This article on Eurodollar Futures is the opinion of Optimus Futures.

Inflation, interest rates, and the state of the economy have dominated the headlines on Wall Street in 2022. And while you can play inflation and interest rates in several ways, Eurodollar is a unique option different from currencies and treasuries.

In fact, Eurodollar futures are the world’s most-traded futures contract.

Today we’ll dive deeply into Eurodollar futures and show you why this is one of the most exciting markets on the planet.

What Is A Eurodollar

The Eurodollar is a U.S. dollar deposited in commercial banks outside the U.S. Consequently; this puts them outside the Federal Reserve’s jurisdiction. These aren’t specific to Europe and refers to any U.S. dollar deposits in foreign banks, whether they’re in Asia or Europe.

Let’s say someone deposits $100,000 USD in Deutsche Bank in Frankfurt. This would be considered a Eurodollar.

As we all know, the U.S. dollar is the world’s most dominant currency for global trade, exchange, and finance. And thus, Eurodollar plays a significant role in the global capital markets.

Eurodollars allow businesses to transact in the U.S. dollar, avoiding local currencies and the associated risks.

Because Eurodollars fall outside the oversight of the Federal Reserve, foreign banks holding Eurodollars aren’t subject to the costs associated with regulation. This allows them to offer loans at lower rates and higher interest rates on deposits.

It goes without saying; that the Eurodollar shouldn’t be confused with the EUR/USD currency. (6E Futures Contract)

History Behind The Eurodollar

A significant amount of the world’s international trade is invoiced and must be paid with dollars. The Eurodollar market dates back 50 years. After WW II, the U.S. provided funds to Europe to help rebuild the continent as part of the Marshall Plan, which led to a massive spike in U.S. dollars circulating overseas.

Russia was a big driver for the Eurodollar. Its massive exports of gold led it to become a dominant player in global markets. Yet, it feared that they might be seized if it left U.S. dollars in U.S. banks.

Consequently, they pushed for their U.S. dollars to be deposited in their own banks and elsewhere.

Today, the Eurodollar market has evolved into the world’s largest market for short-term funds. Additionally, other currencies now have similar products from Japan to Europe.

What Are Eurodollar Futures

At its core, a Eurodollar futures contract is a time deposit that is stored in banks outside of the U.S. that are denominated in U.S. dollars.

Eurodollar futures at the CME Group are based on the three-month ICE LIBOR underlying rate. ICE LIBOR refers to the London-Inter-Bank Offer Rate. The LIBOR is the rate at which large banks in London are willing to lend money to themselves. The LIBOR has become the premier short-term interest rate in the European market.

Eurodollar futures contracts attract several market participants, including banks, proprietary trading firms, and commercial businesses to hedge funds.

The futures contract is settled in cash. In other words, there is “no delivery.” And they expire on the second business day that precedes the third Wednesday of each contract month.

Furthermore, they are listed under the March quarterly cycle for 40 consecutive quarters, plus four serial contracts at the front end of the curve.

Eurodollar Futures Contract Specs (GE)

| Exchange | CME Group |

| Contract Size | $1 million |

| Minimum Tick Size and Value | 0.0025, worth $6.25 in the epiring front-month contract, and 0.0005 worth $12.50 in all 40 quarterly expirations |

| Trading Times | Eurodollar futures trade electronically on the CME Globex from 6 pm ET until 5 pm ET the following afternoon, Sunday through Thursday |

| Principal Trading Months | March, June, September, and December. |

Catalysts That Impact Eurodollar Futures

The Federal Reserve has the power to manipulate interest rates through its policy actions. Therefore, it pays to follow the FOMC meetings and policy decisions.

Traders will utilize Eurodollar futures to speculate on short-term interest rates.

Furthermore, big banks will utilize them to hedge against interest rate/yield curve risks. Corporations may use it to lock the interest rate on funds they plan to borrow, at today’s levels.

The Biggest Show On Earth

While the mainstream media tends to focus more on equities than anything else. Eurodollar futures see more action than the S&P 500 futures.

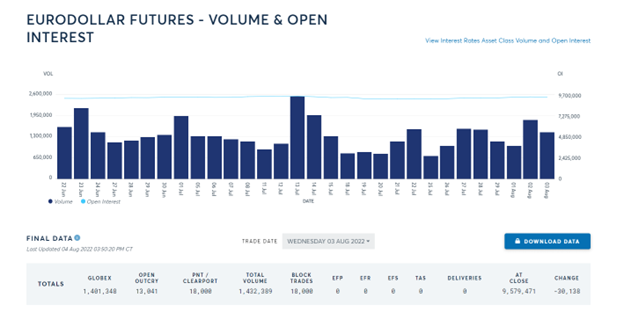

Source: CME Group

Source: CME Group

Eurodollar futures can have as much action as the S&P 500 futures contract on any given day and often sees more volume.

And while traders often gauge the state of the overall markets by what’s happening in the S&P 500, the smart money will follow the Eurodollar market to capture insight into global capital flows, the demand for credit, and interest rate expectations.

Breaking Down A Eurodollar Futures Trade

Let’s say a trader buys one Eurodollar futures contract at $97, which goes up to $97.05. That means a LIBOR change from 5.00% to 4.95%.

Now in terms of PnL, one basis point equals $25 per contract, which means that the trader made a $125 profit. To derive the profits, we multiplied 5 basis points x $25 per contract.

Advantages of Trading Eurodollar Futures

First and foremost, liquidity. As mentioned above, it’s not unusual for Eurodollar futures to trade greater volume than S&P 500 futures and 30-Year Treasury Bond futures.

Furthermore, Eurodollar futures have been around now for more than 40 years, making it one of the most established and respected products to trade.

Disadvantages of Trading Eurodollar Futures

It’s been that “the smart money” trades the interest rate market. Unless you are well-versed with interest rates and yield curves, then you may struggle to find an edge in this market.

You also must be actively following geopolitics. For example, trade wars and imposed tariffs could send shockwaves to this futures market. Therefore, being a student of the global economy is essential if you want to succeed in trading Eurodollar futures.

Bottom Line

Inflation, the Fed, the economy, and rising interest rates have been the hot topic of 2022. Eurodollar futures give traders the opportunity to speculate on interest rate moves.

It represents the 3-month LIBOR for a deposit value of $1 million, held in banks outside the U.S.

If you’d like to like to learn more about trading Eurodollar futures then click here for our free futures trading platform.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.