This article on Prop Trading vs Live Trading is the opinion of Optimus Futures.

The journey from prop trading to live futures trading represents a significant milestone in a trader’s evolution. While proprietary trading firms provide valuable training grounds and capital access, many successful futures traders eventually seek the freedom, control, and unlimited profit potential that comes with trading their own capital.

This comprehensive guide explores why and how futures traders can successfully transition from prop firm constraints to the independence of live trading, while maximizing their chances of long-term success in the futures markets.

Understanding Prop Trading vs Live Trading in Futures

Prop Trading in Futures

Proprietary trading in futures involves using a firm’s capital to trade futures contracts under strict risk management rules and profit-sharing arrangements. Prop firms typically provide traders with buying power ranging from $25,000 to $150,000 or more, allowing them to trade contracts like ES (E-mini S&P 500), NQ (E-mini NASDAQ), or CL (Crude Oil) without risking personal funds.

However, prop traders must operate within rigid parameters including daily loss limits, maximum position sizes, and specific trading hours. Most firms retain 10-30% of profits while imposing monthly fees and strict performance metrics.

Live Trading in Futures

Live futures trading means using your own capital to trade futures contracts with complete autonomy over strategy, risk management, and profit retention. With a properly capitalized account, futures traders can access the same markets and leverage as prop firms while maintaining 100% of their profits and full control over their trading approach.

The futures market’s inherent leverage means that even modest account sizes can generate significant trading opportunities when managed properly.

Why Prop Trading Falls Short for Serious Futures Traders

Restrictive Risk Parameters

Most prop firms impose daily loss limits of $1,000-$3,000, which can be constraining for futures traders who understand that occasional larger drawdowns are normal in systematic trading. A single bad day in volatile markets like crude oil or natural gas can trigger account restrictions that prevent capitalizing on subsequent opportunities.

Limited Strategy Flexibility

Prop firms often prohibit overnight positions, news trading, or holding contracts through economic releases – exactly the scenarios where experienced futures traders can generate substantial profits. Many firms also restrict trading during the most volatile and profitable market sessions.

Profit Sharing Reduces Returns

Successful futures traders who consistently generate 15-25% monthly returns find themselves giving away 10-30% of their profits to prop firms. Over time, these fees represent hundreds of thousands in foregone income that could be reinvested to grow trading capital.

Scalability Limitations

Most prop firms cap trading size once you reach certain profit levels, preventing natural account growth. In futures, where successful strategies can often be scaled significantly, these artificial limits severely constrain long-term earning potential.

The Compelling Case for Live Futures Trading

Complete Strategic Freedom

Live futures trading allows you to trade any strategy, any time frame, and any market condition. Whether you specialize in overnight gap trading in index futures, energy market volatility, or agricultural seasonal patterns, you’re free to capitalize on every edge without firm restrictions. You can choose your own trading hours and adapt strategies to changing market conditions without seeking approval.

100% Profit Retention

Every dollar of profit remains in your account, compounding your trading capital and dramatically accelerating wealth building. A trader generating $5,000 monthly profits keeps the full amount rather than $3,500-$4,500 after prop firm fees. This full profit retention creates a powerful compounding effect that significantly accelerates wealth building over time.

Natural Account Growth

Successful futures strategies can typically be scaled proportionally with account size. A system that generates consistent returns with 2 ES contracts can often be expanded to 10 or 20 contracts as capital grows, multiplying profit potential exponentially.

Professional Tax Benefits

Live traders can often qualify for trader tax status, allowing them to deduct home office expenses, equipment, data feeds, and education costs while potentially qualifying for more favorable tax treatment on trading profits.

No Artificial Demo Limitations

Unlike prop firm evaluations that often use demo data with unrealistic fill rates and minimal slippage, live futures trading exposes you to real market conditions from day one. This means better preparation for actual trading challenges including slippage, partial fills, and commission costs that can significantly impact performance.

