This article on Futures to Hedge Against Inflation is the opinion of Optimus Futures.

These days, inflation is on everyone’s mind, and rightfully so.

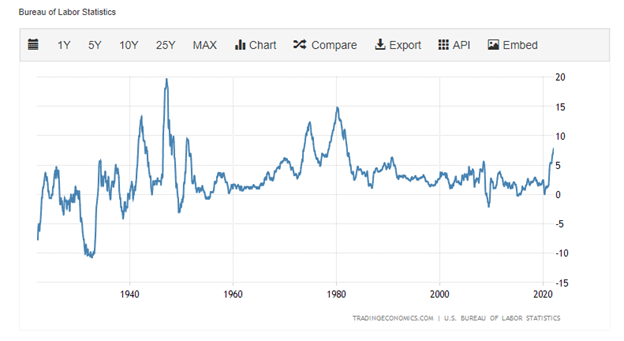

In the U.S., Consumer Price Index (CPI) readings haven’t been this high in 40 years.

You see, the purchasing power of the dollar weakens when gas prices at the pumps rise and food prices at the grocery store go up. If it gets out of hand, inflation has the potential to destroy an economy.

That’s why the Federal Reserve Bank has a dual mandate to manage inflation and price stability along with full employment.

When the Fed raises rates they are making it more expensive to borrow money. Naturally, this slows down demand and gives suppliers time to catch up and for prices to normalize.

In February 2022, the annual inflation rate shot up to 7.9%, the highest reading seen since January of 1982.

Inflation hasn’t been this high in over 40 years!

That’s why many traders and investors expect the Federal Reserve to raise rates multiple times over the coming months and years.

This opens up opportunities for traders to use futures to hedge against inflation and profit from higher interest rates.

How?

It’s no secret that hard assets like commodities tend to outperform during inflationary periods.

Today we are going to look at four futures products which you can use to hedge against inflation.

Using Commodity Futures to Hedge Against Inflation

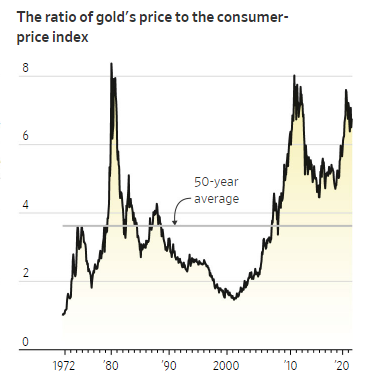

Ask any futures trader who has been around the game for a while what’s the classic inflation hedge—and they’ll most likely tell you it’s gold.

In 1979 the rate of inflation was 11.3%. That same year, gold prices shot up 120%, closing above $450 per ounce.

Gold reached an all-time high of $2074.88 on 8/20.

Gold is often considered a safe haven during times of uncertainty, it has been around for thousands of years and the supply and inventory are relatively finite.

Some of the main reasons investors are attracted to gold are:

- Universally recognized value

- Easily transportable

- Corrosion-resistant

- Space efficient

Because of its finite nature and is denominated in U.S. dollars, traders will buy gold when inflation is high and sell it when rates are expected to rise.

Now, when it comes to trading gold via the futures market there are some options.

For example, Micro Gold Futures Contract (MGC) leverages 10 troy ounces. The contracts are quoted in ten-cent increments. At the time of this publication, the day trading margin for one MGC was $50, and the exchange margin was $750.

There is also a 100-ounce Gold Futures Contracts (GC). The day trading margin for GC is $500 and the exchange margin is $7500.

For the latest on margins, click here.

One unique feature of standard gold contracts is that you can hold them until expiration and take physical delivery of gold. This can also be done if you collect 10 micro gold futures contracts.

Black Gold Could Be A Place To Hide

We still have some time until electric-powered vehicles take over and become mainstream. Until then, the world will still rely on crude oil for transportation.

That was made evident in the first half of 2022 when the price of the crude spiked to $130 a barrel after Russia invaded Ukraine causing an almost immediate shock to the supply of oil.

