This article on Best Futures to Trade in 2026 is the opinion of Optimus Futures.

Futures day trading offers powerful opportunities for retail traders — but the best futures to trade depend on three things: your risk tolerance, your account size, and the hours you can be at the screen.

The right markets combine sufficient volatility, deep liquidity, and a contract size that fits your risk plan without over-leveraging.

This guide — developed from years of working with active traders at Optimus Futures — breaks down the most actively traded futures markets heading into 2026 and shows you how to match each with your strategy, schedule, and experience level.

Quick Answer: The Best Futures to Trade Right Now

If you want a fast shortlist by trading style:

| Trading Style | Best Contract | Why |

|---|---|---|

| Best All-Around | E-mini S&P 500 (ES) / Micro (MES) | Deep liquidity, tight spreads, stable structure |

| Best for Volatility | E-mini Nasdaq-100 (NQ) / Micro (MNQ) | Larger intraday ranges, faster momentum |

| Best for Macro Themes | Crude Oil (CL) / Micro (MCL) | Moves cleanly on economic releases, OPEC, geopolitics |

| Best for Slower Tape | 10-Year Note (ZN) | Thicker order book, predictable data reactions |

| Best for 24-Hour Action | Euro FX (6E) | FX-style flow with centralized futures volume |

Market Data Snapshot: The 2026 Liquidity Landscape

Heading into 2026, the data shows a clear shift in where retail volume is concentrating. Based on CME Group Monthly Volume Reports (Nov 2025), here are the trends defining the new year:

The “Micro” Takeover: Micro E-mini volume has cemented its dominance, now accounting for over 45% of all Equity Index volume (up from ~40% previously).

- Micro Nasdaq-100 (MNQ): Averaging ~2.2 Million contracts/day.

- Micro S&P 500 (MES): Averaging ~1.6 Million contracts/day.

- 2026 Insight: Liquidity in Micros is no longer “thin”—it now rivals full-sized contracts, making them the primary vehicle for retail day traders in 2026.

Interest Rate Volatility: The 10-Year Note (ZN) complex is seeing massive activity (~2.8M daily contracts) as traders position for 2026 rate policy shifts.

Energy Resilience: Crude Oil (CL) remains the king of commodities with ~1M+ daily contracts, far outpacing other metals or grains for day trading suitability.

Source: CME Group Leading Products (Year-End 2025 Data).

The Decision Framework: What Makes a Futures Contract “Best”?

Definition: A futures contract is a standardized agreement to buy or sell an asset at a set price on a future date, traded on regulated exchanges like the CME.

A strong futures market has five core traits. Understanding these will help you filter any market you evaluate — now or in the future.

1. Liquidity

Definition: Liquidity measures how easily you can enter and exit positions without moving the price against yourself.

High average daily volume and tight bid–ask spreads reduce slippage and improve fill quality. ES and MES are the gold standards here, often maintaining one-tick spreads even during high-volume rotations.

Why It Matters: In illiquid markets, your own trade pushes price against you. Every tick lost to slippage eats directly into profits.

2. Volatility

Definition: Volatility refers to how much — and how fast — a market moves within a given timeframe.

Enough volatility creates opportunity after spreads and commissions. Too much volatility creates emotional pressure and forces wider stops.

Why It Matters: Higher volatility means larger profit potential per trade, but also larger losses if you’re wrong. Your position sizing must match the contract’s typical movement.

Volatility Spectrum:

- Higher: NQ, CL — Larger ranges, momentum-friendly

- Lower: ZN, 6E — Smoother structure, smaller rotations

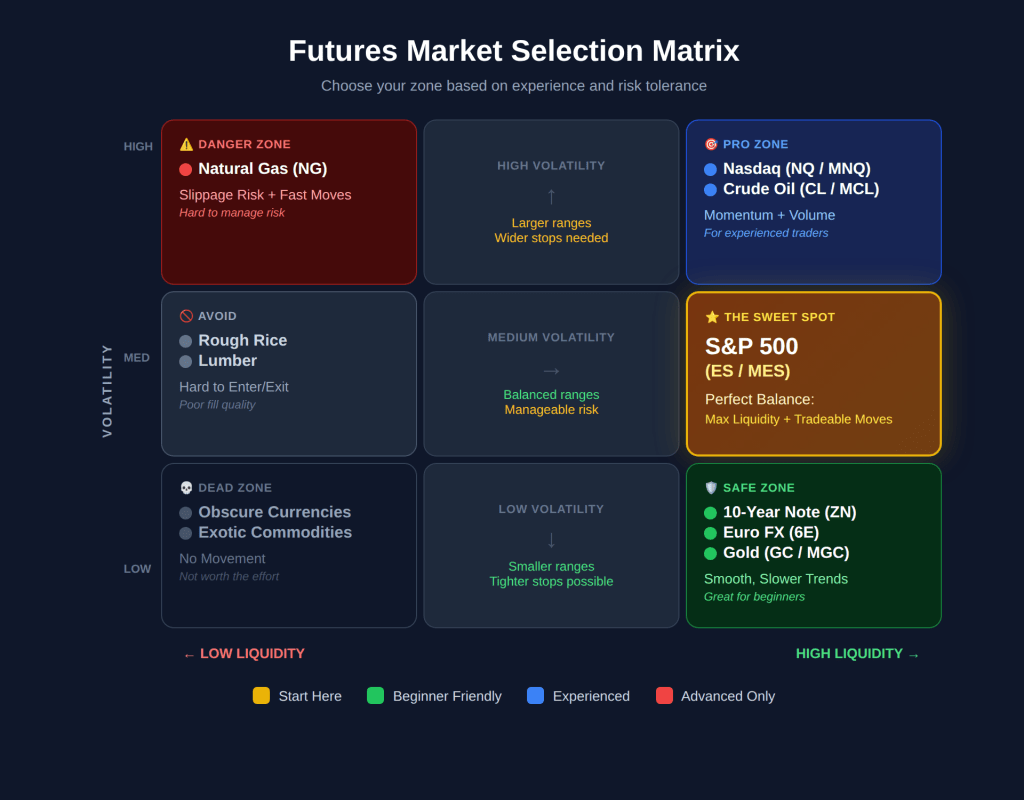

The Risk Matrix: ES and MES sit in the ‘Sweet Spot’ (Right-Center), offering the perfect balance of high liquidity and tradeable volatility.

For more context on trade setups and approaches, see our futures trading strategies on the Optimus Futures Blog.

3. Margin Requirements

Definition: Margin is the good-faith deposit required to open and hold a futures position.

Intraday margin allows you to control a significant notional value with smaller capital, but leverage magnifies losses as much as gains.

Why It Matters: Lower margin = higher leverage = amplified risk. Define your dollar risk per trade before choosing contract size. Never trade the max your margin allows.

Typical Day Trading Margins at Optimus Futures (2026):

- MES: ~$50–$100

- ES: ~$500–$1,500

- NQ: ~$1,000–$2,500

- CL: ~$500–$1,500

4. Contract Size (Notional Value)

Definition: Contract size determines how much each tick movement affects your account balance.

Why It Matters: Micros offer precision, lower stress, and easier scaling. E-minis deliver more exposure but require larger capital and tolerance for bigger swings.

For a deeper breakdown of smaller-sized contracts, see our Micro Futures page.

5. Trading Hours

Definition: Trading hours are when a market is open; peak windows are when volume and volatility actually cluster.

Each market has “prime windows” when the real action happens. Trading outside these windows often leads to chop, poor fills, and frustration.

Why It Matters: Align your schedule with peak activity. Forcing trades during dead periods is how disciplined traders lose money.

Prime Windows:

- U.S. Equity Open: [9:30] AM ET

- Economic Releases: [8:30] AM, [10:00] AM, [10:30] AM ET

- European/U.S. Overlap: [8:00]–[11:00] AM ET

Contract Specs Cheat Sheet (2026)

Note: Values are approximate and for educational purposes. Always verify with the exchange or your futures broker.

| Contract | Symbol | Tick Size | Tick Value | Intraday Character | Best For |

|---|---|---|---|---|---|

| E-mini S&P 500 | ES | 0.25 | $12.50 | Medium volatility | Consistency, structure |

| Micro S&P 500 | MES | 0.25 | $1.25 | Medium volatility | Beginners, scaling |

| E-mini Nasdaq-100 | NQ | 0.25 | $5.00 | High volatility | Momentum traders |

| Micro Nasdaq-100 | MNQ | 0.25 | $0.50 | High volatility | Beginners, momentum |

| E-mini Dow | YM | 1.00 | $5.00 | Medium volatility | News-reactive traders |

| E-mini Russell 2000 | RTY | 0.10 | $5.00 | Higher volatility | Small-cap exposure |

| Crude Oil (WTI) | CL | 0.01 | $10.00 | High volatility | Macro/news traders |

| Micro Crude Oil | MCL | 0.01 | $1.00 | High volatility | Energy beginners |

| 10-Year Note | ZN | 1/64 | ~$15.625 | Lower volatility | Order-flow scalpers |

| Gold | GC | 0.10 | $10.00 | Moderate volatility | Safe-haven traders |

| Euro FX | 6E | 0.00005 | $6.25 | Moderate volatility | 24-hr FX-style traders |

Top Futures Contracts by Trader Type

Stock Index Futures: The Retail Core

E-mini (ES) & Micro (MES) S&P 500

- Why traders choose it: ES is one of the most liquid markets in the world. Institutions actively participate, creating cleaner reactions to support, resistance, VWAP, and opening-range levels.