Preparing for the Transition: Key Steps

Validate Your Edge with Sufficient Data

Before risking live capital, ensure your trading approach has been profitable across multiple market conditions. Successful prop traders should have at least 6-12 months of consistent profitability and detailed performance metrics including maximum drawdown, win rate, and average trade duration.

Calculate Required Capital

Futures trading requires adequate capitalization to weather normal drawdowns while maintaining proper position sizing. A general rule is to have 3-5 times your maximum historical drawdown as starting capital. Additionally, ensure you have sufficient funds to cover living expenses and emergencies separate from your trading capital.

Account for Operational Costs

Budget for ongoing expenses including data feeds, trading platform fees, commission costs, and reliable internet connectivity. Professional futures trading software may require monthly subscriptions, and some platforms offer more sophisticated features than others. Research the capabilities and limitations of your chosen platform, as not all trading software provides the same level of risk management flexibility.

Choose the Right Broker and Platform

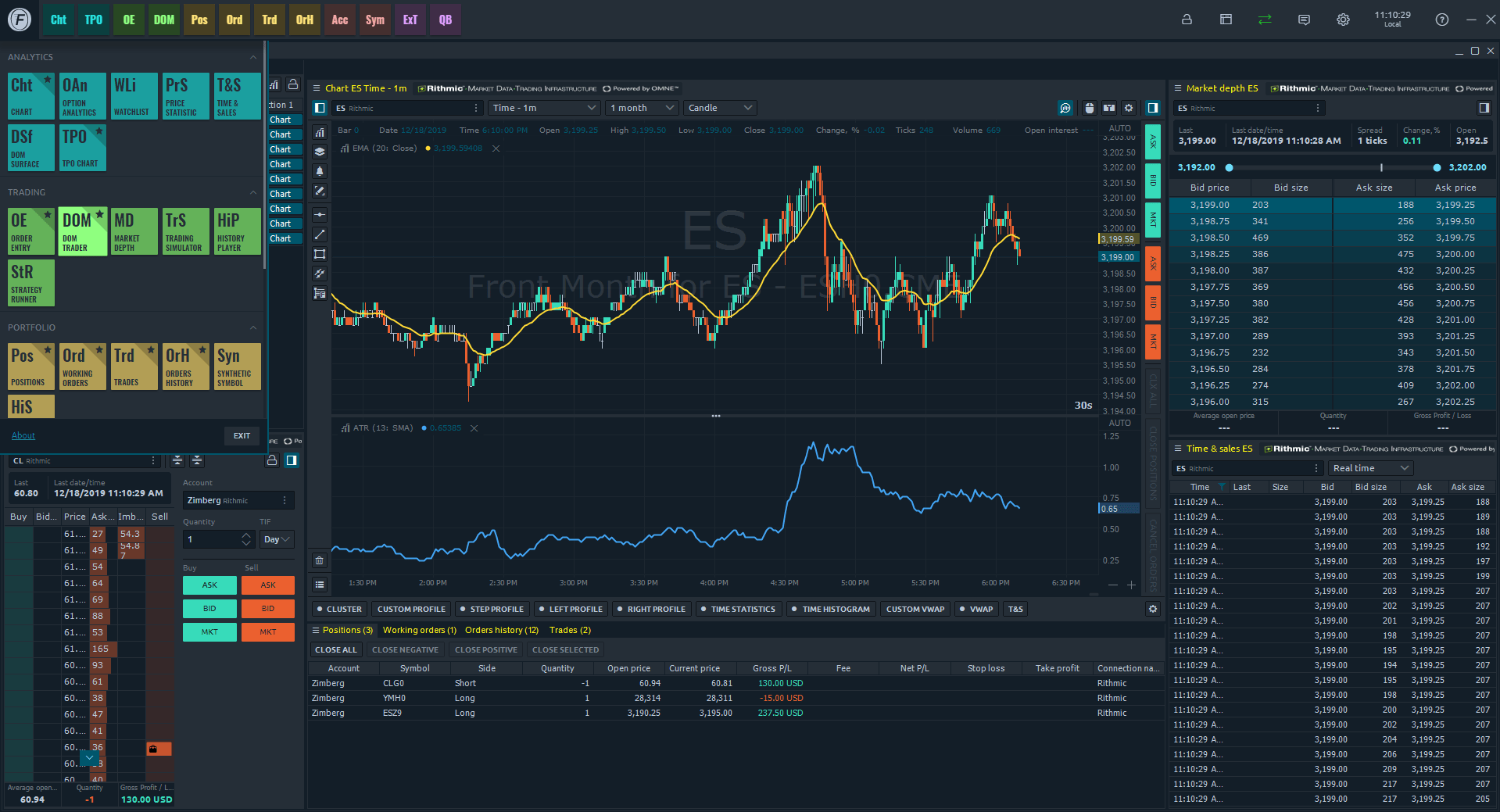

Select a futures broker that offers competitive commissions, reliable execution, and professional-grade platforms. Look for brokers providing direct market access, comprehensive charting tools, and responsive customer service.

At Optimus Futures, we offer highly competitive commission rates at just $0.25 per side for micro futures contracts and $0.75 per side for standard contracts, significantly below industry averages. Additionally, we provide free access to professional-grade desktop, web, and mobile trading platforms, eliminating platform fees that many brokers charge. This combination of low commissions and free platforms helps reduce your operational costs during the transition from prop trading to live trading.

Consider Starting with Micro Futures Contracts

To manage risk effectively during the transition, consider beginning with micro futures contracts (like MES for S&P 500 or MNQ for NASDAQ). These contracts require lower margin and allow you to test strategies with reduced position sizes while you adapt to live market conditions.

Implement Rigorous Risk Management

