R | Trader Pro™ is a sophisticated trading platform that delivers speedy time-based execution that is measured in microseconds (millionths of second). In this review we will go over some of the features in which Futures traders tend to be quite interested.

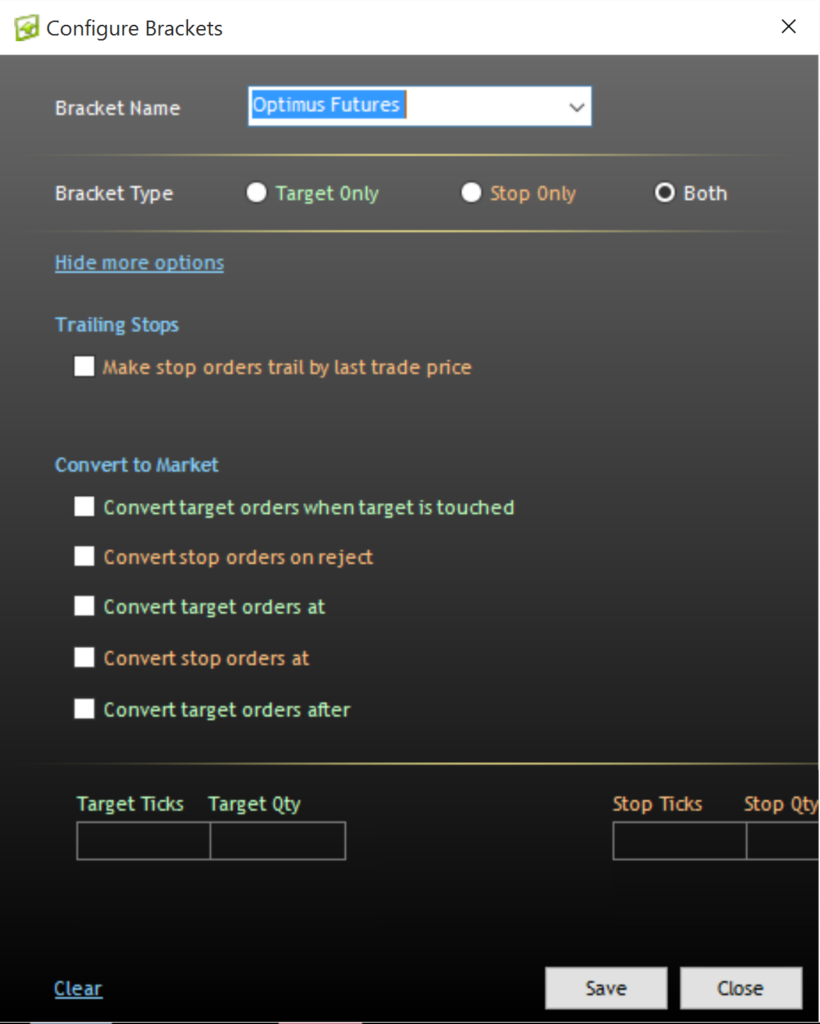

Order Execution: One of the most important features that R | Trader Pro offers is server side Bracket and OCO orders. A bracket order is an order to which a Stop-Loss order and a Profit-Target order are attached. They are OCO (order cancels order) as when one is filled or cancelled, the other is cancelled automatically. Further, you may specify the number of contracts and tick value attached to each of the orders in the OCO portion of the bracket (please refer to R | Trader Pro’s documentation for details on how to configure brackets). Above all, if your stop-loss and profit target are not met within a desired time, or if you are worried that your target price is reached but you may not be filled, R | Trader Pro provides you with the ability to have your profit and stop-loss orders converted to market orders (please see the picture below).

Stop-Loss Disclaimer: The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders

This is all conducted within the DOM of R Trader.

Although the features of R | Trader Pro are too numerous to cover in this article, keep in mind that all orders can be tracked and managed through the Recent Orders window and through the Order History window. They are essential for traders who incorporate R | API+ into their own trading programs.

- The Recent Orders window is divided into 2 sections: Working Orders and Completed Orders. You may see them one above the other or you may increase their visible size and access them as page tabs. Each section of the recent orders window permits you to view information about your orders – open orders in the working orders section and completed orders in the completed orders section. Additionally, the working orders section enables you to pull or modify specific open orders. You may sort the contents of each section by clicking on any column heading. Sorting a section of the window by specific columns enables you to group open orders by order type (Market, Limit, etc.), by symbol or to arrange them by order number or order size. Double clicking on an order shows you more of its details including the time, usually to the microsecond, at which its processing state was changed. This is particularly handy to calculate how long an order took to be processed, either by R | Trade Execution Platform™ (the Rithmic infrastructure) and/or by the exchange.

- The Order History window is the same as the Recent Orders window except that it shows information about previous trading days and it does not permit you to pull or modify open orders.

The R | Trader Pro can also be used as a visual platform to view and manage orders if you use a program you wrote that incorporates R | API+ or use other futures trading screens connected to R | Trade Execution Platform™. You can be logged in simultaneously through more than one futures trading program. Your orders will be visible and manageable through R | Trader Pro. We strongly believe that the R | Trader Pro’ Recent Orders window is one of the better windows of any futures trading platforms for order tracking.

Further Resources: