The following article on the futures trading outlook for 2022 is the opinion of Optimus Futures

The pandemic has brought about several changes in the economy over the last two years. This, of course, comes with its own unique set of market opportunities and risks. As a trader, you might want to adapt your outlook and strategy to the uncertainties that such an economy might bring.

You might want to kick off 2022 with a series of questions:

- How might industries, sectors, and indexes be affected by pandemic uncertainties and the likely monetary and fiscal solutions to come?

- Where do various markets stand with regard to valuations?

- What might we expect in terms of volatility?

- Which instruments are trending in terms of popularity, volume, and liquidity?

- How might your trading approach fit within the context of today’s economic conditions?

In time, the market will answer these questions for you. Remember…

Your job is not to predict market outcomes. Analysts’ predictions are a dime a dozen; the results are usually all over the map, meaning that it’s often hit or miss.

Neither is it your job to wait and respond. Taking a reactive approach can cause you to miss out on high-probability trades.

Your goal is to anticipate reasonable outcomes and to prepare for them, be it profit or loss.

So, how might we anticipate what’s to come in 2022, and how might that inform our choices as to which futures markets to trade? Let’s begin with the potential market drivers for this year.

The Biggest Story of 2022 is the Rising Inflation Rate

Once upon a time, like as little as six months ago, inflation was a “transitory” problem. We know now, as the Federal Reserve itself admits, that inflation may run higher and deeper than what it had expected.

What’s the pressing issue? The Fed is facing a dilemma: to bring down inflation, it will have to raise interest rates; but raising interest rates can cause the stock market to crash. The idea of a “soft landing,” where the central bank hikes rates while maintaining an orderly decline in the stock market, makes for a nice narrative. So too was “transitory inflation.”

What’s likely to happen? In this year’s meeting of the American Economic Association, economists agree that the Fed funds rate might have to rise as high as 3% to 6% to stave off inflation. That’s a HUGE hike (sorry, but no soft landing there).

Where’s the opportunity?

- If the Fed drags its feet in taking a more hawkish approach, or if inflation continues to shock us with figures approaching the “disco ball era,” then gold, silver, and commodities in general might do well.

- The S&P 500 (ES) also tends to do well alongside the tech-heavy Nasdaq 100 (NQ) but note that both are up 28% and 25% respectively year over year. In other words, their valuations are high compared to that of the Dow Jones (YM) at 20% and the Russell 2000 (RTY) at 9% YOY.

- Bitcoin (BTC) and Ethereum (ETH) futures have taken quite a hit since reaching all-time highs in November, but despite their plunge, they’re still up 87% and 83% respectively, making them the top out-performers among all assets (or the biggest bubbles). BTC is now considered a strong inflation hedge, similar to gold, though hard-asset proponents might question the validity of such a claim.

Now, if the Fed cuts rates more aggressively than Wall Street had anticipated, pay attention to gold, Nasdaq (as tech tends to perform poorly in a high interest rate environment), Bitcoin, and other inflation safe-havens. They, among other assets, are likely to fall.

Top instruments to watch:

| Commodity/Index | Standard | Mini | Micro |

| S&P 500 | – | ES | MES |

| Nasdaq 100 | – | NQ | MNQ |

| Dow | – | YM | MYM |

| Russel 2000 | – | RTY | M2K |

| Gold | GC | QO | MGC |

| WTI Crude Oil | CL | QM | MCL |

| Bitcoin | BTC | – | MBT |

The Next Big Story is Corporate Spending (while interest rates are still low)

According to Bank of America, BlackRock, JPMorgan, and Morgan Stanley forecasts for 2022, corporate spending may see an uptick for as long as interest rates remain relatively suppressed.

Where’s the opportunity?

As a futures trader, you might find this opportunity a bit tricky to exploit. Just because a company will spend for investment doesn’t mean it’s going to pay off in the near or long-term.

Companies that were profitable in 2021 may have enough cash to burn in 2022. But some capital investments may take months or years to pay off. So, businesses that raked in handsome profits in 2021, and that project strong revenue and earnings in the coming quarters, and have little debt and more cash to spend—these are the companies to pay attention to.

Here’s the tricky thing: if any of these companies happen to have a strong weighting in a given index, then that index will likely rise under favorable conditions or fall once those conditions fade away.

