This trading week, all eyes will be on Thursday’s BREXIT referendum and financial players and investors from all around the world will closely watch the financial markets. We may see a major impact on price behavior across multiple asset classes due to the BREXIT poll, before and after the actual vote on the 23rd, when investors and traders position themselves. The opinions below are of Optimus Futures, LLC and are shared for your convenience and do not constitute a trading advice. We encourage you to read the note we have placed in our forum addressing the issues that may be associated with “Brexit” and trading around this period. Please Click here: Preparing for Brexit

What is BREXIT?

BREXIT stands for “British Exit” and it means that Britain is considering and voting on leaving the European Union. The reason behind the poll is that many British people believe that it will be better for them to leave the EU because the benefits they are getting from being a member are less than the problems and burdens that come with an EU membership. The economic problems of some member states along with other political and geopolitical uncertainty are the main reasons for the BREXIT referendum.

What to expect as a trader

An increase in volatility is a high likelihood and when we take a look at the VIX (measure of volatility) later, we can already see the increase in short-term volatility. During the days leading up to the vote, it’s likely to see whipsawing behavior as markets are especially vulnerable to any related news or story that hit the wire, regardless of their actual meaning.

The short-term volatility is usually not driven by rational thoughts and facts, but purely emotional nature. Uncertainty is a major influencing factor here since no one can really foresee the actual consequences a ‘remain’ or a ‘leave’ will have.

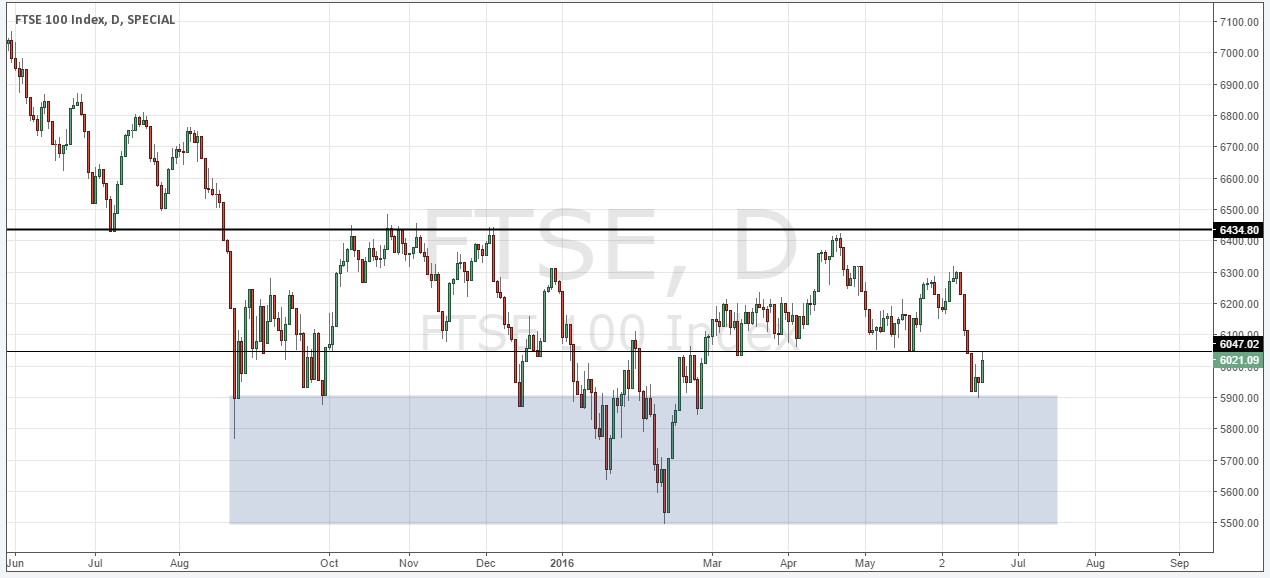

FTSE – Downside momentum

A “Leave” vote would probably cause a sharp fall in share prices. On the other hand, a “Remain” result won’t necessarily lead to optimism and rising prices as the consequences are unknown.

The FTSE shows that over the past 10 days, downside momentum was much larger and bearish candles were larger in size and magnitude. At the end of last week, price stopped the selloff and has been trading higher slightly due to some supportive news; the recovery will also be visible when we take a look at other asset classes and also bookmakers report that the odds for a “Remain” have increased.

GBP/JPY Analysis

Interesting is the development in the Forex markets as well. Charting the British Pound against the currency Japanese Yen shows the clear downtrend nicely. The uncertainty weighs heavily on the Pound and the strength of the Yen have offered selloff potential over the past months. Recently, the GBP/JPY showed a small recovery, similarly to what we saw on the FTSE.

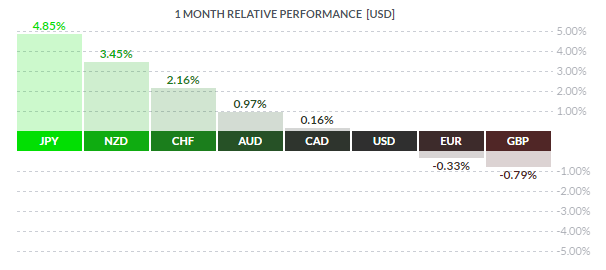

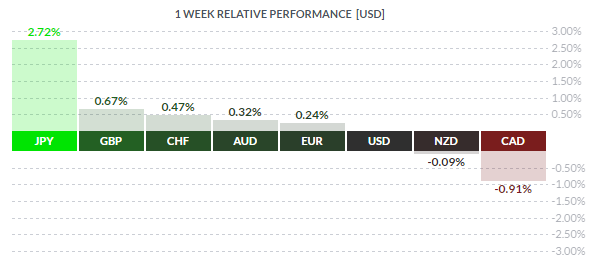

When we look at relative currency performance (measured against the USD), we can see the Pound as the clear loser over the past month. This doesn’t come as a surprise considering the uncertainty of the BREXIT referendum and the consequences.

Gold and the Brexit

Charting Gold against the FTSE also confirms our previous findings. Gold in green has rallied lately while the FTSE in blue has dropped. The correlation at the bottom is highly negative which means that when the FTSE falls, Gold rallies; however, correlation doesn’t equal causation.

In certain times of uncertainty, investors may flock to Gold as a safer investment opportunity and the BREXIT situation weighs heavily on the risk appetite of investors.

VIX spike – Uncertainty high

Finally, the spike in the VIX shows the same picture. Just 4 trading days away from the BREXIT poll, the VIX is increased substantially and reached new highs for the last few months. Although there seems to be some type of a relief rally over the past few days, volatility , again, may increase.

The currency performance from last week shows that the Pound was able to stop the massive sell off but you can expect a lot of up and down going into the new week. The most common trading recommendations wherever you look suggest staying away from any GBP related Forex pairs and also safe haven investments such as Gold and other currencies are likely to experience major fluctuations. The BREXIT referendum is a very rare event and even professional traders (from our research) such as hedge funds are favoring a cash position without any direct exposure to the BREXIT.

There is a substantial risk of loss in Forex and Futures trading. Past performance is not indicative of future results.

References

Relative Forex performance: finviz.com