The article on How to Trade Micro E-Mini Futures on TradingView is the opinion of Optimus Futures, LLC.

One of the most popular trading products in the futures market is the E-Mini S&P 500 (ES).

However, it’s out of range for many retail traders with small accounts due to relatively high margin. Thankfully, they have options.

Mirco E-Mini futures have opened a new realm of opportunities for retail investors.

These instruments allow traders to navigate the major indices with a significantly reduced capital outlay compared to traditional futures contracts.

Today we’ll discuss how regular folks can trade Micro E-mini futures on TradingView, a platform celebrated for its sophisticated charting and analysis tools.

What Are Micro E-Mini Futures?

Micro E-mini futures contracts represent a more approachable variant of the conventional E-mini futures, designed specifically to be within reach for self-directed traders.

As the notional value of major stock indices has escalated over time, trading standard futures contracts became increasingly challenging for many retail traders.

The substantial margin requirements associated with these contracts often priced individual investors out of the market.

In response, the Chicago Mercantile Exchange (CME) innovated the Micro E-mini futures, addressing this market gap.

Micro E-Mini Futures – Everything You Need to Know

These contracts are scaled down to 1/10th the size of their E-mini counterparts, drastically lowering the entry barrier for trading significant indices.

This reduction in size translates into a more manageable capital requirement, opening the door for a wider array of investors to participate in these markets.

Taking the highly-traded S&P 500 E-mini (/ES) as an illustrative case, it possesses a multiplier of $50 for each index point.

Consequently, with the S&P 500 index at 4,500, an /ES contract holds a notional value of $225,000.

A 10-point index movement would thus alter the value of the /ES contract by $500.

In stark contrast, the Micro E-mini version for the S&P 500 (/MES) features a multiplier of just $5.

At the same index level, an /MES contract’s notional value stands at $22,500, merely a tenth of the /ES’s value.

This implies that a similar 10-point fluctuation in the S&P 500 would result in a $50 change in the /MES contract – a figure much more palatable for individual traders.

The introduction of Micro E-mini futures has significantly democratized access to trading major indices such as the S&P 500 (/MES), Dow Jones Industrial Average (/MYM), NASDAQ 100 (/MNQ), and Russell 2000 (/M2K).

MNQ Futures VS Nasdaq 100 ETF | Which One Should You Trade?

Moreover, setting up a trading account with an online broker provides retail investors not only with the ability to trade these contracts but also with access to sophisticated technical analysis tools and charts.

This combination of lower capital requirements and advanced trading resources makes Micro E-mini futures an ideal entry point for retail investors looking to delve into the futures market.

Furthermore, traders have the advantage of nearly 24/7 market access, allowing them to respond swiftly to global economic events and news.

This accessibility, coupled with the reduced financial commitment, makes Micro E-mini futures a compelling option for both newcomers to futures trading and experienced traders seeking more granular control over their investment and risk management strategies.

Opening a Trading Account at Optimus Futures

Before you jump in and start trading Micro E-mini futures, you’ll need to setup a trading account.

Optimus Futures, nominated as one of TradingView’s Best Futures Broker in 2023, is an ideal choice, offering seamless integration with TradingView. Check out our reviews on TradingView here: https://www.tradingview.com/broker/OptimusFutures/reviews/

This powerful combination provides essential tools and charts for in-depth market analysis, a cornerstone for making informed trading decisions.

With nearly 24-hour trading, you can swiftly adjust your strategies in response to global news and market movements.

Moreover, there are no short-selling restrictions, allowing traders to go short just as easily as going long. This flexibility is critical in a market that never sleeps and is continually influenced by global events.

In addition to Micro E-Mini Futures, Optimus Futures provides access to 20 Micro futures contracts:

- Micro WTI Crude Oil futures: Offering the same robust transparency and price discovery as the benchmark WTI futures contract but at 1/10th the size.

- Micro Bitcoin futures: Get bitcoin exposure that’s more manageable and precise, at 1/50th the size of the standard five-bitcoin futures contract.

- 3 Micro Metals futures: Engage in the most liquid Metals futures markets with contracts at 1/5th or 1/10th the size of standard contracts, including Gold, Silver, and Palladium.

- 7 Micro FX futures: Access the $6T a day FX market with contracts sized at 1/10th or 1/5th the standard pairings, including major currencies like EUR/USD, JPY/USD, and GBP/USD.

- Micro Treasury Yield futures: Explore government bond markets with smaller-sized contracts in 2-year, 5-year, 10-year, and 30-year yields, all with smaller margin requirements.

The platform is known for its user-friendly interface, combining powerful charting tools with efficient order execution.

Optimus prides itself on offering comprehensive guidance and technical support on TradingView. We have published numerous guides and videos explaining the platform’s features, making it easier for traders to navigate and leverage TradingView’s full potential.

When you trade Micro E-Mini Futures with Optimus, you’re not just using a platform; you’re engaging in a seamless operation that harmonizes your TradingView charts with effective order execution and personalized brokerage support.

Developing Trading Strategies for Micro Futures on TradingView

TradingView stands out for its array of analytical tools, perfect for crafting strategies for Micro E-mini futures.

Understanding market dynamics, economic indicators, and technical patterns is key.

It’s vital to adapt these insights to the specific nuances of the Micro E-mini futures market, considering factors such as liquidity, volatility, and market sentiment.

Some popular strategies for Micro Futures include:

Mean Reversion

Mean Reversion Trading is a strategy predicated on the principle that asset prices often revert to their historical average following extreme movements.

This concept mirrors a rubber band that eventually snaps back to its original position after being stretched. While it appears straightforward, executing mean reversion trading effectively requires skill, patience, and the ability to adapt.