- The Nasdaq can give you the most tech-heavy exposure among all four indices.

- The S&P has the heaviest financial sector exposure, for traders looking to capitalize on that sector.

- Industrials and other defensive sectors tend to dominate the Dow, though it does have heavy Tech sector exposure as well.

Top futures instruments to watch:

| Commodity/Index | Standard | Mini | Micro |

| Nasdaq 100 | – | NQ | MNQ |

| S&P 500 | – | ES | MES |

| Dow | – | YM | MYM |

Non-Fungible Tokens Are Gaining Ground

What do big brands like Taco Bell, Pizza Hut, Visa, Twitter, Nike, Warner Music, and a few hedge funds have in common? They’re all buying different amounts of NFTs. NFTs are digital assets, much of them centered on blockchain-verified ownership of original digital art and music.

Where’s the opportunity?

Will NFTs play a big role in future asset portfolios? Some institutions think so; others don’t. The short answer is that nobody knows, but some companies and investors are pouring money into it because they see potentially high upside weigh against a limited downside (controllable by virtue of position sizing).

We’re not recommending this asset, but we’re not discouraging you from it either. Buy at your own risk.

Top futures instrument to watch:

| Commodity/Index | Standard | Mini | Micro |

| Ethereum | ETH | – | MET |

Why Ethereum? NFTs operate on the ethereum network. And unless you’re willing to search out individual stocks of companies that have NFT exposure, there currently isn’t a futures contract that can give you “direct” exposure to this emerging asset class.

Consumers Confidence is Steadily Falling

If consumers are hesitant to spend due to inflation or the pandemic, then the economy may face growth headwinds. After all, consumer spending makes up 70% of the US GDP.

While consumer staples and some discretionary goods are seeing an uptick (an effect of Washington’s stimulus payments), big ticket item purchases are dropping to levels unseen since the early 1980s.

Where’s the opportunity?

Less spending can translate to revenue and earnings misses and lower guidance. All four major US indexes represent different exposures to market sectors. You’ll have to do your homework, but declining sales may signal the need to hedge your portfolio or the opportunity to short various sectors via stock index futures.

Top futures instrument to watch:

| Commodity/Index | Standard | Mini | Micro |

| S&P 500 | – | ES | MES |

| Nasdaq 100 | – | NQ | MNQ |

| Dow | – | YM | MYM |

| Russel 2000 | – | RTY | M2K |

Gold May (or May Not) Lose Its Luster in 2022

Newmont mining just spent $2.13 billion to ramp up operations with the goal of producing 7.5 million ounces of gold this year. Mining companies generally don’t ramp up production unless they’re anticipating metal prices to rise or remain steady.

Newmont sees inflation and pandemic fears as major factors driving up gold prices. Not all analysts agree. Some claim that precious metals’ safe haven status is losing ground to Bitcoin and Ethereum.

Where’s the opportunity?

If inflation continues to rise, there may be an opportunity in safe haven assets. Whether it’s US Treasuries, gold, silver, bitcoin, or ethereum, you’ll have to see where the money flows or when it happens. But it helps to be prepared once safe haven rotation takes place,

Top futures instrument to watch:

| Commodity/Index | Standard | Mini | Micro |

| Gold | GC | QO | MGC |

| Silver | SI | QI | SIL |

| Bitcoin | BTC | – | MBT |

| Ethereum | ETH | – | MET |

| US 30-Year Treasury Bonds | ZB | – | – |

| US 10–Year Treasury Notes | ZN | – | – |

The Biggest Wildcards of 2022

Glancing at various mega-bank forecasts, two things are consistently identified as potential disruptors: Covid variants and the political climate in Washington.

Covid-19 Variants

You saw how the latest Omicron variant plunged the US stock market as the economy was working its way toward a “post-pandemic” recovery. There is no model to predict the covid’s spread or mutations. Each country and its various municipalities will respond differently to the pandemic.

This is something that can be estimated but not predicted. Nevertheless, its effect on the economy can be anywhere from mild to severe.

The Political and Geopolitical Climate

On a local level, when the principles of the bipartisan debate are no longer valid in a “post-truth” environment, the effects of politically-charged events can be far-reaching and drastic; potentially disrupting and exceeding the realm of economics. Even more so the effects of geopolitical instability and unrest (as the recent trade wars have taught us).

