This article on FANG Futures is the opinion of Optimus Futures LLC.

We have all seen just well the Stock Indexes, particularly the technology sector, have performed lately. But it may come as surprise to discover that it only takes a few stocks to affect the overall performance of an index. In some cases, a big price fluctuation in one single stock can move an entire index, either because of its weighted average or just based on the psychology of the market. And it’s always the same big stocks that are responsible for such market moving sentiments: Facebook, Amazon, Netflix, and Google (FANG).

If you ever wanted to trade these stocks individually, you would need a lot of capital to truly enjoy the benefits of their rising prices. And it would require even more capital if you decided to short them, not to mention short interest charges. If you did not invest in these stocks years ago, it is hard to buy into them now, both financially and psychologically. Let’s face it, it’s pretty hard buying into AMAZON once it broke $1,000. So instead of looking into investing in stocks that we all know have outperformed the market, beginner traders especially, tend to look for stocks that will be the NEXT big breakout, while the smart money continues to pour millions into the best performing stocks TODAY.

On Nov 8, 2017, the ICE Futures US exchange introduced the FANG Plus Futures Contract. Click Here to view full contracts specifications, margins and pricing info.

NYSE FANG+™ is a new index providing exposure to the following highly-traded growth stocks of next generation technology and tech-enabled companies.

The index’s underlying composition is equally weighted across all stocks. So unlike the S&P 500 Futures Index where the value is computed by weighted average market capitalization of the underlying stocks, each of the 10 stocks in the FANG+ Index contributes 10 percent, regardless of market capitalization. This methodology provides a more value-driven approach to investing with an equal-weighting allowing for a more diversified and represented portfolio. For more information, see ICE’s methodology here.

The futures contract on the index is designed to offer the ability to gain or reduce exposure to this key group of growth stocks in a capital efficient manner. You can now trade all these highly capitalized, well-established stocks through one index. Go long and short on these stocks altogether. Although the FANG Index covers only a small number stocks, they can be just as volatile, if not more, than entire index Futures of S&P 500.

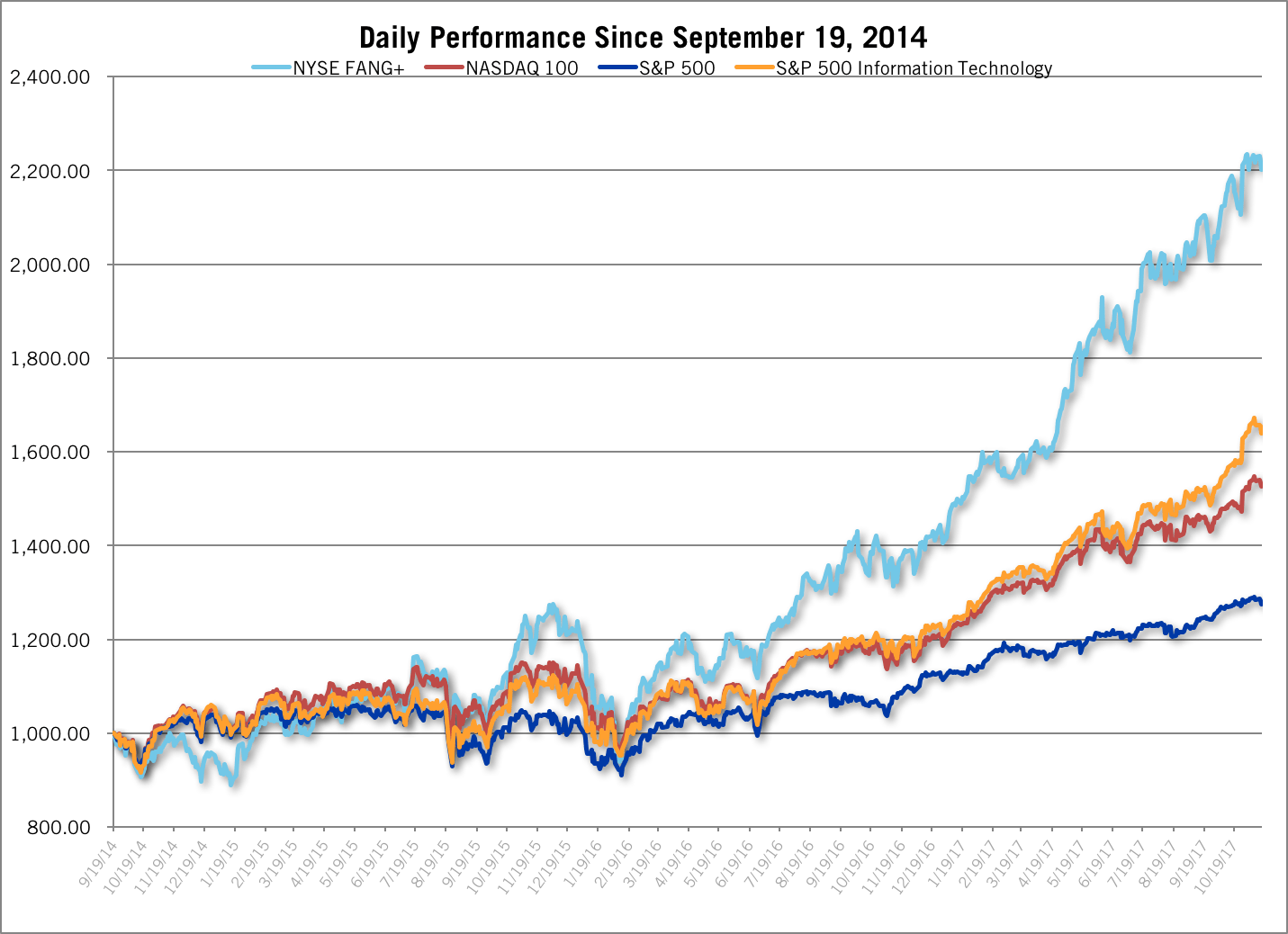

NYSE FANG+ INDEX PERFORMANCE COMPARISON

(Hypothetical performance using backtested data)

Past performance is not indicative of future results.

Backtesting the performance of the stocks in the NYSE FANG+ Index shows a 29% annualized total return compared to 15.9% for the NASDAQ-100®, 10.5% for the S&P 500® and 19.1% for the S&P 500® Information Technology Index.

Keep in mind that many of the news announcements and earning reports occur after the major cash markets close. Trading on the stocks above after hours could be hard due to the liquidity. So even though this is a new futures contract, it does represent an efficient way to participate in those highly capitalized stocks with a minimal capital outlay. Clearly, any time an exchange creates a product, it is out of demand, whether that is institutional, retail and/or both.

Lastly, it is our opinion that the selection of stocks making up the index can change in the future. One of the benefits of the FANG+ futures contract is its narrow focus. In particular, this new index gives us a glance into how the most advanced companies today are performing in the future. In particular, any change in the selection of stocks in the underlying index would point out to major shifts in the technology sector, signal new players that represent new technology or companies that simply offer a better solution to the existing one.

Interested in Learning More About NYSE FANG+? Contact Us to Get Started.

We also offer free Demo Accounts so you can paper trade the FANG+ futures contract without risking any of your funds.

For more information, visit our website: https://www.optimusfutures.com

There is a substantial risk of loss in Futures trading. Past performance is not indicative of future results.