You hear it over and over again as a trader, and it takes many different forms: “Money management is more important than great entry signals”, “The market can stay irrational longer than you can stay solvent”, “It’s more important to manage risk than to generate profits”, and so forth. So how do you put this advice into practice? I won’t propose a general theory of risk management here, but instead, I’ll discuss one helpful tool you can use as a trader of Futures and Options on Futures: the SPAN risk algorithm.

What Is SPAN?

The name stands for “Standardized Portfolio Analysis of Risk”, and it was developed by the CME in 1988. It is a scenario-based algorithm which attempts to compute the maximum loss your account might reasonably incur within one trading day. This amount is what the exchange requires you to hold in margin, or “performance bond” as it’s also called. The goal is twofold: margin coverage and capital efficiency. I’ll say more on those a bit later. Over 50 exchanges use SPAN as their official way to compute margin requirements, so it’s a big deal.

How Does SPAN Work?

The algorithm is complicated, so the following information won’t be complete. You can find a lot more detail on the CME website. But here’s a brief description.

It starts with the scenarios, which are encoded in “risk arrays” computed a few times each day by the exchange. The CME and most other participating exchanges construct 16 scenarios, in which the prices of the individual markets are assumed to move up or down by varying amounts, while volatility is also assumed to go up or down. To compute the margin required in your account, the SPAN algorithm values the positions in your account under all 16 scenarios, and the one with the worst loss is your account’s SPAN Risk.

Drilling down a bit more… How does SPAN value your positions in each scenario? And what if you are holding positions in some closely-related contracts? For example, maybe you are long an ES futures contract and short an NQ. Or perhaps you hold an iron condor spread on GC futures options. Or maybe you put on a CL futures calendar spread. Or maybe you wrote a naked put on EC currency futures far from the money. SPAN has to value your account under each scenario in a “smart” way to take into account all the interrelated movements of your holdings. This is where it gets complicated. SPAN will try lots of different ways of grouping your holdings to compute charges and credits to your overall margin requirement. So if you add a new contract that truly hedges your existing positions, it will reduce the amount of margin you are required to hold.

A SPAN Example

Exchanges and their clearing organizations must ensure that every trader holds enough margin to cover potential losses. This is the most important goal of SPAN and it’s what keeps the system safe. But it’s in nobody’s interest to tie up capital that a customer could be trading responsibly. Recall the “capital efficiency” goal I referenced earlier. SPAN tries to achieve both of these goals.

For example, let’s say you are holding a defined-risk position, such as an iron condor spread on Gold. It consists of four individual contracts, and a naive risk system using quantity limits might charge you four times the margin of holding just one contract. But because you’re holding a defined-risk options spread, you know in advance what your maximum loss can be. So a more “smart” algorithm should charge you just enough margin to cover your max possible loss.

Let’s see what SPAN does. If you are a futures market participant, you can ask your broker to help you get set up with a “SMART Click” ID, and to get you permission to use the CORE Margin Calculator on the CME’s website. It’s free for both professional and non-professional traders. If you want more functionality (and are willing to spend more time), you can also download the PC-SPAN app from CME and import parameter files for the exchanges you are trading. Now let’s get to the example.

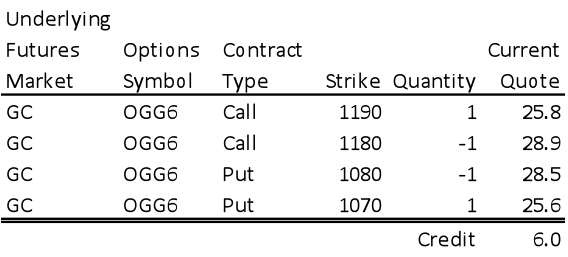

I’ve created an iron condor spread as follows:

Using quotes currently in the market, its payoff diagram (assuming no early exercise or assignment) looks like this:

