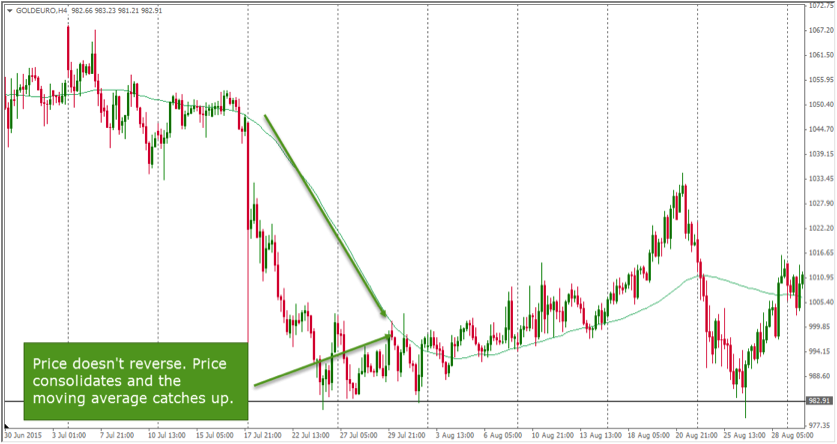

Mean reversion trading is also known as trading reversals or as trading V-Tops and V-Bottoms. At its core, mean reversion traders look for strong price movements and then try to identify when those prices are likely to reverse. The screenshot below shows a GoldEuro chart with a very strong bullish move and the green line is the 50 period moving average. By definition, the price will eventually meet again with the moving average.

However, there are three main problems mean reversion traders face:

1) Strong price movements can go on for a very long time and a reversal may not occur for a long period

2) Instead of price reversing and meeting the moving average again, often price just consolidates after a strong move and the moving catches up with price

3) Reversals can happen very fast without giving any hints

Why you should still pay attention to mean reversion trading?

It is long known that prices move much faster on the way down than when trending higher. The old saying that “markets take the stairs on the way up and the elevator when going down” is especially interesting for mean reversion traders because of the resulting trading opportunities.

Not all traders are comfortable with trading the usual trend-following approach and it is essential for a trader to find the trading approach that suits his thinking and personality best. Especially traders who struggle with impatience during slower trending markets, can possibly benefit from a more volatile reversal trading method.

However, if you have problems with volatility and with making impulsive trading decisions, mean reversion trading might not be the best fit because volatility and momentum can be significant during reversals.

Tools for mean reversion trading

Mean reversion traders can benefit from using and combining different trading tools. It is also advisable to follow a strict rule-based approach when trading reversals. The reason being is that having a set of strict rules can keep you out of trades that should have been avoided and also decrease the impacts of emotional trading decisions which can be significant when trading reversals.

The most commonly used tools for mean reversion traders are:

1) Divergences

Divergences can signal a shift in momentum and strength. The most efficient indicators are the STOCHASTIC and the MACD. Once you see a divergence on any one of them it can signal a shift – although a divergence by itself is NOT a trading signal.

2) Reversal price action patterns

Price action patterns reflect the balance between bulls and bears. For example, a hammer (pinbar) candlestick pattern in an uptrend shows that traders tried to push price higher but the bears took over and sold, driving prices down. Other reversal candlestick patterns are Engulfing bars or Dojis.

3) Important support and resistance

Support and resistance plays a big role for reversal trading. When price hits a resistance level, prints a reversal candlestick pattern and also shows a divergence, it can be a strong signal that a reversal might be waiting.

4) The ADX

The ADX indicator measures trend strength. But for reversal trading it can be a great indicator as well when it shows fading trend strength. Once you see a “hook” on your ADX (when it goes from pointing upwards, to pointing downwards) it signals that the previous trend is losing strength.

5) Moving averages

Moving averages are typically used to determine how far price has moved away from its norm and also moving averages can function as targets for reversal trades.

Combining tools effectively

As we have said earlier, a reversal trader can avoid a lot of false signals and increase the accuracy of entry-timing by combining different concept and trading tools.

Trading reversals vs. catching tops and bottoms

The main problem why traders struggle when it comes to mean reversion trading is because they often try to predict the next reversal while the trend is still going on. A good mean reversion trader never tries to guess what might be happening next, but he waits for confirmation that the trend is losing strength and momentum and is already turning the opposite way. Trying to catch the absolute highs and lows is not necessary sass a mean reversion trader and should be avoided at all costs.

See yourself as a reversal-following trader; similar to a trend-following approach. A trend following trader does not try to predict a new trend but he wait for the trend to take off before he joins it. The same holds true for reversal trading!

Are you looking for all the technical analysis tolls you are seeing in this article, please demo MultiCharts (.NET) which is a free platform, had the ability to connect to a number of data feeds, including CQG, Trading Technology and Rithmic. MultiCharts (.NET) also includes advanced charting, trading from the DOM and automated trading.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.