- Trade-off: Mid-day price action ([12:00]–[2:00] PM ET) can become choppy with fewer clean setups.

- Practical edge: Use MES to test setups live with one-tenth the exposure. Many traders at Optimus Futures use this approach to validate strategies before scaling up.

E-mini (NQ) & Micro (MNQ) Nasdaq-100

- Why traders choose it: NQ typically delivers bigger intraday ranges and faster directional bursts — ideal for momentum traders.

- Trade-off: Deeper wicks and sharp snap-backs require wider stops and disciplined sizing.

Energy Futures: For Volatility Seekers

Crude Oil (CL) & Micro (MCL)

- Why traders choose it: CL reflects global supply/demand, OPEC decisions, and geopolitical risk. It frequently produces clean directional moves around economic releases and weekly EIA inventories.

- Risk note: CL is notorious for fast spikes around news — always size conservatively and define your max loss before entry.

Natural Gas (NG)

- Profile: NG is extremely volatile and sensitive to weather patterns and seasonality. Many experienced traders consider it one of the toughest instruments to trade intraday.

- Recommendation: Treat NG as an advanced market; focus on index futures first.

Treasury & Currency Futures: The Diversifiers

10-Year Treasury Note (ZN)

- Why traders choose it: ZN trades with deep liquidity and reacts predictably to interest-rate expectations and macroeconomic surprises.

- Fit: Ideal for traders who prefer structure and order-flow reading over pure momentum.

Currencies (6E, 6B, 6J)

- Why trade them: Currency futures offer FX-style movement with a centralized, regulated futures market structure (no dealing desks).

- Fit: Attractive for traders transitioning from spot FX who want exchange-traded transparency.

For more structured education by market type, browse the Optimus Futures Learn Center.

Micro vs. E-mini: Sizing & Scalability

The introduction of micro contracts fundamentally changed how smaller accounts can participate.

| Contract | Tick Value | 10-Point Move |

|---|---|---|

| ES (E-mini S&P 500) | $12.50 | $500 |

| MES (Micro S&P 500) | $1.25 | $50 |

| NQ (E-mini Nasdaq-100) | $5.00 | $200 |

| MNQ (Micro Nasdaq-100) | $0.50 | $20 |

Key Relationship: 10 MES ≈ 1 ES in notional exposure.

Practical Implication: Traders gain flexibility to scale in, scale out, manage runners, and keep risk consistent. Many traders at Optimus Futures continue using micros even after they can afford E-minis — the precision in trade management is worth it.

Learn More: E-mini vs Micro Futures: Which Should You Trade?

Interactive Tool: Futures Risk & Position Sizer

One of the most common mistakes new traders make is sizing their positions based on margin (what they can buy) rather than risk (what they should lose).

Use the calculator below to determine your optimal contract size. It checks two limits: your personal risk tolerance and your account’s buying power.

Futures Risk Calculator

Visualize your risk before you trade.

How to Read This:

Important Notes on This Calculation:

- Margin Data: The calculator uses Optimus Futures Day Trading Margins active at the time of publication (e.g., $500 for ES, $1,000 for NQ, $2,000 for CL).

- Subject to Change: Exchange margins and broker requirements fluctuate with market volatility. The values in this tool are for educational estimation only. Always verify the latest live margin requirements here before trading.

- Execution: Real-world execution is subject to liquidity, slippage, and platform connectivity. This tool does not constitute investment advice.

💡 Optimus Insight: Why is this calculator capped at 5% risk?

This calculator allows up to 20% risk per trade — but we strongly recommend staying at 5% or below.

In futures trading, the “Mathematics of Recovery” works against you. If you lose 50% of your account (which happens quickly when risking 10%+ per trade), you don’t need a 50% gain to get back to breakeven—you need a 100% gain.

- Risking 1-2%: Professional standard. You can absorb losing streaks and recover.

- Risking 3-5%: Aggressive but manageable for experienced traders.

- Risking >5%: Danger zone — emotions take over and drawdowns compound fast

We built this tool to help you survive the learning curve, not accelerate a drawdown.

Tax Advantage: Section 1256 (U.S. Traders)

Many U.S. futures qualify for Section 1256 tax treatment, which blends gains/losses as:

- 60% Long-Term Capital Gains

- 40% Short-Term Capital Gains

This blended rate can be significantly more favorable for active traders than pure short-term taxation on stocks.

Always consult a qualified tax professional before making tax-related decisions.

