The question of all questions in trading is whether entries are really the most important aspect of a profitable trading method. And if not, what is!? It is very difficult to understand, especially in the beginning, that entries are just a way to get into the markets and that they have little correlation to the final outcome of your trades.

We want to take a closer look at the components of a trade, how your trading method fits in and what really makes a difference in your trading. Hereby, we will highlight the role of entries and how other concepts influence your trades.

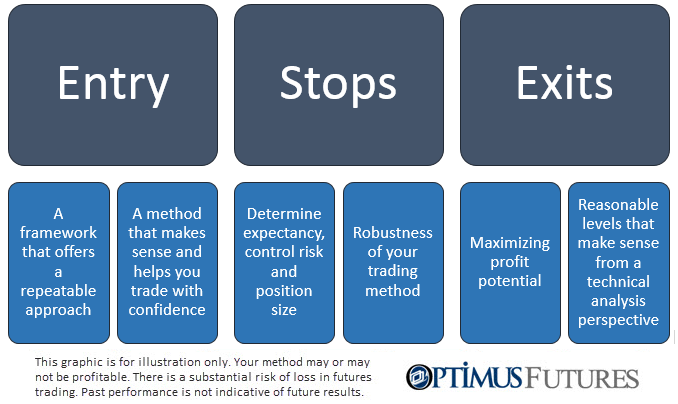

The role of entries

The role of an entry is to provide a repeatable approach that allows you to identify high probability trade scenarios where you believe, or have verified, that you have an edge over the long term by eliminating subjectivity. Finding a trading method that makes sense to you and where you can execute entry orders with confidence is very important and this is one of the most important roles for entries in trading.

This is usually in sharp contrast to how most traders approach the market where they blindly follow the instructions they have read somewhere on the internet. Following entry rules based on what some other trader wrote usually leads to trading without confidence which then leads to a variety of other emotional problems. Traders who lack of confidence are more likely to interfere with their trades in negative ways and they are more likely to abandon trading rules because they don’t mean a lot to them.

Why order placement is more important than entries

If a trading method does not explicitly explain the role of stop loss setting, it’s usually not worth investing your time and money in it. The way you place your stop loss defines the whole outcome of your trades. Let us explain what this means since this is typically an overlooked concept in retail trading.

Stops define the expectancy

Although you often read that trading without a stop loss is the most efficient approach, such claims are wrong. Without a stop, there is no way of defining your risk and you are not able to determine your position size. Furthermore, you can’t calculate your reward-risk ratio and, thus, can’t control the expectancy of your traders.

Stops and the end of your trade

Without a stop, your entry becomes a random price level at your chart without any context. Stops will end your trades for you and, thus, you should spend more time working on your stop placement than finding a “better” entry method.

Stops that are too close will end your trades too soon and stops that are too wide will unnecessarily reduce your expectancy. As you can see, stops carry much more weight and importance than entries alone because they are the final way to get you out of a trade.

Micro-managing – the role of trade management

Micro-managing is a common problem where traders can’t stop fiddling with their trades and move around stops, profit target or manually close trades. Often, such moves are not based on sound trading principles, but on hunches and emotional responses.

A more robust approach is to just let your trades run which means that after you have set your stop and take profit, you let price do the work and you don’t touch the trade again. It will be hard to resist the urges to “outsmart” the market by manually managing your trades, but it usually makes a big difference in a trader’s performance and it also helps establish a more stress-free approach where you can develop discipline and confidence by sticking to your rules.

Working on your trade exits

For most traders, exits play a very minor role which is a major mistake. If you are not following a thought out exit strategy, you are missing out. Many traders randomly choose their exit based on the profit they want to achieve. What then happens next is that your exit becomes a random price level at your chart that does not fit into the larger context.

Trade exits are often the missing component for most traders. A profit target that is too far will reduce your winrate when price turns ahead of your order because you were too optimistic. On the other hand, a target that is too close does not allow you to maximize your profit potential and you are potentially missing out, reducing the expectancy.

Again, an entry just gets you in the market but it is what happens afterwards that determines your profitability. Traders should avoid the entry-based mindset and should start seeing their trading system as a whole and start recognizing the importance of all individual pieces.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Placing contingent orders, such as “stop loss” or “stop-limit” orders, will not necessarily limit your losses to the intended amounts, since market conditions on the exchange where the order is placed may make it impossible to execute such orders.