Futures traders often lack the proper approach and know-how to re-enter a trade or add to an existing position. In this article, we will introduce 5 ways you can add to an existing trade or find re-entry opportunities during a trending market. We also discuss the pros and cons of the various techniques and what to be aware of.

Moving Averages

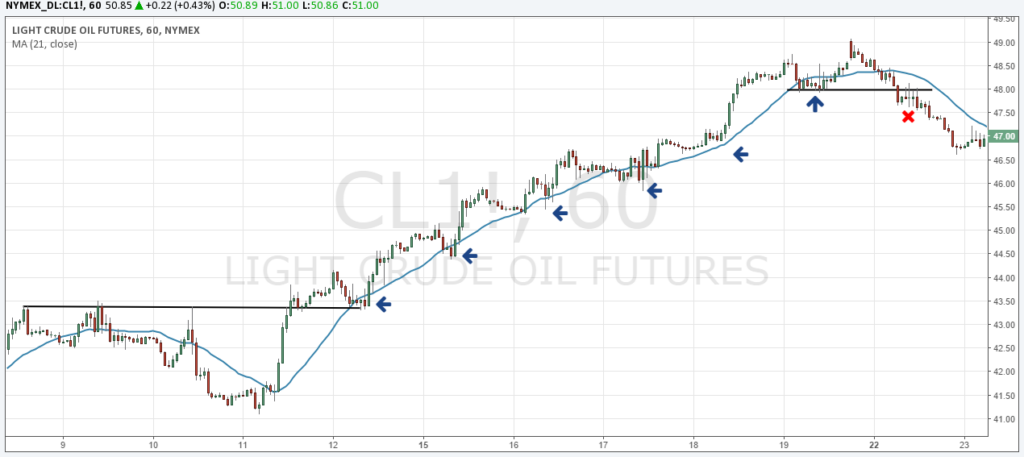

Using moving averages is probably among the most commonly used techniques when it comes to adding to an existing position during a trend or getting into a trade. The first question that comes up is, of course, which moving average period you should use. This highly depends on the market but if the market tends to make deep pullbacks, you should use a higher period setting. In the end, it’s a trial and error process, where you adopt the right moving averages to your method of trading.

However, one important thing here is that you don’t automatically enter once price reaches a moving average; placing pending orders at moving averages is not a good idea. Instead, wait until price is pulling away from the moving average again and resumes into its original direction. This way, you may avoid running into reversals.

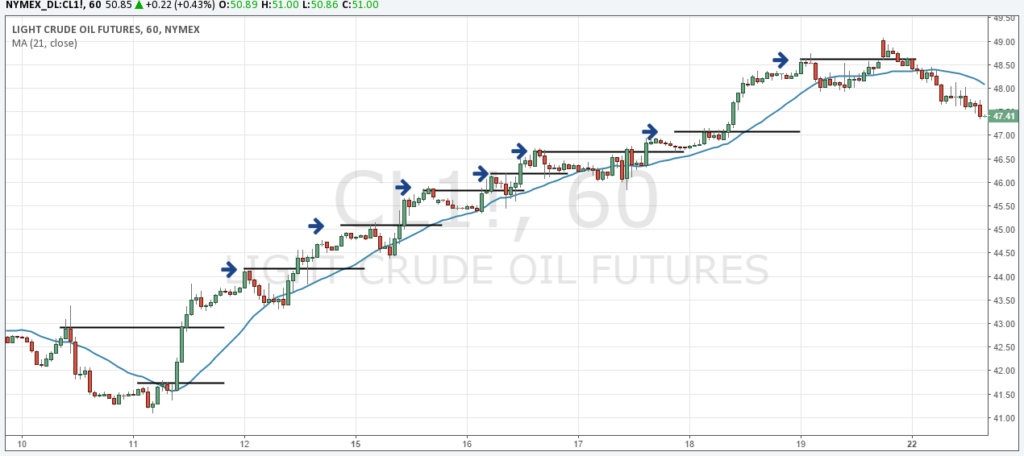

Support-Resistance

Using support and resistance, especially when it comes to trendlines, is similar to using moving averages. Once you have defined a valid support or resistance trendline, you wait for the next touch and then reenter or add to your trade once price pulls away from the trendline. The mistake many traders make is that they trade “blindly” off those levels without having confirmation. Yes, you can get in at a better price by entering directly at the trendline but you will also run into more breakouts when the trendline doesn’t hold. Try to watch what happens.

Breaks of Highs/Lows

This is relatively a “conservative” approach and it uses swing points and the Dow Theory. During a rally, price usually makes higher highs and between swing points we see retracements. Entering on the retracement is what we explained with the moving average and the trendline technique. Entering on the break of a previous swing point gets you into a trade at a ‘worse’ price but it follows the premise that the trend is confirmed once price makes a higher high and momentum is supporting the trend.

