Bid/Ask Spread Every currency pair has a Buying Price (Offer) and a Selling Price (Bid). The difference between the two is called Spread, and it determines how fast you can exit with a profit if the market has gone your way. The Spread is a cost that is associated with each trade, and it is an important part of your trading method. For short term traders, the Spread usually has a much bigger impact because the Spread makes up the more significant portion of their profits. Longer term traders, on the other hand, often have fewer trades and they hold their trades longer – the Spread usually does not have a meaningful impact for longer term traders. Currency Spreads have to be considered together with account size, position size, and platform costs; these factors determine the cost structure for traders. Forex traders often call the Bid/Ask spread also the Pip Spread. It is very easy to see the spread on your Forex trading platform as you can compare the buying price and the selling price. The narrower the range, the better it is for you.

CPM (Commission Per Million) to reduce the Bid/Ask Spread, more experienced traders are charged Commissions per Million which represents a fixed commission. Experienced traders may, at times, choose a fixed commission structure as opposed to a wider and fluctuating Spread. This may, at times, help them lower the cost of transactions and fees. Just a clarification: the trader does not have to place one a one million Dollar trade. Instead, his commission is broken down to the fractional units of a million.

ECN Forex Broker (Electronic Communication Network) This type of trading forex model allows a Forex broker to provide a number of liquidity providers. The broker matches buyers and sellers, and the broker does not have the ability to trade against the customer.

Typically, ECN Forex Spreads are much narrower; however, there is a commission cost involved. In essence, the Forex broker links retail Forex traders with Tier 1 liquidity providers through a technology called FIX Protocols (Financial Information Exchange Protocol). The ECN Forex broker that uses ECN technology could potentially provide you with instant fills with minimal slippage during non-news trading hours.

Market Maker/Liquidity Providers (dealing desk) Market makers provide the Bid/Ask Spread for the different Forex pairs and displays them electronically on their Forex trading platforms. They stand prepared to make transactions at these prices with their customers who range from banks to retail Forex traders. In doing this, market makers provide some liquidity to the market. As counterparties to each Forex transaction, in terms of pricing, market makers must take the opposite side of your trade. In other words, whenever you sell, they must buy from you, and vice versa.

There are Tier 1 liquidity providers that are the major banks and institutions that are willing to make a price in almost any currency pair available.

Low Latency Forex Execution When you spot a trading opportunity you usually do not have much time to take advantage of it. You should be able to deliver your orders to your brokers instantly and benefit from your perceived favorable market condition. Latency measures the delay it takes for your order to get the broker, execute it and report the price back to you. In this day and age, it should be done within milliseconds and latency should be very low. Just like Spreads and commissions, Latency will affect you P&L (profit and loss) because conditions can change rapidly and get a fill on your trade too late can have meaningful impacts.

No Last Look It simply means that a Liquidity Provider (LP) can reject a trade within a given time interval. No last look means that once an LP offers a price quote, it must accept the trade on it. No Last Look appears to be more of a transparent way for execution; however, those who use the Last Look do it because they want to protect themselves from a “Stale Quote.” However, an advanced ECN should keep liquidity providers that execute well, and do not promote those who underperform. No Last Look provides the same opportunity for all participants to make a profit.

Trading Anonymity This is the case where certain avenues allow you to stay anonymous when you place your traders. This may result in a number of advantages where the trader could reduce his costs, his limit orders do not get imitated, and trading patterns are not being revealed. If you run an automated trading strategy, scalp trading for ticks, or any other short-term horizon, this is usually the preferred trading environment.

RFQ (Request For Quote) As the name suggest, it is a request for a Bid/Offer from a liquidity provider. Since Forex offers deep liquidity, those who use RFQ might have a larger size for a trade, like 5 Yards (5 Billion). Also, some less liquid OTC markets like FX Options may require special pricing.

Margin (leverage) Forex trading is a highly leveraged trading venture. What drives many small players to the Forex trading arena is the ability to leverage their capital with a much larger amount.

As an example: You can execute a currency trade with a volume of $100,000 with only $500 in capital. This is what traders mean by “broker margin” or “leverage.” Naturally, trading on leverage increases your profits, and the same time increases, by an equal amount, the level of risk you are undertaking if the markets are not going in your favor. High leverage is not always a benefit for the beginning Forex trader. The choice of leverage, whether it is [1:10]0 or [1:40]0, should depend on the trader’s experience, risk tolerance, and risk capital.

