This article on Best VPS for Futures Trading in 2026 is the opinion of Optimus Futures

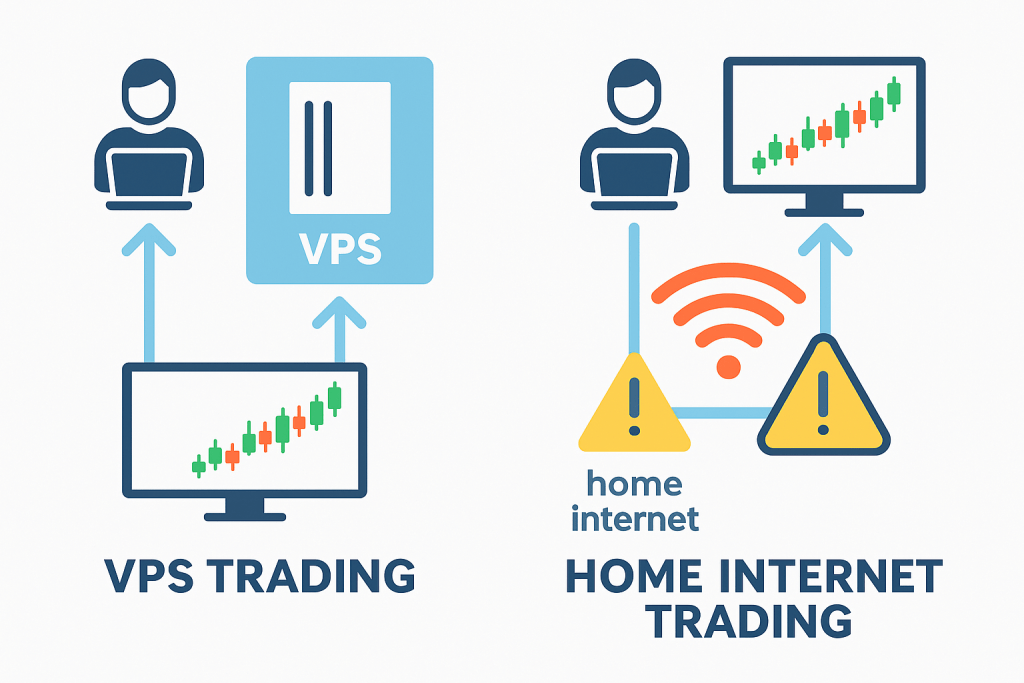

The best VPS for futures trading in 2026 is not simply the server with the lowest advertised ping—it’s a Chicago- or Aurora-proximate machine that keeps your platforms, algorithms, and charting stable through volatile market conditions. For most retail futures traders, a Virtual Private Server functions primarily as a stability and risk-management tool, with latency optimization as a secondary benefit.

If your home internet drops during a chaotic open, or your PC forces a Windows update while you hold a leveraged position, the resulting loss can far exceed years of VPS subscription fees. This guide breaks down the specs that matter, the VPS providers leading the space in 2026, and how to configure your trading infrastructure for maximum uptime.

Trading-Grade VPS: Key Specifications at a Glance

Definition: A trading-grade VPS is a remote Windows server hosted in a professional data center, optimized for the computational demands and low-latency requirements of financial trading platforms.

- CPU Clock Speed: 3.5 GHz+ (Intel i7/i9 or AMD Ryzen 7/9)

- RAM: 4–8 GB (16 GB for multi-platform setups)

- Storage: NVMe SSD (mandatory for tick data)

- Server Location: Aurora, IL or Chicago (for CME futures)

- Latency to CME: < 2 ms (sub-1 ms for algos)

- Uptime Guarantee: 99.9%+ SLA

- Operating System: Windows Server 2019/2022

Quick Verdict: Top VPS Providers for 2026

A trading VPS provider is considered “trading-grade” when it can deliver low, consistent latency to CME, strong uptime, and hardware suitable for real-time markets rather than generic web hosting.

| VPS Provider | Location Strengths | Suitable For | Notable Features |

| QuantVPS | Chicago/Aurora | CME Futures (Overall) | Dedicated CME proximity, NVMe Storage, Optimus-optimized |

| Speedy Trading Servers | U.S. & Global | General Use | Reliable uptime, trader-aware support, balanced cost |

| ChartVPS | U.S. / EU | Visual / DOM | GPU-accelerated hardware optimized for Bookmap |

| FXVM | Global (NY/London/Tokyo) | Multi-Asset | Low latency to multiple venues (Forex + Futures) |

| Kamatera | Global Network | Enterprise / Devs | Instant resource scaling & hourly billing options |

What a Trading VPS Actually Does

A Virtual Private Server (VPS) is a remote Windows machine hosted in a professional data center that traders access via Remote Desktop Protocol (RDP).

