The article on How To Paper Trade On TradingView is the opinion of Optimus Futures, LLC.

Whether you’re a new futures trader or someone with experience who wants to test a new strategy, paper trading with TradingView can help you immensely.

Paper trading, a practice analogous to pilots training in flight simulators, has become an invaluable tool for traders. It offers unique opportunities to test strategies in a “real-time” setting and risk-free environment, providing the confidence to venture into futures trading.

But the big question remains: how does one go about paper trading on platforms like TradingView, especially in the futures market?

Keep reading to find out.

How to Paper Trade on TradingView

TradingView has swiftly become one of the go-to platforms for charting, paper trading, and even live trading, including 1-click trading from your charts.

Steps to Set Up Paper Trading on TradingView

1. Connect to the Paper Trading Account: Once logged into TradingView, navigate to the trading panel at the bottom. Among the list of brokers, select “Paper Trading.” This option is available even on TradingView’s basic free plan, allowing users to experience paper trading without monetary commitment.

2. Reset Your Account to the Desired Balance: By default, TradingView starts you off with a $100,000 balance. Click on the gear icon and choose “Reset Paper Trading Account” to match your intended real trading account size.

3. Modify Commission Settings: You could say they can enter the commissions found here to get an accurate reflection of the cost of trading futures.

4. Understanding the Trading Panel: This comprehensive panel overviews your trading activities. It displays your open positions, active orders, overall account balance, and a profit/loss statement. The user-friendly dashboard makes it easy to place and modify trades directly from the charts or via the order panel.

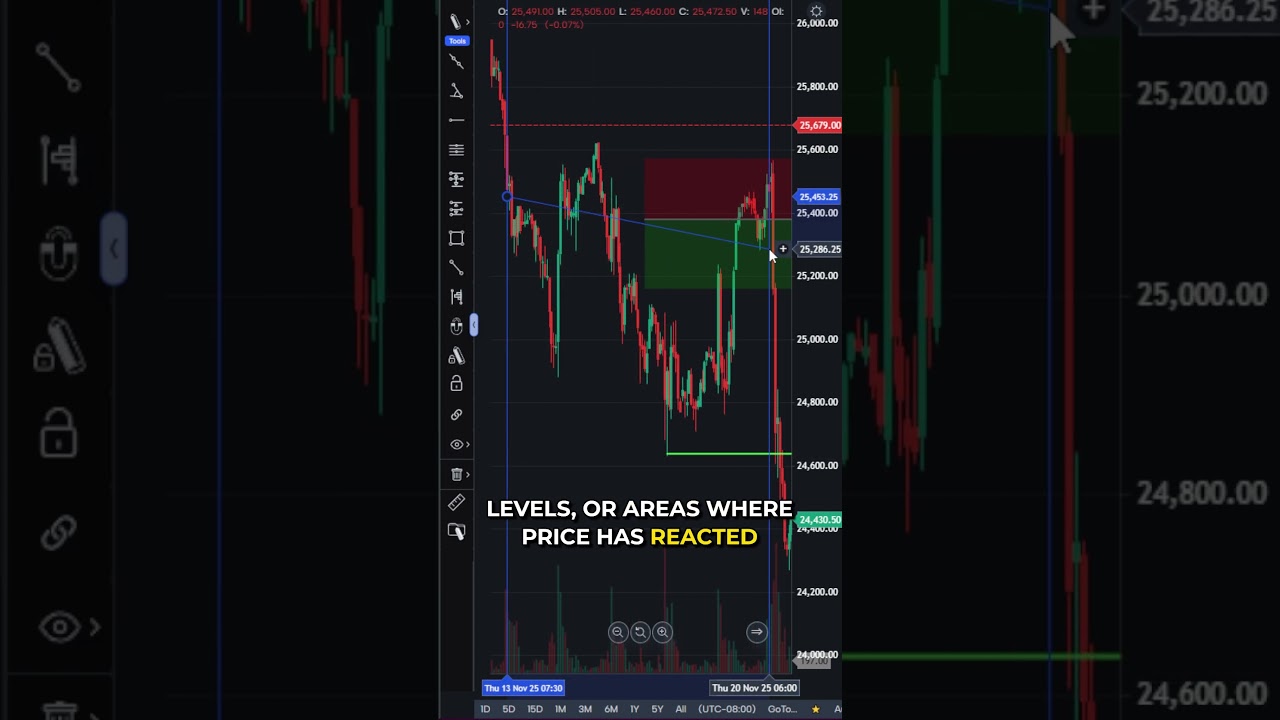

5. Placing Orders in the Futures Market: Futures have specific contract sizes and margin requirements. You can use different order types when trading futures, including market, limit, or stop orders. Especially for beginners in futures, the limit order is recommended. This lets you determine the exact price for entering the market.

