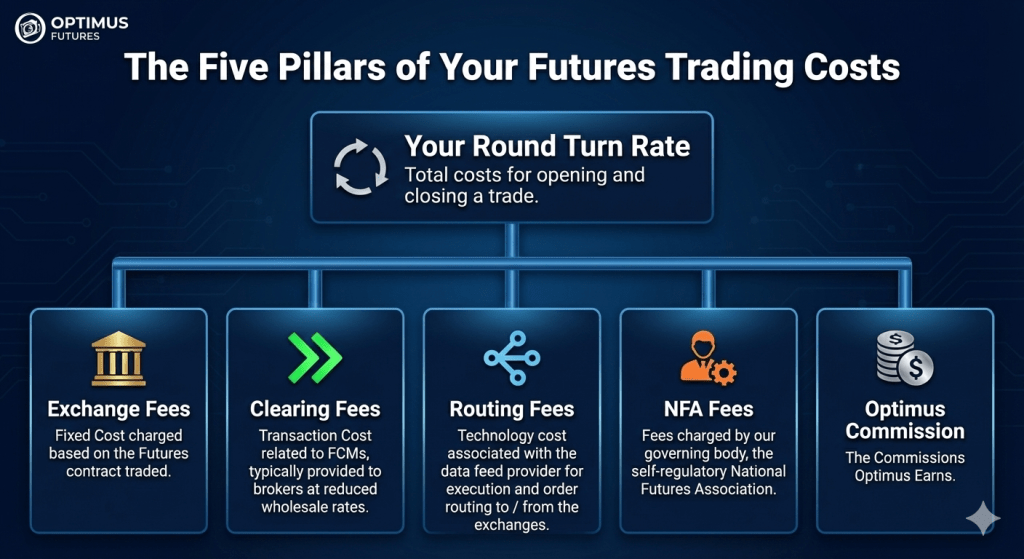

Futures trading commissions are the total transaction costs paid to execute a trade and consist of four primary components: Brokerage Fees, Exchange Fees, Clearing Fees, and NFA Regulatory Fees. Unlike stocks, which may be “commission-free,” futures incur non-negotiable fees set by exchanges (like the CME) and regulators.

What are the Different Futures Trading Commission Components?

Brokerage Commission: This is the only fee your broker controls. At Optimus Futures, this can be as low as $0.25 per side for micros, depending on volume.

Exchange Execution Fees: These are mandatory fees charged by the exchange (e.g., CME Group) to match your trade. They vary by contract—for example, an E-mini S&P 500 contract has a different fee than a Micro E-mini. Varies over time. Typically, CME increases those based on popularity.

The CME provides this tool to find the rate for the Futures or Commodities you are trading: https://www.cmegroup.com/company/clearing-fees/fee-finder.html

NFA Assessment Fee: The National Futures Association (NFA) charges a flat regulatory fee of $0.02 per side on all futures transactions to fund industry oversight. (NFA fees may vary over time.

Clearing Fees: These are pass-through costs paid to the Futures Commission Merchant (FCM) to process.

Routing Fee: A technology fee passed for routing to the exchnages. (Rithmic, CQG, Plus500, etc).

International Exchange Fee: This fee may apply when trading on an international exchange where the clearing FCM lacks a membership seat and employs an alternative clearing FCM that possesses a membership seat.

It is important to realize that the actual brokerage commission typically accounts for only 20%-30% of your total execution cost; the remaining 70%-80% is comprised of the essential fees required to reach the exchange matching engine.