A VPS remains online around the clock with redundant power, enterprise internet, and 24/7 monitoring. For traders using the Optimus Flow platform, Sierra Chart, or Rithmic-based platforms, the VPS becomes the always-on execution hub.

Core Functions:

- Risk Management: Server-side logic (OCOs, brackets, trailing stops) remains active even if your home connection fails.

- Automation: Runs scripts, trade copiers, and algorithmic strategies without leaving your PC powered on.

- Latency Normalization: Hosting near Aurora stabilizes routing and reduces jitter compared to long-haul retail internet paths.

Why It Matters: A VPS turns your trading setup into a professionally managed execution environment accessible from any device.

Important: A VPS cannot mitigate exchange halts, broker outages, or routing issues that occur beyond your own infrastructure.

Stability vs. Latency: Understanding the Real Priority

Definition: Latency is the round-trip network time between your platform and CME. Stability is the consistency and reliability of that connection over time.

For most discretionary traders, stability matters more than single-digit milliseconds. Manual traders will not notice the difference between 2 ms and 15 ms, but they will notice a jittery connection that causes delayed order updates or platform freezes.

- For discretionary traders, uptime is the priority. A VPS allows you to immediately manage your position from a phone or backup device if your home internet fails.

- For algorithmic traders, location is the priority. Aurora-proximate VPS hosts provide consistent, near-zero latency that helps preserve queue priority and execution efficiency.

The Trading-Grade Checklist: Specs That Matter

A trading-grade specification checklist is a minimum standard of hardware and network characteristics required for reliable futures execution.

- CPU: Clock Speed Wins

Most trading platforms are single-threaded. High per-core performance is essential.

- Target: 3.5 GHz+ (Ryzen 7/9, Intel i7/i9)

- Avoid: Underclocked Xeon-based VPS plans

- Storage: NVMe Is Mandatory

Tick data, market depth, and footprint charts load significantly faster on NVMe SSDs compared to standard SATA SSDs. This speed difference becomes critical during volatility when platforms process large bursts of tick data.

- Server Location: The Aurora Standard

CME’s matching engines for ES, NQ, CL, GC, and 6E reside in Aurora, Illinois.

- Best: Aurora or Chicago

- Acceptable: New York (for multi-asset traders)

- Avoid: West Coast, EU, and Asia for CME execution if your primary focus is futures

- Uptime and Support

- Target: 99.9% uptime or higher

- Support: Look for teams familiar with Rithmic, CQG, and trading platform configuration so issues can be resolved quickly and accurately

Best VPS Providers: 2026 Analysis

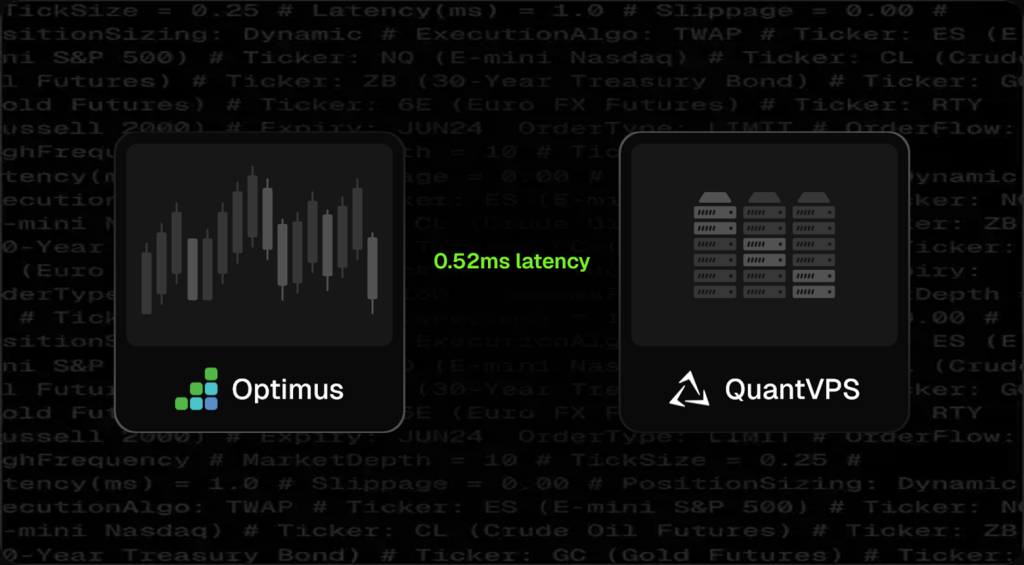

QuantVPS — Best for CME Futures Overall

QuantVPS is designed specifically for algorithmic and active futures traders.

