Welcome to this tutorial on how to create and execute a momentum trading plan for futures!

Momentum trading is a popular technique where traders purchase futures contracts that display positive momentum and sell contracts that show negative momentum. In this tutorial, we will guide you on how to create and implement a successful momentum trading strategy for futures.

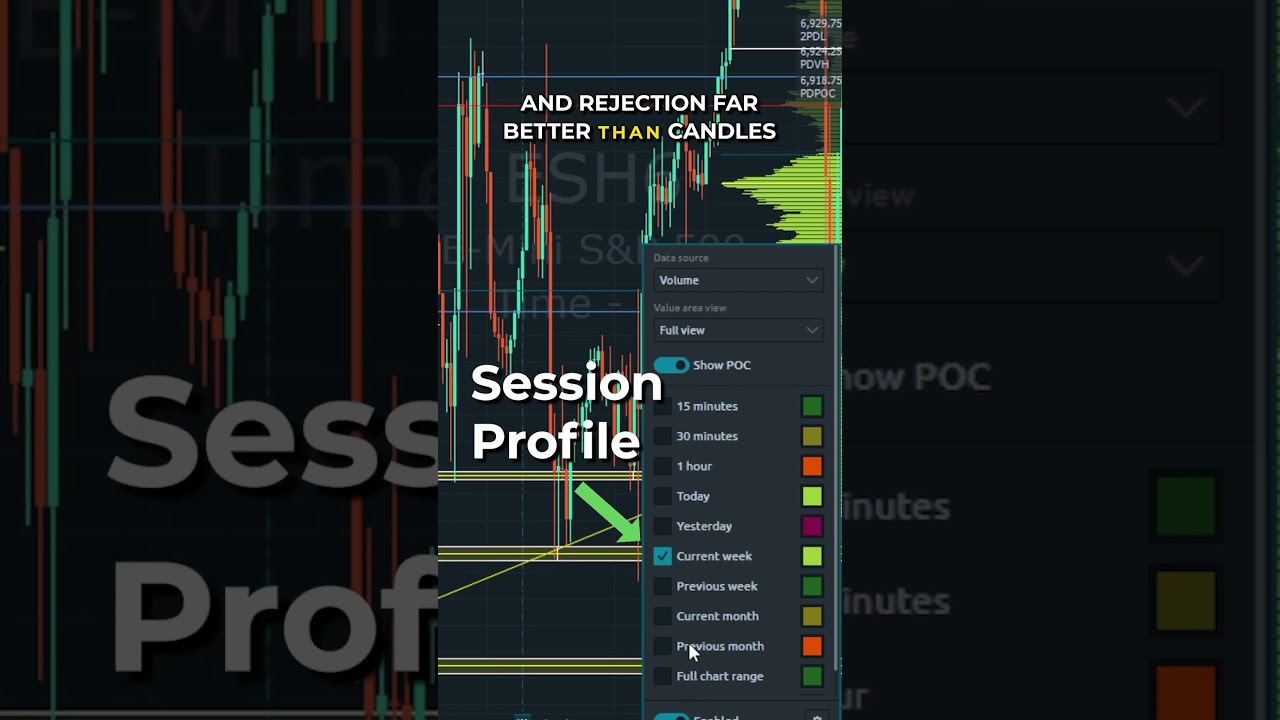

To begin, you must identify futures contracts that demonstrate momentum. You can achieve this by examining factors such as the contract’s price, trading volume, and open interest. Additionally, you can utilize technical analysis tools such as RSI and MACD to identify momentum.

Once you have identified a futures contract that exhibits momentum, you must develop a trading strategy that aligns with your goals and risk tolerance. This may involve implementing stop-loss orders to minimize losses and taking profits when a contract reaches a predetermined target price.

It is also important to regularly monitor your trading strategy and make adjustments based on changing market conditions.

_______________________________________________________________________________________________

Want to learn more about Optimus Futures? Visit our website: http://www.optimusfutures.com/

Our commissions, margins, and pricing: https://optimusfutures.com/Futures-Tr…

Open an account with us today! https://optimusfutures.com/Futures-Co…

Check out our community forum: https://community.optimusfutures.com/

Please don’t forget to like the video, comment, and subscribe!

THANKS FOR WATCHING!

________________________________________________________________________________________________

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. When considering technical analysis, please remember educational charts are presented with the benefit of hindsight. Market conditions are always evolving, and technical trading theories and approaches may not always work as intended.

#MomentumTrading #tradingstrategy #tradingmarkets