This article on Futures Trading Setups is the opinion of Optimus Futures.

There is an abundance of trading setups available–hundreds, all with multiple variations. But not all are easy to identify, not all are frequently recurring, and not all aim for quick and easy targets. In contrast, that is what we’re going to talk about here. Futures trading setups that are easy to identify, that aim for (relatively) quick targets, that recur on a regular basis, and most importantly, that can be considered high-probability trades.

“Quick” Depends on Your Time Frame

The term “quick trade” or “fast trade” can easily sound like a “scalp.” For a scalper, a 10-minute trade may seem like a lifetime (I am exaggerating, of course, but you get the point). Similarly, day-trading setups may vary, depending on your timeframe.

The setups we are about to cover span different time frames, from minutes-long day trades to swing trades that can last a few days. Most of the futures trading setups are trend-driven, one seeks to fade tops and bottoms in a non-trending environment. But each setup we present is frequently recurring; one setup, centered on a regularly-scheduled economic report.

High-probability is relative. It depends as much on the fundamental context as it does the levels of market noise (especially during low-volume periods). So be sure to manage your risk if you choose to execute any of these trades.

#1 – Trading the Weekly Jobless Claims Report

There are two factors that make the Jobless Claims report a high-opportunity event. First, jobless claims numbers tend to move the market more often than not; second, they’re released every Thursday at 8:30 am ET, making the opportunity consistent.

For this trade, either the S&P 500 futures or Dow Jones futures will work best. The Dow Jones might be the more volatile of the two, simply because the DJIA is composed of only 30 stocks, whereas the S&P 500 has a much wider range of assets.

How might you approach this trade from a directional bias? We prefer to trade it neutrally, unless the fundamental conditions are heavily leaning bullish or bearish. What you want to watch out for is any major surprises between the consensus numbers and the actual numbers–namely, whether the numbers reveal a significant “beat” or “miss.’

Either way, what will determine the direction of the indexes after the report is not necessarily the bullishness (beats) or bearishness (misses) of the figures, but the markets interpretation of the numbers–more specifically, market sentiment. We saw this at the wake of the pandemic. Jobless numbers that were dismal, generally speaking, would spark a rally if they were not dismal enough.

Here is the futures trading setup:

Step 1: At the beginning of each week, note the anticipated Jobless Claims number.

Step 2: At 7:00 am ET, identify the morning’s swing high and swing low.

Step 3: Depending on your directional bias–bullish, bearish, or neutral–place a buy stop a few ticks above the swing high, or a sell stop a few ticks below the swing low (or both).

Step 4: Place a stop loss for each position at the opposite swing high or low level.

Step 5: Find the difference between the top and bottom of the swing high and low, and set a profit target between 61.8% to 100% of the entire distance (above if you are long, below if you’re short). If you choose to hold your position beyond this target, close out the trade at your discretion.

Disclaimer: The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

Example:

The measured distance between the swing high and low is 163 points. The jobless claims report triggered a trade on the short side. The profit target was set to 61.8% of the entire move, exiting the trade with a 100-point profit.

Feel free to further research this setup. It recurs every Thursday morning at 8:30 am ET. Try to work with different scenarios, namely, fundamental contexts and expectations. This is pretty much “news trading.” But with enough practice, and with an adequate grasp on basic fundamentals, you might be able to get this event-driven “day trade” to work for you.

#2 – Fading the Range Using VWAP

Fading tops and bottoms is a tricky thing to do. And should you attempt to do this during moments of low volume trading, you may be vulnerable to larger players who go “stop hunting.” That’s the fate of most day traders, simply because they can’t see what larger institutional traders are doing. In short, they can’t see any real “order flow.”

And that’s where the VWAP indicator comes in. The VWAP, or Volume Weighted Average Price, is an indicator that tells you the “average price” of a security based on both volume and price. Why is this important? If an institutional player (such as a fund manager) wants to get in at a competitive price, they will often take a glance at this indicator as a reference point for their entries.

So if an asset is far above its theoretical average price, chances are that the actual price of the asset may eventually fall (or be shorted) to match its theoretical value (that’s just one assumption to help contextualize your trading strategy).

Take a look at the following scenario:

How might I have known to enter a short in these two particular areas? Why didn’t I enter the short positions sooner? The answer to this question is rather mechanical. Look at the chart again, this time with its volume-weighted average price, VWAP, plus the help of a Stochastic indicator.