- Ryzen-class CPUs, NVMe storage, and fiber cross-connects to CME

- Latency as low as 0.52 ms

- Ideal for scalpers, automated strategies, and high-frequency discretionary traders

- Recommended setup: Get the Optimus-Optimized CME VPS from QuantVPS

Speedy Trading Servers — Best for General Use

Speedy Trading Servers offers near-zero latency to major futures gateways, reliable uptime, and strong user support. It is well suited for NinjaTrader, Sierra Chart, and Optimus Flow users needing a balanced price-performance option without deep custom infrastructure.

ChartVPS — Best for Visual / DOM Traders

ChartVPS focuses on GPU-accelerated VPS configurations designed for Bookmap, footprint charts, and multi-DOM setups.

- Uses Ryzen 9000/7000 series CPUs and Gen4 NVMe SSDs

- Offloads graphics-heavy workloads from your local computer

- Well suited for order flow and visually intensive analysis

FXVM — Best for Multi-Asset Traders

FXVM operates multiple global data centers and offers a 99.99% uptime SLA.

- Appropriate for traders spanning futures, forex, and CFDs

- Useful when you need low-latency access to multiple venues, not just CME

Kamatera — Best for Scalable Enterprise

Kamatera provides highly customizable virtual machines with instant resource scaling and hourly billing options.

- Chicago and NYC locations available

- Suitable for developers, quants, and traders who require granular control over server resources and architecture

How to Test Your Latency to CME

A latency test measures round-trip packet travel time between your computer and an exchange gateway, expressed in milliseconds.

- Open Command Prompt.

- Enter: ping futures.rithmic.com

- Check the average latency value after several packets.

Latency Guide:

- < 20 ms: Very close to CME; a VPS helps mainly with stability and redundancy.

- 20–50 ms: Typical for many retail traders; a VPS can significantly improve consistency.

- >100 ms: A VPS near Aurora will often provide a substantial improvement in order routing and execution quality.

Frequently Asked Questions

Not always. Traders who value uptime, consistency, or automation benefit most.

It can reduce latency depending on location, but the main benefit for manual traders is stability.

Yes. Most VPS setups operate like a standard Windows desktop environment.

Many futures traders prefer Chicago/Aurora due to its proximity to CME infrastructure.

Optimus Flow, Sierra Chart, TradingView (broker-connected), CQG, and Rithmic often benefit from improved uptime and stable routing.

Yes, as long as you allocate sufficient resources. A common guideline is 2–4 GB of RAM per platform instance, depending on chart load and historical data usage.

Yes. The VPS protects your execution environment, but you still need a stable connection to access and control it.

A VPS is virtualized hosting at a relatively low monthly cost (often $50–$100). Colocation is dedicated hardware housed inside or near the exchange ecosystem and is priced at institutional levels (often $2,000+ per month). For most retail traders, a high-quality Aurora VPS provides a better cost–benefit balance.

Optimus Futures Trader’s VPS Toolkit

1. Infrastructure

Recommended VPS: Get the Optimus-Optimized QuantVPS Setup (includes pre-configuration for Rithmic and Optimus Flow)

2. Platform

Optimus Flow: Download the Free Optimus Flow Platform (professional-grade DOM, footprint charts, and TPO)

3. Education

New to futures? Learn more at the Optimus Futures Learn Center

Ready to Trade?

Open a live futures trading account with low day-trading margins

Disclaimer

The VPS providers mentioned in this article are listed for informational purposes only. Their inclusion does not constitute an endorsement, recommendation, or guarantee by Optimus Futures. Each trader is responsible for evaluating, selecting, and managing their own VPS service. Optimus Futures does not control, monitor, or take responsibility for the operation, reliability, or performance of any third-party VPS provider.

A VPS cannot prevent issues related to trading APIs, data feeds, routing, or exchange connectivity. If an API, platform, or data provider experiences an outage, a VPS will not resolve those interruptions. Traders should conduct their own due diligence and understand the risks before using any VPS for trading activities.

The information above was gathered from internet sources. While we strive for accuracy, Optimus Futures, LLC cannot guarantee completeness or freedom from errors. We encourage you to conduct your own due diligence, and we always welcome corrections brought to our attention.

Disclaimer: Futures trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.