Re-Quote A re-quote is a price change that occurs between the time that the trader sends the order and when the market order cannot be filled. At that point, you can accept the newly quoted price or reject it. Although many consider re-quotes as a bad business practice, there are legitimate reasons for re-quotes, for example when the market is moving fast or when the liquidity becomes very thin.

Slippage The difference between the price you saw on the screen and your fill that you realized on your trade. Slippage can occur on ECN and Dealing Desks alike.

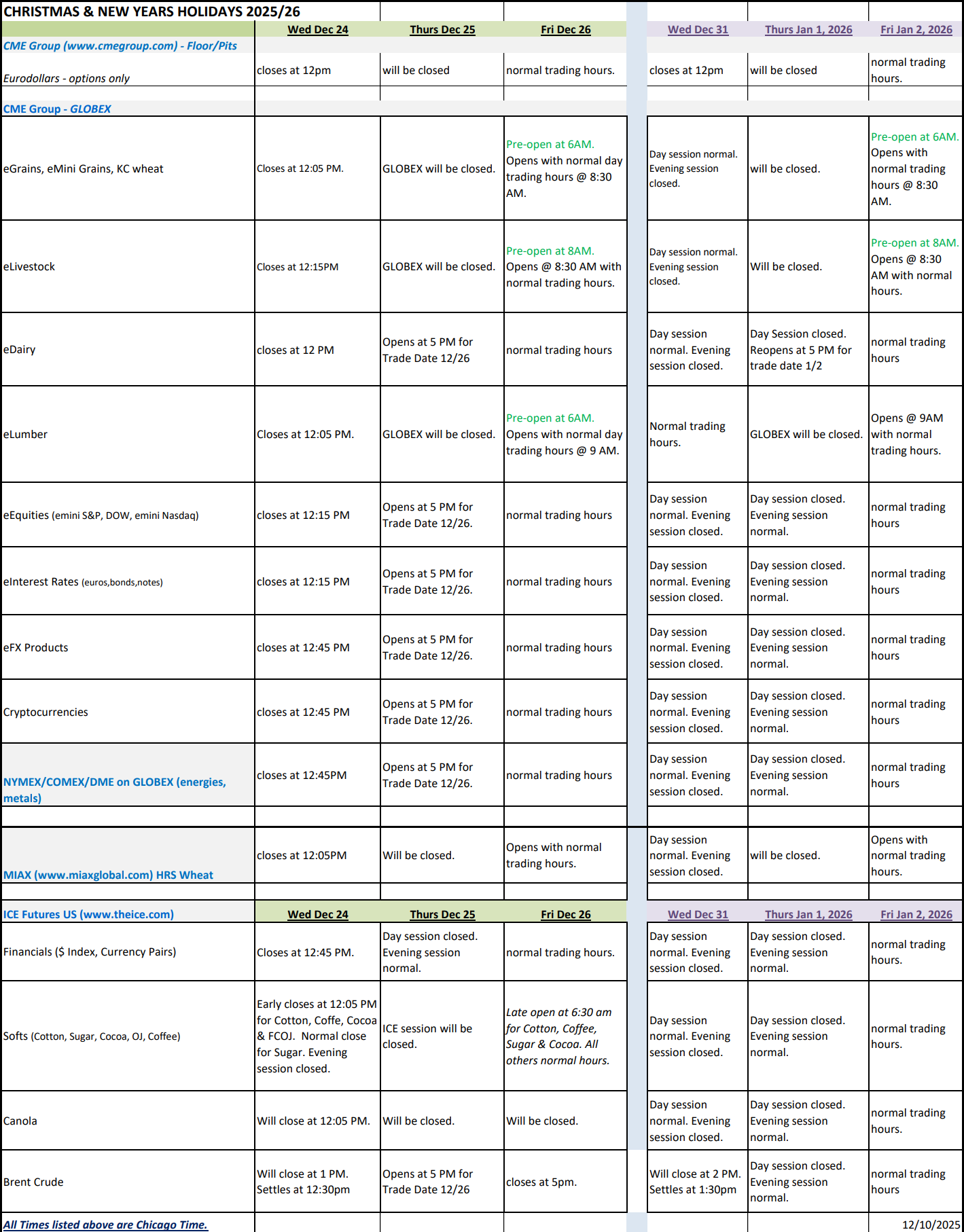

There is a substantial risk of loss in futures and Forex trading. Past Performance is not indicative of future results. Forex Trading offers are not intended to US based customers.