Regardless of whether I like this trade, I think it’s a good illustration of SPAN. How much should we expect to need in margin to hold this position? Well, it’s a credit spread, which means we receive a $600 credit when we open the position. The worst-case scenario is that the underlying futures price finishes outside the profit zone, and we lose all that premium plus an additional $400. So immediately after opening this position, after receiving the premium, the margin we might expect to be required to hold is $1000. Now let’s look at what the CORE Margin SPAN tool actually computes for us:

The answer it returns is $660. Presumably, the SPAN algorithm requires less than the full $1000 because the short strikes are pretty far from the current underlying price, and are unlikely to reach it within a single trading day. (But a wise trader will make a note of this and keep the full $1000, just in case price finishes outside the long strikes.) As I write this, the margin required by CME for a single GC futures contract is $3,750, so a naive quantity limits risk algorithm might require 4 x $3,750 = $15,000 in margin! In this case, SPAN is over 20x more capital efficient compared to a naive quantity limits algorithm.

So we’ve seen in this example that SPAN can be a trader’s friend. It can enable a trader to responsibly hold many contracts, provided they are properly hedged. What about inter-market futures spreads, like Corn/Wheat, or 10-Year Notes/30-Year Bonds? Or a calendar spread in the WTI Crude market? Each spread has its own margin adjustment, and you can see for yourself what it looks like with the online SPAN tool.

Avoiding Margin Calls

I have never received a margin call, and if I make it through life without ever having a margin call that will be just fine by me. I’ve known traders who’ve survived many of them, and I’ve known traders who were destroyed by just one of them. In none of those cases did the process sound fun. Some brokers will liquidate your positions immediately and without consulting you as soon as a margin call occurs. Other (more civilized) brokers will contact you and involve you in the process of either posting more capital or making the necessary liquidations. But it may not be a cheerful conversation.

Best of all is to avoid the situation entirely. This is another case when SPAN can be a trader’s friend. Before putting on a new position, you can run a quick SPAN check to see how it will affect your Margin/Equity ratio. This ratio is computed by dividing your required margin by the current market value of your account. You have to make your own determination of what a “safe” Margin/Equity ratio is for your trading style. If you are making directional trades in outright futures contracts, or if you are writing naked options, then you probably want to keep the ratio low, say 10-20%. The reason is that a fast market move can quickly result in losses, and even if you have a statistical edge, you may find that temporary drawdowns can result in margin calls and become not-so-temporary. If you are trading in-and-out quickly, with automated stop-loss orders and a global system cutoff, you might be OK with more than that, because your system can be designed to go flat before a margin call can occur. And if you are trading defined-risk options spreads in which your max loss is well known in advance, then you can go much higher and still be safe. It’s a judgement call, and it’s important to make it consciously rather than accidentally.

In Conclusion

Every successful trader knows the importance of managing risk. In this article, I’ve discussed a tool that can be used by traders in the futures markets to understand the margin impact of a position before opening it. I hope it helps you trade more successfully and sleep more peacefully.

Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not indicative of futures results.

IF YOU PURCHASE OR SELL A COMMODITY FUTURES CONTRACT YOUR ACCOUNT.OR SELL A COMMODITY OPTION YOU MAY SUSTAIN A TOTAL LOSS OF THE INITIAL MARGIN FUNDS OR SECURITY DEPOSIT AND ANY ADDITIONAL FUNDS THAT YOU DEPOSIT WITH YOUR BROKER TO ESTABLISH OR MAINTAIN YOUR POSITION. IF THE MARKET MOVES AGAINST YOUR POSITION, YOU MAY BE CALLED UPON BY YOUR BROKER TO DEPOSIT A SUBSTANTIAL AMOUNT OF ADDITIONAL MARGIN FUNDS, ON SHORT NOTICE, IN ORDER TO MAINTAIN YOUR POSITION. IF YOU DO NOT PROVIDE THE REQUESTED FUNDS WITHIN THE PRESCRIBED TIME, YOUR POSITION MAY BE LIQUIDATED AT A LOSS, AND YOU WILL BE LIABLE FOR ANY RESULTING DEFICIT IN