Notice the price of the YM advanced far above its VWAP line. This corresponds to the Stochastic reading, which entered the “overbought” territory. There is a chance that the asset might have exceeded this last high. But given the divergence in the Stochastic, as the asset price rose to match its last high, the trading scenario favored the short side. We closed out the position upon price meeting its VWAP price.

Let’s go over the actual setup:

Step 1: Identify a market that is trading sideways in the near term.

Step 2: Look for a scenario in which a rising asset is moving far beyond its volume-weighted average price.

Step 3: Wait for a second swing toward the end of that range (up or down).

Step 4: If there is a divergence between price momentum and the stochastic reading, go short (if it’s a top) or long (if it’s a bottom). Place a stop loss above the swing high (if going short) or swing low (if going long).

Step 5: Exit the position once the price of the asset crosses the VWAP line.

The risk-to-reward scenario in this trade should always be weighted toward the profit side, not the risk side.

Again, we caution anybody who attempts to fade tops and bottoms. At the same time, markets are often prone to moving sideways, providing plenty of opportunities to trade sideways markets.

So, if you’re going to do this, be sure that you can see at least one aspect of order flow indicating where institutional bias may be situated. VWAP is one of those indicators. And combined switch a Stochastic indicator, it can help take some of the pure guesswork out of the equation.

#3 – 1-2-3 Setup

If you think about it, the idea of a trend is very simple. For an uptrend, it has to exceed the last high while remaining above the last significant low. For a downtrend, it has to establish a new low while remaining below the last high. That’s why we define uptrends as higher highs, and higher lows; downtrends as lower lows and lower highs.

If we enumerate these steps, we get three initial steps:

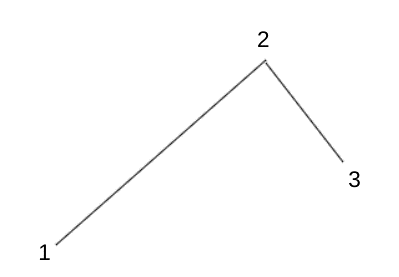

Uptrend

1: Price begins at a given point.

2: Price moves up.

3: Price pulls back (but well above the last low).

If the uptrend were to continue, it would have to break above resistance at 2. It looks like this.

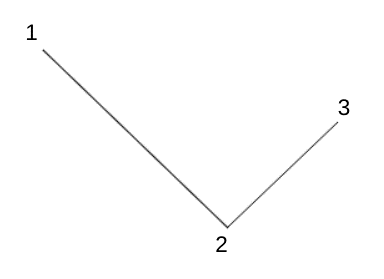

Downtrend

1: Price begins at a given point.

2: Price moves lower.

3: Price pulls back (but well below the last high).

If the downtrend were to continue, it would have to break below support at 2

Given that this pattern is the most basic building block of a trend, it occurs frequently in any trending market. And if you are correct in identifying the trend, then this setup provides a high probability of success. Also, note that levels 2 and 3 describe a simple support and resistance formation,

One caveat though is that trends tend to be clearer on higher time frames due to less market noise. Although trends do occur on a micro-level, they can also be noisier, making this 1-2-3 pattern more difficult to identify. So, you might want to trade this easy setup on any time frame starting with hourly and above.

Identifying 2 (swing high becoming resistance) and 3 (pullback becoming support) is relatively easy. But if you would prefer an automated tool to help you identify these levels on various time frames and larger trends, try using Optimus Auto-Generated Support and Resistance Levels.

Here’s the setup:

Step 1: Identity an existing trend (up or down).

Step 2: Wait for the trend to pull back (#3 in the 1-2-3 pattern).

Step 3: Place an entry stop at point 2 (a buy stop if it’s an uptrend; a sell stop if it’s a downtrend).

Step 4: Place a stop below 2 (uptrend) or above 2 (downtrend).

Step 5: Exit at the equivalent length of 1 to 2, or once you’ve reached your % target (which will vary from trader to trader).

The Bottom Line

These are just three of a handful of recurring high-probability setups you can use to take advantage of frequent or regular market opportunities. In each setup, there is a stop loss and a profit target. You can vary your profit target, but you shouldn’t alter your stop loss, as it is placed at a level that renders the trade invalid (so, respect the stop loss level at all times).

Good luck in your trading, and remember that position sizing is key when it comes to managing your risk. No setup will work every time. So don’t blow everything on one trade. Manage your risk always. Your profits will take care of themselves.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.