Traders capitalize on this by buying or selling assets when they significantly deviate from their usual value, betting on a return to normalcy.

However, this approach isn’t foolproof, as markets may continue moving in the extreme direction, defying the expected reversion.

Appealing to those comfortable with volatility and quick price shifts, mean reversion trading challenges traders to discerningly navigate market dynamics and manage risks astutely.

Trading Order Flow

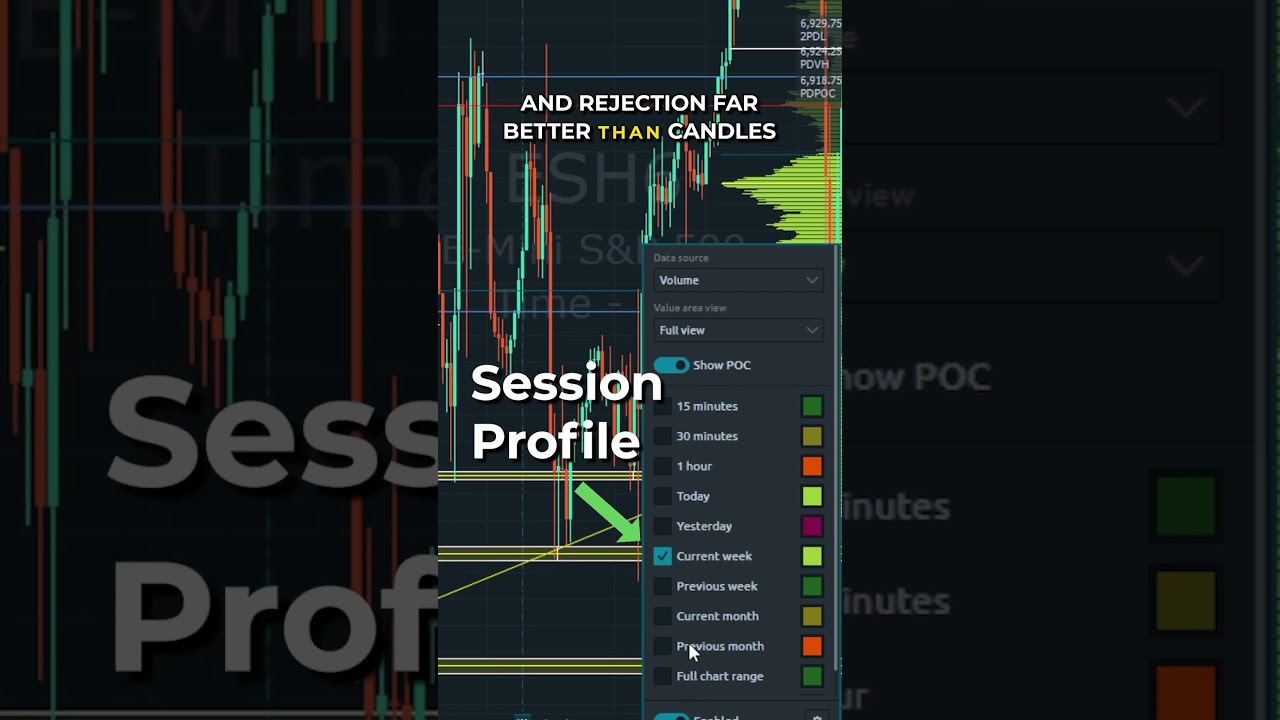

Order Flow Trading in the futures markets is a technique where traders analyze the flow of buy and sell orders to gauge market sentiment and predict future price movements.

This strategy delves into the raw data of market transactions, focusing on the volume and size of orders at different price levels.

Traders utilizing this method seek to identify imbalances between buyers and sellers, capturing opportunities where significant demand or supply could drive price changes.

It’s a real-time, dynamic approach that requires keen observation and quick decision-making.

While challenging, mastering order flow trading can provide a deep understanding of market mechanics and enable traders to anticipate shifts before they are reflected in price charts.

Ideal for those who thrive on detailed market analysis, order flow trading in futures offers a nuanced perspective on market trends and potential reversals.

Advanced Techniques and Risk Management

Success in Micro E-mini futures trading also hinges on mastering advanced trading techniques and effective risk management.

Utilizing strategies like scalping for quick, small profits, or swing trading for longer-term position plays, can be beneficial.

Risk management techniques, such as setting stop-loss orders and having a clear exit strategy, are essential to protect your investments.

It’s a lot easier to trade when you have plan.

Placing a Micro E-Mini Futures Trade on TradingView

Trading Micro E-mini contracts like /MES requires an understanding of their expiration cycle and selecting the appropriate contract month.

TradingView streamlines this process, enabling you to seamlessly execute trades linked to your Optimus Futures account.

Monitoring the Status of Trades

Effective trade monitoring is critical. TradingView offers real-time data and sophisticated charting tools, enabling you to track your positions, set alerts, and respond promptly to market changes.

The platform also supports advanced order types and risk management strategies to optimize your trading approach.

Watch the video below for a step-by-step tutorial on how to place trades on TradingView.

The Bottom Line

Trading Micro E-mini futures on TradingView, supported by Optimus Futures, presents an opportunity for retail traders to engage in major market movements with reduced capital deposit.

The platform’s comprehensive tools and real-time analytics, combined with strategic planning and continuous education, equip traders to navigate the Micro E-mini futures market effectively.

Embrace this opportunity to expand your trading horizons and explore the potential of Micro E-mini futures with Optimus Futures and TradingView.

Trading in futures involves a significant risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. Any use of external indicators or downloaded materials is at the user’s own risk. The information provided herein is intended solely for educational purposes and does not constitute investment advice. Optimus Futures does not endorse or assume responsibility for the content or services of any external links referenced. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.