Without prop firm oversight, self-discipline becomes crucial. Establish daily loss limits, maximum position sizes, and systematic rules for reducing size during drawdown periods. Set clear risk parameters determining the maximum percentage of capital you’re willing to risk on a single trade. Consider using automated stop-losses and position sizing algorithms to remove emotional decision-making. Use stop-loss orders to automatically exit trades that move against you, and carefully assess the volatility and leverage of each futures market to align with your risk tolerance.

Managing the Psychological Transition

Start with Reduced Size

Even experienced prop traders should begin live trading with smaller position sizes than they’re accustomed to. The psychological impact of risking personal capital differs significantly from trading firm money. Start with 25-50% of your intended size and gradually increase as comfort levels improve.

Develop and Follow a Comprehensive Trading Plan

Having a well-defined trading plan becomes even more critical when trading your own capital. Your plan should outline strategies, entry and exit rules, position sizing, and risk management protocols. This structured approach can reduce impulsive decisions and provide guidance during emotionally challenging periods.

Maintain Detailed Performance Tracking

Document every trade with entry/exit prices, reasoning, and emotional state. Keep a detailed trading journal that helps identify patterns and emotional triggers. This data becomes invaluable for identifying performance patterns and areas for improvement. Professional futures traders often use specialized software like Tradervue or maintain detailed spreadsheets.

Address Common Psychological Hurdles

Trading with your own money introduces emotional factors that can significantly impact decision-making. Fear of loss, overconfidence, and revenge trading are common psychological challenges. Take regular breaks from trading to prevent burnout and emotional fatigue. Stepping away from the screen during stressful periods can help maintain objectivity and prevent costly emotional decisions.

Build Capital Gradually

Rather than attempting to match prop firm position sizes immediately, focus on consistent profitability and gradual account growth. Successful live traders often withdraw a percentage of profits regularly while reinvesting the remainder for compounding growth.

Prepare for Drawdowns

Live trading means absorbing losses from your own capital, which can be emotionally challenging. Maintain sufficient capital reserves and consider keeping 3-6 months of living expenses separate from trading capital to reduce psychological pressure during difficult periods. Remember that drawdowns are a normal part of trading, and having adequate capital helps weather these periods without compromising your strategy.

