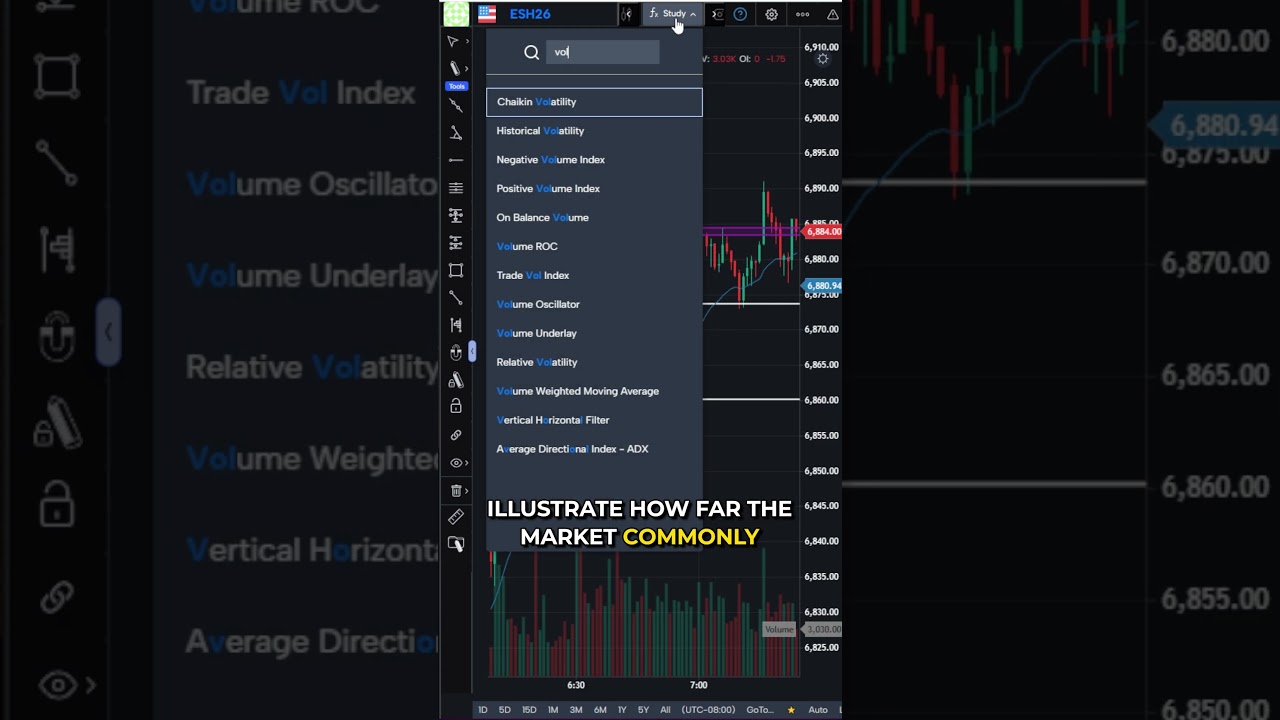

Order Flow is a complex topic made easier by Optimus Flow Footprint/Cluster charts.

This video explains how to find this common-day trading strategy, why it works, and what to look out for. This video’s intended audience is intermediate to advanced traders with a general understanding of order flow tools.

All the illustrations in this video can be viewed on our trading platform, Optimus Flow: https://optimusfutures.com/OptimusFlow.php

________________________________________________________________________________________________

Want to learn more about Optimus Futures? Visit our website: http://www.optimusfutures.com/

Our commissions, margins, and pricing: https://optimusfutures.com/Futures-Tr…

Open an account with us today! https://optimusfutures.com/Futures-Co…

Check out our community forum: https://community.optimusfutures.com/

Please don’t forget to like the video, comment, and subscribe!

THANKS FOR WATCHING!

________________________________________________________________________________________________

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. When considering technical analysis, please remember educational charts are presented with the benefit of hindsight. Market conditions are always evolving, and technical trading theories and approaches may not always work as intended.

#Daytradingfutures #Footprint #OptimusFlow