Peak Trading Hours by Contract

| Contract | Prime Window (ET) | Key Catalyst |

|---|---|---|

| ES, NQ, RTY, YM | [9:30]–[11:30] AM | Cash open, highest volatility |

| ES, NQ, RTY, YM | [2:00]–[4:00] PM | Afternoon momentum |

| CL (Crude Oil) | [9:30] AM–[12:00] PM | U.S. open, EIA report (Wed [10:30] AM) |

| ZN (Treasury) | [8:30]–[10:30] AM | Economic data releases |

| 6E (Euro FX) | [3:00]–[8:00] AM | London session overlap |

Optimus Futures Insight: Track your P&L by time of day. Many traders fail not from bad strategy, but from forcing trades during low-volume periods.

How to Choose Your Market

Specialization beats rotation.

| Your Situation | Recommended Approach |

|---|---|

| Under ~$5,000 capital | Micros only (MES, MNQ, MYM, M2K) |

| $5,000–$25,000 capital | Micros and E-minis |

| Trade U.S. hours | ES, NQ, CL |

| Trade European/Asian hours | 6E, ZN |

| Momentum personality | NQ or CL |

| Structured personality | ES or ZN |

The Edge: Pick one or two markets and master their behavior. Familiarity compounds into edge over time.

Common Mistakes to Avoid

| Mistake | Why It Hurts |

|---|---|

| Over-leveraging | Trading max size based on margin (not risk) kills accounts |

| Ignoring trading hours | Forcing trades in dead periods = chop and slippage |

| Contract hopping | Jumping between markets prevents deep familiarity |

| Underestimating volatility | Same size in CL vs. MES = very different risk |

| Skipping news awareness | Entering before FOMC, EIA, NFP without a plan |

Frequently Asked Questions

The Micro E-mini S&P 500 (MES) is widely considered the most beginner-friendly contract. It offers deep liquidity, tight spreads, structured price action, and a tick value of just $1.25 — allowing new traders to gain live market experience without risking significant capital. Other good starting points include Micro Nasdaq (MNQ) and Micro Dow (MYM).

You can technically start with $500–$1,000 for micro contracts, but most experienced traders recommend $2,500–$5,000 to handle normal drawdowns without emotional pressure. Position sizing should be based on your dollar risk per trade, not the minimum margin requirement.

Micros are one-tenth the size of E-minis. MES has a $1.25 tick value vs. $12.50 for ES. This means 10 micro contracts provide approximately the same exposure as 1 E-mini contract. Micros allow finer position sizing and lower capital requirements while trading the exact same underlying markets.

Yes. Unlike stocks, futures are not subject to the $25,000 Pattern Day Trader (PDT) rule. You can day trade futures with significantly less capital, especially using micro contracts. This is one of the key reasons retail traders choose futures over equities for active trading.

Natural Gas (NG) is consistently the most volatile futures contract, followed by Crude Oil (CL) and E-mini Nasdaq-100 (NQ). High volatility means greater profit potential but also higher risk — beginners should generally start with lower-volatility contracts like MES before graduating to more volatile markets.

Most CME futures trade nearly 24 hours per day — Sunday [6:00] PM through Friday [5:00] PM ET, with a daily trading halt from [5:00]–[6:00] PM ET. However, peak liquidity and volatility typically occur during U.S. cash market hours ([9:30] AM–[4:00] PM ET) and around scheduled economic releases.

Yes. In the United States, many index and commodity futures qualify for Section 1256 tax treatment, which applies a blended rate of 60% long-term and 40% short-term capital gains — regardless of how long you held the position. This can result in a lower effective tax rate compared to short-term stock trading. Consult a qualified tax professional for guidance specific to your situation.

Summary Cheat Sheet for Best Futures to Trade in 2026

| Decision | Key Takeaway |

|---|---|

| Just starting? | Trade MES or MNQ. Master one before adding others. |

| Under $5,000? | Stick to micros. Avoid E-minis until properly capitalized. |

| Want momentum? | NQ offers larger ranges — requires wider stops. |

| Follow macro news? | CL and GC respond strongly to data and geopolitics. |

| Prefer slower tape? | ZN offers readable order flow, smaller ranges. |

| Trade off-hours? | 6E provides 24-hour FX-style action. |

| Position sizing rule | Define dollar risk first, then calculate contracts. |

| Time of day | Match trading to peak windows. Avoid dead periods. |

| Long-term edge | Specialize. Deep familiarity beats shallow knowledge. |

Ready to Trade These Markets?

Try Optimus Flow — Our Signature Trading Platform Advanced charts, DOM, volume tools, and fast execution built for serious retail traders. Download the Free Demo

New to Futures? Start with our free education center — contract specs to advanced strategy. Visit the Learn Center

Open an Account — Tight margins, low commissions, multiple platform choices. Open a Live Futures Account

Risk Disclosure

Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before trading futures, carefully consider your investment objectives, experience level, and risk tolerance. Seek advice from an independent financial advisor if you have any doubts. The placement of contingent orders, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

This article is for educational purposes only and does not constitute investment advice.