There are two widely used types of charts by futures markets participants – candlestick charts and bar charts. Candlestick charts were developed by a number of participants in Japanese rice markets in the 17th century. The form of candlestick charting and analysis that is used today took form around 1755 when a rice trader named Munehisa Honma recorded rules for rice trading, based on his observations of candlestick charts. The rules are known as the Sakata Rules and form the basis for most modern candlestick chart analysis.

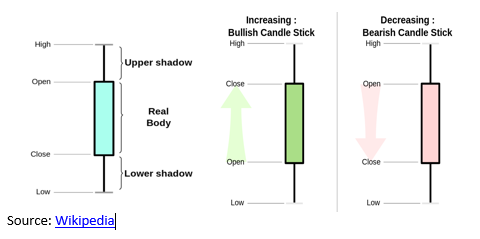

A candle contains a body and up to two shadows, each above and below the body. The body is bounded by the opening and closing price for the day (or time period used) and the shadows represent any trading above or below the opening and closing price, up to the day’s high price or down to its low. Shadows are also referred to as wicks and tails.

On days when the closing price is greater than the opening price, the body of the candle is generally colored green. On days when the closing price is lower than the opening the price the body is colored red.

There are literally dozens of candlestick chart patterns which may be used to calculate trade entries, exits and stops. We will examine three of the most popular patterns used by futures markets participants today.

[bctt tweet=”Candlestick Charting – Entries, Exits and Risk Management. $ES_F $STUDY #trading #multicharts”]Hammer

Chart created using MultiCharts. ©MultiCharts LLC, 1999-2015. All rights reserved.

A commonly cited aspect of candlestick charting is the importance of long shadows. A hammer candle marks a turning point, where a downtrend ends and uptrend begins. Throughout the day of a hammer prices have reached new lows, only to be rejected by market participants and again bought up.

A hammer is defined as occurring at the end of a downtrend and has a lower shadow that is at least twice as long as its body. Further, the body is fully contained in the upper portion of the day’s range. Generally, the longer the shadow of a hammer candle, the more reliable it is as an indicator of a change in trend.

Successful hammer patterns are usually accompanied by an increase in trading volume, signifying that market participants feel prices became too low during the day and vigorously bought the asset, which they perceived as cheap.

The June 2015 E-mini S&P 500 Index contract printed two hammer patterns in close proximity, one in late March and another on April 1, 2015. The lower shadow of the first hammer is slightly shorter, indicating some indecision and a short-lived rally. The longer shadow of the second hammer indicated more conviction on the part of buyers and led to a rally of longer duration. Both patterns coincided with trading volume above recent average levels. The bearish equivalent of a hammer is a shooting star.

Traders often use the bottom of the lower shadow of a hammer or the top of the upper shadow of a shooting star as a stop-loss level to mitigate risk.

Bullish and Bearish Engulfing

Chart created using MultiCharts. ©MultiCharts LLC, 1999-2015. All rights reserved.

Another common candlestick pattern that may signify a change in trend is the engulfing pattern. Engulfing patterns come in both bullish and bearish varieties.

The body of a bullish engulfing candle opens below the close of the previous bearish candle and closes above its open, completely “engulfing” the previous body.

Chart created using MultiCharts. ©MultiCharts LLC, 1999-2015. All rights reserved.

As with the hammer and shooting star, successful engulfing patterns are usually accompanied by heavy trading volume. The longer the body of an engulfing candle, the more reliable it is seen as indicative of a change in trend.

Also similar to the hammer pattern, stop-losses may be placed just below the low of the candle’s shadow for bullish engulfing patterns or just above the high of the candle’s shadow for bearish engulfing patterns. When markets trade below or above these levels when bullish and bearish engulfing candles, respectively, have been established, it is said that the engulfing pattern has failed.

This also highlights the fact that while it is useful, candlestick analysis is not infallible. No technical indicator should ever be used on its own. Significant fundamental developments, unknown to market participants at the time an engulfing pattern is established can quickly render them obsolete, even if they have been formed the previous day.

The February 2015 gold contract experienced a bullish engulfing pattern on December 1, 2014 which resulted in a $100 rally in price over the following weeks. The price did correct about half-way into the body of the candle in late December. However, the low of the candle’s shadow was never breached.

The November 2014 crude oil contract experienced a bearish engulfing pattern on September 30, 2014. Crude oil, was attempting to rally from pronounced downtrend when this bearish engulfing pattern was printed. Prices quickly deteriorated further and never came close to touching the high of the upper shadow.

Spinning Top

Chart created using MultiCharts. ©MultiCharts LLC, 1999-2015. All rights reserved.

A spinning top may signal the beginning of a new trend, both upward and downward. Spinning tops are characterized as having short bodies and short upper and lower shadows. They are typically accompanied by a decrease in volume. They usually form just above the close (in tops) or just below the close (in bottoms) of the previous day’s candle.

Spinning tops indicate lack of decisiveness on the part of market participants. Because of this, they are preferably used as a signal to exit a position rather than a signal to enter.

The May 2015 crude oil chart is used as an example. Relative strength index traders who bought the oversold condition that the contract experienced in mid-March could have used the spinning top printed on April 16 as an exit point. This would have resulted in a $10 profit per contract.

There is no guarantee that prices will not continue higher. However, the spinning top undoubtedly signally indecision by the market. It is for this reason that spinning tops make better exit signals than they do entry signals.

Please be advised that trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. This matter is intended as a solicitation to trade. The use of stop loss orders may not protect profits or limit losses to the amount intended as certain market conditions make it difficult or impossible to execute such orders.