6. Setting Targets: Setting targets is crucial in futures trading. After all, you’re only as good as your trading plan. TradingView allows you to use visual cues, like setting a blue line, to gauge the potential risk and reward for a trade.

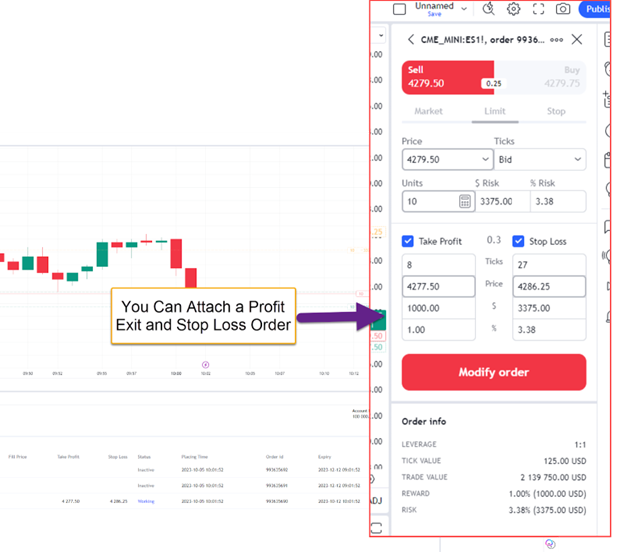

7. Modifying and Reviewing Trades: Once your trades are active, they will appear in your open orders list. Before these orders are executed, TradingView offers flexibility in modifying them.

Whether you’re adjusting the price, changing the order type, or altering the number of contracts, these changes can be made seamlessly. Keep a close eye on your trading performance through the dashboard and review past trades to refine your futures trading strategy.

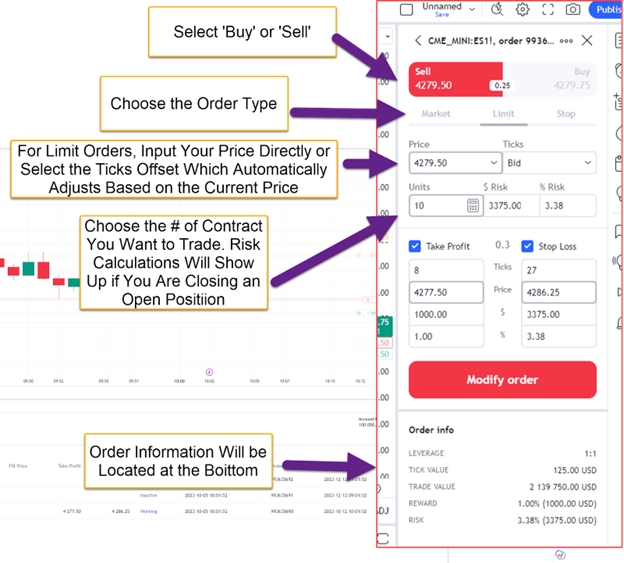

By Clicking on the three dots icon in the trading panel on the right side, you’ll be able to access the display settings for your orders. Recommended settings include:

- Uncheck “Show Order Price In Ticks.”

- Check “Show Quantity In US Dollar Risk”

- Uncheck “Show Quantity In Percent Risk.”

- Check “Show TP/SL Inputs In USD,” (that’s Target Profit & Stop Loss).

- Uncheck “Show TP/SL Inputs In %.”

8. Using a Trading Journal: A detailed journal of your trading activities is pivotal. Note down your observations, strategies, and learnings from each trade. This consistent record-keeping provides insights into your trading behavior and helps identify patterns.

9. Regularly Adjust Your Strategies: Futures markets are known for their volatility. Revisiting and tweaking your trading strategies based on market movements and your performance is essential. Success in futures trading hinges on effective risk management.

