After Friday’s huge price movements, many traders now face the question of how to trade a market that is trading at price levels unseen for 20+ years. Price that is trading below/above multi-decade lows and high, or below/above all-time highs and lows is often very difficult to analyze because no current reference points exist. In our opinion, it’s impossible to apply most concepts of technical analysis, such as horizontal support and resistance, moving averages or other tools that are based on historical price points.

In this article, we provide actionable and practical tips for beginner and advanced traders so that they can potentially improve their price analysis skills and make sense of chart analysis.

- GBP/USD – Below 20-year low

- GBP/JPY – Approaching the low

- EUR/GBP – Still in range

- AUD/GBP – Still in range

- GBP/CHF – Close to the lows

Extending technical concepts

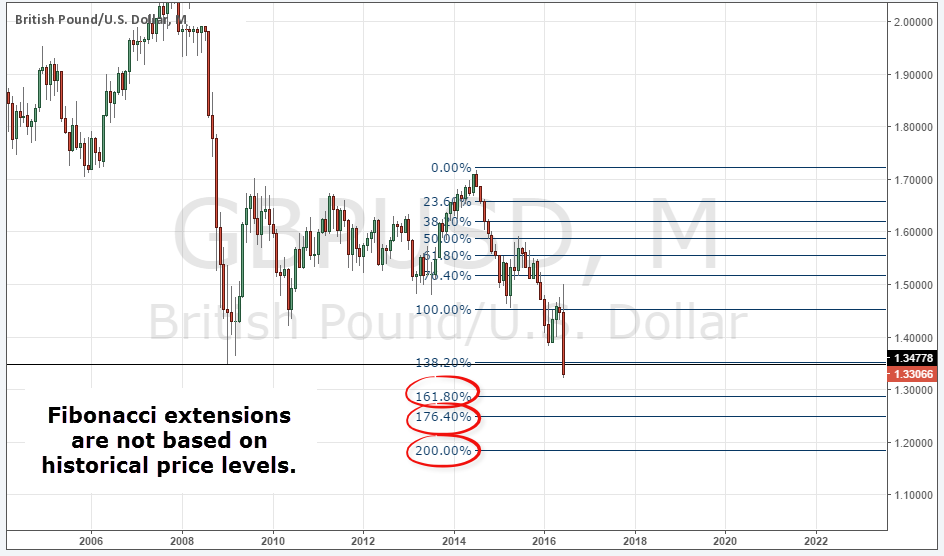

Two concepts of technical analysis are especially interesting when it comes to trading in unseen price levels. First, trend lines can be a good fit because trend lines don’t move horizontally, but they can extend well below or above historic price levels. Second, Fibonacci extensions are valid because the target Fibonacci levels are not based on historic price levels but they only take current trend and momentum information into account.

Other charting principles such as the extensions from a Head and shoulders pattern or general Elliot Wave theory fall into the same category and can be used when trying to chart a market that is trading in new price levels.

Fundamental analysis and using proxies

Of course, in times like this, market correlations can also play a major role and help traders understand and analyze price movements as well. With the recent BREXIT decision, a lot of uncertainty about the future state of the economy has come up. Investors typically shy away from uncertainty and then pile into other, “safer” investments and avoid the high risk and high volatility markets.

Especially Gold, government bonds and other so-called ‘safe-haven investments’ have experienced significant capital inflows over the past 2 trading days and rising prices. On the other hand, riskier assets such as equities, indices are markets closely linked to the British economy are selling off.

Understanding the risk dynamics and the way investors position themselves can also help traders analyze markets even though they lack historical price reference points. For example, as long as the general situation is uncertain and volatility is high, assets such as Gold and the Japanese Yen will likely rise and, subsequently, prices of GBP related markets will move lower. A trader who wants to trade the GBP/USD should, thus, closely monitor other correlated markets.

Pick a new spot – stay flexible

The final piece of advice is usually the one that can help traders avoid unnecessary mistakes and potentially improve their general approach to trading.

The markets are the same now as they were five or ten years ago because they keep changing-just like they did then. – Ed Seykota

Although we can agree that the recent BREXIT referendum has caused a lot of uncertainty, extreme volatility and forced traders to think differently, this is not going to be the end. Markets are always undergoing changes and challenging times are coming up frequently to any type of trader, whether experienced or a

Adopting and adjusting your trading approach is a key characteristic of every professional trader. Here are a few points you can consider when you are unsure or doubting your markets and price behavior:

1) Rotating your instruments

Traders should not be narrow-minded when it comes to market selection. If you have been only trading a few selected markets, maybe it’s time to change things up and look somewhere else. Rotating the markets you trade based on the market environment is a key principle that many professionals follow. for example, if you traded stock index futures, try the treasuries, and if you traded the GBP/USD Forex pair, you may consider looking at the JPY/USD.

2) Changing timeframes

Especially lower timeframe day traders are probably better off changing to the higher timeframes where the erratic volatility is not having the same impact. The same works in the other direction as well when volatility is low: higher timeframe traders are often better off moving to a lower timeframe when volatility and momentum are drying off.

3) Sit it out

Most traders don’t consider the last option often enough. Standing aside and not taking a trade is a valid option and you don’t (and shouldn’t) be in the markets at all times. If you are uncertain about the market, the validity of your edge or can’t make sense of the charts, you can simply wait for some time until you feel comfortable again.

There is a substantial risk of loss in futures and forex trading. Past performance is not indicative of future results.