This article on How To Trade Different Futures Markets is the opinion of Optimus Futures.

Would you drive a car blindfolded?

While the question might sound silly, you’d be surprised to hear that many traders will ignore vital information which is similar to approaching the market blindfolded.

For example, some traders avoid fundamentals and event catalysts because they believe that price action alone will reveal everything they need to know.

Others focus on the fundamentals, believing that the underlying facts will drive price action.

What about the futures market? Can you trade soybeans the same way you would trade gold futures? Or are there different dynamics you should consider across different market segments?

It may seem reasonable that gold and silver might hold similarities, but cattle and copper probably don’t have much in common. That may or may not be true though.

While consistent trading approaches are important, that doesn’t mean we should ignore critical differences between products.

In this post, we’ll look at both sides of the argument and try to come up with a reasonable answer to the question:

Can You Trade All Futures Markets The Same?

In order to break our bad habits, let’s first look at why some would think it’s possible to approach all markets the same way.

Many traders assume you can trade any futures product based on price action.

And while it’s true that you can set up a trading plan based on areas of support and resistance using technical analysis, one element that makes it difficult to accomplish this is getting a read or firm understanding of market depth and volume.

For example, in the equities markets, on August 16th, 2022, shares of Bed Bath & Beyond soared by as much as 29%. Furthermore, this stock traded 387 million shares compared to its average of only 17 million shares.

The volume during this period was roughly more than 22x its normal. At least during this period, the data showed that there was massive volume behind the underlying stock price move.

Now, looking to the futures markets, the day before, natural gas futures had a strong move upward. The September contract moved from $8.81 to $9.33, representing a 5.9% gain. The difference between this move and the Bed Bath & Beyond example from above?

Natural Gas futures during this period didn’t show any discernible or unusual trading volume.

While significant volume changes can and do appear from time to time in the futures markets, as occurred with Natural Gas on June 13, 2022, the divergence from the averages typically isn’t as pronounced as what is more frequently seen with stock trading. Futures volume changes are also typically not as correlated to price activity as is often seen with stock moves.

So while trading levels can work, if one is considering only this factor, they would be foolishly missing the volume element. Doing this can make it much more difficult to properly assess current price action.

Now, what if you believed the fundamentals are what drove the price action? Could you look at supply and demand factors to make trading decisions?

Sure. You could look at upcoming catalysts, study what analysts expect, and then compare them to the actual results and price behavior observed in the market.

Say for example, the EIA releases a petroleum status report on Wednesdays. This hypothetical report shows the inventory status of crude oil, gasoline, and distillate inventories.

Typically, one would believe that a build in crude supply is seen as bearish to price action, while a draw may be considered bullish. But how do you build a trading plan around that? Where do you set your stops and profit targets? It’s difficult to make this assessment without all of the appropriate market data in view.

In Optimus’ experience, the best futures traders will utilize all the information they have at their disposal—technical and fundamental.

Although we believe the statement above to be true, it still doesn’t mean you can trade gold futures the same way you would trade corn futures.

And here’s why…

First, the size of the contracts are different.

For example, one gold futures contract leverages 100 troy ounces of gold. In contrast, one futures contract in crude oil leverages 1,000 barrels of oil.

In other words, in this example, a $1 move in gold futures equals +/- $100, while a $1 move in crude oil futures is +/- is $1,000.

The leverage dynamics due to the underlying contract sizing and effects of leverage make it difficult to make an apples-to-apples comparison.

Furthermore, the margin requirements will vary across futures products. For example, as of the time of this writing, the day trading margin for a micro silver contract is approximately $200, while a micro gold futures contract has an approximate day trading margin of $50.

Margins are based on volatility and are always being adjusted. Another factor leading to margin adjustment is the size of the futures contract. You can read more about the current margin requirements here.

Not only are the contract sizes and margin requirements different and continuously changing. But not all futures contracts have the same level of volume or market depth.

That’s one reason why Optimus recommends that traders transact primarily within the most liquid futures contracts.

The bid/ask spread generally will be much wider when you’re trading illiquid futures. This means you’ll also likely have to deal with slippage, which can make it harder for you to break even on your trade.

By focusing on the most liquid futures contracts, you give yourself a better opportunity to potentially profit without having to pay more to the market in the form of price slippage upon entry and exit due to a lack of liquidity.

Lastly, it takes time to familiarize yourself with how a specific futures product moves.

You see, some futures products will move based on seasonal trends. Others jump or fall based on specific catalysts.

Furthermore, some futures products, like currencies, rely on economic news, while others might not be impacted or may only be impacted by certain events at certain times.

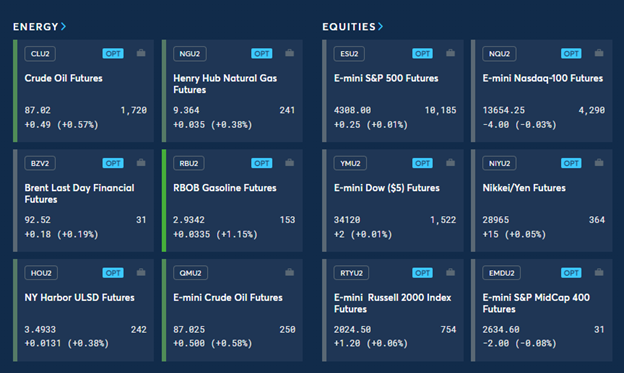

And, of course, not all futures products trade with the same price action. For example, crude oil futures increased +0.57% in the grid below, while RBOB gasoline futures moved +1.15%.

Source: CME Group

It takes time to understand the different nuances of each product as well as the various market data correlations. Some products are highly volatile, while others seem like they barely move. Often this can occur with little to no readily apparent reason.

As an example, historically speaking, Bitcoin futures have moved a lot differently than 30-Year Treasury futures – this does not mean that this will always hold however. Markets are highly unpredictable and a strong understanding of all factors which may impact price is warranted before proceeding with a trade.

Bottom Line

Some traders believe they can rely on technical analysis to trade any futures product. While technical analysis is important, it’s only a fraction of the information needed to trade them.

Ignoring the fundamentals and outlooks for different markets can leave you unprepared for catalysts that move asset prices.

Different products have their own volatility, supply and demand dynamics, and fundamentals. As well as liquidity. Let alone margin requirements and leverage. Market sentiment can also play a large wild card factor and create unanticipated price action.

For this reason, before trading in the actual markets, it is always wise to test trading theories in a demo environment. If you’d like to see how futures trade and place simulated orders based on your unique market approach, click here to download a demo of our trading platform and see for yourself.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.