Tradingview is not only a great web based charting platform, but the social and member-oriented aspect of it allows you to connect with other traders and learn from more experienced traders as well.

We will now show you how to leverage Tradingview’s social functions to build a portfolio of traders that you can learn from and improve your own trading potentially.

Step 1: Finding the traders with a positive expectancy

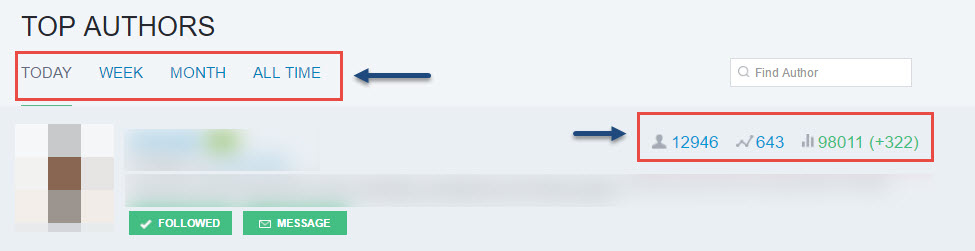

First, you need to make sure that you follow the right people. For that, it’s usually good to go through the top authors and look for the traders with the largest following and also the most reputation points (green number at the right).

In Tradingview you can go through the top authors by week, month and of all time. Here you only need to pre-select some potential candidates and we will show you afterwards how to make sure you follow the right traders.

Step 2: Find the right traders for your own purposes

Obviously, it only makes sense to follow traders that have a similar trading approach, trade the same underlying asset class (futures, forex, etc) and have the same trading horizon as you. Don’t make the mistake of following high profile traders on Tradingview just because they seem to have a large following but then have nothing in common with your own trading. This will only create a lot of noise and confusion for yourself and probably not add a lot of value.

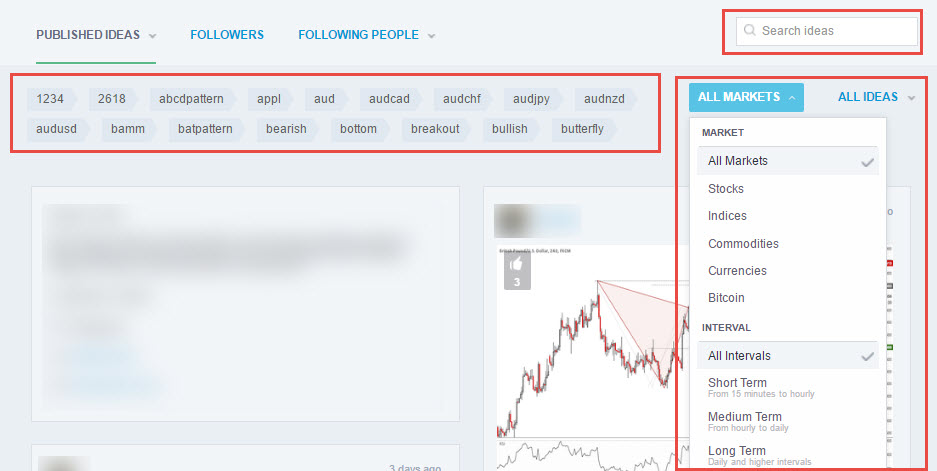

In Tradingview, you can filter based on market and time frames, which will already narrow down the field significantly and very effectively.

Step 3: Analyzing trader portfolios

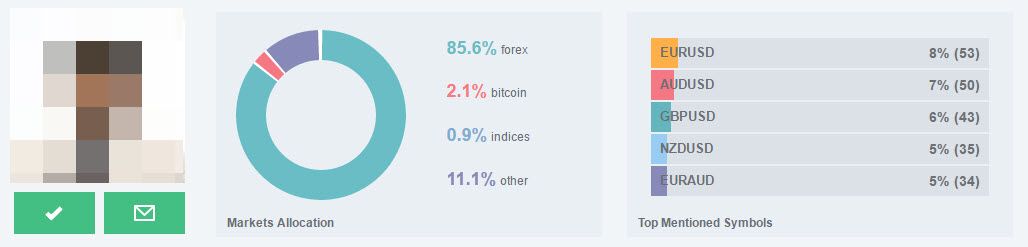

Now that you have narrowed down the field of potential candidates, you can go into the individual trader profiles and take a closer look. At first, you will see the markets those traders trade and which pairs, commodities, stocks or futures the trader talks most about.

If you think that the trader is a good fit, you can go own and evaluate him further with the tips below.

Step 4: Trader profile I – Evaluating traders

When you scroll down further, you reach the ‘idea stream’ of the trader where you can then see the ideas and chart studies the trader has published on Tradingview. Some traders also use ‘tags’ to categorize their published chart studies which often allows you to get a good idea of their overall trading approach.

Step 5: Replay their trading ideas

Once you see that the trader matches with your trading approach, you can go through some of his published chart studies and ‘replay’ them. For that, open the individual chart studies and click on the round play icon on the right.

Here are a few things to look for when replaying other traders’ chart studies:

- The published chart analysis does not represent actual trades so don’t look for timing accuracy

- It’s more important to look for traders who follow a consistent approach. Traders who change the way they analyze price charts should be avoided(!!!)

- Does the trader contradict himself? Look for clear and precise analysis without fluff and explanations that don’t make sense. Good traders have straightforward methods that could be summarized well.

- What is the motive? Some traders just like to chat all day….it does not mean its useful.

When you believe that you have found a trader who matches your trading and you think that you can learn from him, you can start following him.

The follower stream

The traders you have followed will then appear in your ideas stream in the Tradingview charting view on the right. Click on the lightbulb icon (1) and the stream appears. You can manage the way the ideas are displayed by going through the settings (2).

Don’t copy trades but to learn about chart studies

We don’t suggest to use other traders’ ideas to enter trades directly, but to broaden your horizon, see how other traders with similar trading methods see the markets you also follow and learn from more experienced traders.

In Tradingview, you don’t see how traders enter, where they set their stops and targets and how they manage their trades which makes it less than ideal for a pure trade-copy platform. But when it comes to learning from experienced traders, the social components of the Tradingview platform can be of great help.

Now you follow traders and trade on TradingView.

Get a demo here: https://optimusfutures.com/TradingView.php

Q and A for TradingView: https://community.optimusfutures.com/c/futures-trading-platforms/tradingview

Trading futures and forex involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.