Read the Chart and do not Trade your P & L

The reason many traders fail when it comes to exiting trades is because they focus solely on the money they can potentially lose or win instead of making market-related decisions. This is also called “trading your P&L,” where traders completely detach themselves from their charts and market context and respond only to their account balance and the unrealized profits on their futures trading platform. (P & L stands for Profit and Loss)

Improving Profit Taking & Exiting Trades

Profit-taking or loss, or exiting trades in general, is arguably more important than entry timing because how you exit your trades determines the long-term outcome of your P&L. However, most traders don’t spend much time on developing their trade exit strategies and are often uncertain of even how to exit. This results in emotional trade management driven by impulsive decisions with no clear plan. This results in situations where natural price fluctuations looks like complete reversals, causing traders to exit their positions prematurely. Such decisions are not driven by the real price context or systematic trading plans but rather the result of emotional overreactions.

Psychological Context of Trading the P&L

Imagine yourself running. Do you think about the fact that you are moving your legs in a certain order or about your speed? The action of running comes naturally to you. If you were to become conscious of every single action when you ran, then you probably wouldn’t be able to run as efficiently. Trading has to be done in a similar manner. Thinking of each variable affecting price, whether its personal finance, news, methodologies etc., leads to indecision. It becomes a mixed bag of undetermined factors that can rarely result in profitable trading. Price always fluctuates and may not always go in your favor the minute you get in. You need to accept it as a futures trader and stop following the P&L tick by tick.

Understand Price Structure during Trends

When it comes to staying in potentially profitable trades for longer, a trader can choose from a variety of trading analysis tools. In this article, we will focus on two.

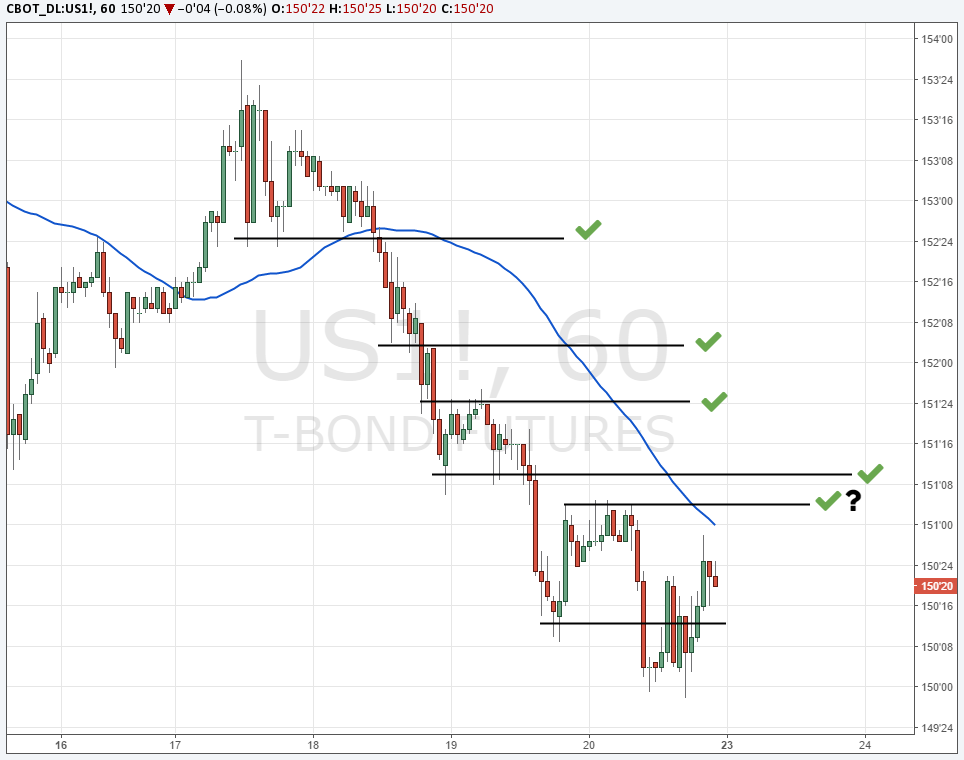

Moving averages are a very popular trading indicator, especially when it comes to riding trades in a trend-following environment. Once an entry has been identified during a trending market, a trader can use a moving average to stay in such trends. A moving average is a very objective way of letting trades run and can help reduce the emotional aspects of trading.

The only variable traders have to consider in this context is the length of the moving average. Short-term moving averages (usually below the 20-period setting) are more “erratic” and susceptible to noise, but they will also get you out of trades faster. If you are a day trader, you should use the 20-day moving average as one of your tools for price context.

Medium-term (20 – 50 period setting) and longer-term moving averages (50+ period setting) move more slowly and don’t react as quickly to changes in price. This is a better tool for swing traders. It allows you to ride long trends longer because short-term retracements don’t get you out. The slower nature means less frequent exits. There is no right or wrong when it comes to choosing an MA period, it simply boils down to a trader’s personal preferences.

Natural swing points are an alternative approach where a trader focuses on swing highs and lows. Similar to moving averages, this can only be used during trending markets. A futures trader who follows this approach looks for swing highs during a downtrend, and as long as the price keeps making lower highs, the trend is still functioning. When price breaks a previous swing high during a downtrend and suddenly starts making higher highs, a change in trend direction is likely, and a trade exit should be considered.

It’s the same for bullish trends where a trader stays in a trade as long as price makes higher lows. Once the lows are violated and price cannot make higher lows anymore, an uptrend is likely to be over. Those are the principles of the Dow Theory, which have been around for decades, and they build the foundation of trend analysis. The advantage is that a trader can respond to natural price moves on his charts and follow the market rhythm. The disadvantage is that markets often pause during trending phases, and consolidations can easily violate the swing points and signal trade exits prematurely. You may have to re-enter the markets in such cases.

The Problem of (Emotional) Trailing Stops

Although this article aims at helping traders improve their trade exiting during profitable trades, we want to spend a few moments looking at stop-loss trailing.

Stop-loss trailing is usually done to protect your profitable trades, securing unrealized profits. However, many traders quickly become emotional and revert to trading their P&L which, in this context, means that they trail their stop loss too close and end up being victims to stop-loss runs or volatility spikes.

A trader who follows the moving average or swing point approach from above can add a trailing stop loss strategy very effectively by trailing a stop loss along the moving average or moving your stop loss to the next confirmed swing point. An important concept here is that a trader never puts his stop directly at the moving average or swing point, but always adds some extra space depending on market fluctuations (some futures traders use ATR). This allows the futures trader to avoid volatility spikes and stop “hunting.”

Disclaimer: The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you.

Does P&L Analysis Matter?

Yes it does. But not on a short term basis or micro-analytical level in the middle of a trade. The P&L should always be a long-term factor in your analysis that involves assessing the size of your profits, the impact of draw-downs on your method and identifying the conditions where your P&L excelled. Watching your P&L as a factor in itself, every second of the day, and considering only the account balance, does little in helping you manage your trades effectively.

Other areas where P&L analysis can help you: Which one of your trades was most profitable? If you developed a hypothetical model, how did the P&L compare to the actual execution? How did P&L perform in lieu of news events? How does liquidity in individual futures affect your P&L strategy?

Consider how you treat your P&L analysis the next time you trade. This can be a major factor in your long-term success.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.