This article on Futures Trading Indicators is the opinion of Optimus Futures.

As humans, we’re always looking for answers and explanations on why things happen.

When it comes to trading everyone wants that one ‘magic bullet’ or tool that will make them successful.

They want to find the holy grail of trading indicators that turns every setup into a winner.

Unfortunately, nothing like that exists. Or if it does, it isn’t widely shared.

It’s uncomfortable not being able to explain things.

That’s why we believe so many futures traders are committed to learning and trusting their indicators.

Traders typically believe if they can find the right mix of signals, everything will change for them.

Unfortunately, they’re likely going nowhere with this attitude or approach.

Indicators are like diagnostic tests. Each reveals a different angle about the futures markets.

Yet, they are only tools to help us trade. In and of themselves they don’t create success and they aren’t a magic bullet or holy grail.

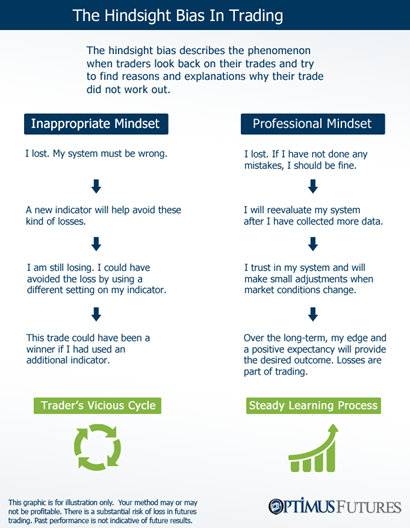

In our experience hindsight bias is a huge factor that impacts traders (see below)

Trading Is Not Scientific

Some traders don’t believe in fundamentals. They think markets aren’t rational, and news is baked into the futures price. Traders that think this way tend to focus heavily on price action.

They’ll use tools like technical analysis and indicators to help guide their trading decision-making.

While there’s no harm in that, using it exclusively can be dangerous.

More on that later.

But for now, let’s continue with how indicators can help futures traders make potentially better decisions.

Futures Trading Indicators for Entries/Exits

Indicators are used in an attempt to help traders make better entry and exit decisions.

Many futures traders apply the VWAP line to their chart. VWAP stands for the volume-weighted average price.

It takes the total dollar value of trading in the futures contract and divides it by the volume of trades. Traders will use it to measure support, resistance, and the trend.

For example, if crude oil futures are trading below the VWAP line, a trader may wait till it crosses above it before taking a long position. Or if it crosses below the VWAP line, they may use it as a signal to short futures into weakness.

Other traders will use it to gauge support.

If they are long and the market dips to the VWAP line, they may decide to add to their position. If they have no position, they wait till it gets to the VWAP line and use it as an entry.

Source: Optimus Flow

Besides VWAP, traders may throw a moving average indicator to their chart. Anything above the moving average and the trend is considered to be bullish. Anything below it, and it’s bearish.

Futures Trading Indicators Can Help You Find Extremes

Mean-reversion is a common strategy that futures day traders use effectively.

A mean-reversion trader buys futures when they’re oversold and sells them when they’re overbought.

Instead of guessing where those levels might be, they apply a Bollinger Band or other overbought/oversold indicators to their chart, which shows them a range of volatility.

If a futures contract gets to the top range of the Bollinger, they decide to short it, and the opposite is true if it’s near or below the bottom range.

As you can see, indicators and technical analysis can be powerful tools for traders. They however remain just tools to inform and guide trading behavior.

When Indicators Become Dangerous

One way futures trading indicators become dangerous is when traders take them as law.

Remember, there are no sure things in trading. Just because a futures contract is oversold doesn’t mean it can’t go any lower. Just because an indicator suggests something may happen that does not mean that it will.

As an example, during April 2020, crude oil futures declined by almost 300%, you may recall at one point they were trading at around NEGATIVE $37 per barrel.

While the futures market is often driven by supply and demand, things can go sideways when fear and greed enter the picture.

Traders who relied on technical analysis and indicators on that day were likely buying up crude oil futures. If they were doing this they likely were getting wrecked and suffering heavy losses at the time.

These traders that followed indicators failed to consider psychology and how emotions can drive prices up or down. Indicators would have been of little to no use that day.

Indicators are just one tool in your decision-making process. They can’t be the end all…be all.

But that’s just one reason why indicators can be dangerous.

Another one is that indcators can make trading even harder.

While that might sound ironic, allow us to explain. Some people get “indicator-happy.” Instead of utilizing one or two, they’ll implement 5 to 10, which can lead to confusion.

Imagine slapping seven indicators on your chart. Three point toward a bullish signal, while the other four point to a bearish or neutral signal. How can that possibly help your trading?

Being overloaded with indicators can lead to indecision or, even worse, making the wrong decision. Trading is difficult as it is. There’s no reason to over-complicate it with more indicators and tools that you don’t understand or contradict one another.

Market Conditions Change, And Some Strategies Stop Working

The best futures traders know how to make adjustments to their trading.

The markets are constantly evolving. What may have worked for one trade won’t necessarily work again – sometimes ever!

Sometimes, liquidity is pumping, and other times it dries out.

Some strategies work well in certain market conditions and don’t work well at all in others.

If you’re too invested in your indicators, you might be too stubborn to make adjustments.

For example, you’ll struggle in choppy markets if you’re trading momentum strategies. In addition, mean-reversion strategies will perform poorly in a strong, trending market.

Think about all those traders who were licking their chops when they saw crude oil go down to $0 in April 2020, and all their indicators were pointing to oversold. Would you have liked to purchase oil at $0 when it fell further and further into negative price territory?

That’s why you can’t fall in love with your indicators; they are simply tools to be evaluated when trying to make a trading decision.

Most Indicators Are A Complete Waste Of Time

Nearly all indicators are based on past information. In other words, they’re not forward-looking. Do you recall the disclosure for all financial investments “Past Performance Is Not Indicative of Future Results”? That disclosure is to warn people of the dangers of relying on hindsight to predict the future.

People often substitute indicators for due diligence.

They assume that price action will tell them everything they need to know about a trade.

However, they often overlook larger time frames to get a more holistic perspective.

Intraday futures traders who look at 1-minute or even 5-minute charts sometimes fail to look at the broader trends.

And no indicator can substitute for common sense.

Holding a position through a major news catalyst, such as jobless claims or CPI, based solely on indicators completely ignores the likelihood price will react to the news, often superseding any technicals.

For example, say crude oil is in a bearish trend based on your indicators. Every time it pops up, you decide to short it. But let’s say there is a breaking news headline of war escalating in the Middle East.

There’s a good chance that crude oil futures will shoot up. But you’d probably lose money if you kept relying on your indicators and stubbornly shorted the spike without considering other market factors prevalent and impacting price at the time.

That’s why it’s important to incorporate fundamentals and news with your indicators. Blindly following your indicators and ignoring news and fundamentals is a recipe for disaster.

The Right Mix

Relying too much on indicators can give traders false confidence and bias. It can also lead to indecision and poor decision-making. As well as confusion and a lot of wasted time.

At the end of the day, futures trading is a game of probabilities.

There is no such thing as a holy grail indicator. Some work well in certain market conditions and completely fail in others.

The best futures traders will utilize indicators to improve their decision-making and formulate trading plans.

However, they don’t live or die by their indicators.

They incorporate fundamentals, account for market psychology, and follow the news.

As traders, we need to stop searching for answers all the time. Instead, identify what’s working in the current market conditions, and pay attention to the changes happening in the market.

Done correctly, trading tools make trading more efficient.

If you’d like to discover what trading tools we have, then click here to see our completely free platform.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.