These are both “wildcards” that can have varying effects on the economy. Unfortunately, the underlying conditions, triggering events, or market responses are not predictable. But you can potentially anticipate them by keeping an eye on these tinderboxes (and adapting in a way you see fit).

Micro Futures Liquidity May Be Favorable to Swing Traders

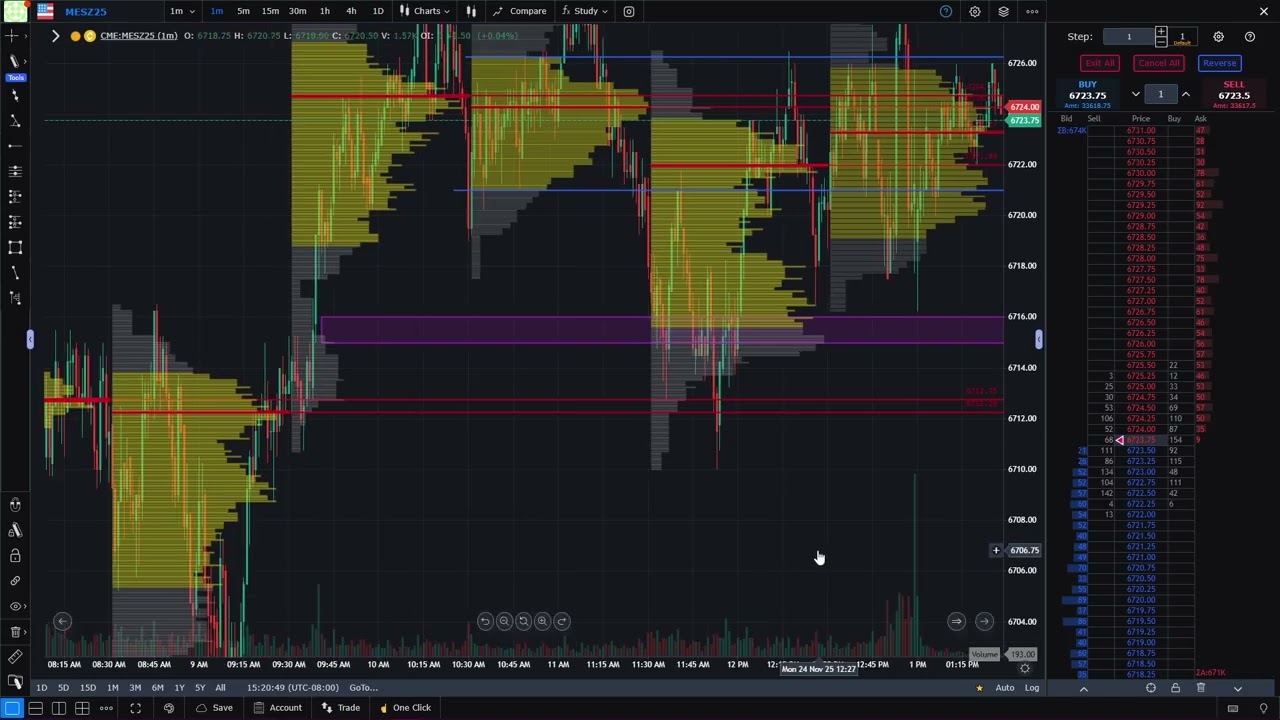

Take a look at the micro futures contracts below (highlighted in blue).

| Commodity/Index | Standard | Mini | Micro |

| S&P 500 | – | ES | MES |

| Nasdaq 100 | – | NQ | MNQ |

| Dow | – | YM | MYM |

| Russel 2000 | – | RTY | M2K |

| Gold | GC | QO | MGC |

| Silver | SI | QI | SIL |

| WTI Crude Oil | CL | QM | MCL |

| Bitcoin | BTC | – | MBT |

| Ethereum | ETH | – | MET |

The first market listed, the S&P 500 futures, has e-mini (ES) and e-micro (MES) available for trading. If you require high volume to accommodate high frequency or low latency trading, then it’s the ES hands down. If you prefer smaller taking positions to accommodate larger price swings, then the MES might be more suitable to your trading approach.

