In the following video, our host Matt Z illustrates and explains why it’s impossible to catch tops and bottoms in the market place.

In our opinion, catching tops and bottoms is nearly impossible because of the price action and the interaction between buyers and sellers. Although some traders may find success a few times during their trading careers using this strategy, we’ll attempt to demonstrate why this is not a sustainable and consistent strategy while trading on a long term basis.

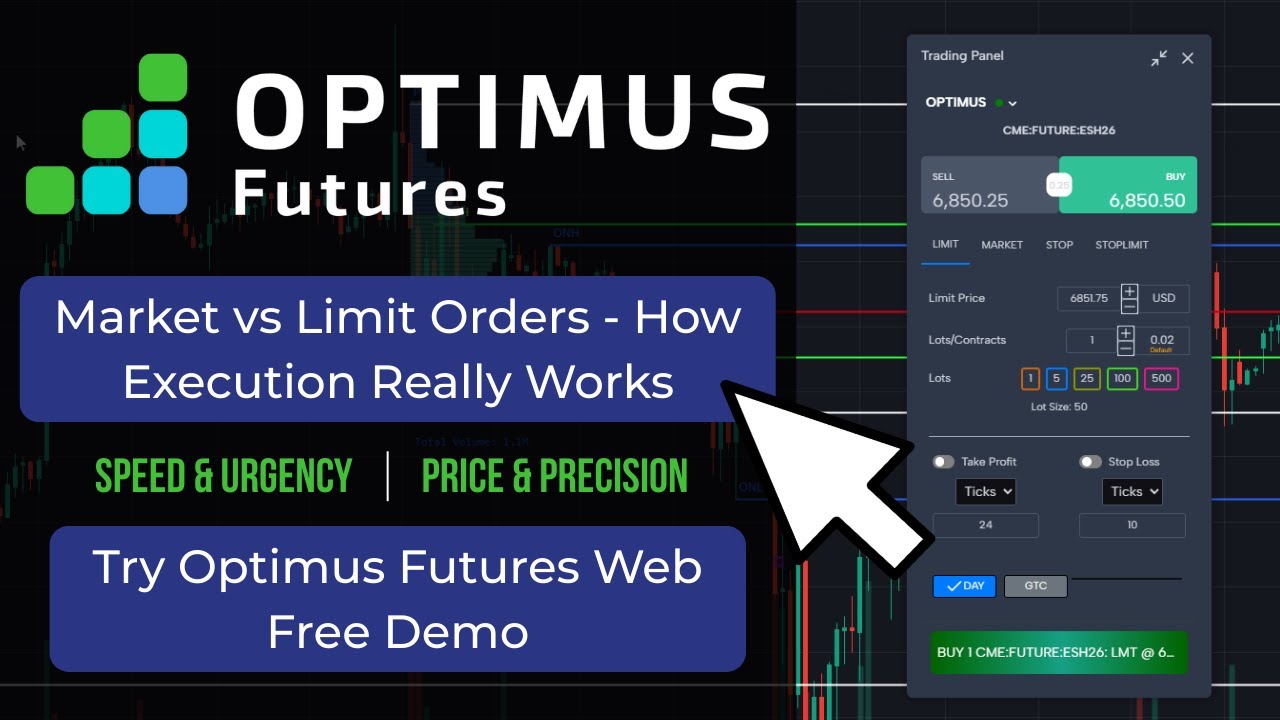

Sign up for a demo of our new platform, Optimus Flow, here: https://optimusfutures.com/OptimusFlow.php

________________________________________________________________________________________________

Want to learn more about Optimus Futures? Visit our website: http://www.optimusfutures.com/

Our commissions, margins, and pricing: https://optimusfutures.com/Futures-Tr…

Open an account with us today! https://optimusfutures.com/Futures-Co…

Check out our community forum: https://community.optimusfutures.com/

Please don’t forget to like the video, comment, and subscribe!

THANKS FOR WATCHING!

________________________________________________________________________________________________

TRADING FUTURES AND OPTIONS INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. THE USE OF STOP LOSS OR CONTINGENT ORDERS MAY NOT PROTECT PROFITS OR LIMIT LOSSES TO THE AMOUNT INTENDED. CERTAIN MARKET CONDITIONS MAY MAKE IT DIFFICULT OR IMPOSSIBLE TO EXECUTE SUCH ORDERS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE ARE RISKS ASSOCIATED WITH UTILIZING AN INTERNET-BASED EXECUTION, BUT NOT LIMITED TO, THE FAILURE OF HARDWARE, SOFTWARE AND INTERNET CONNECTION. SINCE OPTIMUS FUTURES DOES NOT CONTROL SIGNAL POWER, ITS RECEPTION OR ROUTING VIA INTERNET, CONFIGURATION OF YOUR EQUIPMENT OR RELIABILITY OF ITS CONNECTION, WE CANNOT BE RESPONSIBLE FOR COMMUNICATION FAILURES, DISTORTIONS OR DELAYS WHEN TRADING VIA THE INTERNET. OPTIMUS FUTURES EMPLOYS PHONE SUPPORT IN THE EVENT OF PLATFORM FAILURE

The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

#TechnicalAnalysis #Futures #Daytrading