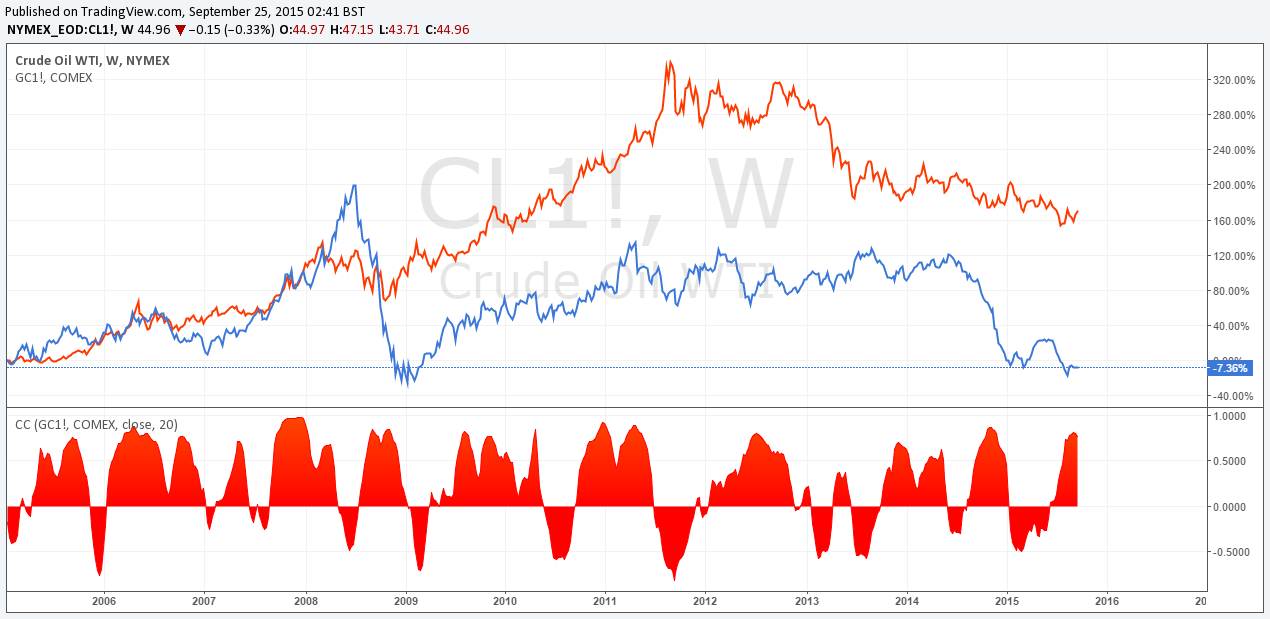

Take, for instance, the chart of Gold and CrudeOil with the correlation graph at the bottom. Often, these two markets move in sync with a very high correlation of close to +1. Other times, it changes to a highly negative correlation. In the next step, we will see how traders can use correlations to their advantage.

1 – Generating more trading opportunities

This is what most traders ask themselves on a regular basis: “How can I get more trading opportunities?”, and correlations can help you with it. Let’s say you are a Crude Oil trader and only watch Crude Oil, but you don’t get the amount of trades you want. A solution might be to start looking into other correlated markets. If, for example, you have been following a specific trading setup on Crude Oil for a few days but it didn’t show the entry trigger, chances are that other correlated markets show a similar pattern which might fit your trading rules more accurately.

On the other hand, if you are trend-following trader and Crude Oil is in a long downtrend, looking for negatively correlated markets which are going up can also expose you to new trading opportunities.

2 – Choosing better setups

Traders who only follow one, or very few markets, often have the problem that they have to wait relatively long to get a trade entry. What happens then is that they try to come up with excuses why taking a premature trade entry and violating their rules would be the right thing to do to justify trades.

Thus, observing other correlated markets exposes you to more trading opportunities and it also allows you to choose from a variety of different setups. By watching two correlated markets, you will often get very similar trading setups and can then choose the one that fits your criteria better.

3 – Diversification and spreading the risk

Instead of choosing between different setups, you can also use correlations to spread the risk. If you are watching correlated markets you will often get very similar trading setups and even though the setups can look almost identical, the outcome on both is uncertain. So, instead of choosing and betting all your chips on one setup, you can split your position and enter two trades. If one setup fails, the other one could still end up in profit. There is a catch to that as we will see next.

Risk diversification is a great opportunity when trading correlated markets.

The pitfalls of trading correlated markets

Everything comes with a catch and although using correlations can help improve the quality of your trading, there are 3 major problems when it comes to using correlations.

1 – Losing focus

Following correlated markets can bring down your focus. Remember, correlated markets will often move very similar and traders often get excited when they see a potential setup. Now imagine you are watching two or three correlated markets and suddenly you have to deal with 3 similar setups – things can get hectic very easily.

To get started, only add one correlated market and see how you can handle the new pressure. If you are experiencing focus problems, come up with a better game plan and a routine that allows you to monitor several markets at once – choosing less correlated markets might be a better fit for you.

2 – Increasing risk

This is something that happens to many traders without even being aware of it. Often traders trade very similar markets and they are not aware of the correlation among their markets and the implications of it. If you enter multiple trades in correlated markets your risk increases significantly because you often have a higher chance of receiving similar results. If you enter long positions on Gold and Crude Oil when the correlations are close to +1, it is more likely that you will receive two winning or two losing trades at the same time. Therefore, being aware of the correlation among your markets and knowing how to adjust your position size to avoid increased losses it essential.

3 – Correlations change

The screenshot above shows that correlations fluctuate a lot, and they can even change from highly positive to highly negative within a short period of time. Therefore, it is not only important to keep track of correlations, but it is equally important to understand that correlations are backwards looking and that they can break down immediately.

Understanding how correlations work can add a new dimension to your trading. Whether you want to generate more trading opportunities, diversify your risk or have a greater selection of trade setups, correlations always play a role in trading – if you are aware of them or not. At the same time, correlations can play against you if you don’t understand the dynamics. Thus, keeping track of correlations should be a part of your trading routine if you trade more than one market.

There is a substantial risk of loss in futures trading. Past Performance is not indicative of future results.