Micros may not have the same liquidity as their larger cousins but they do provide more customizability in position size, smaller margins, lower trading costs, and possibly lower risk due to smaller dollar-per-tick values. Position sizing, risk management, and liquidity are all important factors in day trading and swing trading. So, look at these instruments carefully before trading them.

Five Factors to Consider When Choosing a ‘Tradable’ Market

Last but not least, let’s go over a few basics. What makes a market ‘tradable’?

‘Tradable’ depends on the market characteristics you’re looking for. You need to match your personal trading requirements with the external features of a given market.

In other words, you are trying to match a) your trading strategy, b) capital resources, and c) risk tolerance with any of the following five market characteristics: margins, liquidity (volume), volatility (volume), contract size, and trading hours.

Let’s talk about each one and why their importance may vary according to different types of trading needs and expectations.

Margins

High margins can be prohibitive to traders whose trading accounts lean toward the smaller side. The biggest danger in trading a contract with high margins is falling under the required margin, sometimes resulting in a margin call but often resulting in auto-liquidation and a fee (per contract).

Of course, the flip side to low margins is that you are taking larger risks with smaller amounts of capital. So be sure you have ample risk capital that’s appropriate to whatever margin level your contract requires.

Liquidity

If you’re unable to get in and out of a market quickly, then you run the risk of being stuck in a position (or not being able to get into a position) while the market moves against your preferred price level.

But the idea of getting in or out “quickly” really depends on how fast a time frame you’re working with. For a day trader, that time frame can be seconds-long. For a swing trader, it can mean minutes to hours. For a position trader, it can mean days. Liquidity depends on your time requirement, among other things.

Another thing to consider is that illiquid markets are more susceptible to price manipulation by large traders. If you’re one of them, then perhaps an illiquid market might match what you’re trying to do (if not, then you might want to stay away).

Volatility

Most “investors” hate volatility. That’s why they diversify their portfolios to reduce volatility. Most short-term traders, on the other hand, rely on volatility for their market success.

Some contracts are more volatile on an intra-day basis than others. Knowing a contract’s volatility profile is key to finding the right market to trade.

Contract Size

Many short-term traders don’t have deep pockets. This is particularly the case for traders who are just starting out. This can pose a serious limitation on one’s trading style. For example, most traders could neither afford the margins nor potential drawdowns to hold an E-Mini contract overnight for a swing trade.

But there are contracts that offer standard, mini, and micro exposures, reducing the dollar value per contract, and widening the range of possible trading approaches for customers with smaller levels of capital. Contract size matters depending on your trading strategy.

And the smaller the contract, the wider the range of trading strategies available to you.

Trading Hours

A futures contract is most active when the largest number of buyers and sellers are engaging the market. Since intraday traders rely on price movement to seek profit, trading hours matter a lot. With that said, it makes sense for you to choose a commodity that works within your own personal trading hours.

For instance, a trader in Australia or even India might find it hard to day-trade the ES on a daily basis due to the time zone. Likewise, it may be difficult for a US trader to trade various Asian or European markets during their most active hours.

The Bottom Line

So, what are the “best” futures markets to trade in 2022? There are plenty of them listed above. Select them based on the context of your trading approach, your time-frame, your capital resources and limitations, and most importantly, your risk tolerance. Happy New Year!

Please be advised that trading futures and options involves a substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. This matter is intended as a solicitation to trade.

Customers choosing to trade Bitcoin futures should consider additional significant risks including, but not limited to: (a) Bitcoin futures contracts have not previously traded on a U.S.-regulated futures exchange and as such, there is no futures trading history in this product; (b) The price of the underlying Bitcoin and the indexes on which the futures contracts are based are highly volatile and unpredictable based on many factors; (c) Since a limited number of futures commissions merchants may offer trading in the Bitcoin futures contracts, there might be limited volume that might impact market efficiencies and price movements; and (d) The risk of loss can be substantial and could result in a customer losing more than the initial or maintenance margin requirement. As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. See the link below from the National Futures Association for more information.

https://www.nfa.futures.org/investors/investor-advisory.html

Additionally, the Commodity Futures Trading Commission (“CFTC”) has made available a Virtual Currency Resource Web Page designed to educate and inform the public about this topic and its risks. See the link below for further information from the CFTC.