Common Transition Mistakes to Avoid

Insufficient Capitalization

The most common failure mode is starting with inadequate capital. Undercapitalized accounts force traders to use excessive leverage or risk too much per trade, leading to rapid account depletion during normal drawdown periods.

Overconfidence from Prop Success

Success with firm capital doesn’t automatically translate to live trading success. The psychological dynamics differ significantly, and many traders struggle with the transition despite strong prop trading records.

Ignoring Real Market Conditions

Many prop firm evaluations use demo data where orders get filled with minimal slippage and nearly perfect execution. In live futures trading, slippage on contracts can affect performance tremendously, along with commission costs. Not all orders get filled in live accounts, and this reality can significantly impact strategies that worked well in demo environments.

Assuming Prop Firm Strategies Always Work in Live Markets

Not everything a prop firm teaches or allows works effectively in real trading conditions. For example, some traders believe that having multiple accounts and “dividing risk” is beneficial. In reality, copying trades across multiple accounts introduces complexity such as monitoring issues and synchronization problems that may lead to unintended positions.

Inadequate Technology Infrastructure

Live futures trading demands reliable internet, backup systems, and professional-grade software. Don’t compromise on technology that could cost you money during critical market moments. Additionally, the trading software you choose for self-funded trading may differ from what you used at the prop firm. Some trading platforms require subscription fees, and you may need to learn new software interfaces, although core functions remain similar across platforms.

Lack of Self-Discipline Without External Oversight

Without a firm monitoring your trades, self-discipline becomes absolutely crucial. Many traders struggle with the absence of external oversight and fail to maintain the same level of discipline they had under firm supervision.

Building Long-Term Success in Live Futures Trading

Establish Your Own Trading Rules and Maintain Discipline

In prop trading, firms provide structured environments with specific rules and support systems. In self-funded futures trading, you’re responsible for setting your own rules and ensuring strict adherence to them. Create comprehensive trading protocols that cover position sizing, entry and exit criteria, daily loss limits, and review procedures.

Continuous Education and Market Understanding

Educate yourself thoroughly about the futures markets you wish to trade and the specific instruments involved. Markets evolve constantly, and successful traders must adapt their approaches accordingly. Budget time and money for ongoing education, strategy development, and market research. Stay updated with market trends and continuously refine your strategies.

Develop Multiple Income Streams

Consider combining systematic trading strategies with discretionary approaches, or trading multiple timeframes and markets to reduce correlation and smooth equity curves. This diversification can help stabilize returns and reduce dependence on any single trading approach.

Regular Performance Monitoring and Review

Regularly review your trades to identify areas for improvement. Without the structured feedback systems that prop firms provide, you must become your own performance analyst. Implement systematic review processes to track your progress and identify patterns in your trading performance.

The Path Forward: Making the Transition

The transition from prop trading to live futures trading represents both opportunity and risk. Success requires adequate capital, proven strategies, disciplined risk management, and realistic expectations about the challenges involved.

For traders with prop trading experience, the potential rewards of live trading – unlimited profit potential, complete strategic freedom, and true business ownership – often outweigh the increased responsibilities and risks.

The futures markets offer tremendous opportunities for skilled traders with proper capitalization and discipline. By carefully planning your transition and learning from the experiences of successful independent traders, you can build a sustainable and profitable futures trading business that provides both financial returns and professional satisfaction.

Ready to Break Free from Prop Trading Limitations?

Start your live trading journey with Optimus Futures today.

Get access to:

✓ $0.25 micro futures commissions

✓ FREE professional trading platforms (desktop, web & mobile)

✓ Direct market access with institutional-grade execution

Ready to explore live futures trading? Contact Optimus Futures to discuss how our platform and support can help you transition successfully from prop trading to independent futures trading success.

Trading futures and options involve a substantial risk of loss and are not suitable for all investors. Past performance is not necessarily indicative of future results.