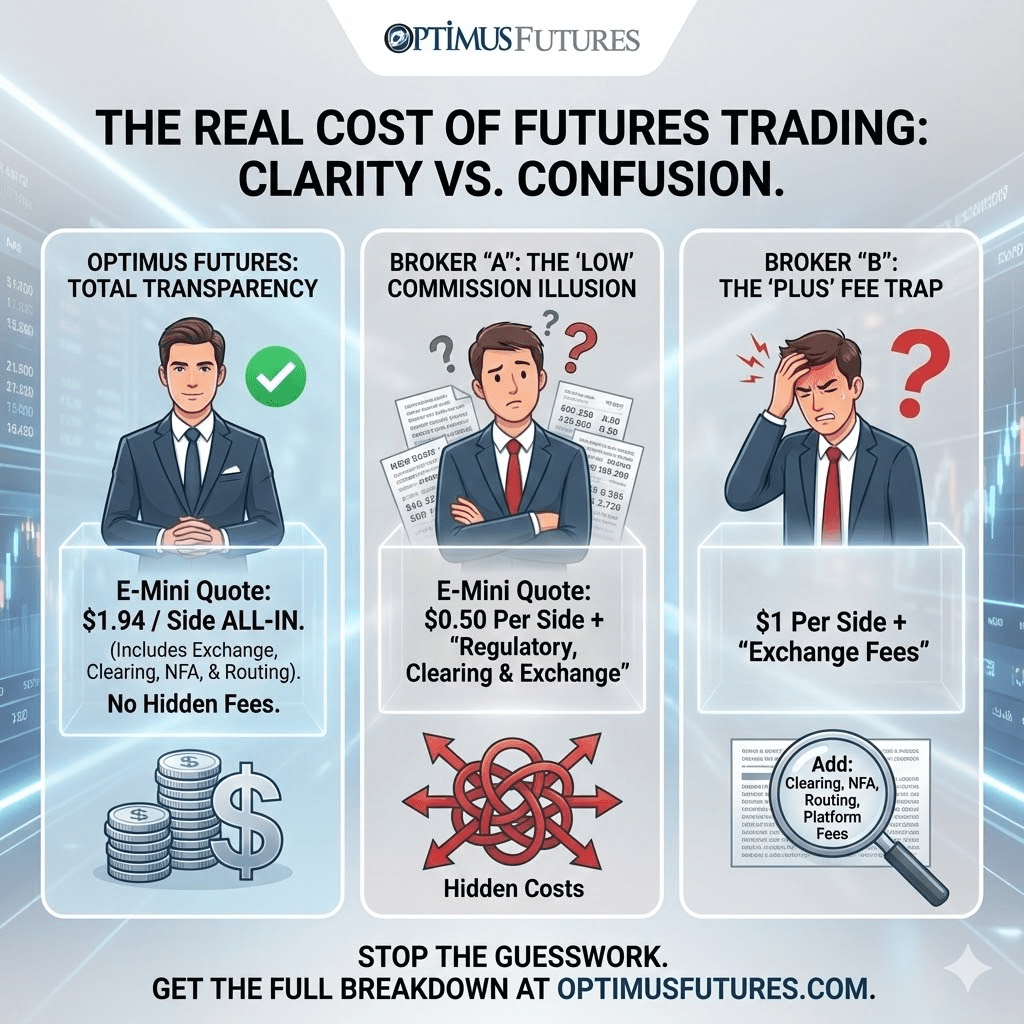

By understanding the full breakdown above, you can move past generic “low commission” headlines and gain a precise understanding of your all-in rate per contract, ensuring there are no surprises on your statement, regardless of your trading volume or platform setup.

Clear Breakdown of Your Commission Costs

For those of you who are confused by all these transaction costs and uncertain about how they relate to your personal trading preferences, please take a look at our all-new Futures Trading Commission Rates page. We built this page because we found many traders who are tired of not knowing exactly how much their brokers charge them. The diagram below shows how the statements break down the fees.

Are the Commissions and Fees on Micro and E-Minis the same?

| Fee Component | E-mini Futures (ES, NQ, CL, GC) | Micro Futures (MES, MNQ, MCL, MGC) |

| Exchange Fee | Higher (Set by the Exchange) | Lower (Discounted for Micros) |

| Clearing Fee | Standard Rate | Reduced Rate |

| NFA Fee | $0.02 per side | $0.02 per side |

| Brokerage Commission | Scaled based on volume | Optimized for small retail accounts |

| All-In Execution Cost | Lower per unit of risk | Higher per unit of risk |

The “10-to-1″ Math: What It Means in Your Account?

Since it requires ten Micro contracts, or MES, to make one E-mini contract, or ES, the total cost is not commonly considered in retail trading.

The Efficiency Gap Strategy: Employ Micros for effective risk management and scale into positions. When your account gets to the point where you are trading 10+ Micros on a consistent basis, it becomes more prudent to trade one E-mini contract.

Optimus has a sliding scale that allows you to be more aggressive when necessary, without affecting your P&L the way a fixed commission would.

Once you discover the costs that apply to your customized trading needs, the next challenge is communicating that information to your broker. For example, how do you know what you will pay if you want to “Trade the ES on average 10 times a day on Tradingview powered by CQG with 50% Margins”-Simply ask!

Request a Futures Commissions Quote

Simply Request A Quote and answer all the questions to the best of your knowledge, and we will provide you with an EXACT rate! No long conversation or sales pitch necessary. Upon submission, we will have all the information we need to provide your personal quote.

Optimus Futures: Commissions & Execution FAQ

Q: What is the difference between “Brokerage Commissions” and “All-In” futures rates?

A: At Optimus Futures, we distinguish between the two for complete transparency. Brokerage commissions are the fees paid to the broker for service and support, typically making up only about 20% of your total cost. “All-In” rates include the entire stack of transaction costs: Exchange fees (CME/CBOT), Clearing fees (FCM), NFA regulatory fees, and Technology/Order Routing fees (like Rithmic or CQG). Always ask for an “All-In” quote to avoid statement surprises.

Q: Why does my data feed choice (Rithmic vs. CQG) affect my trading costs?

A: Data feeds are part of your Execution/Order Routing fees. Different “plumbing” has different costs. Scalpers often prefer Rithmic for its raw, unfiltered speed and sub-millisecond internal processing, while CQG is known for its global stability and co-located servers. The routing fee is the “toll” you pay to use these professional highways to reach the exchange matching engine.

Q: Can I lower my futures trading costs by increasing my volume?

A: Yes. High-volume day traders and scalpers may qualify for tiered commission structures.

Q: Do I have to pay a platform “seat fee” to get professional order flow tools?

A: Not at Optimus Futures. While platforms like Quantower often charge a $70/month license fee for premium features, our version, Optimus Flow, provides that same professional engine—including the price ladder (DOM), footprint charts, and volume profile—with no monthly license fee for funded clients. This eliminates a major fixed cost for retail day traders.

Q: How do day trading margins affect the commissions I pay?

A: While margins and commissions are separate, they are both part of your “cost of doing business.” Low day-trading margins (like $50 for MES) allow for high leverage, but it’s important to remember that commissions are charged per contract. If you trade a high volume of Micro contracts due to low margins, your total commission spend as a percentage of your account may be higher than a single Standard contract.

Q: What are CME “Non-Member” fees, and why do they appear on my statement?

A: The exchange (CME Group) charges different rates based on your membership status. Most retail traders are “Non-Members” and pay the standard exchange fee. At Optimus, we break down these logic-based costs for you up front so you understand exactly what the exchange is charging versus what the broker is earning.