Thus, as long as the trend is ‘healthy’ and makes new highs, a trader can use those swing points to reenter a trade or add to a position. Once price fails to make a new high or makes a lower low, in the case of a rally, the trend is likely to be over and the trader usually exits his trade altogether.

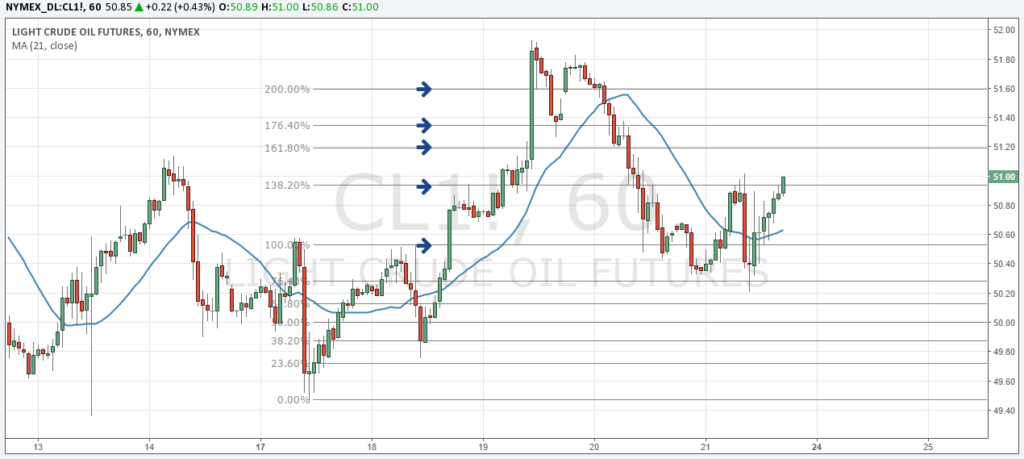

Fibonacci Levels

Using Fibonacci levels is a more objective way and it removes a lot of uncertainty and guesswork because Fibonacci levels are fixed once you have drawn the Fibonacci sequence. The trader then adds to a position once a new Fibonacci level has been broken.

However, dealing with retracements is the biggest challenge following the Fibonacci approach and traders can choose to add a moving average to this method to make it more robust. At the same time, a trader doesn’t have to enter at every Fibonacci level and he can pick a few where he thinks it makes sense.

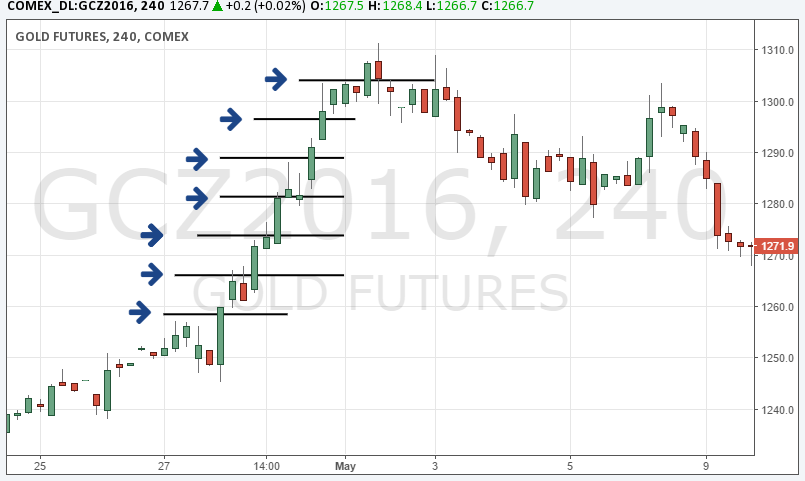

Equidistant Orders

Similar to the Fibonacci method is this final way of determining reentry opportunities. However, this approach is more suited for the experienced trader because there are several things to take into account:

First, it’s important to know how large the distance between the individual orders can be. When orders are too close together, retracements can easily eat up big chunks of the trading margins. When the orders are too far apart, a trader might not get in enough orders to maximize potential profit.

Second, volatility and momentum play an important role and this has to be factored in when deciding about the distance between the orders and also how many orders a trader plans on using.

And finally, a trader should not forget about visual support and resistance levels on his charts and also take those into consideration when planning the order structure.

Scaling into a trade can, potentially, reduce initial risk because if the trade goes against the trader right from the start, he is only in the markets with a partial position. The downside of using such a money management model is that a trader could, potentially, realize bigger profits if he had just enter a full position at the beginning. However, most traders do well by looking at ways to reduce potential risk and not force bigger winning trades. Keep in mind that reward and risk always go hand in hand.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.