Taking Your Paper Trading To The Next Level

The best futures traders know their strengths and weaknesses well. They don’t rely on memory either. They record their trades and review them via a trading journal.

Beyond a mere list of trades, a trading journal dives deep into understanding your trading psychology, offering a meticulous record of strategies, habits, decisions, and market lessons.

Key Benefits of a Trading Journal:

Analytical Insight: It helps identify patterns and evaluate strategies based on tangible data from past trades.

Emotional Discipline: By noting emotions tied to trades, traders gain insights into psychological triggers, promoting balanced decisions.

Risk Management: Journals spotlight areas of potential overexposure, fostering refined risk strategies.

Continuous Learning: As a repository of market interactions, it becomes a feedback loop, refining strategies and encouraging growth.

The Power & Need for Objectivity: Intuition, while occasionally fruitful, is only sometimes reliable. A trading journal grounded in data offers an unbiased view of trading.

A trading journal’s strength is in its objective, data-driven insights. It presents an unbiased record, helping traders understand their habits and tendencies, offering a stark contrast to inconsistent, intuition-based trading.

Navigating Market Uncertainty: In the unpredictable world of financial markets, a trading journal stands out as a beacon, guiding traders using insights from past experiences to forge robust future strategies.

The Impact on Decision-Making: From cognitive benefits to performance boosts, journaling reshapes decision-making, propelling traders toward success.

A trading journal is more than just a record. It’s an evolving tool crucial for traders, guiding them through the volatile financial markets.

Developing A Strategy And Taking The Next Step

Simulated trading through TradingView is an excellent way for new traders to get familiar with the futures market, leverage, and contract specifications. For experienced traders, it’s an excellent tool for testing new strategies.

The key is to try to paper trade like you would if you were trading real money. For example, if you intend to trade a $10,000 futures account, but the strategy you’ve been trying out requires you to have $100,000, then you’re not doing yourself any favors.

The same is true with your planning on trading one to five contracts, but your paper trading 20 to 30 contracts.

The big issue with paper trading is it eliminates the emotions of trading. And while that might sound good, it’s not. You have to learn how to control your emotions when there’s money on the line, and without any skin in the game, you won’t be able to practice this vital skill.

Having some skin in the game is significantly better than having none. Luckily, the futures market offers micro contracts, allowing traders to test out strategies with skin in the game while risking small amounts of money.

Once you’ve paper-traded and journaled your findings, you’ll be ready to move on to something like Optimus Flow.

Optimus and TradingView

Optimus Futures brokerage integrates seamlessly with TradingView. To take your futures trading to the next level, follow these steps.

- Dabble with Micro Futures Contracts: Before diving into the vast futures market, begin with micro futures contracts. These smaller, more manageable contracts allow you to test the waters without significant risk.

- Develop a Strategy: Consider scaling into regular contracts as you become more comfortable. Always have a clear plan, including entry and exit points, and ensure you’re consistently evaluating and tweaking your strategies. Learn How to Effectively Backtest Your Trading Strategy on TradingView

- Integration with Optimus Flow: Enhance your TradingView chart analysis with Optimus Flow execution to access advanced analytics, heatmaps, and volume analysis. This will supercharge your trading experience, allowing you to make more informed decisions in real time.

Download Optimus Flow for free right here.

Take Action and Elevate Your Trading Journey

Paper trading serves as a bridge between theory and reality, between knowledge and application.

However, true trading mastery evolves from commitment, continual learning, and leveraging the right tools.

While TradingView offers the sandbox, real-time tools like Optimus Flow translate your strategies into tangible outcomes.

Imagine a future where every trading decision is data-informed, each move is strategic, and emotions are managed not by suppression but by understanding market dynamics holistically.

That’s what Optimus Flow brings to the table. It doesn’t just enhance your strategy; it becomes an integral part of it.

Are you ready to take your futures trading journey to unprecedented heights?

Integrate your TradingView account with Optimus Flow and immerse yourself in a holistic trading experience.

With its unmatched analytical prowess and real-time insights, it’s not just about making trades but mastering them.

Dive Deeper, Trade Smarter, and Elevate with Optimus Flow.

To view more tutorials on TradingView, explore our comprehensive guides below:

How to Use Tradingview | A Beginner’s Guide

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.