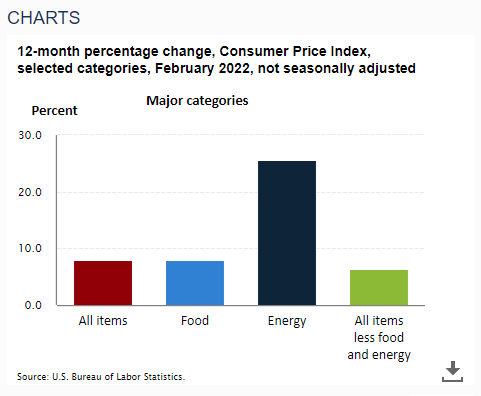

Very few things hit consumers harder than the rise of gasoline prices at the pump. In fact, energy has seen the largest increase over the last 12 months, according to the Bureau of Labor Statistics.

You can use oil futures to hedge against inflation via micro contracts or full-size contracts. The exchange margin for a micro contract (MCL) is $510 and has a day trading margin of $50. Meanwhile, the full-size contract, (CL), is ten times larger than the micro-contract.

The exchange margin is $5,100 and the day trading margin is $500. For every dollar CL futures move, the trader will make +/- $1,000 depending on their position.

To stay up-to-date on the latest margin requirements, click here.

Fair warning. Crude oil futures are settled with delivery for regular contracts. That means if you own a contract at expiration you are required to take delivery of oil.

Back in 2020, this became a problem for the USO ETF which owned almost 25% of the front-month oil futures contracts.

With storage completely full in Cushing Oklahoma, the fund managers were in no position to take ownership of millions of barrels of crude oil.

They were forced to liquidate their futures at any price, which sent the price of crude futures below $0 for the first time ever.

The moral of the story – close out or roll your futures before expiration.

How About Some Digital Gold

Borrowing money we don’t have to pay for things we don’t need is something the government excels at. Eventually, the debt piles up so much it becomes difficult to service it. But if there is one thing we’re good at when times are tough is—printing more dollars.

As the purchasing power of the dollar weakens, people lose faith in it as a store of value.

That’s why we’ve seen such great interest in bitcoin.

People are attracted to it because it is decentralized and its supply is fixed supply. And unlike gold, it is very easy to transport and it is stored digitally.

Many businesses are now accepting bitcoin as payment, including the: Miami Dolphins, GameStop, Tesla, Etsy, and PayPal to name a few.

Now, the beauty of trading bitcoin futures (BTC) is that the contracts are cash-settled. You don’t have to worry about delivery.

Furthermore, you don’t need a digital wallet to trade them like you would if you were trading the actual cryptocurrency.

Another reason why some traders might find BTC more attractive is because it is traded on the Chicago Mercantile Exchange, which has a rich history of making fair markets for traders.

The tick increments are quoted in multiples of $5 per bitcoin. In other words, a one-tick move of the BTC future is equal to $25.

Using Micro Treasury Yield Futures to Hedge Against Inflation

Micro treasury yield futures are one of the newest products to hit the market.

Unlike treasury futures, treasury yield futures track the yield of treasury bonds rather than their price.

Best of all, you can select from different maturities including the 2-year, 5-year, 10-year, and 30-year yields.

Micro treasury yields are a great way to hedge against inflation given the relationship between debt markets and fed interest rate policy.

When the Fed wants to tame inflation, they’ll increase borrowing rates which spills down to consumers. They do this through a variety of mechanisms including open market operations that buy and sell U.S. Treasury bonds.

Raising rates means the Fed will either reduce the purchase of bonds or sell them outright. Doing this lowers the price of U.S. Treasuries and sends their yields higher.

Traders can take advantage of this by going long micro U.S. Treasury yields.

Conversely, higher inflation tends to mean higher Treasury prices and lower yields.

So if you believe inflation is going to get worse, you might sell micro treasury yield futures.

And with the different maturity options, traders can tailor their positions to match their outlook.

The Bottom Line

It’s no secret hard assets like commodities, precious metals, and treasury bonds do well during inflationary times. On the flip side, all of them tend to decline as interest rates rise.

That’s why trading or even investing in commodity futures can be an advantageous strategy during periods when inflation is expected to rise.

Today we touched on three assets that have the potential to appreciate when inflation rises.

As you probably noticed, the products we discussed are available in both micro and regular-sized futures contracts.

Optimus Futures provides traders with access to these products and dozens more, ensuring a wide selection of assets to choose from.

Traders can open an account with Optimus Futures for free and begin trading for as little as $100. Plus, you get access to our flagship Optimus Flow platform and all the indicators, tools, and analytics right out of the gate.

Additionally, our automated trade journal logs and analyze your trades, helping you uncover opportunities and areas of improvement.

See what futures trading has in store for you.

Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.