Indicators can be a great addition to your trading methodology. But they can also ruin even the best trading approach if you don’t know how to use and / or combine them with other tools in efficient ways.

In this article, we provide you with a realistic view of trading with indicators, how to choose the right one and which indicator mistakes to avoid.

Do you know your edge and trading strategy?

The biggest mistake traders make is that they try to be in the market and find trades all the time. The professionals, on the other hand, know exactly which market circumstances favor their trading approach and then choose their tools accordingly.

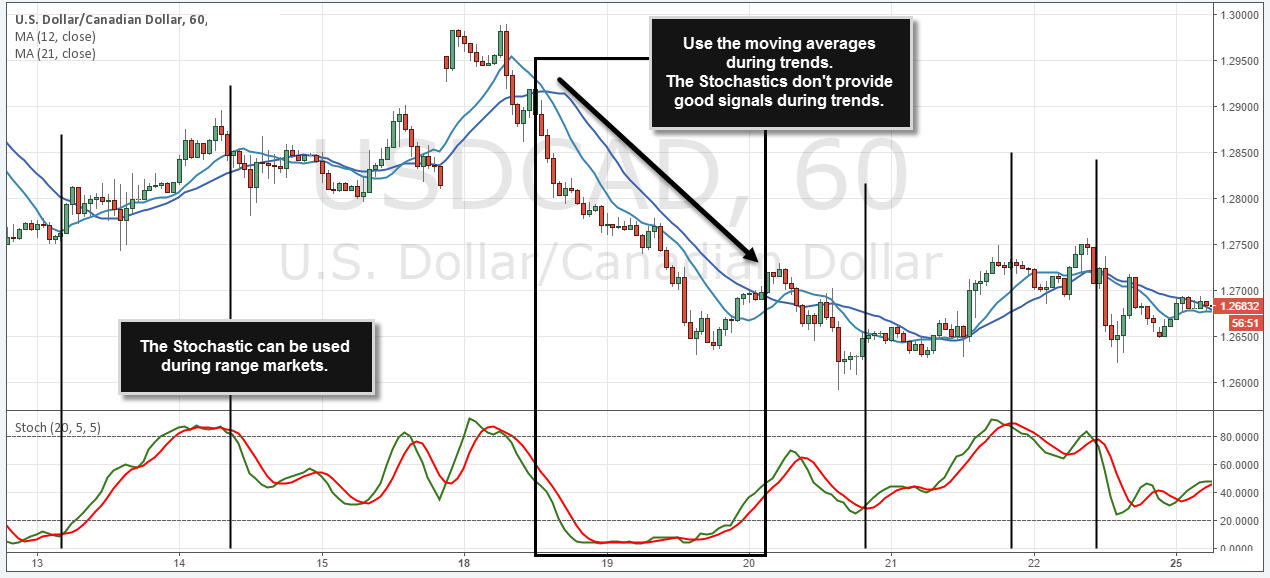

If you are a trend-following trader, you should look at momentum indicators and stay away from oscillators. When you are a range trader, on the other hand, momentum indicators won’t improve your trading and you have to pick from oscillators.

Using the wrong indicator for the wrong trading method causes a lot of confusion and also gives you wrong trading signals. Thus, the first step always has to be to be clear about your trading approach, which market conditions your trading strategy works best in and then pick the indicators based on your objectives.

| Oscillators | Momentum and trend following |

| CCI | ADX |

| RSI | Bollinger Bands |

| MACD | Ichimoku cloud |

| RVI | Moving averages |

| Stochastic |

Avoid multiple and duplicate signals – paralysis by analysis

The second mistake many traders make is that they combine multiple indicators that should not be used together. A very common scenario you see often is that traders use multiple oscillators such as the Stochastic, CCI or RSI together which then create duplicate signals that don’t add any value, but confuse the traders.

Charts Courtesy of TradingView

Charts Courtesy of TradingView

Using multiple indicators that are based on the same goals (momentum or range trading) will show you very similar signals at the same time. Traders then often experience a state of ‘paralysis by analysis’ where they don’t know how to follow a signal. Furthermore, when you use multiple oscillators, you might be putting too much emphasize on certain signals and then don’t pay attention to other things happening on your charts.

Therefore, only pick one indicator of each category and don’t mix indicators from the same category.

Charts Courtesy of TradingView

Charts Courtesy of TradingView

Recency bias – chasing hindsight trades

Once you have decided on an indicator, the question about the correct period settings comes up. In this context, we have to talk about the recency bias. You can often see that traders change their indicator settings or rules, based on what has happened recently. For example, if you see that you could have made a winner with a different setting, many traders will then immediately change their indicator setting and hope that this pattern will repeat itself the next time.

In trading, you have to make consistent decisions over a longer period if you want to get meaningful results. Therefore, it’s very important not to make any changes to your indicators on a trade by trade basis. Although you may be tempted to interfere with your trading system after a loss or a missed winning trade, don’t mess with your system too soon.

Conclusion

Indicators can be great tools and they can help your trading and your price analysis. At the same time, they can cause a lot of confusion and errors if you don’t know how to use them. With the help of this article, you are able to choose your indicators better, avoid some of the common mistakes and leverage the power of indicators.